Fine Beautiful Info About Net Change In Cash And Equivalents Balance Sheet Xero

![[Solved] Review AT&T SEC 10K company's balance sheet (statement of](https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/097fd547fed1a54c71af471add1927b7/thumb_1200_1855.png)

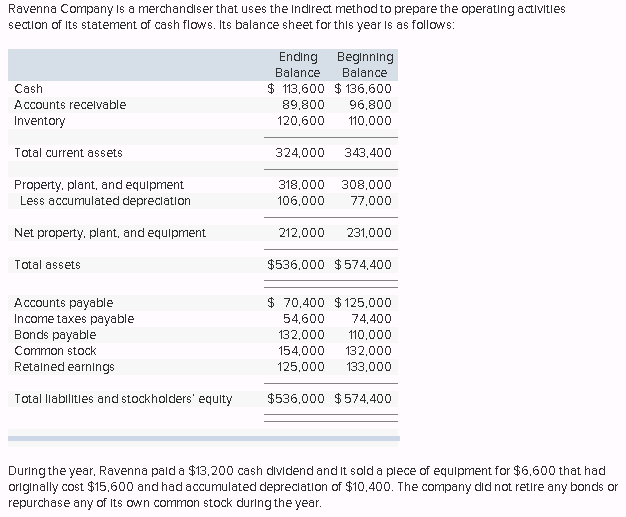

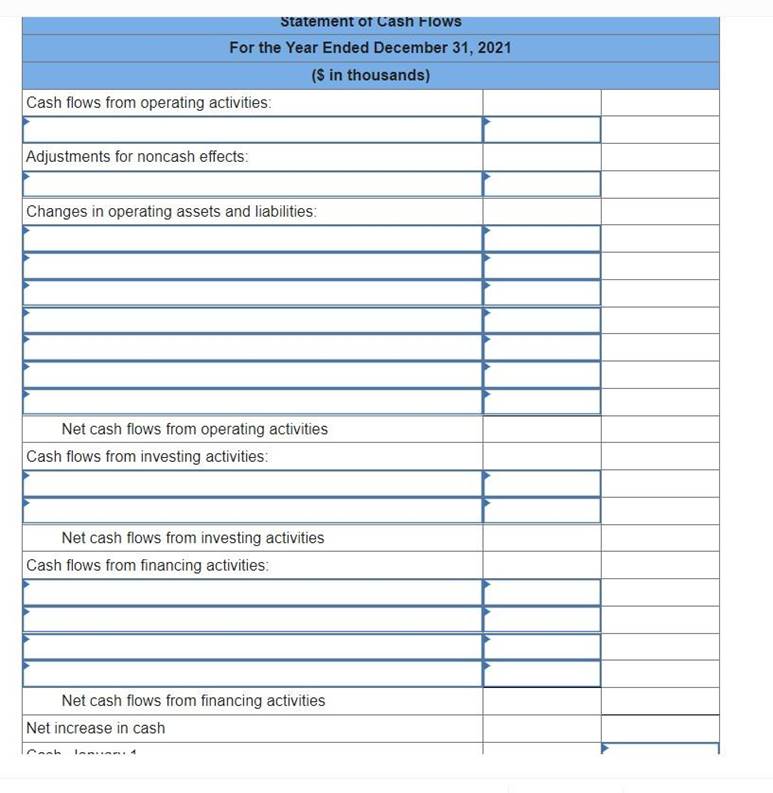

Investing and financing transactions that do not require.

