Simple Tips About P&l Us Gaap Notes Payable On Balance Sheet

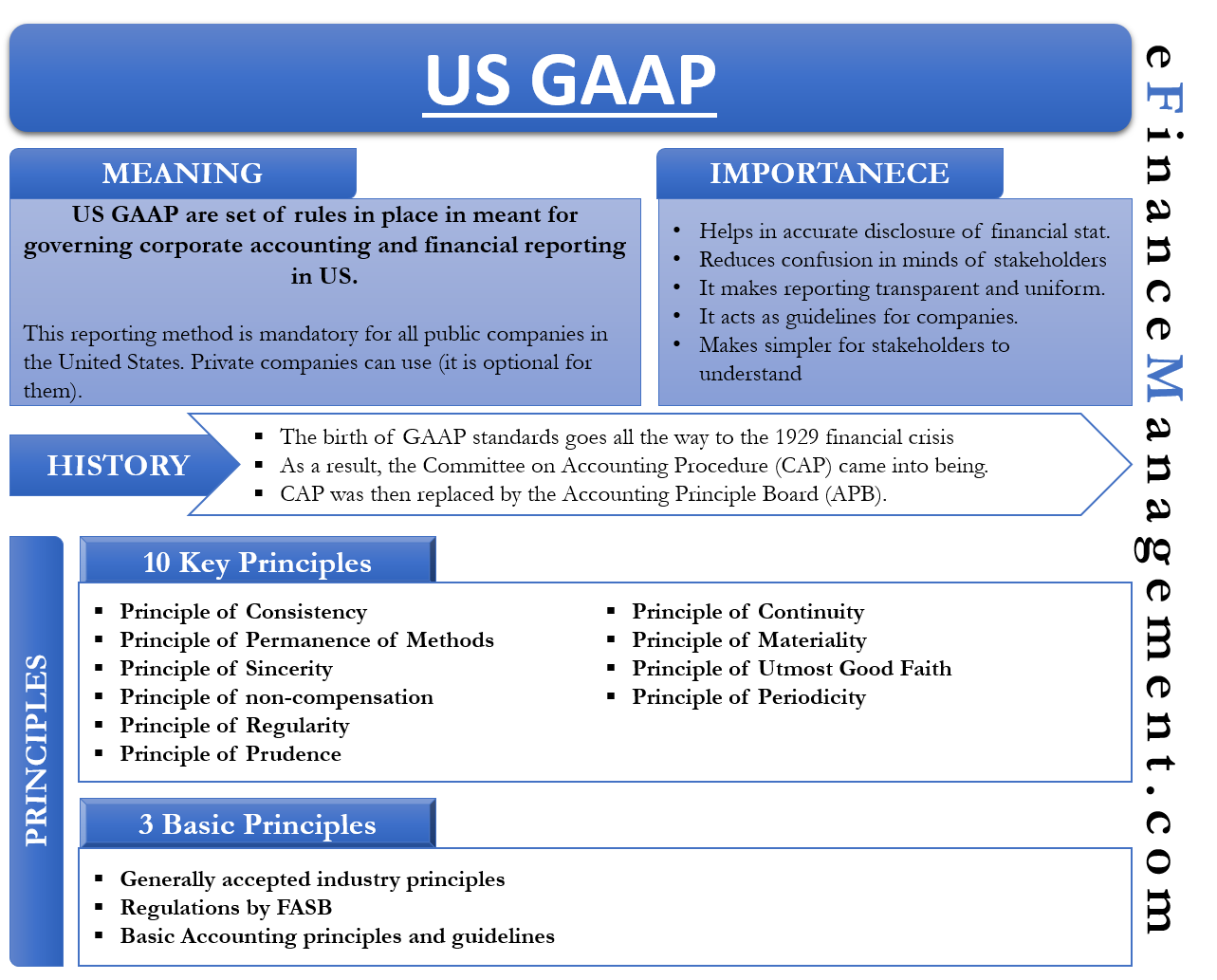

