Great Info About Free Cash Flow Chart Sanofi Annual Report 2015

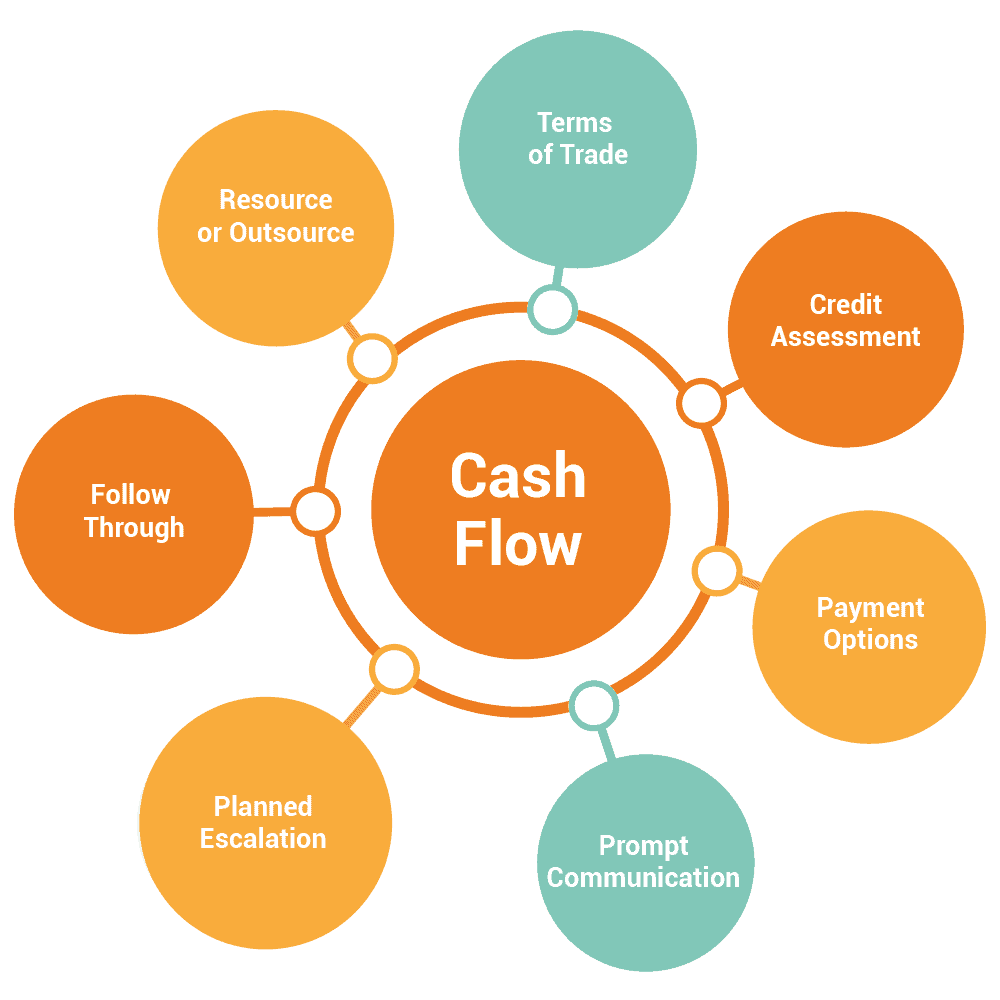

Free cash flow (fcf) is a company's available cash repaid to creditors and as dividends and interest to investors.

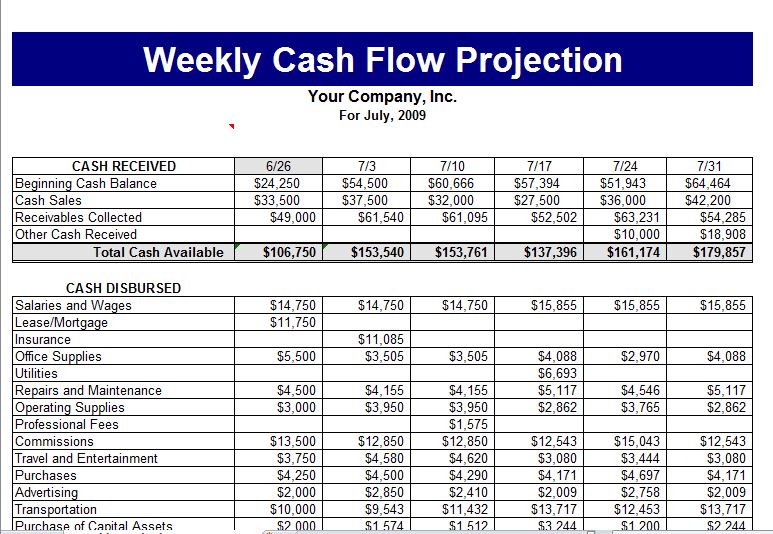

Free cash flow chart. When corporate finance experts discuss “cash flow,” they may be referring to a few different metrics. Financecharts.com bull case for nvda bullish on 4 of 8 tests (50%) ttm free cash flow growth of 263.99% is in the top 10% of its industry. Dkng stock's value could be worth at least 50% more if it occurs.