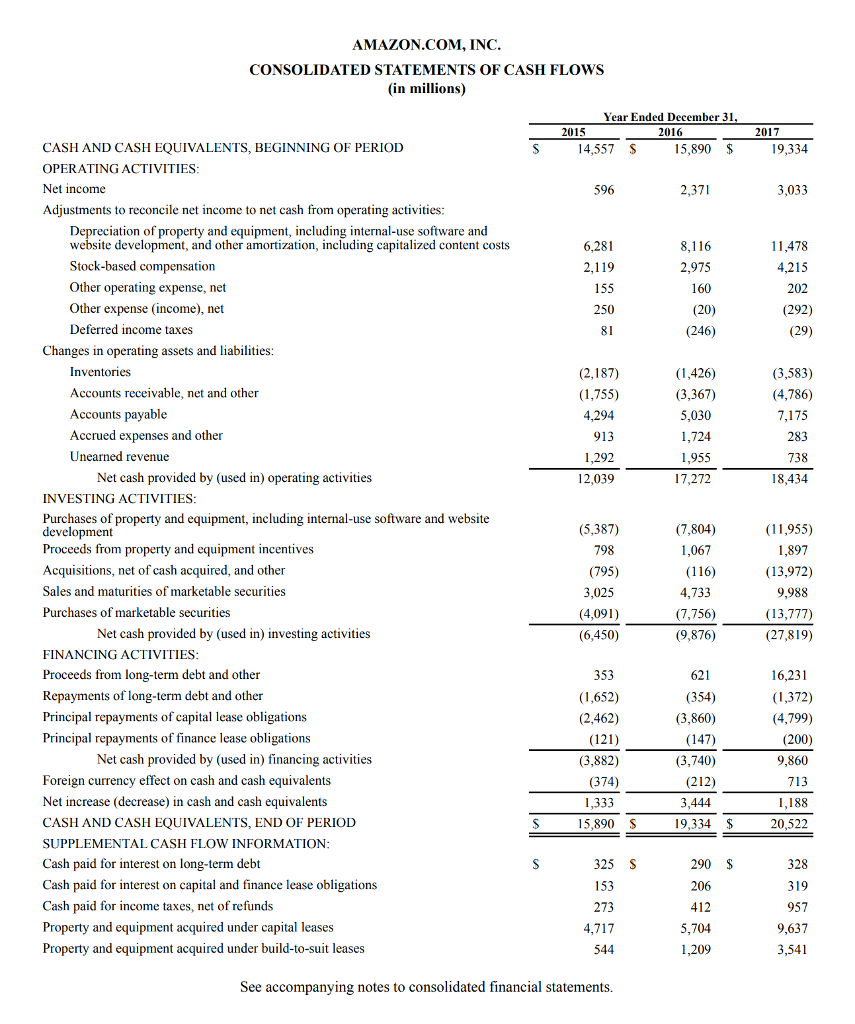

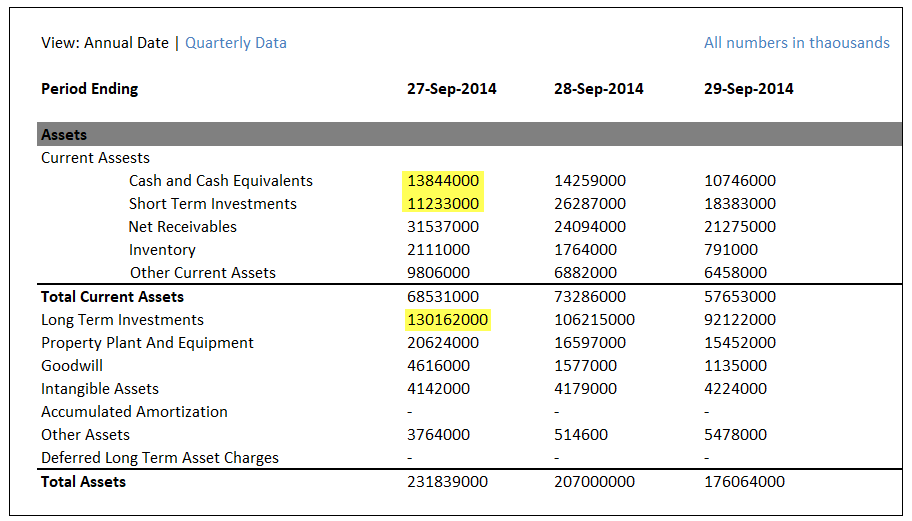

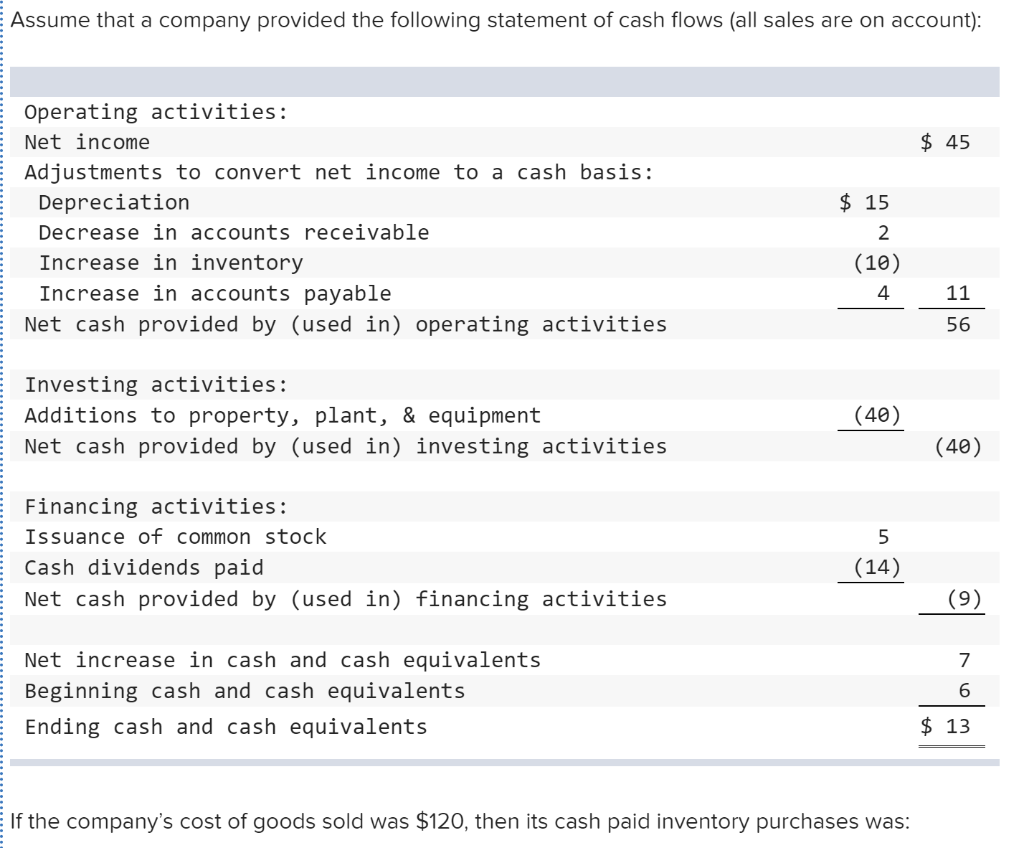

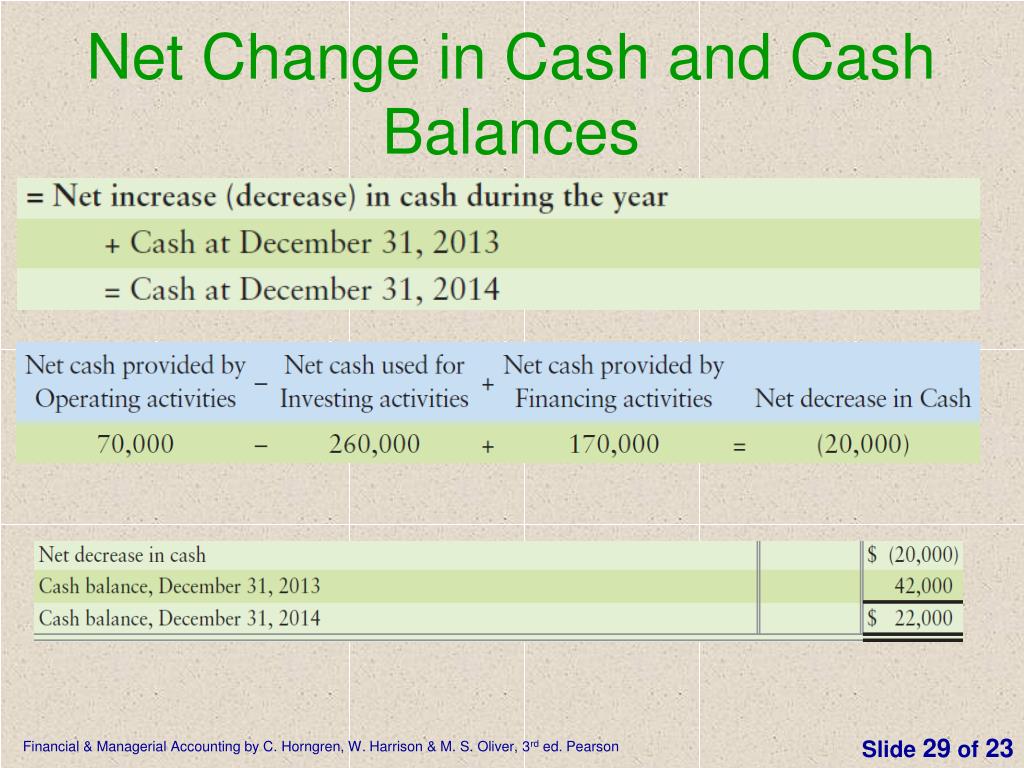

Net change in cash and cash equivalents. The 2020 net increase (decrease) in cash and. The statement of