Awesome Tips About Free Cash Flow Direct Method Iocl Balance Sheet

Indirect cash flow method, on the other hand, the calculation starts from the net income,.

Free cash flow direct method. The cash flow from operations in the cash flow statement represent cash transactions that have to do with a company's core operations and is therefore an extremely important measure of the health of a business. As with the indirect method, preparing a statement of cash flows using the direct method is made much easier if specific steps are followed in sequence. Free cash flow to equity is a measure of how much cash is available to the equity shareholders of a company after all expenses, reinvestment, and debt are paid.

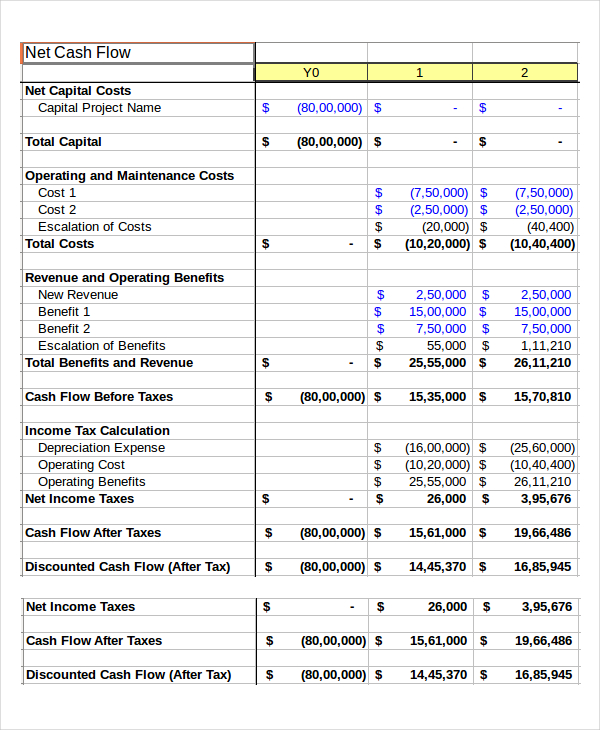

A cash flow direct method formula is used to calculate cash inflows and cash outflows when preparing a cash flow statement using the direct method. Three ways to calculate free cash flow are by using operating cash flow, using sales revenue, and using net operating profits. The direct method is one of two accounting treatments used to generate a cash flow statement.