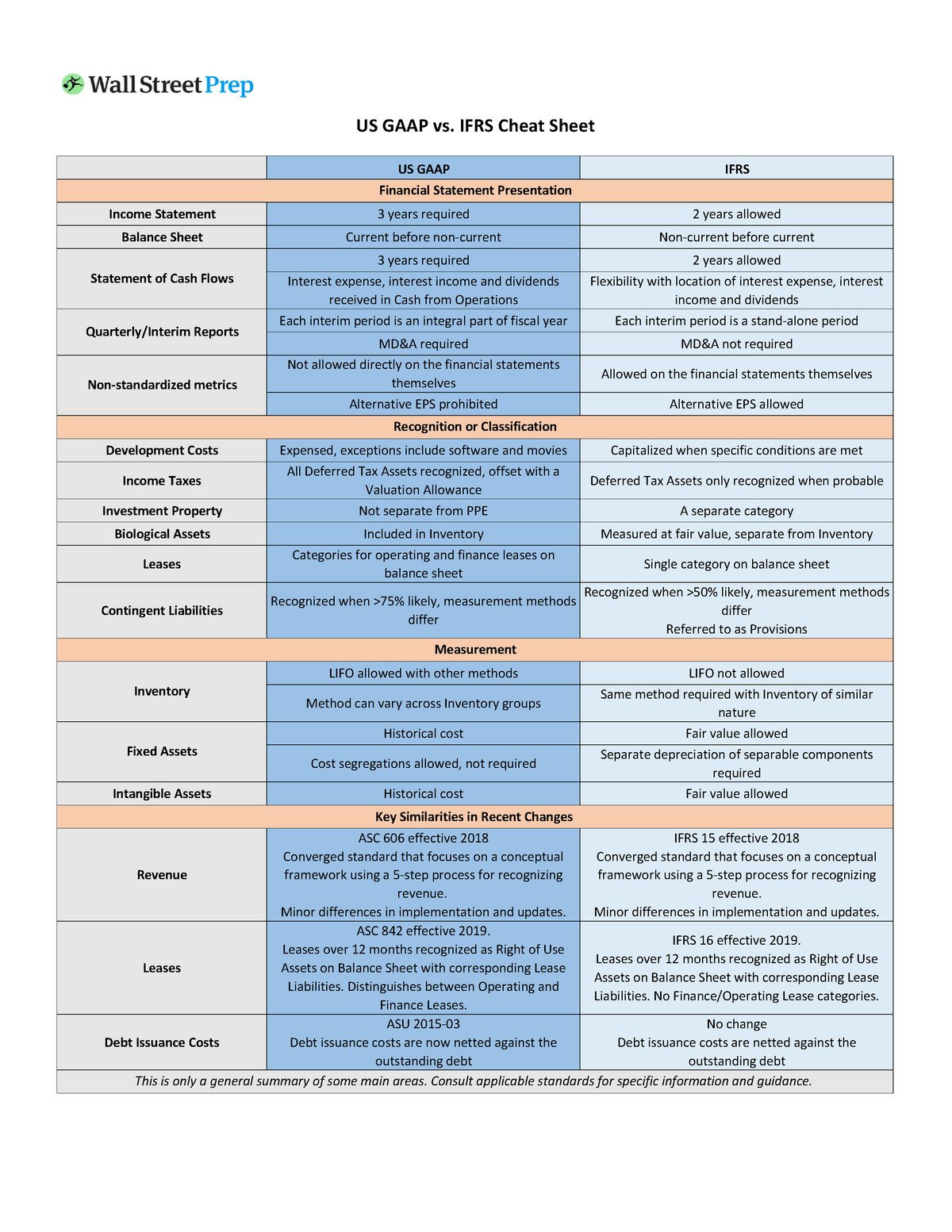

What is ifrs vs us gaap?