Free cash flow can be defined as a measure of financial performance calculated as operating cash flow minus capital expenditures. 3y free cash flow cagr of 60.30% is in the top 10% of its industry. Free cash flow measures the amount of cash left over from a time period after all operational and working capital payments are made.

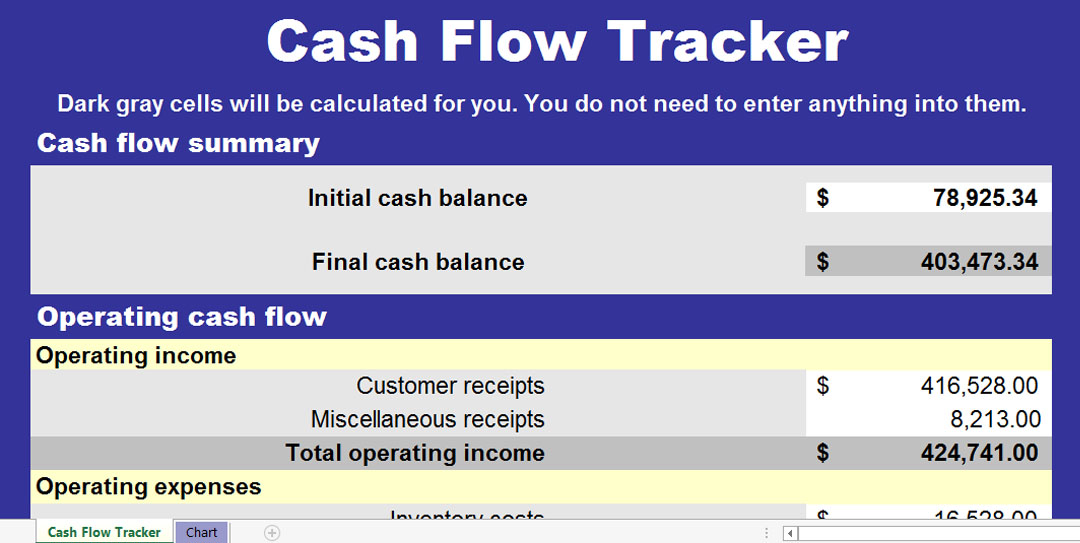

3y free cash flow cagr of 17.28% is worse than the sector median of 22.31%. Get the free cash flow charts for microsoft (msft). Try smartsheet for free, today.

Free cash flow (quarterly) chart. However, in its most generic form, free cash flow is calculated as cash from operations minus capital expenditures. Get 20 years of historical free cash flow charts for aapl stock and other companies.

Download the free cash flow (fcf) template download cfi’s free excel template now to advance your finance knowledge. Ttm = trailing 12 months. Free cash flow is one of the most important ways to measure a company’s financial performance.

Is one of the largest electronics manufacturing services company in the world, serving the computer, and communications sectors. Free cash flow (fcf) is the cash flow to the firm or equity after all the debt and other obligations are paid off. Draftkings said in its latest earnings release that it expects to make between $310 and $410 million in free cash flow this year.

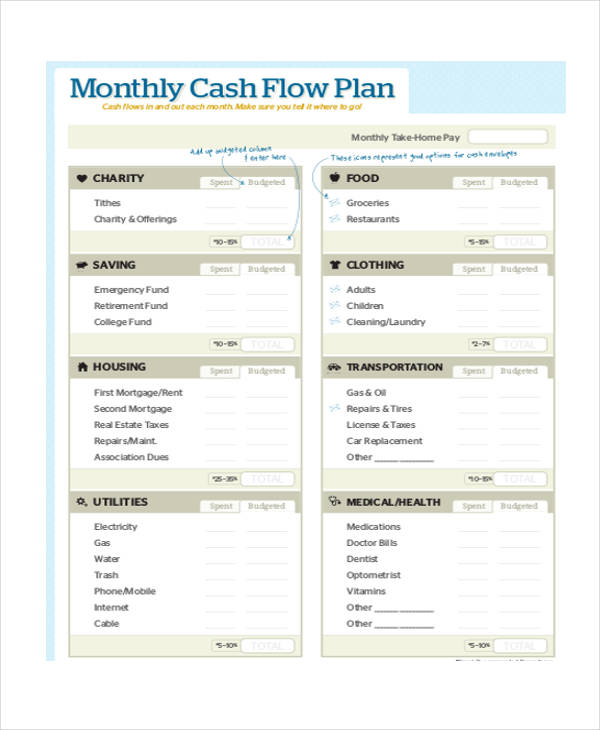

Key highlights free cash flow (fcf) can be defined and calculated in many ways. Are you looking for templates that are of high quality, free of charge, and efficiently reusable and ready to use? View and export this data back to 1999.

