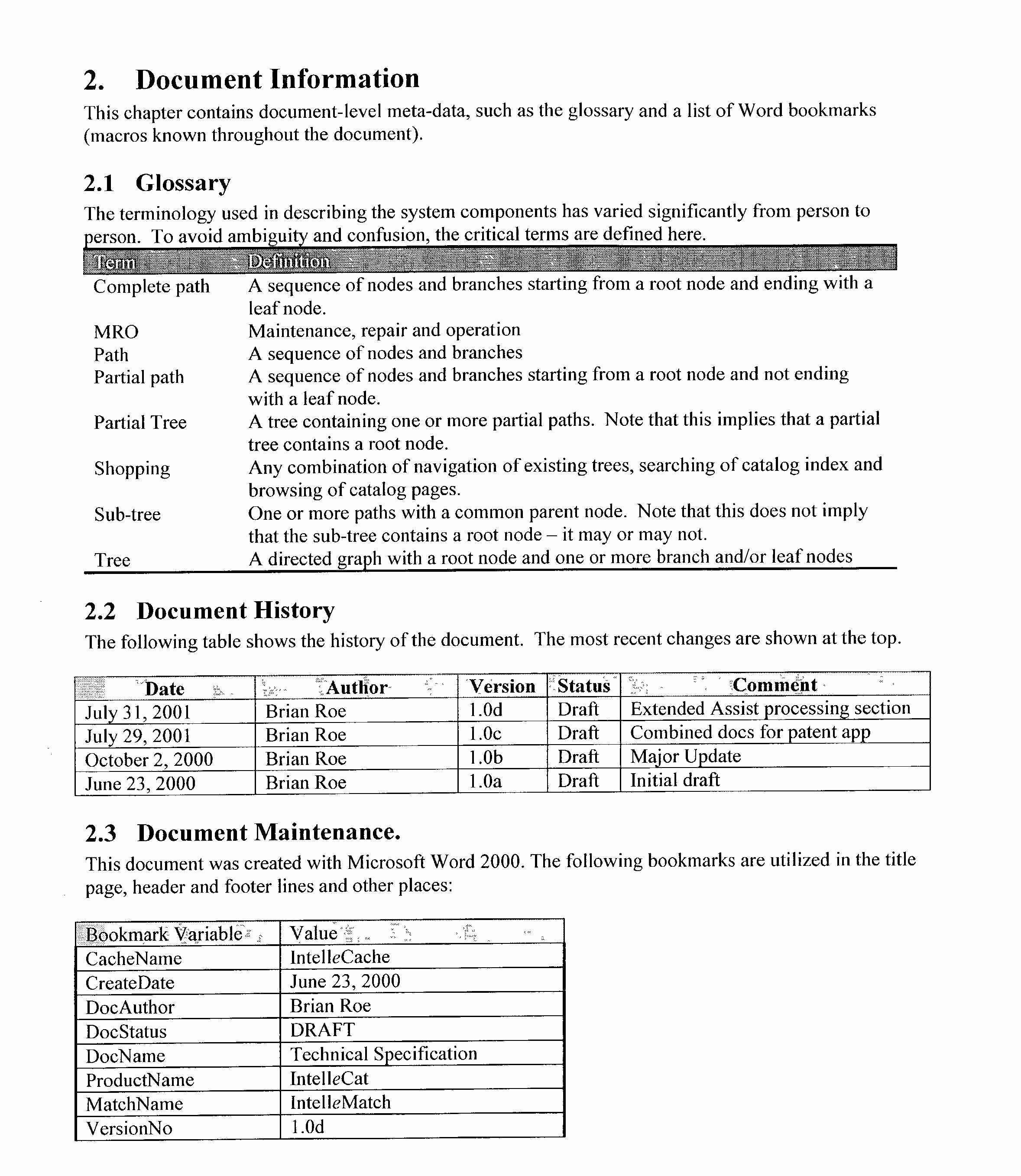

Stunning Info About Forecasted Profit And Loss Statement What Makes Up A Financial

The p&l statement is one of the three most important financial.