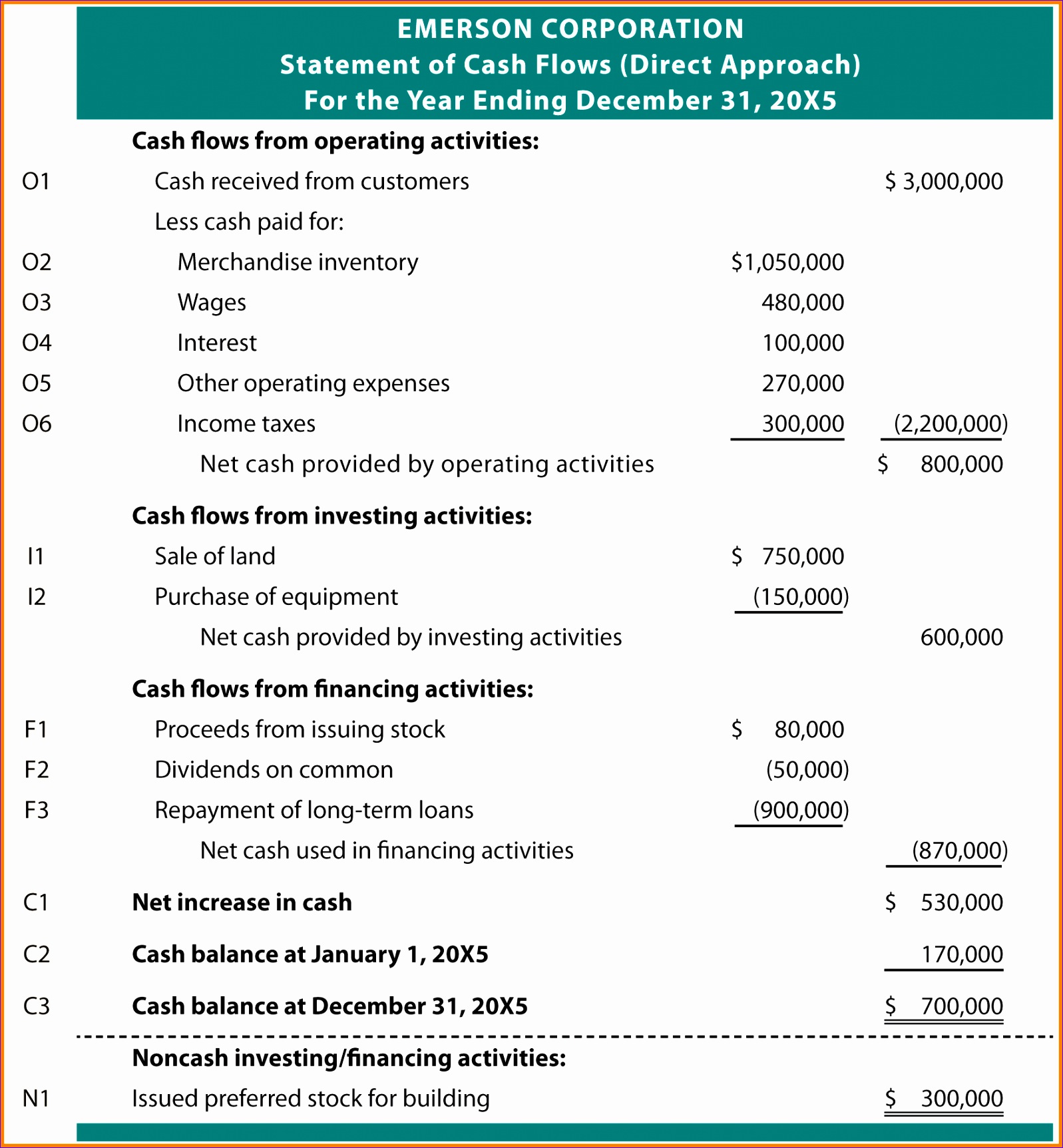

Free cash flow to the firm (fcff) represents the cash flow from operations available for distribution after accounting for depreciation expenses, taxes, working capital, and investments. In other words, it lists where the cash inflows came from, usually customers, and where the cash outflows went, typically employees, vendors, etc. The cash flow statement presented using the direct method is easy to read because it lists all of the major operating cash receipts and payments during the period by source.

The cash flow is calculated by netting the inflows and outflows. In the direct method, the cash records of the business are analysed for the period, picking out all payments and receipts relating to operating activities.

