Outrageous Tips About Financial Accounting Trial Balance Boots Statements

![[Solved] prepare a chart illustrating 'the accounting cycle' and each](https://spscc.pressbooks.pub/app/uploads/sites/64/2021/07/OSX_Acct_F04_05_YT02Sol_img.jpg)

Aggregate the amounts of the remaining account in two separate headings that is,.

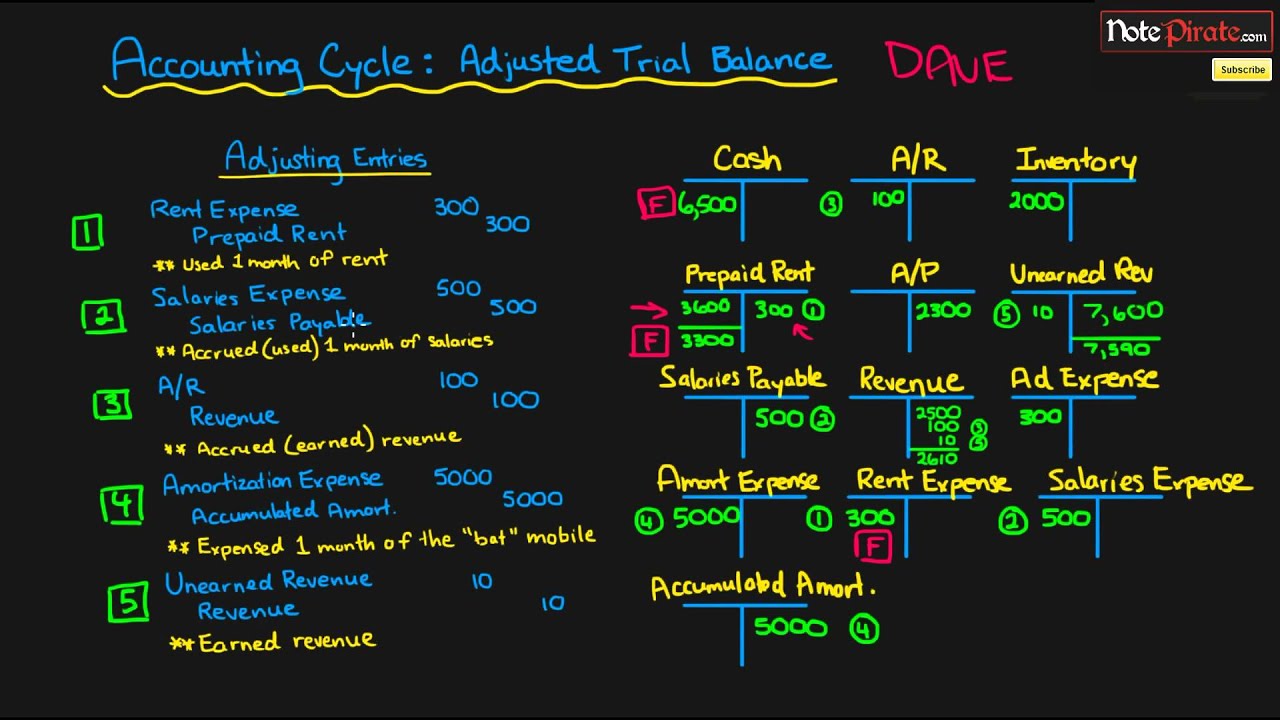

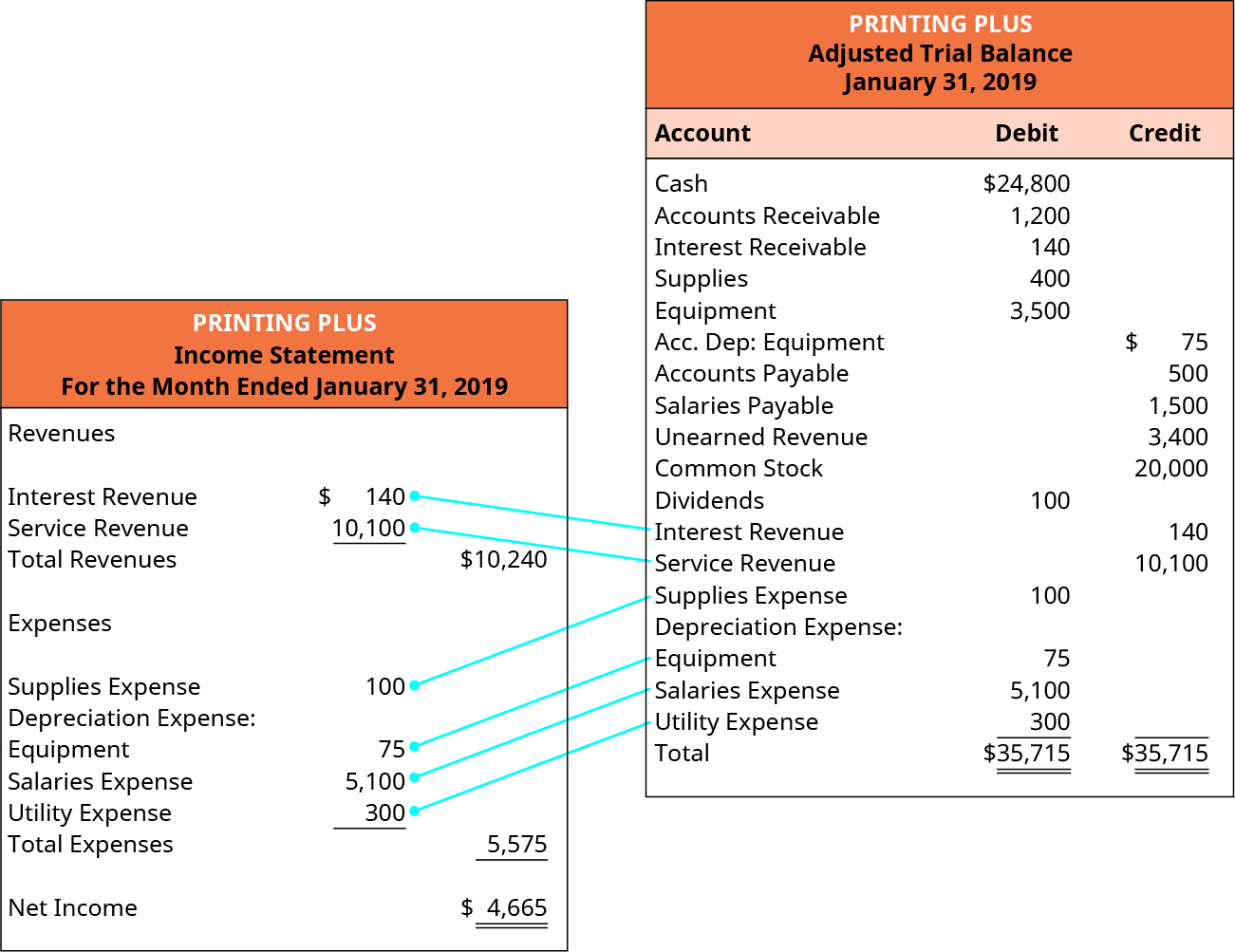

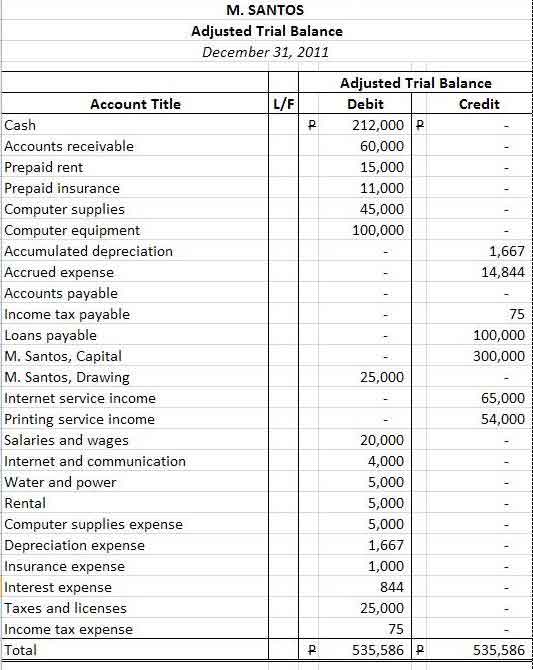

Financial accounting trial balance. What is a trial balance? Preparing and adjusting trial balances aid in the preparation of accurate financial statements. A trial balance is a listing of the ledger accounts and their debit or credit balances to determine that debits equal credits in the recording process.

A trial balance in accounting is a foundational tool that validates the accuracy of financial records. Follow the process below to prepare a balance sheet from the trial balance: Preparing and adjusting trial balances aid in the preparation of accurate financial statements.