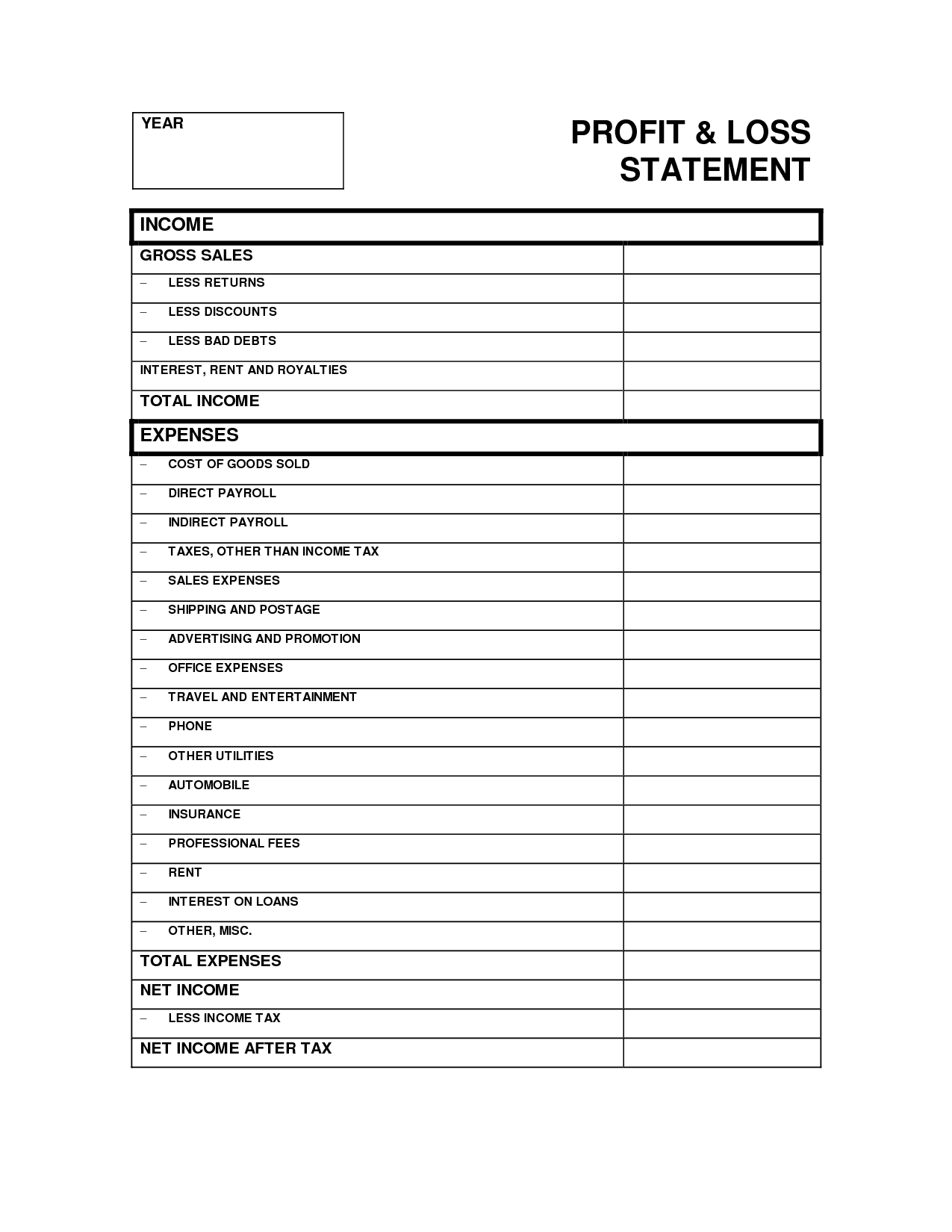

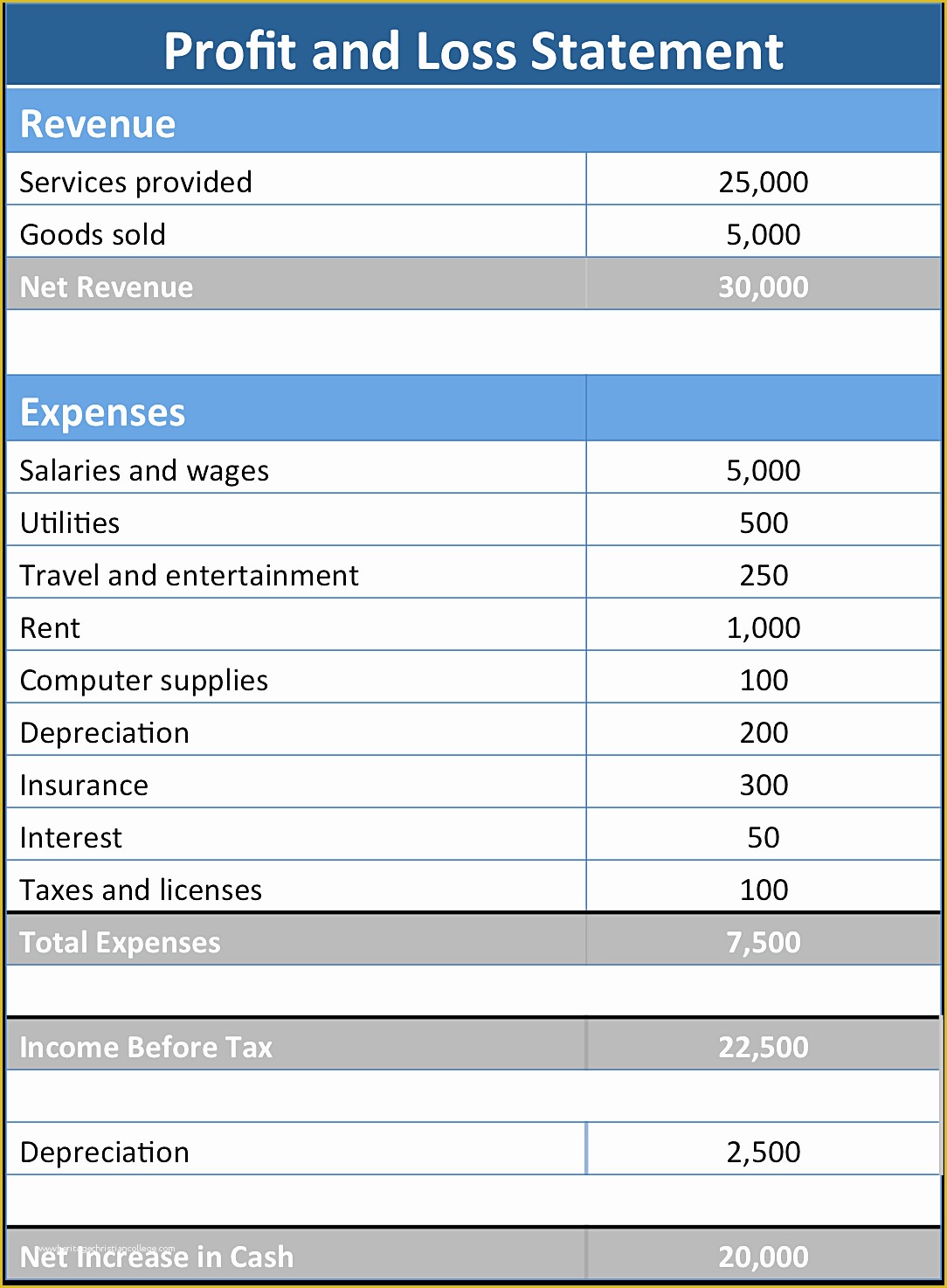

Forecasted profit and loss statement. Complete your profit and loss statement. A profit and loss statement (p&l) sets out your company income versus expenses, to help calculate profit. Shareholders must be reassured that a business has been, and will continue to be, successful.

Typically, an income statement is a list of. You also need to clearly state on your profit and loss statement whether your figures are gst inclusive or exclusive. You’ll sometimes see profit and loss statements called an income statement, statement of.

If you want to find out more about profit and loss based key performance indicators (kpis) check out these 7 profitability ratios. It’s important to take every expense into account so you get an accurate projection. Download our profit and loss template (xls 1.5mb) to start your financial.