cash flows must detail changes in the total of cash, cash equivalents, restricted cash, and restricted cash equivalents and any other segregated cash and. Its value changes each time that the business either receives or spends cash and.

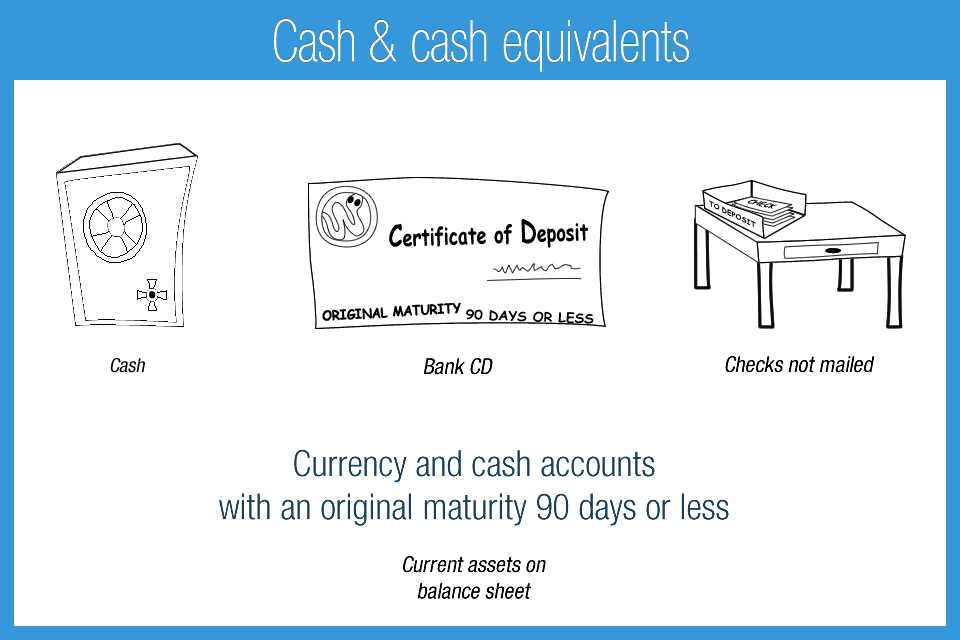

These are few formulas that are used by analysts to calculate transactions related to cash and cash equivalents: Cash and cash equivalents (cce) are company assets in cash form or in a form that can be easily converted to cash. It is equal to the net change.

