Here’s A Quick Way To Solve A Info About Miscellaneous Expenditure In Balance Sheet Auditor Responsibility For The Detection Of Errors And Frauds

Cost incurred before the start of business operations is.

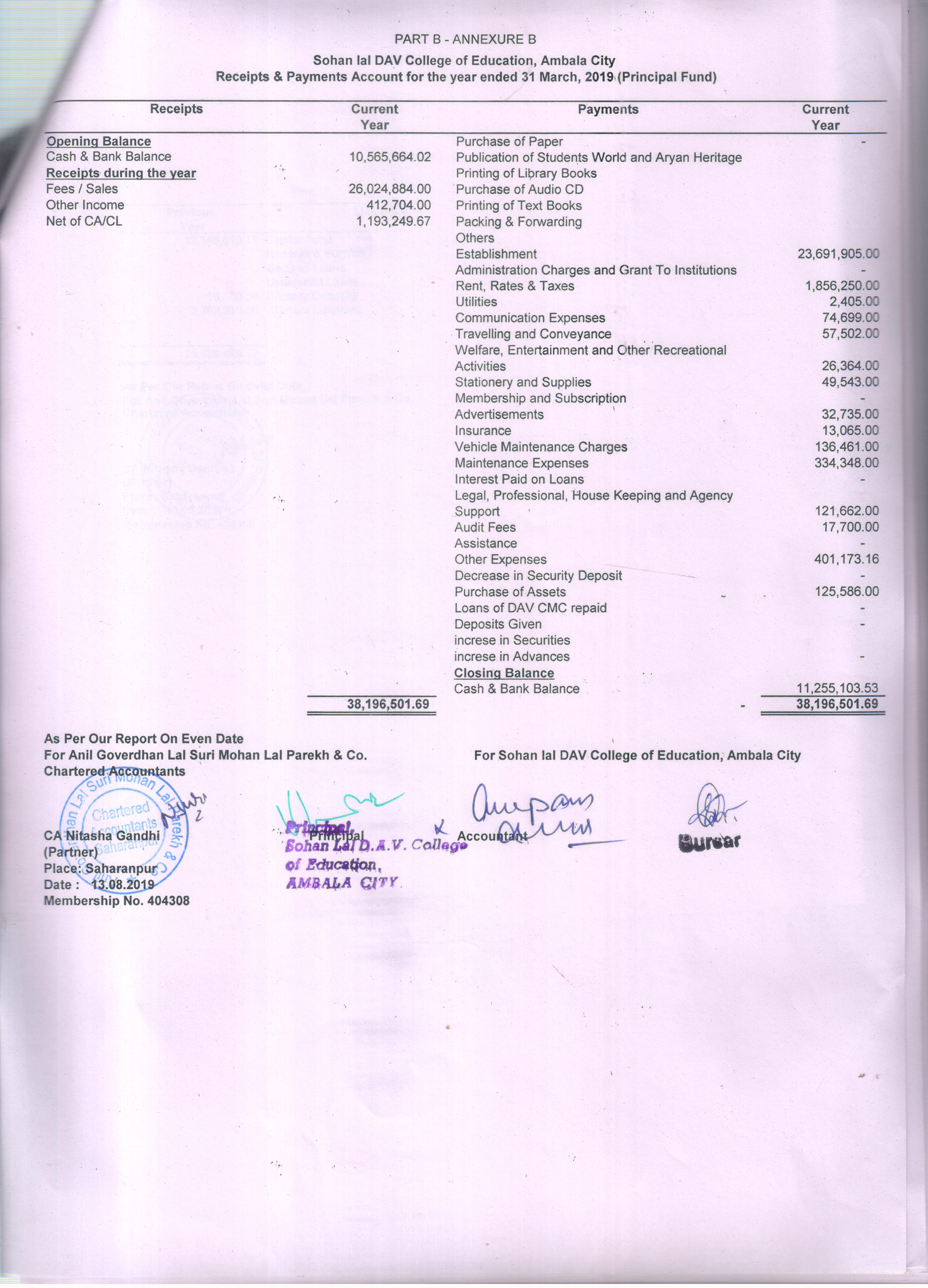

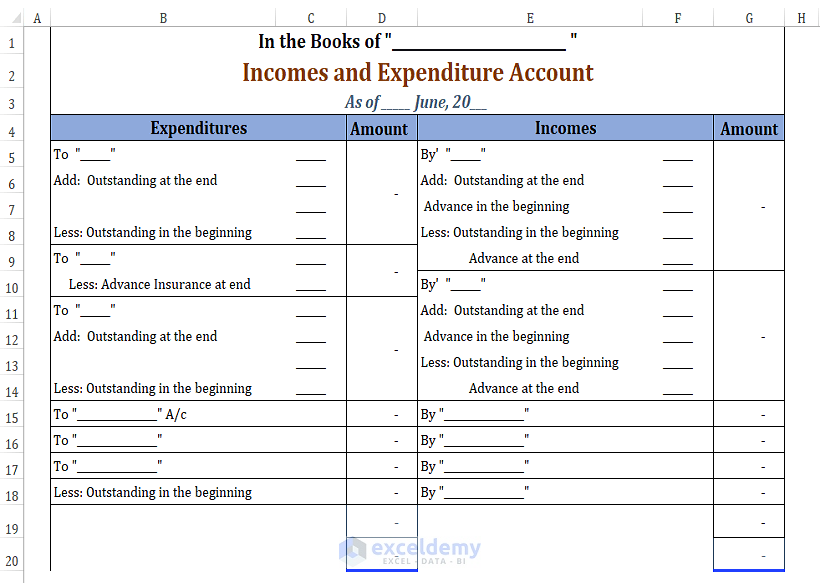

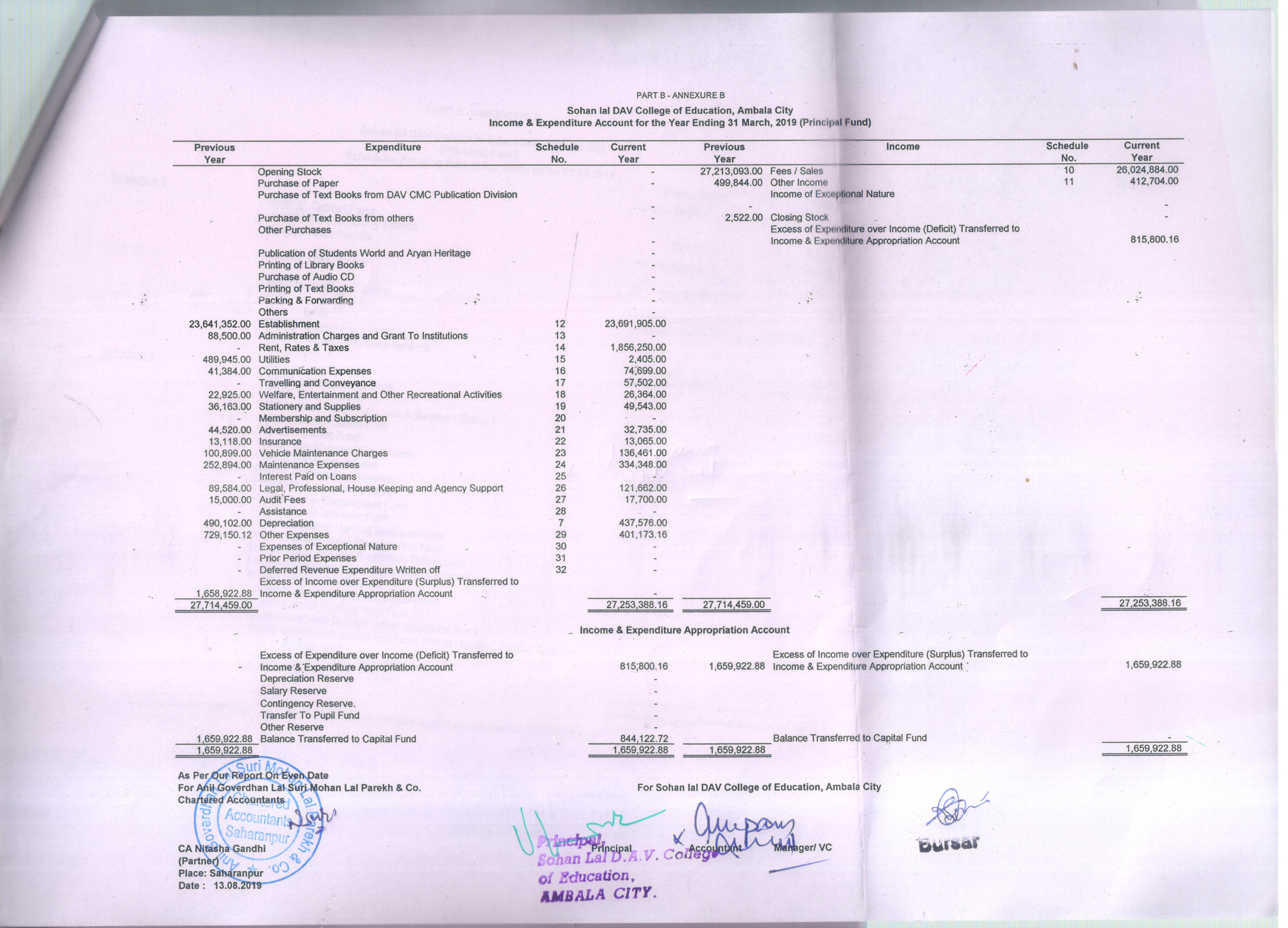

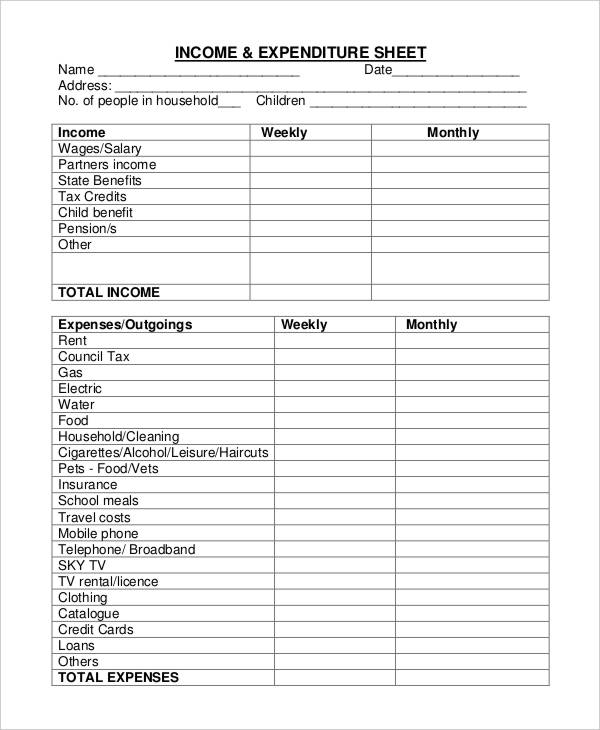

Miscellaneous expenditure in balance sheet. Miscellaneous expenses, meaning costs that don’t fall into a specific tax category, must be recorded and accounted for in your business’s general ledger account. What are preliminary expenses? Definition of miscellaneous expense in accounting, miscellaneous expense may refer to a general ledger account in which small, infrequent transaction amounts are recorded.