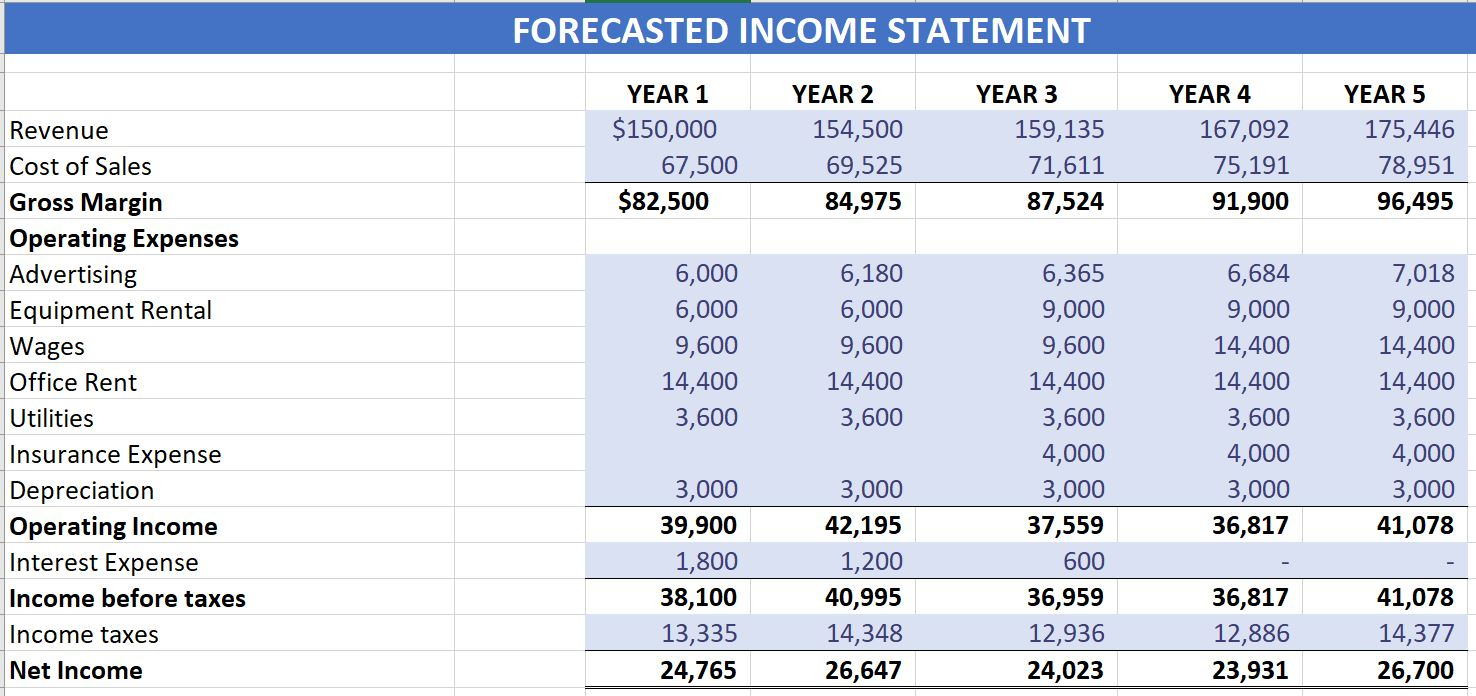

A projected profit and loss (p&l) statement provides a forecast of income, expenses, and profits. Format the table as desired and review the forecast for accuracy. A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and profits/losses over a given period of time.

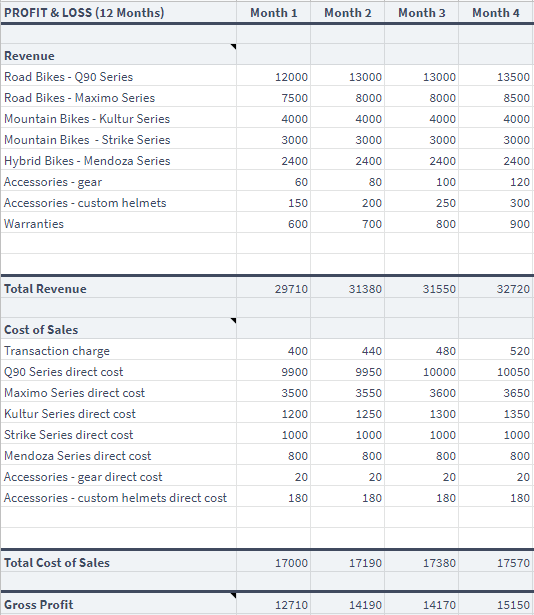

Profit and loss statements (also known as income statements) provide a detailed analysis of your company’s revenue experience for the previous year or another period of time. Deduct any other operating expenses you have, as well. Then, it’s time for the “loss” part of “profit and loss.” calculate the cost of goods sold for each month, and deduct it from your sales.