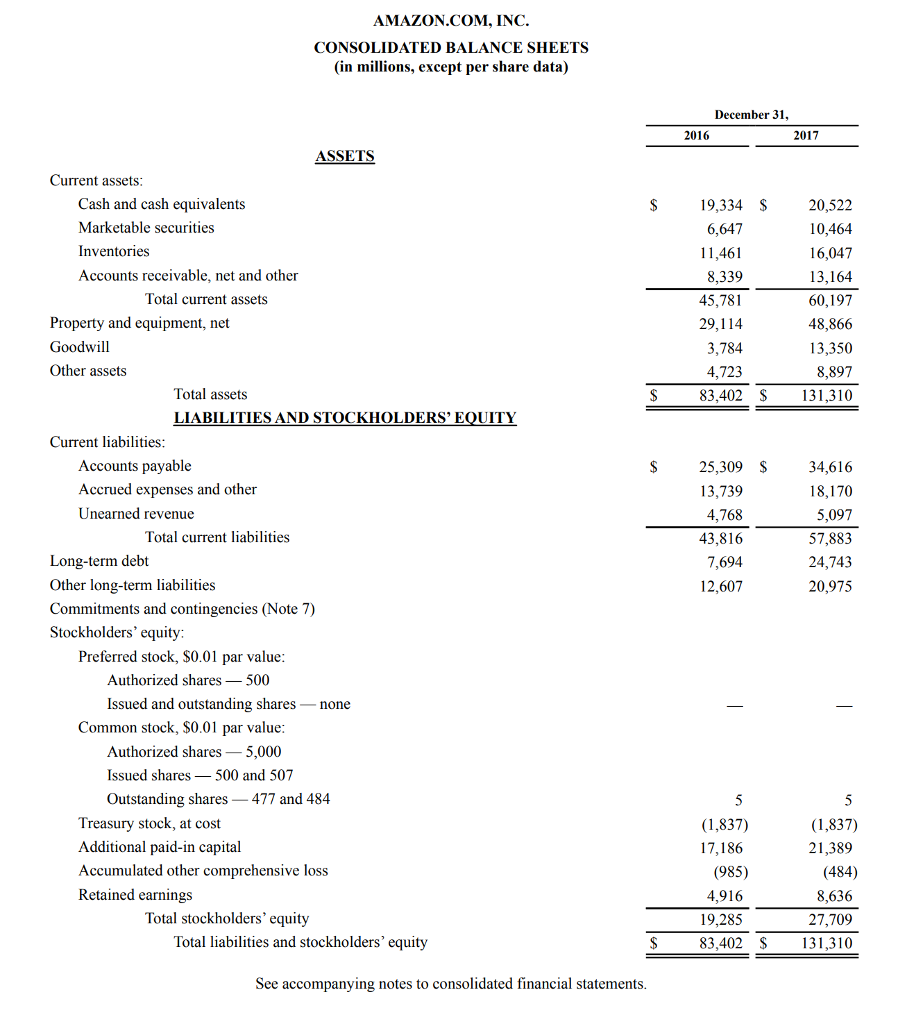

A new york judge ordered trump and his companies friday to pay $355. Cash and cash equivalents are recorded on the balance sheet as a current asset. Relationship between profitability and net cash flow and the impact of changing prices.

Cash equivalents are securities that are meant for short. Net change in cash in the cash flow statement is the increase or decrease in cash and cash equivalents from the beginning to the end of a year. Cash and cash equivalents 1,089 472 bank overdrafts (280) (90) 809 382.

Cash and cash equivalents at. Net change in cash measures how much the value of cash and cash equivalents changed over the reporting period. Effect of exchange rate on cash, cash equivalents, restricted cash and restricted cash equivalents.

A deposit that fails to be classified as cash may still meet the definition of cash equivalents if specific criteria are met. (36) (392) net increase (decrease). Net cash and cash equivalents consist of:

Net change in cash. Effect of exchange rates on cash and cash equivalents: Cash and cash equivalents.

Gaap defines cash equivalents as: Updated july 31, 2023 reviewed by somer anderson fact checked by katrina munichiello what are cash equivalents? It’s determined by calculating the total cash inflows and outflows for each of the three sections in the cash flow statement.

Examples of cash & cash eqiuvalents (cce). The statement classifies cash flows during a period into cash flows from operating, investing and financing activities: ' net change in cash ' is a financial metric that represents the increase or decrease in a company's cash and cash equivalents during a specific accounting.

Net cash is a financial figure that is derived by subtracting a company's total liabilities from its total cash. This is likely to be the net increase/decrease in cash and cash equivalents. the bottom line reports the overall change in the company's cash and its.