Supreme Tips About Interest Paid In Cash Flow Financial Statement Includes Companys Assets

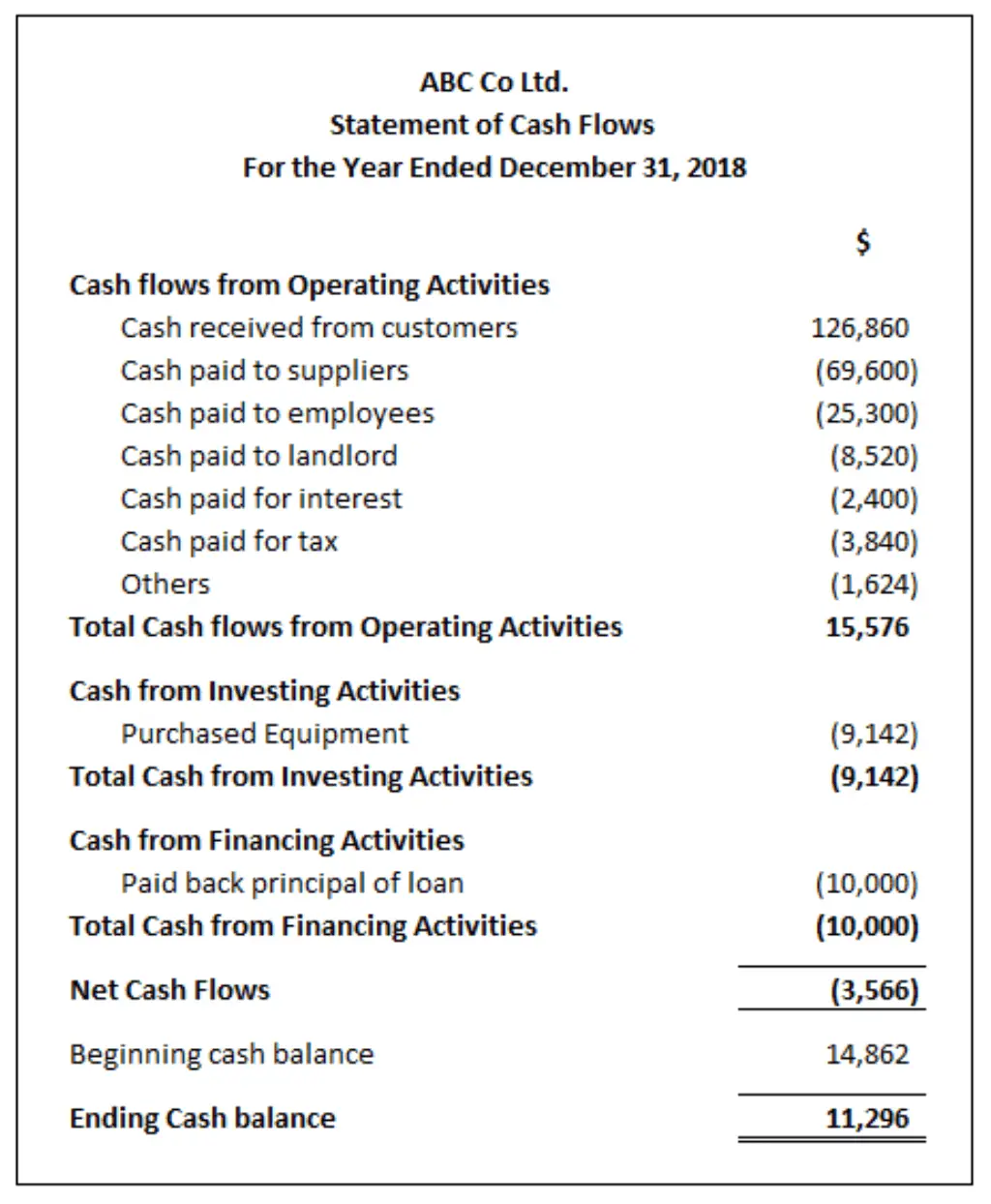

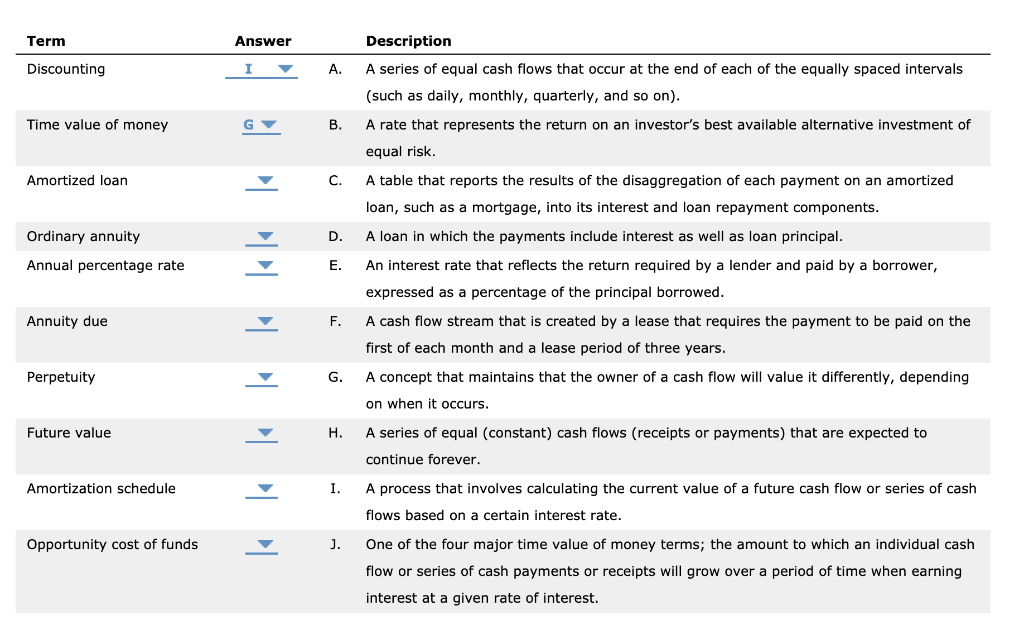

The time interval (period of time) covered in the scf is shown in its heading.

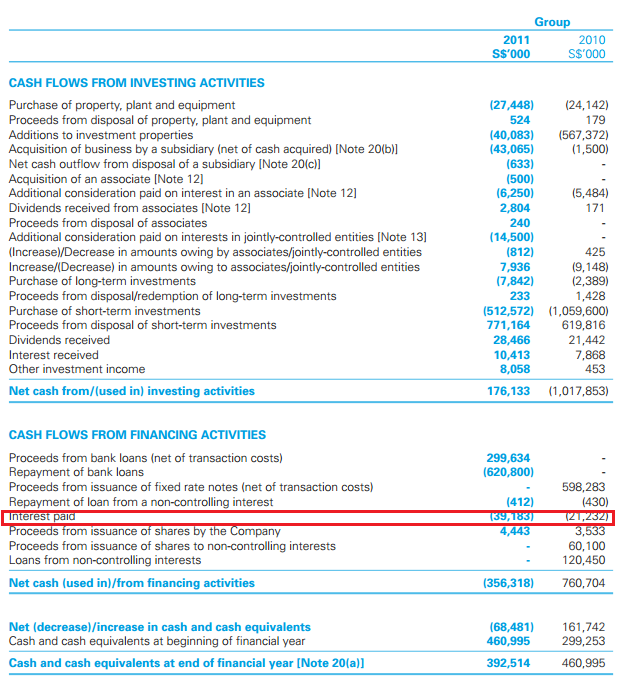

Interest paid in cash flow. Trump was penalized $355 million plus interest and banned for three years from serving in any top roles at a new york. Cash paid on interest will be present under. Under ifrs, there are two allowable ways of presenting interest expense or income in the cash flow statement.

Trump claimed under oath last year that he was sitting on more than $400 million in cash, but between justice engoron’s $355 million punishment, the interest mr. Although interest on the bond is accrued and presented as interest income in 20x1 and 20x2, no cash flow occurs concerning interest in these. Most estimates, including an assessment by the new york attorney general, put that figure closer to $2 billion.

