Looking Good Info About Cash Flow Statement Structure Khan Academy Financial Statements

The cash flow statement reports the cash generated and spent during a specific period of time (e.g., a month, quarter, or year).

Cash flow statement structure. The cash flow statement provides information about a company’s cash receipts and cash payments during an accounting period. External users also use the statement. The bottom line reports the overall change in the company's.

Ias 7 cash flow statements replaced ias 7 statement of changes in financial position (issued in. A cash flow statement is a financial statement which serves the inflow and outflow of the cash and cash equivalents by the company. Cash flow from investing activities;

How to create a cash flow statement 1. The statement of cash flows acts as a bridge between the income statement and balance sheet by showing how cash moved in and out of the business. The cash flow statement includes the bottom line, recorded as the net increase/decrease in cash and cash equivalents (cce).

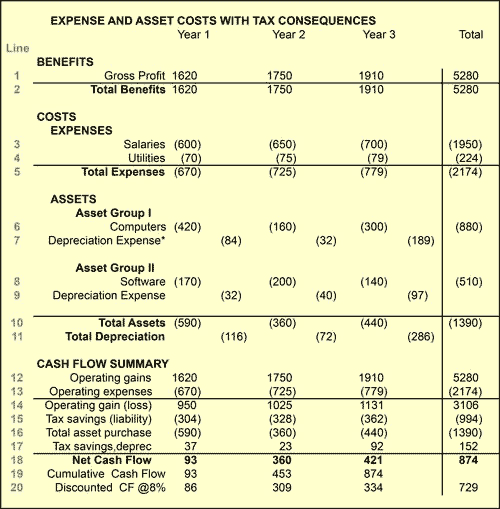

A positive cash flow indicates cash inflows, whereas a negative cash flow indicates cash outflows. It reports the cash receipts (cash inflows) and the cash disbursements (cash outflows) to explain the changes taking place during the year in the cash balance. A typical cash flow statement comprises three sections:

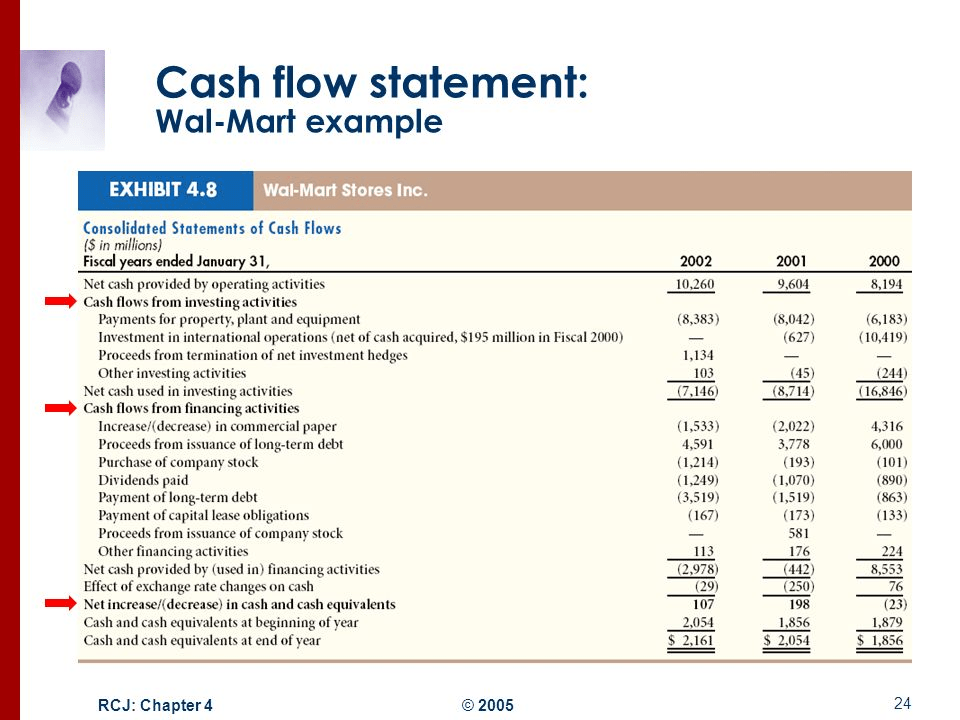

In accounting and finance, the cash flow statement (cfs), or “statement of cash flows,” matters because the financial statement reconciles the shortcomings of the reporting standards established under. Cash flow from operating activities, cash flow from investing activities, and cash flow from financing activities. It reports the cash receipts (cash inflows) and the cash disbursements (cash outflows) to explain the changes taking place during the year in the cash balance.

The cash flow statement (cfs), along with the income statement and balance sheet, represent the three core financial statements. Each head signifies the source from which a company can make money. A cash flow statement of a company lays down an organisation’s total fund.

A cash flow statement is a regular financial statement telling you how much cash you have on hand for a specific period. The statement of cash flows analyses changes in cash and cash equivalents during a period. Cash flow from operating activities this includes cash arising out of the core business the company is in.

A cash flow statement is a financial statement that presents total data. Together, these different sections can help investors and analysts determine the value of a company as a whole. Internal users can assess sources of and uses of cash in order to aid in adapting, as necessary, to ensure adequate future cash flows.

Statement of cash flows in april 2001 the international accounting standards board adopted ias 7 cash flow statements, which had originally been issued by the international accounting standards committee in december 1992. Income statement and free cash flow. Structure of the cash flow statement;

Cash flow from operating activities; The cash flow statement is typically broken into three sections: Cash flows from operating activities, investing activities, and financing activities.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)