Fantastic Info About Cash On Financial Statement What Is A P&l Sheet

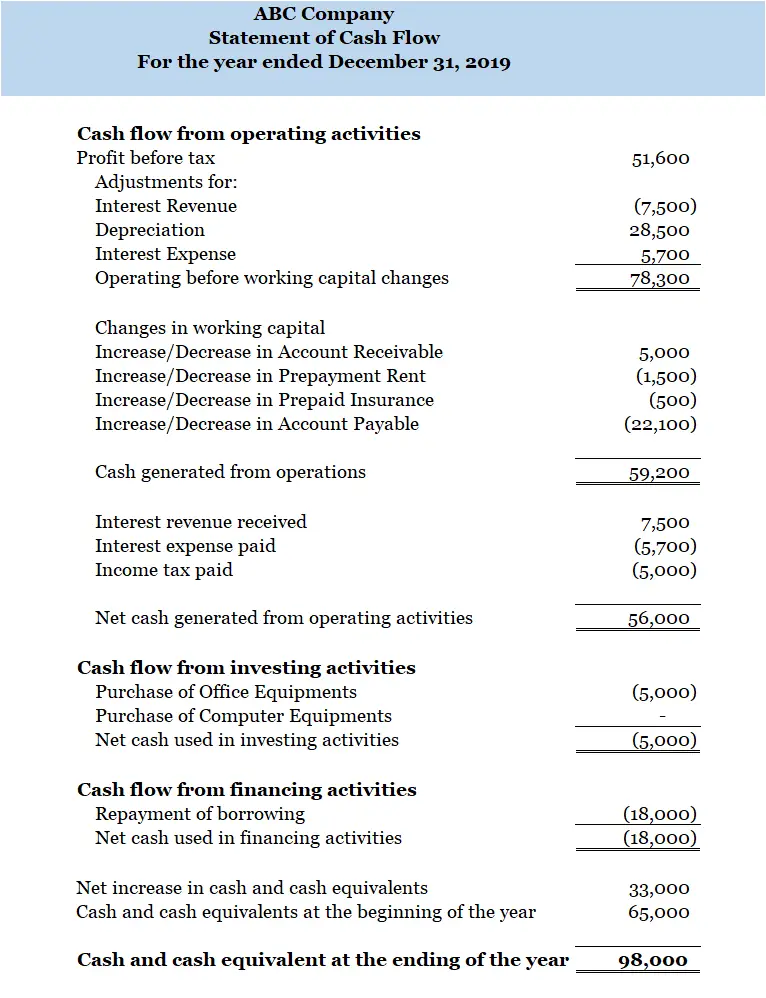

The cash flow statement provides a view of a company’s overall liquidity by showing cash transaction activities.

Cash on financial statement. There are three major financial statements: Capital one to acquire discover. The bulk of all cash flows are generally listed in the operating activities section, which.

Operating activities investing activities financing activities operating activities detail cash flow that’s generated once the company delivers its regular goods or services, and includes both revenue and expenses. A statement of cash flows is a financial statement that depicts all cash inflows and outflows from a company’s operations, investments, and financing activities in a specified period. Taking into account the profit and cash generation in 2023, as well as the expected strength of future cash flows, subject to shareholder approval at the agm on 7 may 2024, temenos intends to pay a dividend of chf1.20 per share in 2024.

A cash flow statement (cfs) is a financial statement that captures how much cash is generated and utilized by a company or business in a specific time period. Cash flow is also a crucial metric for determining the value of a company. A cash flow statement is a regular financial statement telling you how much cash you have on hand for a specific period.

Under the terms of the agreement, discover shareholders will receive 1.0192 capital one shares for each discover share, representing a premium of 26.6% based on discover's closing price of february 16, 2024. Cash in financial statements. The cfs measures how well a.

The cash flow statement and the income statement are two of the main financial statements. The cash flow statement (cfs), is a financial statement that summarizes the movement of cash and cash equivalents (cce) that come in and go out of a company. Cash plays an important role in the financial statements of a company.

Investing activities include any sources and uses of cash from a company's investments in its. Trump was penalized $355 million plus interest and banned for three years from serving in any top roles at a new york. The beginning and ending balance of cash, cash equivalents, restricted cash, and restricted cash equivalents and any other segregated cash and cash equivalents shown on the statement of cash flows should agree to.

Determine the starting balance the first step in preparing a cash flow statement is determining the starting balance of cash and cash equivalents at the beginning of the reporting period. Income statement income statement read more. The final financial statement is the statement of cash flows.

It shows changes in an entity's cash flows during the reporting period. The three financial statements are: (1) the income statement, (2) the balance sheet, and (3) the cash flow statement.

The scf reports the cash inflows and cash outflows that occurred during the same time interval as the income statement. Statement of cash flows definition a statement of cash flow is an accounting document that tracks the incoming and outgoing cash and cash equivalents from a business. The statement of cash flows acts as a bridge between the income statement and balance sheet by showing how cash moved in.

Cash flow statements provide details about all the cash coming into and exiting a company. Intuitively, this is usually the first thing we think about with a business… we often ask questions such as, “how much revenue does it have?” “is it profitable?” and “what are the margins like?” Transaction is 100% stock consideration.

:max_bytes(150000):strip_icc()/Understanding-the-Cash-Flow-Statement-Color-fc25b41daf7d45e3a63fd5f916fbf9ee.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-02-6a82acc4cf2d4434a77899c09d49e737.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

:max_bytes(150000):strip_icc()/ScreenShot2022-04-26at10.48.43AM-b060c24322b74084aa691c24b753b3fc.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-03-aac8341b98da4fd3a4f13ed3ee7fa053.jpg)