Bear case for tsla. Free cash flow can be defined as a measure of financial performance calculated as operating cash flow minus capital expenditures. Use these unusually active options to protect your downside.

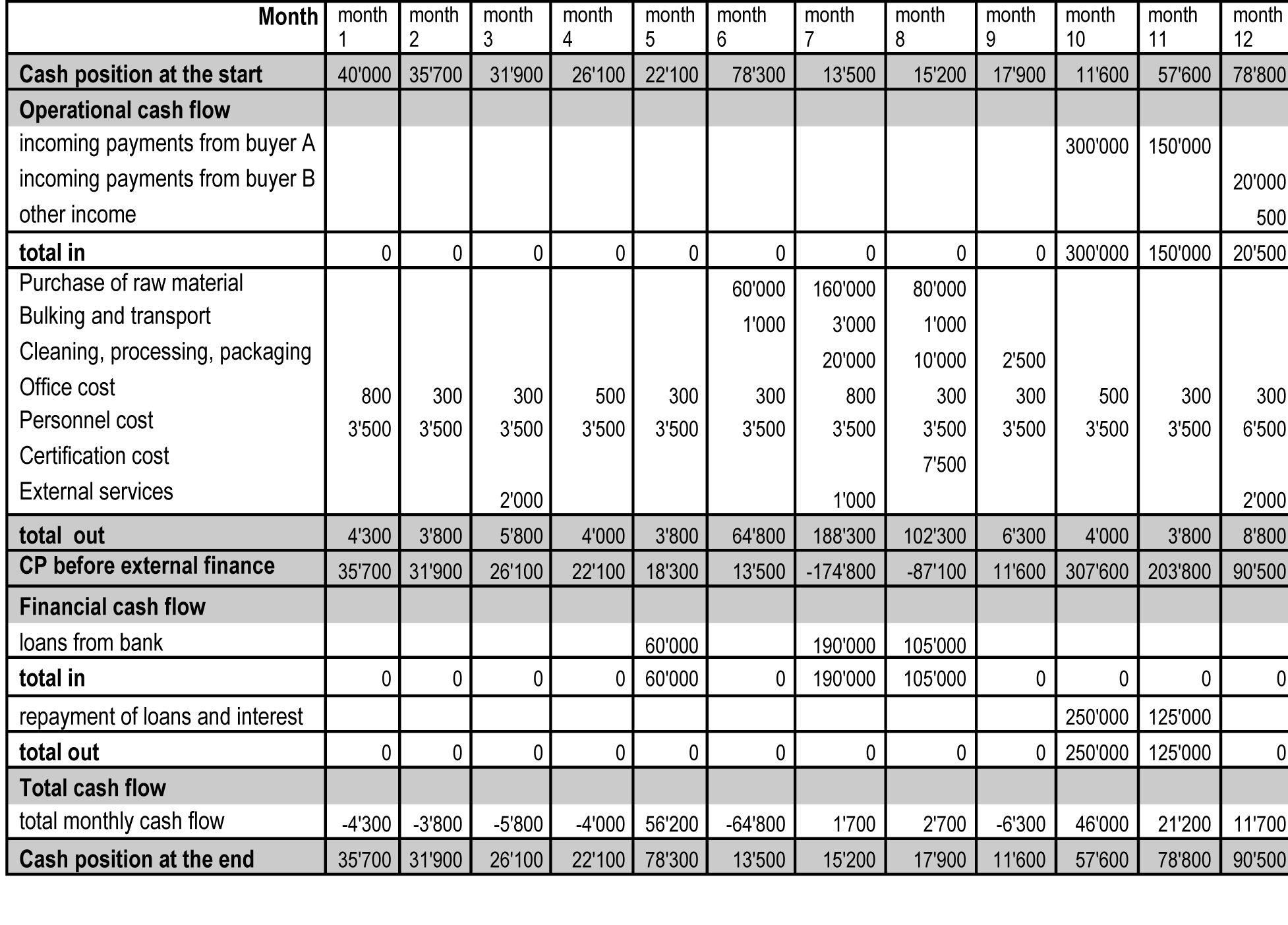

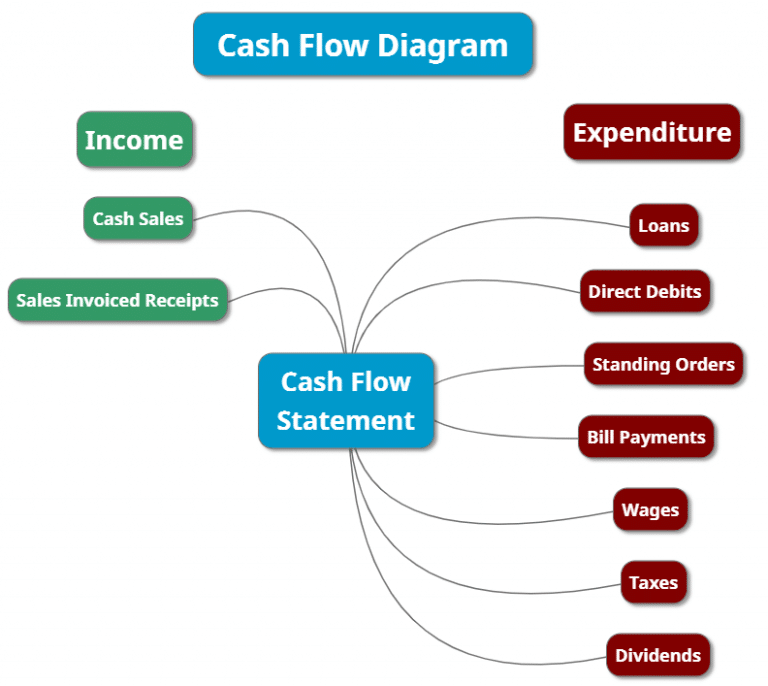

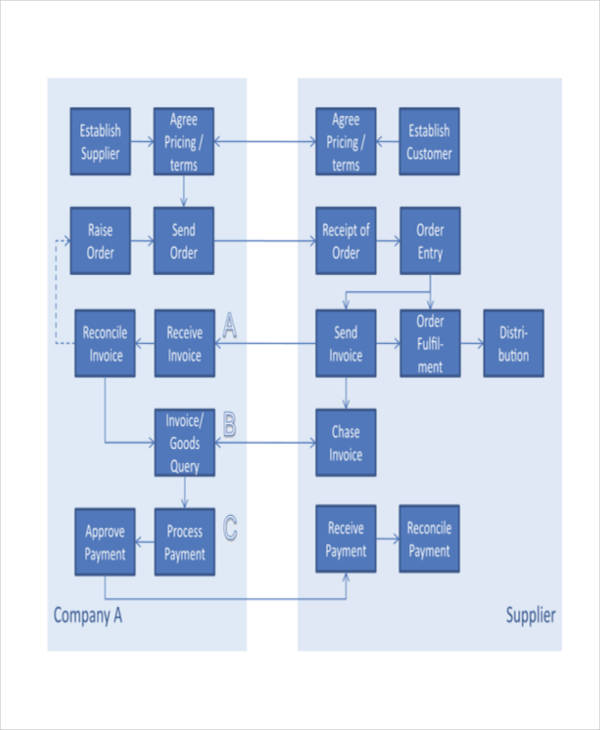

