Brilliant Tips About Comparative Common Size Balance Sheet Poa

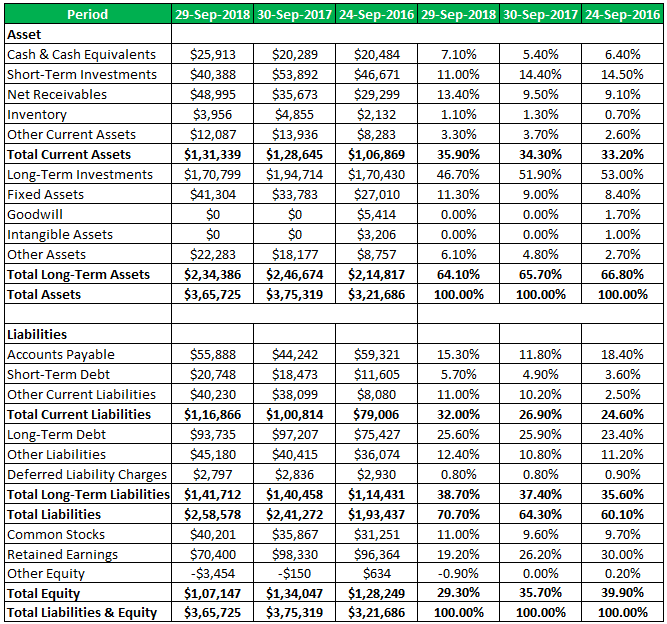

Since from the accounting equation, total assets also equals total liabilities plus equity, the common size balance sheet also shows the percentage each line item has to total liabilities plus equity.