The p&l statement is therefore one of the financial statements within the business plan's financial forecast. A p&l statement (sometimes called a statement of operations) is a type of financial report that tells you how profitable your business was over a given period. A profit and loss forecast report is the illustration of the health of the business at a given time.

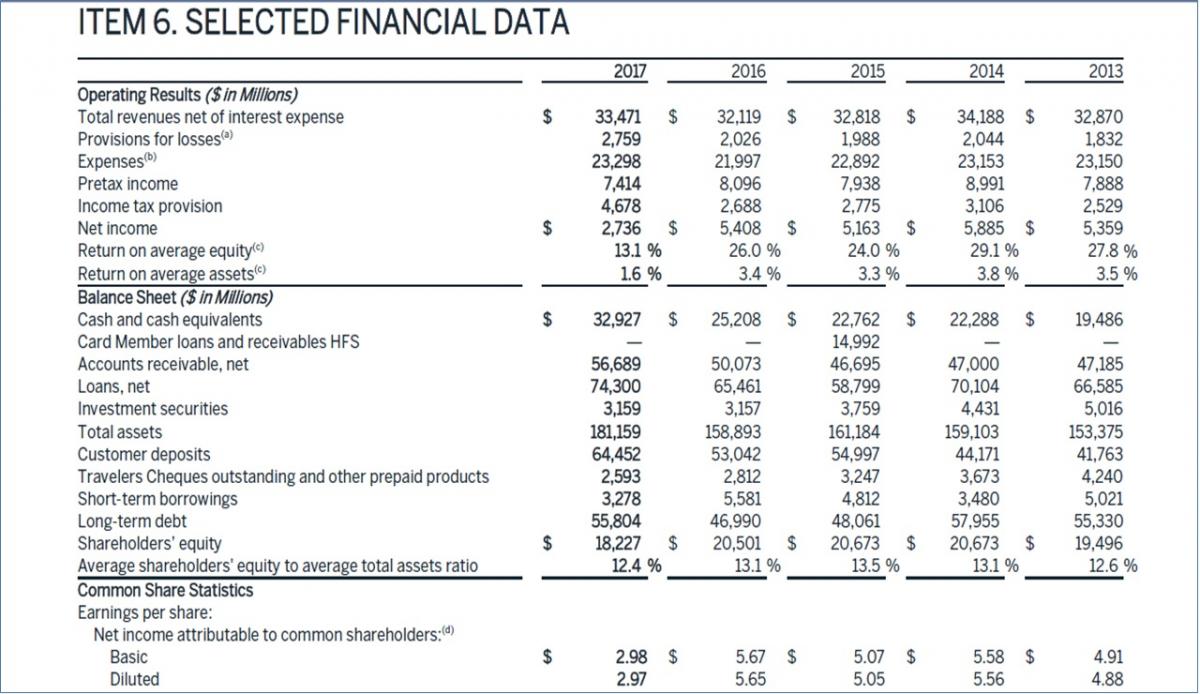

An income statement summarizes a company’s revenue, costs and expenses over a specified period, typically by fiscal quarter or by year. The calculated data is stored in the form of templates that can serve as the starting point for a new document. Alongside your balance sheet and cash flow statement, financial forecasting is one of the key elements of setting up your business financially.

Forecasting revenue there are inherent tensions in model building between making your model realistic and keeping it. A profit and loss forecast is a financial snapshot of where your business is headed. The financial forecast, an essential part of a business plan, consists of three major elements:

Basic income statements contain the following elements: The p&l statement is one of three. In this guide on how to build a financial forecast, we will complete the income statement model from revenue to operating profit or ebit.

Financial statement forecasts help small businesses plan for future growth. In good times, you use it to ensure that there will be enough money coming in to exceed the costs of providing the goods and services so you can make a solid profit. Here’s the calculation:

![Restaurant Profit and Loss Complete Guide [Free template]](https://sharpsheets.io/wp-content/uploads/2022/12/Screenshot-2022-12-16-at-17.10.04.png)