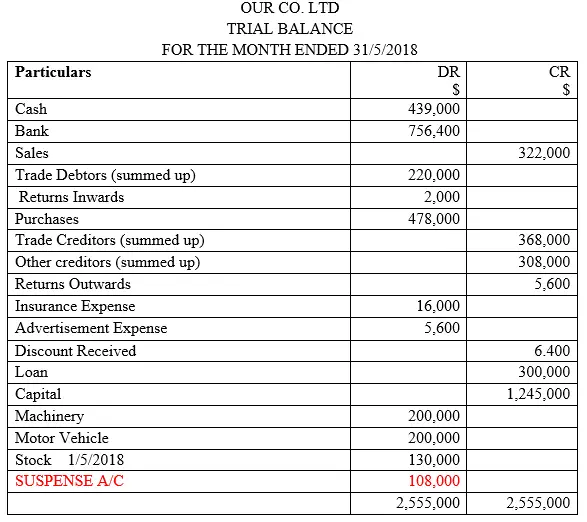

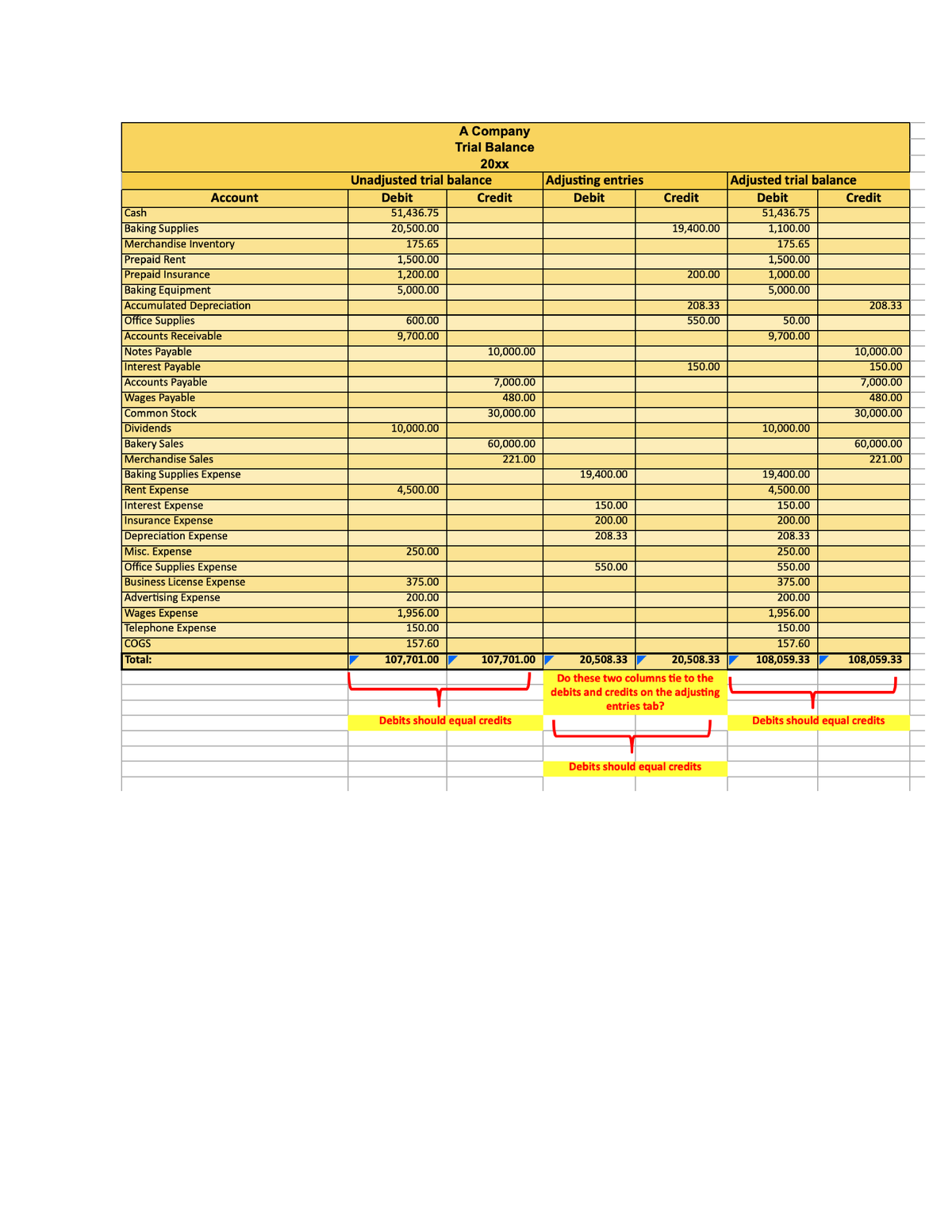

Trial balance is a foundational pillar in the world of accounting, essential for both the practice and the understanding of financial management. For example, utility expenses during a period include the payments of four different bills amounting to $ 1,000, $ 3,000, $ 2,500, and $ 1,500, so in the trial balance, single utility expenses account will be shown wi. Example of a trial balance document

A trial balance is a listing of the ledger accounts and their debit or credit balances to determine that debits equal credits in the recording process. Put all the debit balances in one column, and all the credit balances in another, and compare the totals, like this: There’s an easy way to check this:

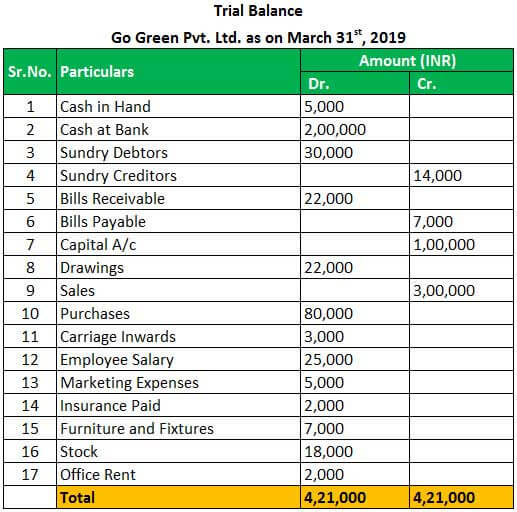

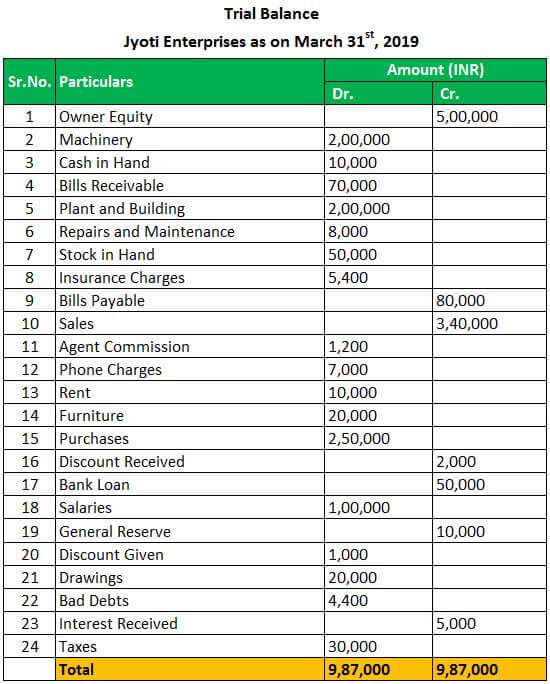

It includes transactions done during the year and the opening and closing balances of ledgers, as every entity needs to evaluate its financial position over a particular period. As accountants know that to arrive at extracting a trial balance one must use the balance brought forward by each account in the ledger books such as the sales ledger, purchases ledger and general ledger. The concept is based on the understanding that all assets of a business are either the financial right of the creditors (liabilities) or the owner (equity) in different proportions.