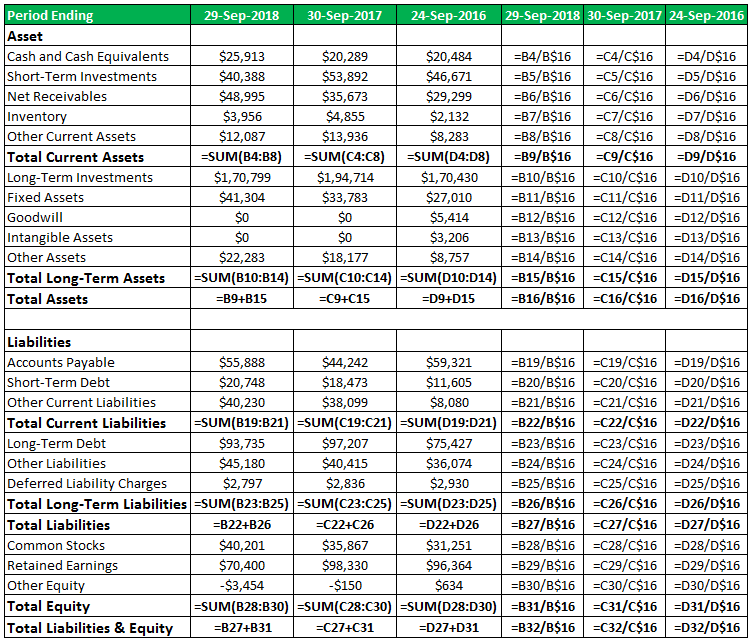

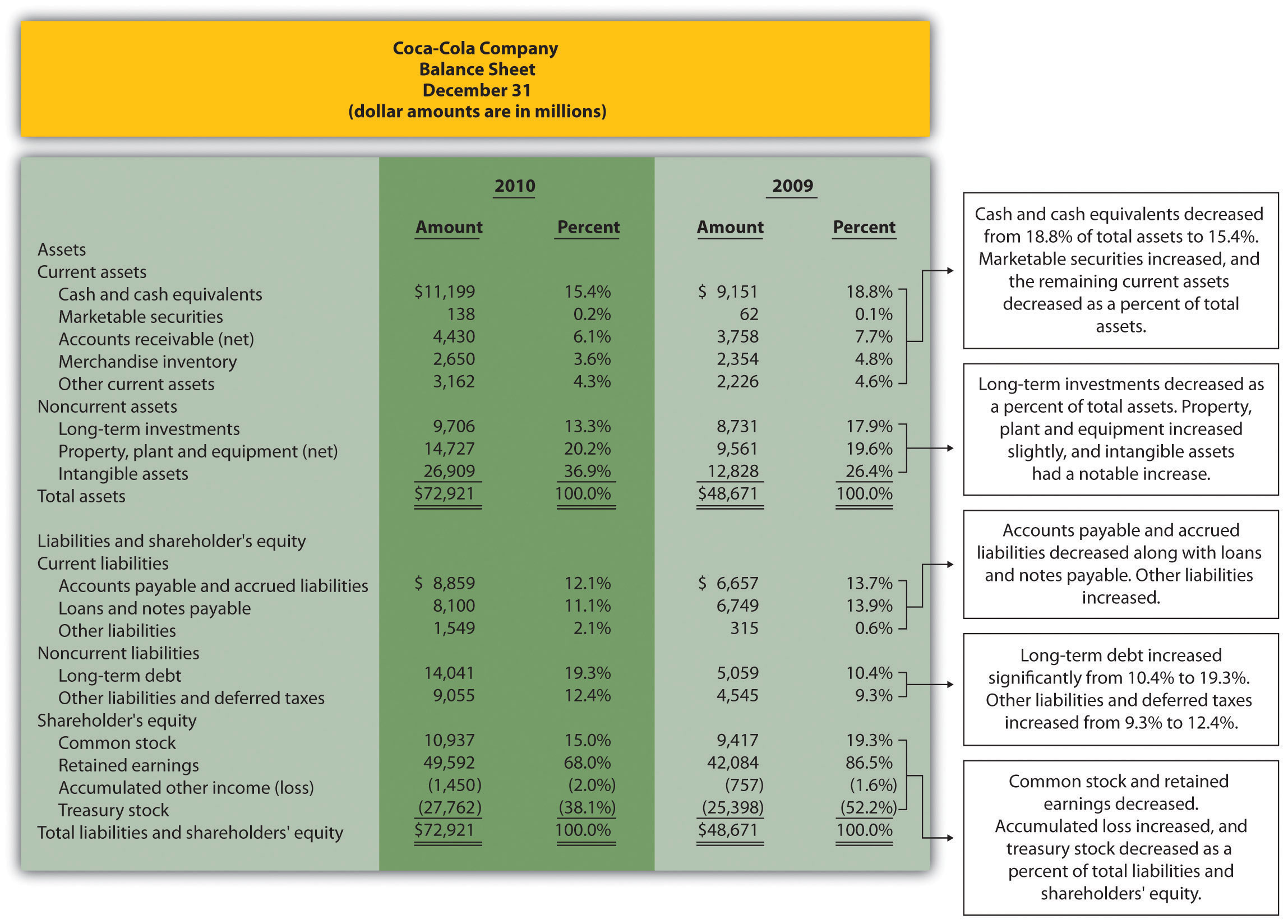

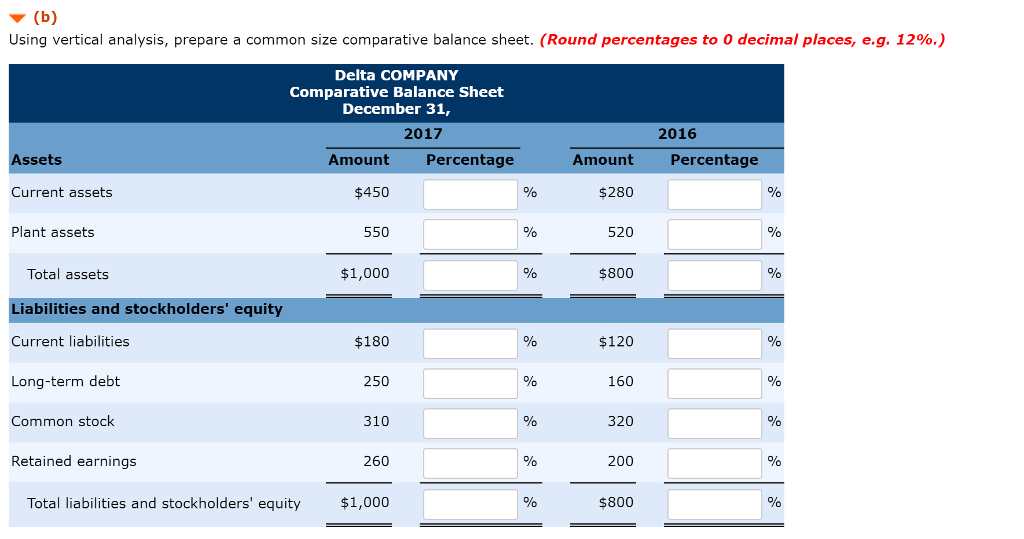

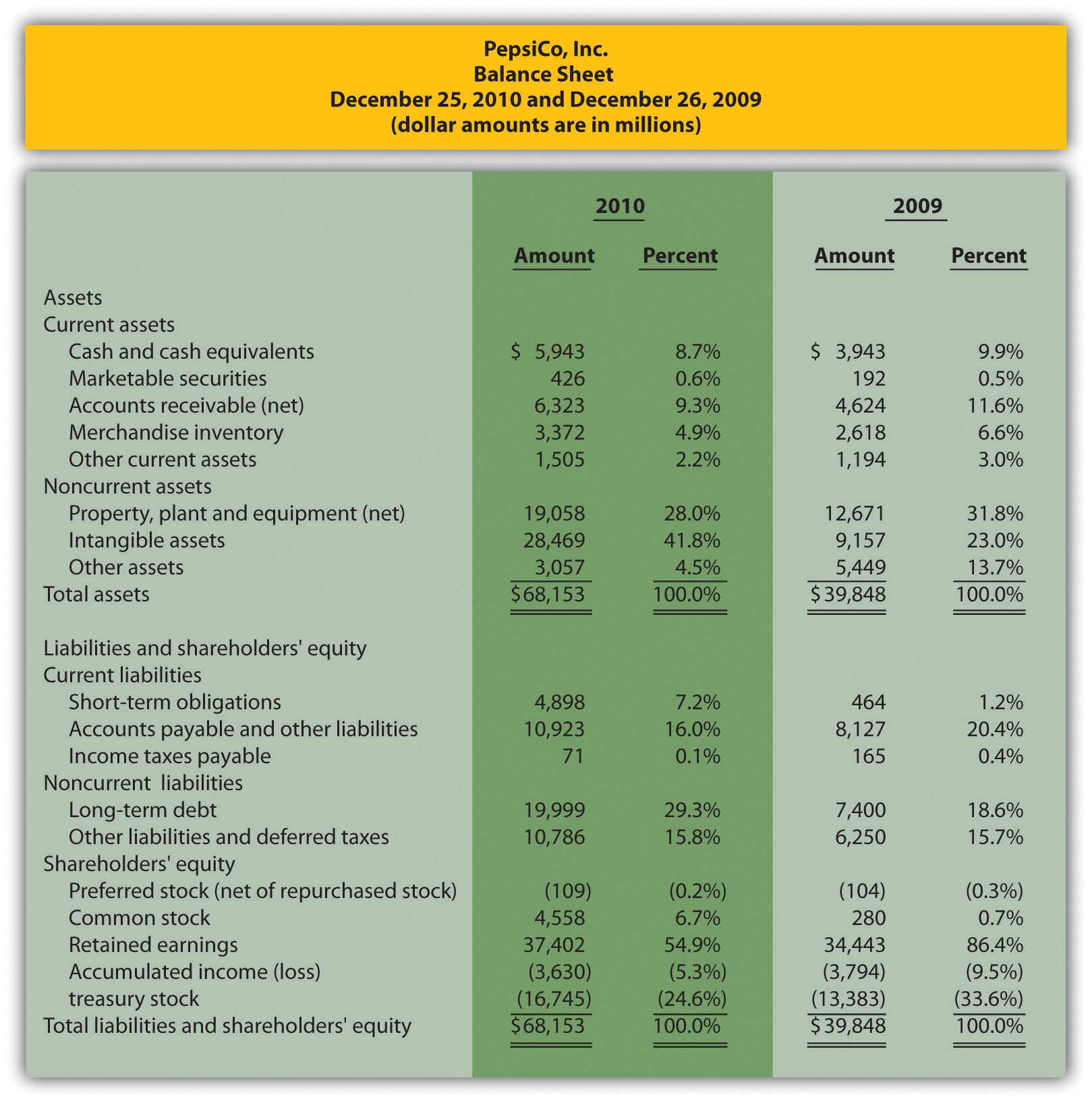

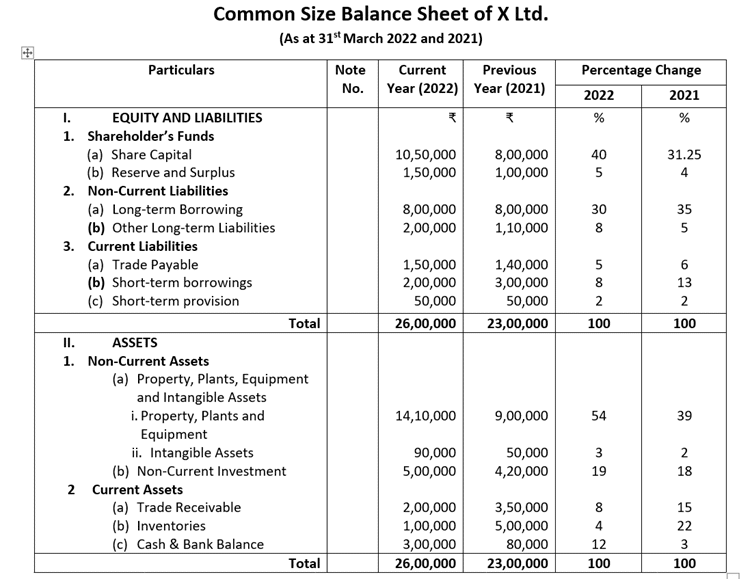

Comparative common size balance sheet. Common size statements let analysts. A common size balance sheet is a statement in which total of assets or equity and liabilities is assumed to be equal to 100 and all the figures are expressed as percentage of the total. To common size a balance sheet, the analyst restates each line item contained in the balance sheet as a percent of total assets.

Comparative common size balance sheet for different periods help to highlight the trends in different items of the balance sheet for e.g. A common size balance sheet is a balance sheet that displays both the numeric value and relative percentage for total assets, total liabilities, and equity accounts. A common size balance sheet is one that has an additional column showing each monetary amount as a percentage of the total assets of the business.