The 20 year free cash flow compound annual growth rate for aapl stock is 28.50%. To calculate the free cash flow, we subtract capital expenditures from operating cash flow: Let’s take a look at a cash flow diagram example in the real world.

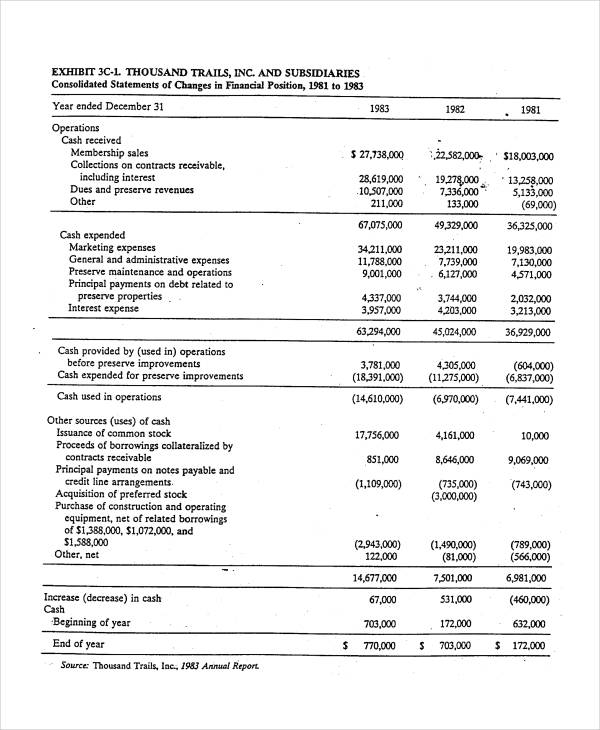

Docs free cash flow data by ycharts; Imagine you run a freelance graphic design business. Taking into account the profit and cash generation in 2023, as.