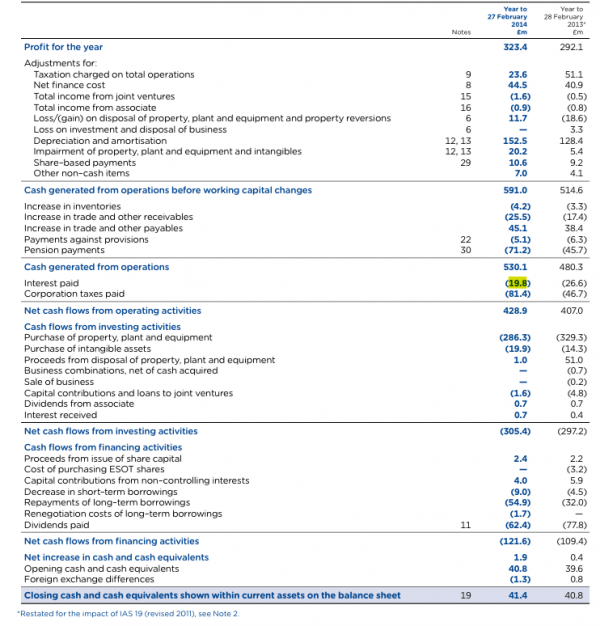

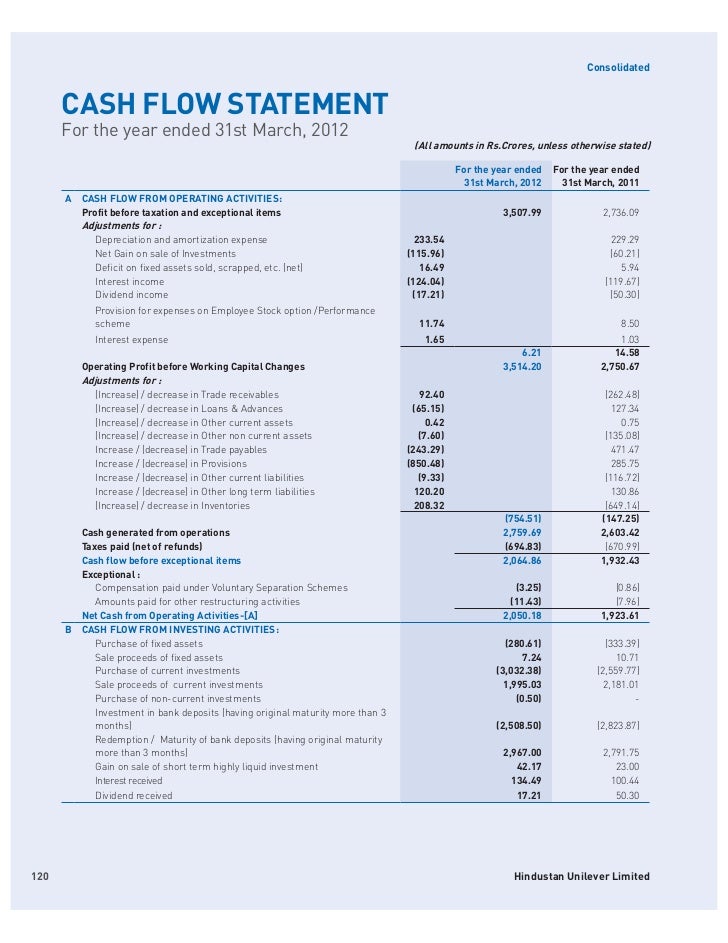

Paragraph 33 of ias 7 states that interest paid and interest and dividends received are normally classified as operating cash flows by a financial institution. Payments for the interest portion are classified as operating or financing activities, in line with a company’s policy election for interest paid (see difference #3). All of that could put him over $600.