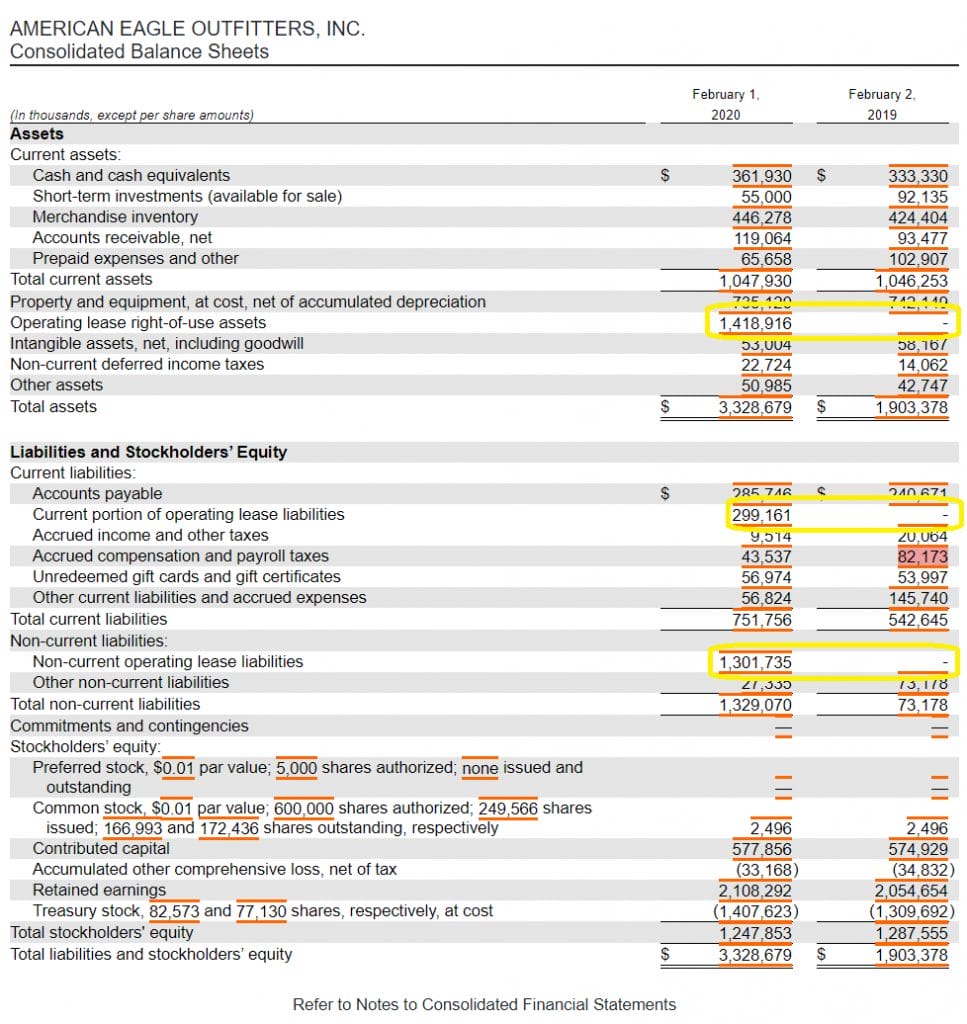

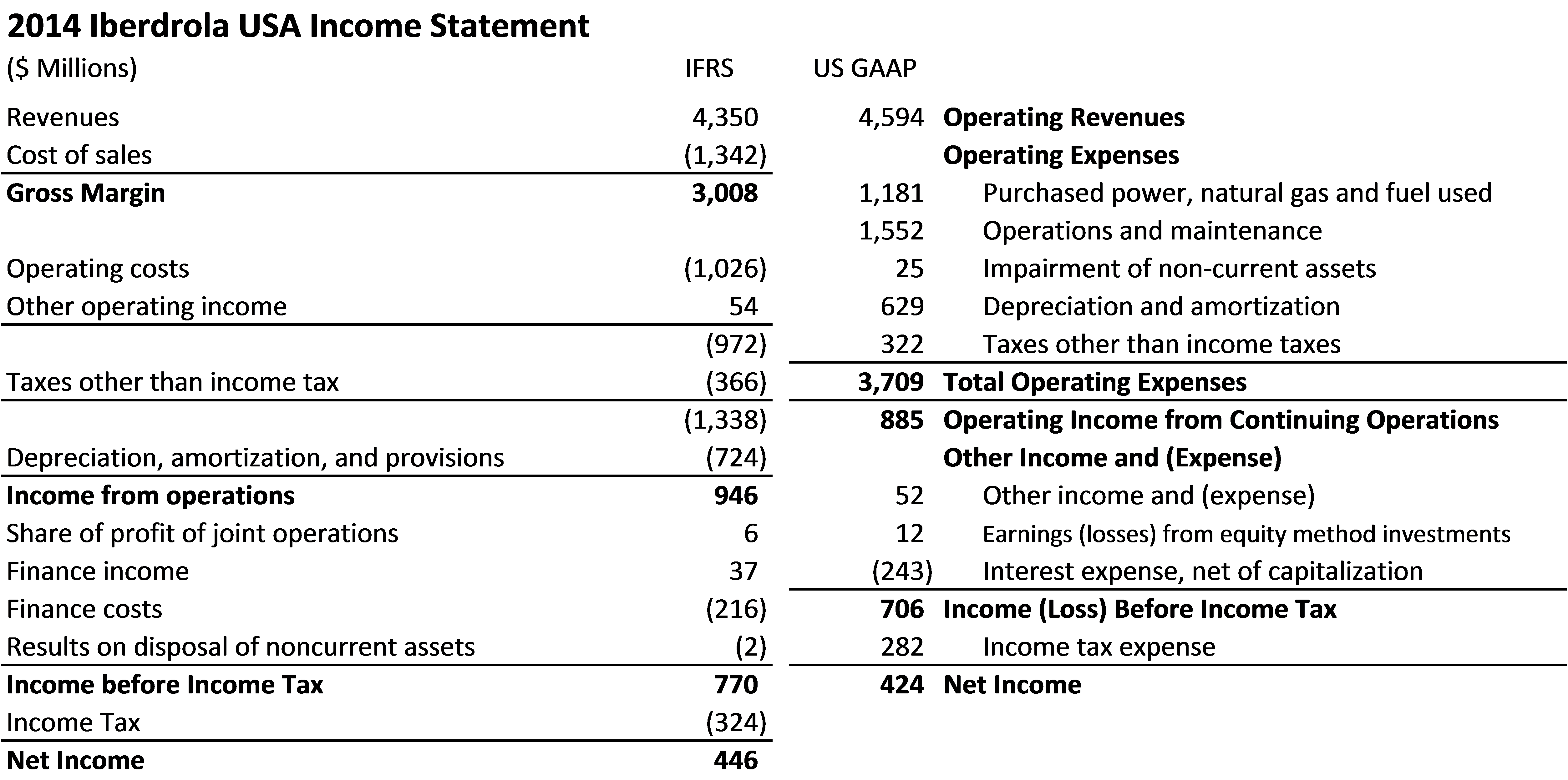

P&l us gaap. Once the debits and credits have been settled, presentation and disclosure is how that information is conveyed to financial statement users in a transparent, understandable. And other comprehensive income (p&l and oci) and the statement of financial position (balance sheet). Fasb.org) does not define a us gaap coa.

It is very important for the business. Given that significant differences exist between lease accounting under ifrs 16 and topic 842, the following companies need to be particularly cognizant of these. Income