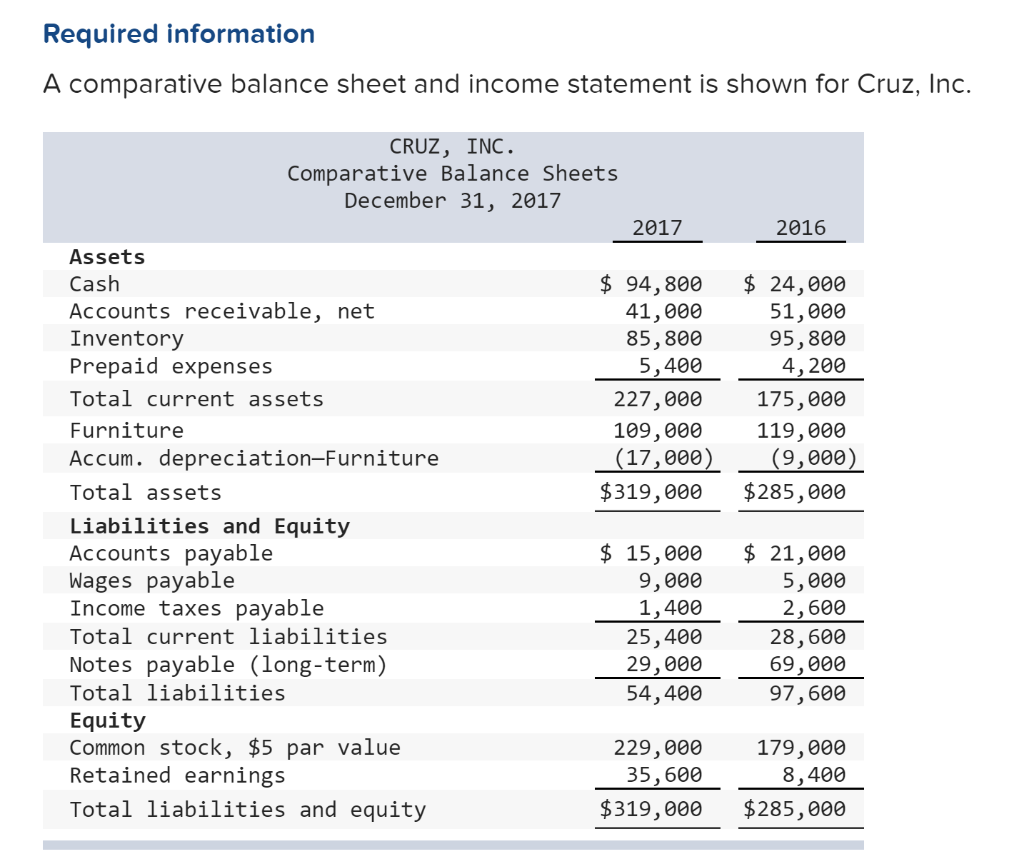

The common size balance sheet analyzes a balance sheet that presents each item as a percentage of a standard figure. As at 31st march, 2018 and 2017, prepare a common size balance sheet: The format of the comparative income statement puts together several income statements into a single statement.