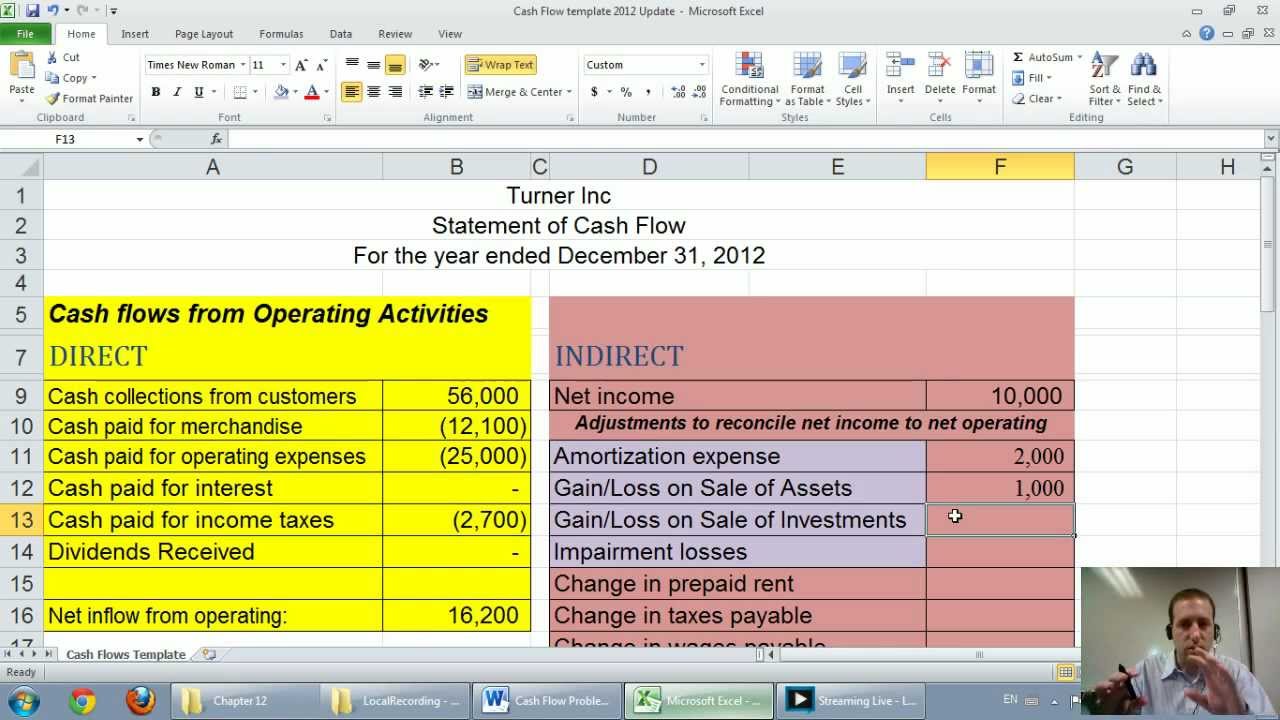

The direct method of presenting the statement of cash flows presents the specific cash flows associated with items that affect cash flow. The statement of cash flows direct method uses actual cash inflows and outflows from the. Preparing a statement of cash flows:

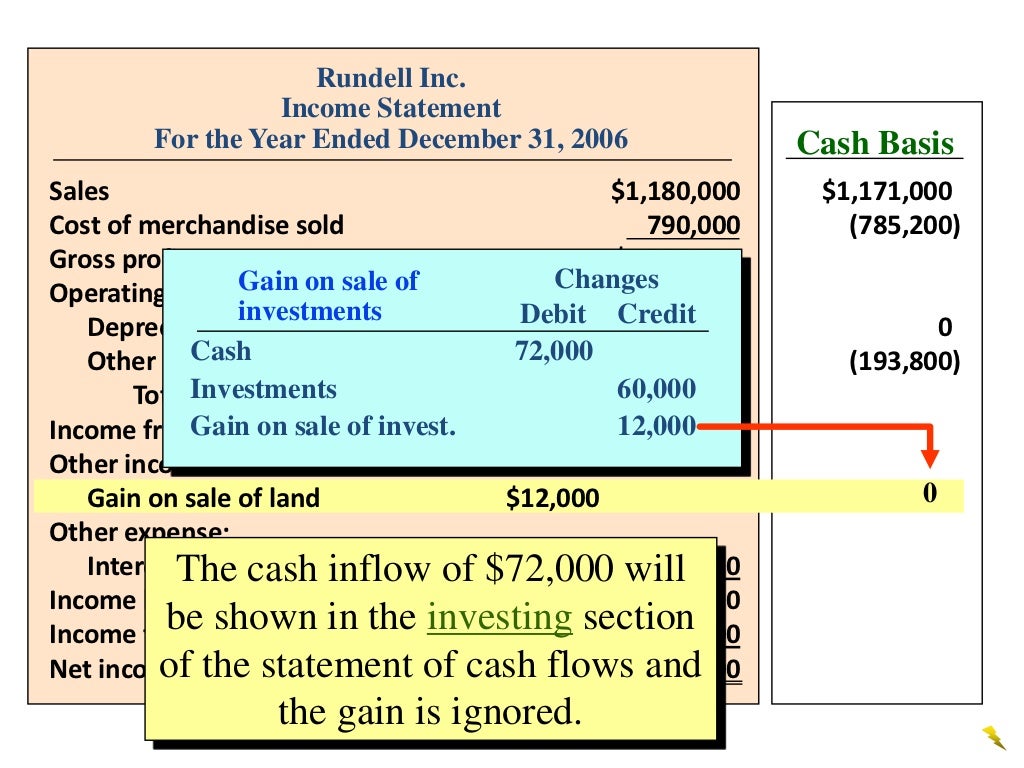

There are two ways to prepare the cash flow statements. Cash flow from operations (cfo) represents the net cash flow of a company from its core operating activities. It can be calculated using either the direct method which finds out actual receipts from customer and payments to suppliers and others, or the indirect method which adjusts net income to arrive at net cash flow from operations.

Free cash flow is one of the most important ways to measure a company’s financial performance. Free cash flow (fcf) is a company's available cash repaid to creditors and as dividends and interest to investors. The direct method of cash flow tracking records every single cash movement in and out of a business, such as payments from customers and expenses for supplies and salaries.

However, in its most generic form, free cash flow is calculated as cash from operations minus capital expenditures. Management and investors use free cash flow as a measure of a company's. The direct method presents actual cash flows, while the indirect method calculates cash flows based on adjustments to cash flow from operating activities.

The free cash flow indicates the amount of cash that remains after all costs incurred in the operational area have been covered. The method lists every transaction on the company’s cash flow statement. Free cash flow (fcf) formula.

Below is a summary of those steps to complete the operating section of the statement of cash flows using the direct method: Key highlights free cash flow (fcf) can be defined and calculated in many ways. Explained a cash flow statement contains three sections;

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)