statements may help investors and creditors determine the past financial performance of the enterprise, predict the future performance, and assess the capability of generating future cash flows using the report of income and expenses.

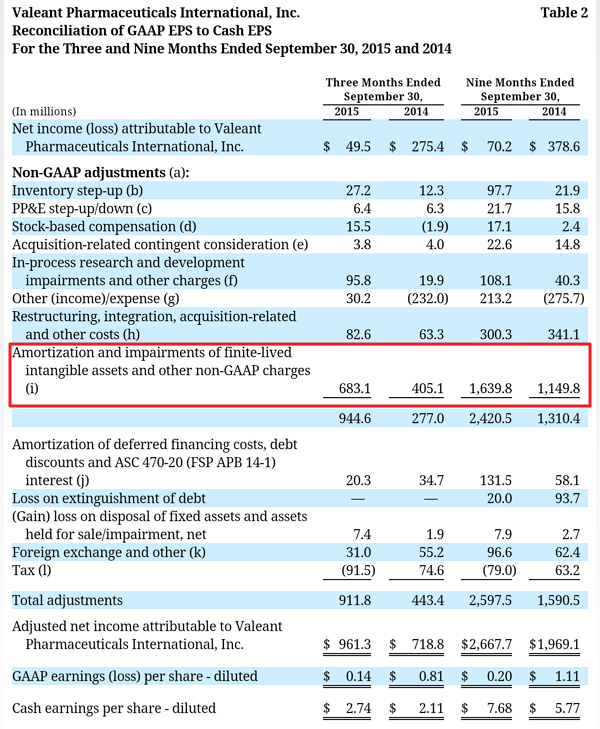

Unlike ifrs, the presentation of ngfms in the financial statements by sec registrants is generally prohibited. Leases of biological assets service concession arrangements certain types of intangible assets however, there are additional differences in scope between asc 842 and ifrs. Generally accepted accounting principles | position paper.