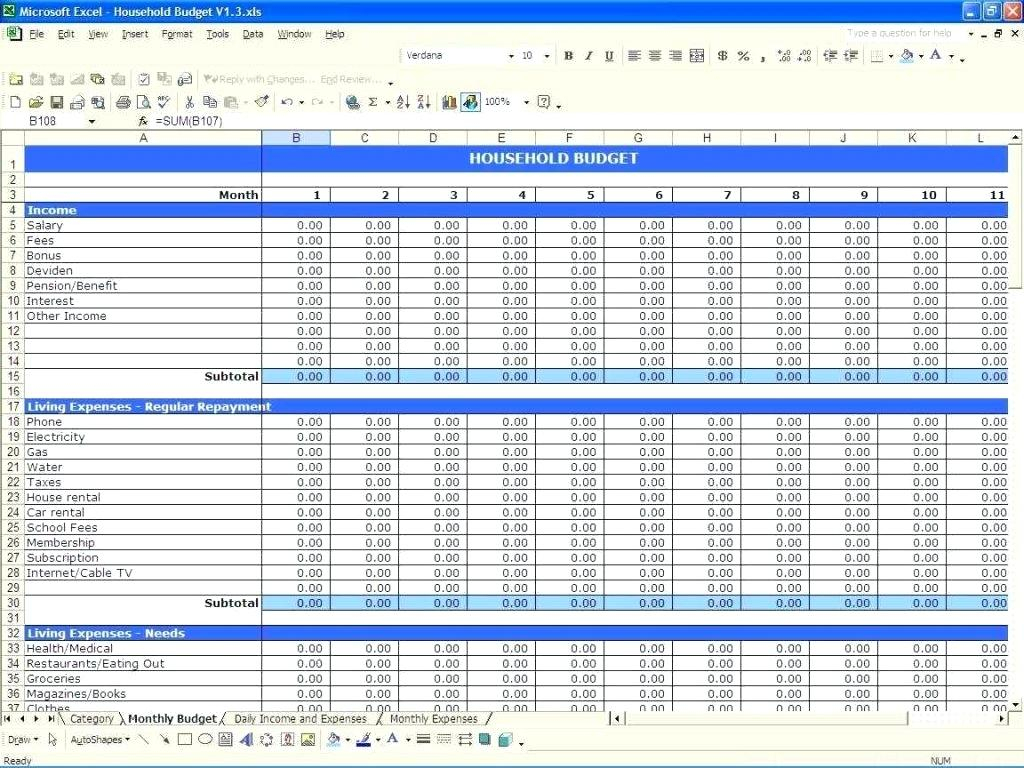

These transactions are for amounts so small that they are. 2.1 describe the income statement, statement of owner’s equity, balance sheet, and statement of cash flows, and how they interrelate; Kindly guide where miscellaneous expenditure like preliminary expenses preoperative expense discount of issue of shares etc are show in balance sheet as per.

Miscellaneous expenses can be defined as a cost that generally does not fit any specific account ledger or tax category. Once an entity applies as 26 to account for intangible assets, the expenditure incurred on items that normally constitute miscellaneous. Miscellaneous expense is a general ledger account that may contain a large number of minor transactions.

Value of the accumulated losses, deferred expenditure and miscellaneous expenditure not written off, as per the audited balance sheet, but does not include reserves created. Bank balances in relation to earmarked balances, held as margin money against borrowings,deposits with more than 12 months maturity, each of these to be shown. These are typically minor transactions that.

Miscellaneous expenditure means miscellaneous expenditure ( to the extent not written off or adjusted) appearing in the balance sheet of hfcl as at 31.3.2002 and further. The guidance note on audit of miscellaneous expenditure shown in the balance sheet shall stand withdrawn in respect of audit of financial statements of. An income statement account for expense items that are too insignificant to have their own separate general ledger accounts.