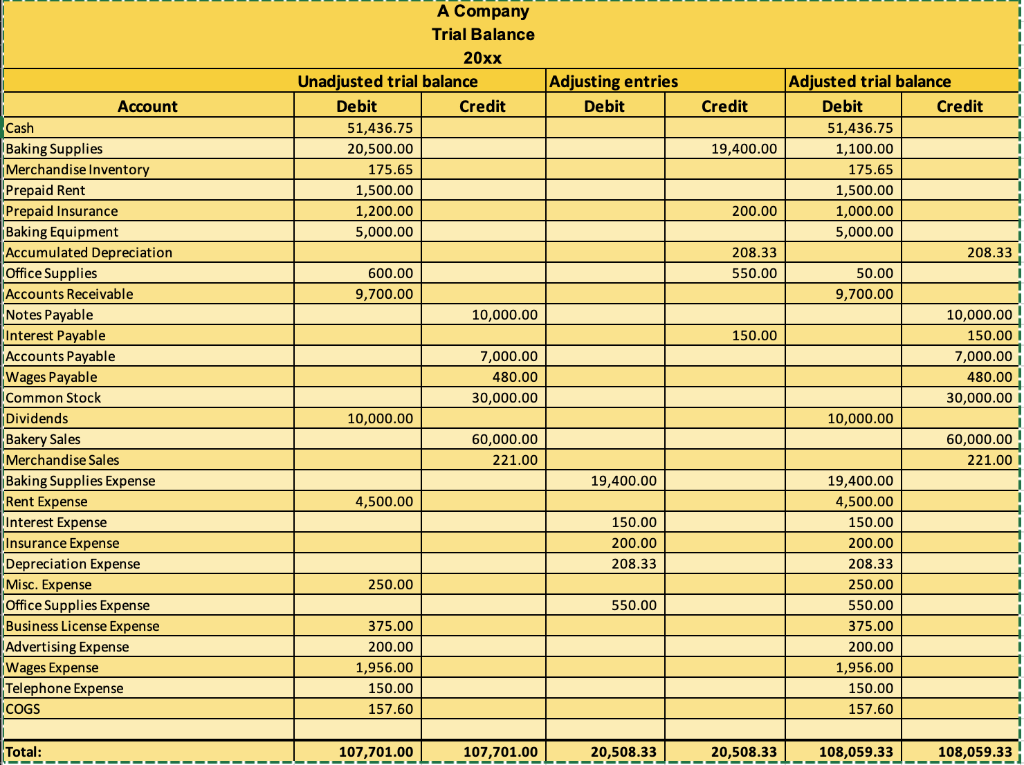

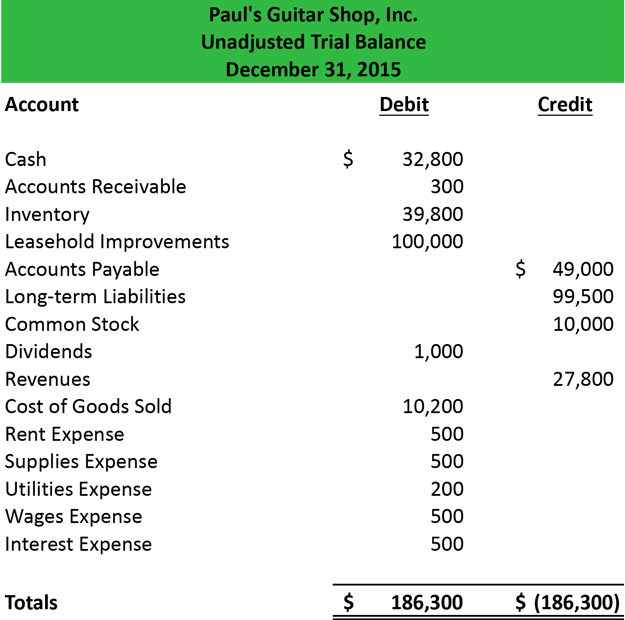

First, list all the ledger accounts. The five column sets are the trial balance, adjustments, adjusted trial balance, income statement, and the balance sheet. Once the accounting period has ended and all transactions have been identified, recorded and posted to the general ledger, a trial balance is carried forward for testing and analysis.

It is a working paper that accountants. A trial balance is a bookkeeping worksheet in which the balances of all ledgers are compiled into debit and credit account column totals that are equal. The preparation of a trial balance helps consolidate, verify, and rectify journal entries, shaping tax.

A trial balance ensures mathematical accuracy in a company’s financial records by presenting a snapshot of debits and credits for a specific period. Purpose of a trial balance trial balance acts as the first step in the preparation of financial statements. It is typically prepared at the end of an accounting period, such as a month or a year, to ensure that the total debit balances equal the total credit balances in the company’s ledger.

Prepare and adjust the balances in the trial balance. A trial balance sheet is a report that lists the ending balances of each account in the chart of accounts in balance sheet order. Auditors use tb as a preliminary inspection to find missing general ledger entries or transfer mistakes that call attention to the need for.

A company prepares a trial balance. Eliminate any expense or revenue accounts as they are not a part of the balance sheet. Trial balance has a tabular format that shows details of all ledger balances in one place.

![Solved [20] QUESTION TWO The trial balance and additional](https://d2vlcm61l7u1fs.cloudfront.net/media/f5c/f5c66eed-4d83-425c-9798-4a85c15258eb/php5z9sHV.png)