Supreme Info About Define Operating Cash Flow Amazon India Balance Sheet 2019

When reviewing your financing statements, you’ll find either a negative or positive cash flow, depending on whether your company spends more than it makes or makes more than it spends.

Define operating cash flow. The first way, or the direct method, simply subtracts operating expenses from total revenues. With these etfs, cash flow is king. Cash flow is the vital fluid that keeps your business alive and running.

A cash flow statement is important because: It does not include any investing or financing activities. Free cash flow is the cash that a company generates from its business operations after subtracting.

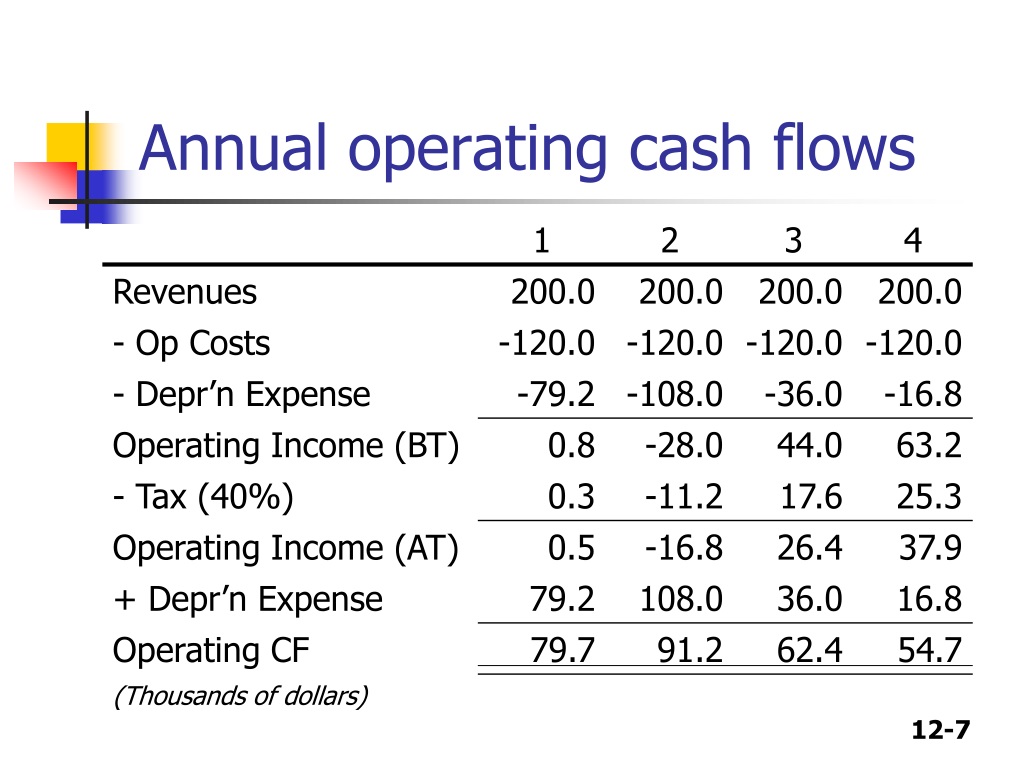

Operating cash flow is the net amount of cash that an organization generates from its operating activities. Here are more details on operating cash flow: Operating cash flow is different than a firm’s free cash flow (fcf) or net income, which includes the depreciation of assets.

Operating cash flow is recorded on a company’s cash flow statement, which divides into cash flows from investing, financing, and operations. Cash flow is the movement of money in and out of a business during a specific accounting period. The ocf calculation will always include the following three components:

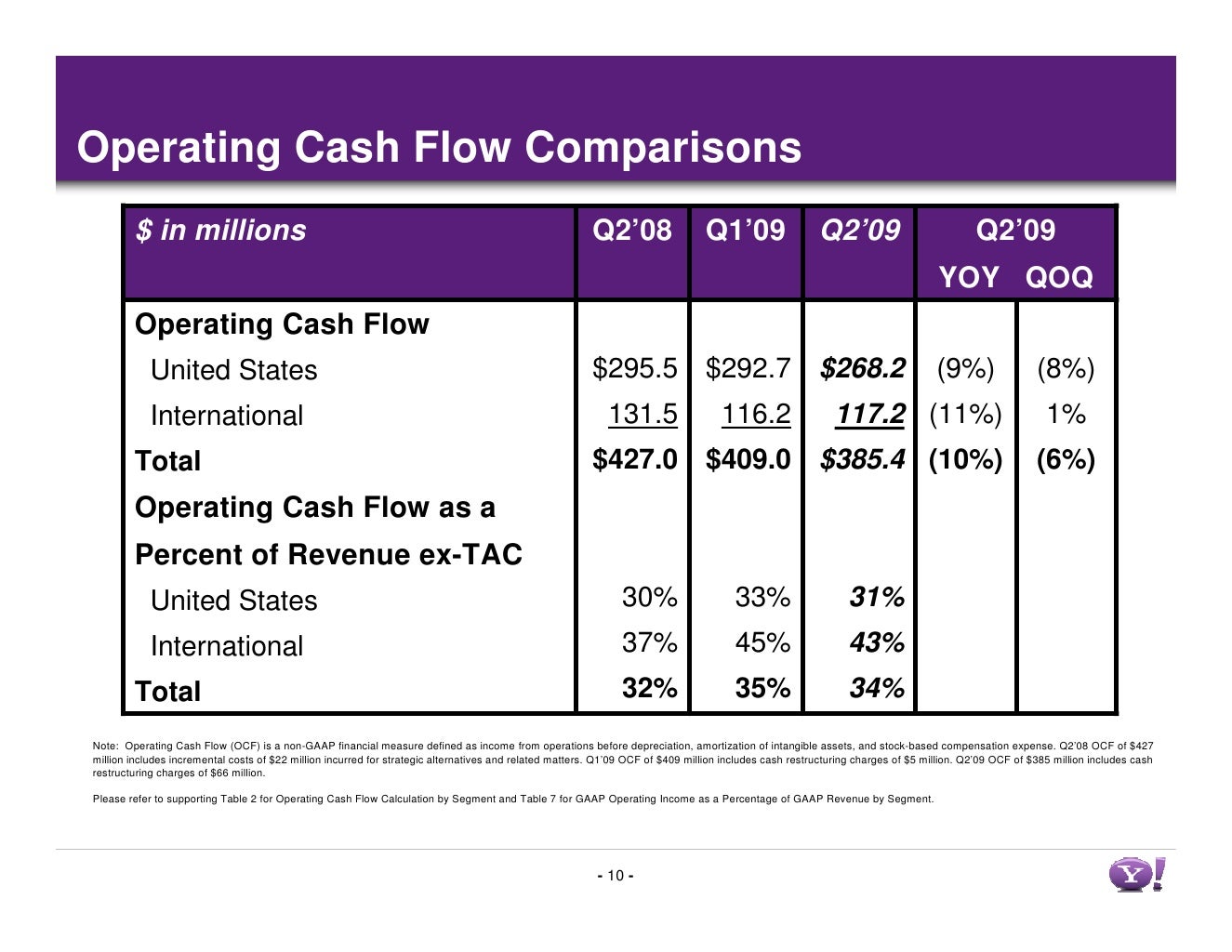

Operating cash flow (ocf) measures the net cash generated from the core operations of a company within a specified time period. Operating activities include generating revenue, paying expenses, and funding working capital. For the full year, labcorp’s operating income was operating income was $725.6 million, or 6% of.

What does operating cash flow mean? For q1 2024, we anticipate: Operating cash flow indicates whether a company can generate sufficient.

It is one of the core components of a cash flow statement, which is a summary of cash and cash equivalents entering and leaving the business. Accounting rules used in generating a business' financial statements can cause a difference between a business' operating cash flow. It typically includes net income from the income statement and adjustments.

It's akin to the circulation of blood in your body's veins, ensuring operational continuity, timely payments, and fueling growth. Leveraging cash flow for loans. Here’s the basic definitions of each:

It’s important to use data from the same accounting period — otherwise, you risk inaccurate results. Cash flow from operations is the section of a company’s cash flow statement that represents the amount of cash a company generates (or consumes) from carrying out its operating activities over a period of time. F ree cash flow (fcf) is defined as what a company has left over accounting for maintenance and operational expenses and it’s a revered investing metric for a.

Like operating margin, it is a. Operating cash flow (ocf) is how much cash a company generated (or consumed) from its operating activities during a period. That’s why gaap requires companies.

:max_bytes(150000):strip_icc()/terms_c_cash-flow-from-operating-activities_FINAL-e4025a9df8de40059fc1b585394c4b8b.jpg)