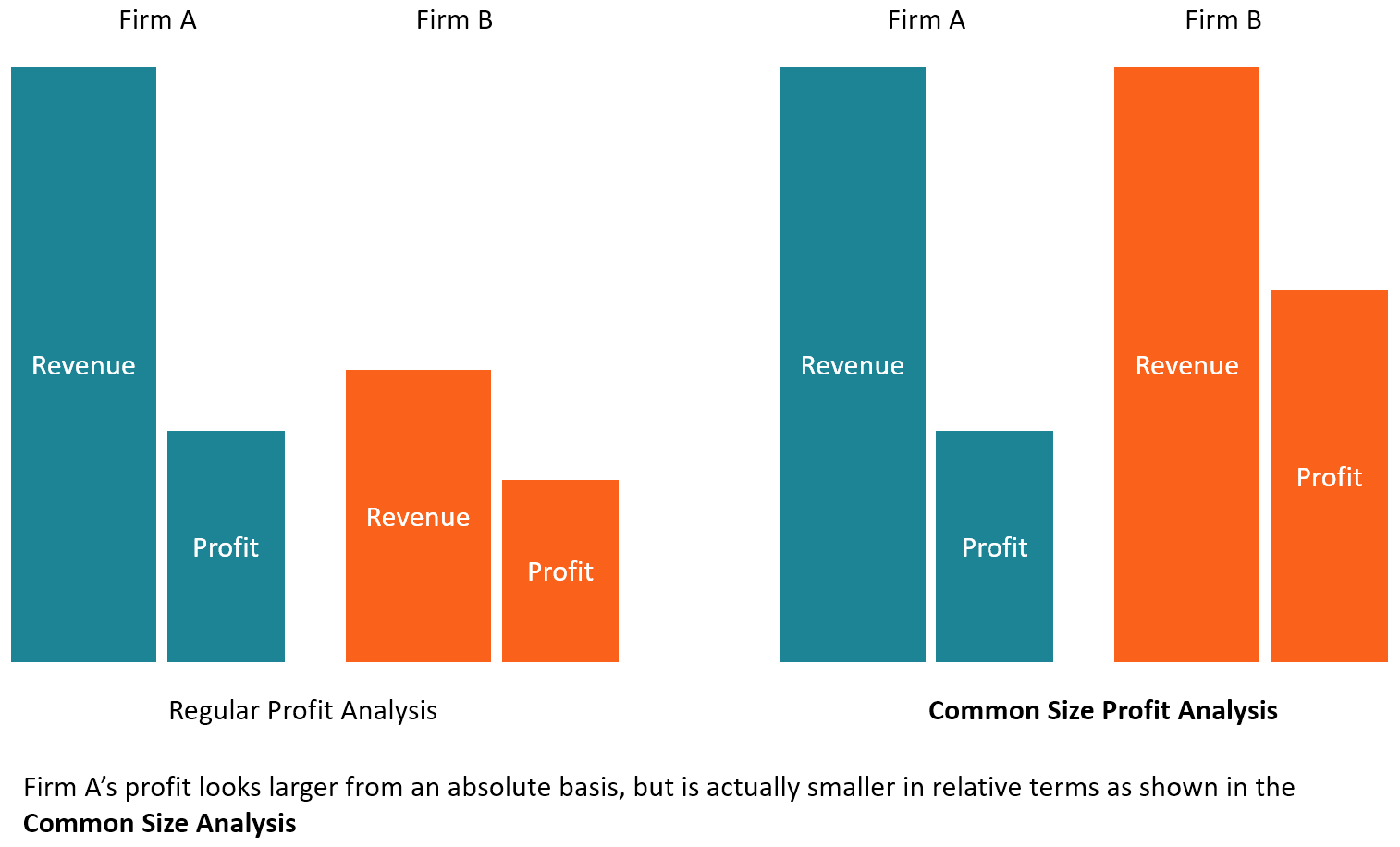

A financial manager or investor can use the common size analysis to see how a firm’s capital structure compares to rivals. Common size balance sheet in this statement the total of balance sheet is taken as 100 & all figures are expressed as percentage of total. A common size balance sheet displays the numeric and relative values of all presented asset, liability, and equity line items.

Line items in income statements are frequently divided by total revenues or total. Comparative financial statement is a document that represents the financial performance of the business by comparing them at different time periods. Common size balance sheet is a statement where balance sheet figures are expressed in the ratio of the common base of total assets or liabilities.

From the following balance sheet of vijay ltd. A technique of comparing financial statements through which the balance sheet of a company is analysed by comparing its asset, and equity and liabilities for two or more two accounting periods is known as comparative balance sheet. The balance sheet common size analysis mostly uses the total assets value as the base value.

If company a has $1,000 in cash and $5,000 in total assets, this would be presented in a separate column as 20%. Assets are expressed as a percentage of total assets, liabilities as a percentage of total liabilities, and shareholder equity as a percentage of total shareholder equity. To express the amounts as the percentage of the total, the total assets or total equity and liabilities are taken as 100.

Balance sheet common size analysis. You can use it in financial analysis to compare the relative results of two or more companies. For full course, visit:

Uses and importance of financial statements financial statements mcqs Key takeaways a common size financial statement displays entries as a percentage of a common base figure rather than as absolute numerical figures. On the balance sheet, looking at each item as a percentage of total assets allows for measuring how much of the assets’ value is obligated to cover each debt, or how much of the assets’ value is claimed by each debt (figure 3.16).

It is helpful for investors to analyse the trends of the business and make proper investment decisions. The absolute values of assets and liabilities are shown side by side in the comparative statement. This is a detailed and simple explanation to how to write the interpretation for comparative balance sheet and common size balance sheet, it will help to score maximum marks that is given for.

:max_bytes(150000):strip_icc()/comparative-statement_final-638912a8e4d7465aacd99e115d561f8f.png)