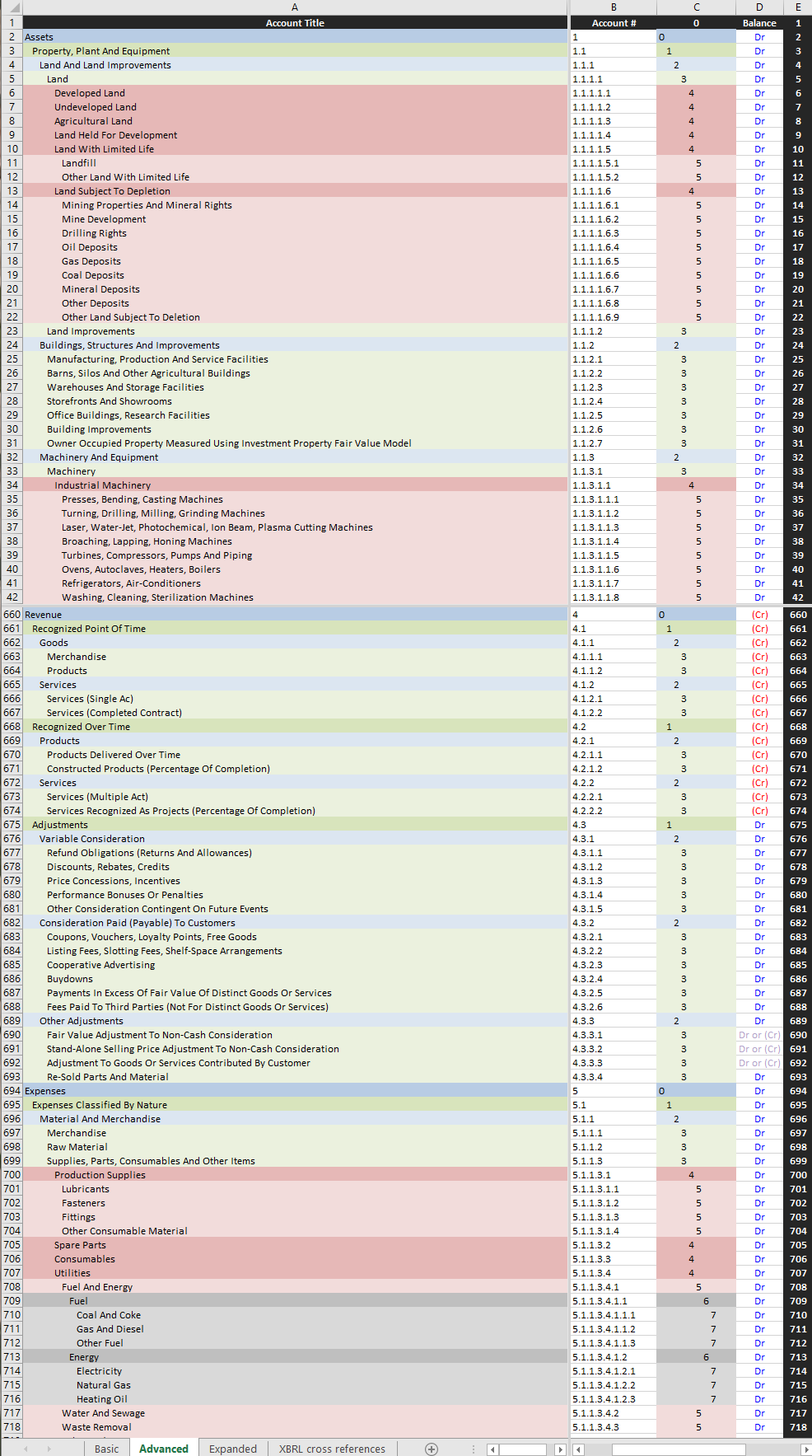

Here we summarize what we see as the top 10 differences in measurement of inventories under ifrs standards and us gaap. This chart of accounts is suitable for use with us gaap.

Generally accepted accounting principles generally. A profit and loss statement, formally known as an income statement or simply as a p&l, tracks the amount of profit that remains after a business subtracts all of.

This profit and loss (p&l) statement template summarizes a company’s income and expenses for a period of time to arrive at its net earnings for the period. However, information of an income statement has several limitations: 30 nov 2020 us ifrs & us gaap guide under ifrs, differences in asset componentization guidance might result in the need to track and account for property,.

Us gaap chart of accounts. A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and profits/losses over a given period of time. One beneficial aspect of the p&l statement in particular is that it uses operating and nonoperating revenues and expenses, as defined by the internal revenue.

13 august 2019 issue brief us gaap: Gaap reporting standards, such as the asc 606 revenue recognition standard. The ifrs vs us gaap refers to two accounting standards and principles adhered to by countries in the world in relation to financial reporting.

Asc 205, presentation of financial statements, provides the baseline authoritative guidance for presentation of financial statements for all us gaap reporting entities.