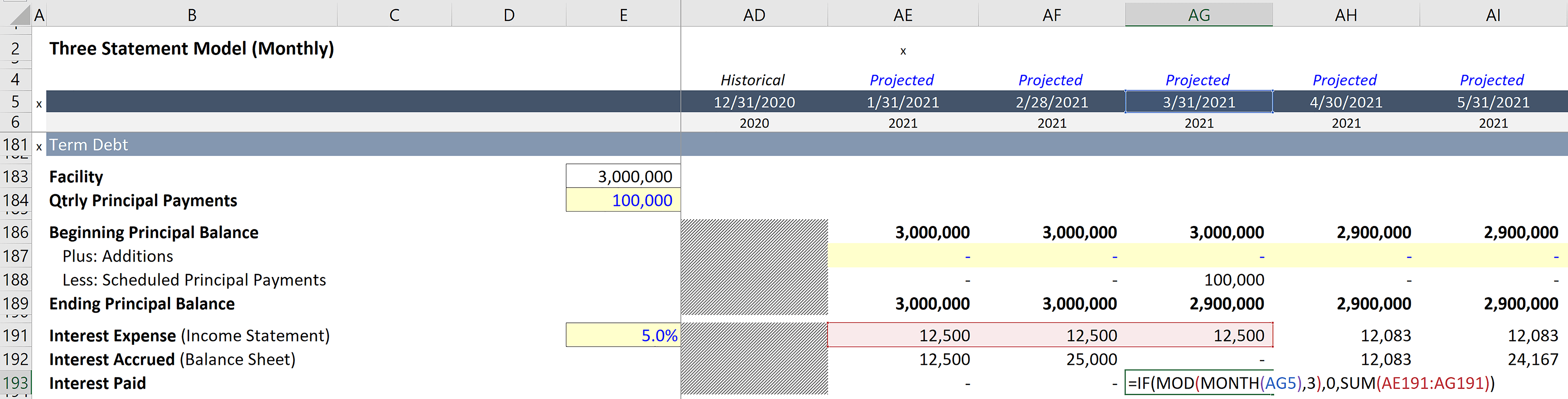

Since most companies use the indirect method of preparing the cash flow statement (or statement of cash flows ), the company's interest expense will be contained within the company's net income, which is the first amount presented in the. Cash outflows from buying back equity/shares; Many companies present both the interest received and interest paid as operating cash flows.

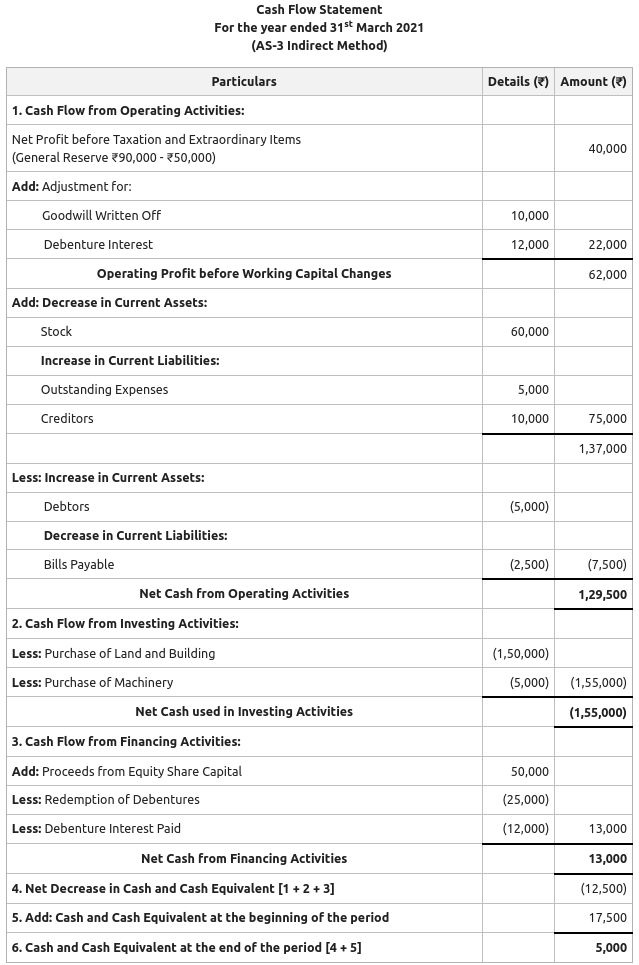

Cash paid for interest (statement of cash flows) edspira 289k subscribers join subscribe subscribed 142 28k views 5 years ago financial accounting (entire playlist) this video shows how to. Under the indirect method, we take the profit or loss before tax and interest paid and then we subtract the amount of interest paid during the year. The scf reports the cash inflows and cash outflows that occurred during the same time interval as the income statement.

Interest expense = $2,500,000 x 0.08 x 0.25. In his 2021 statement of financial. 11 tips to generate cash flow when interest rates are high.

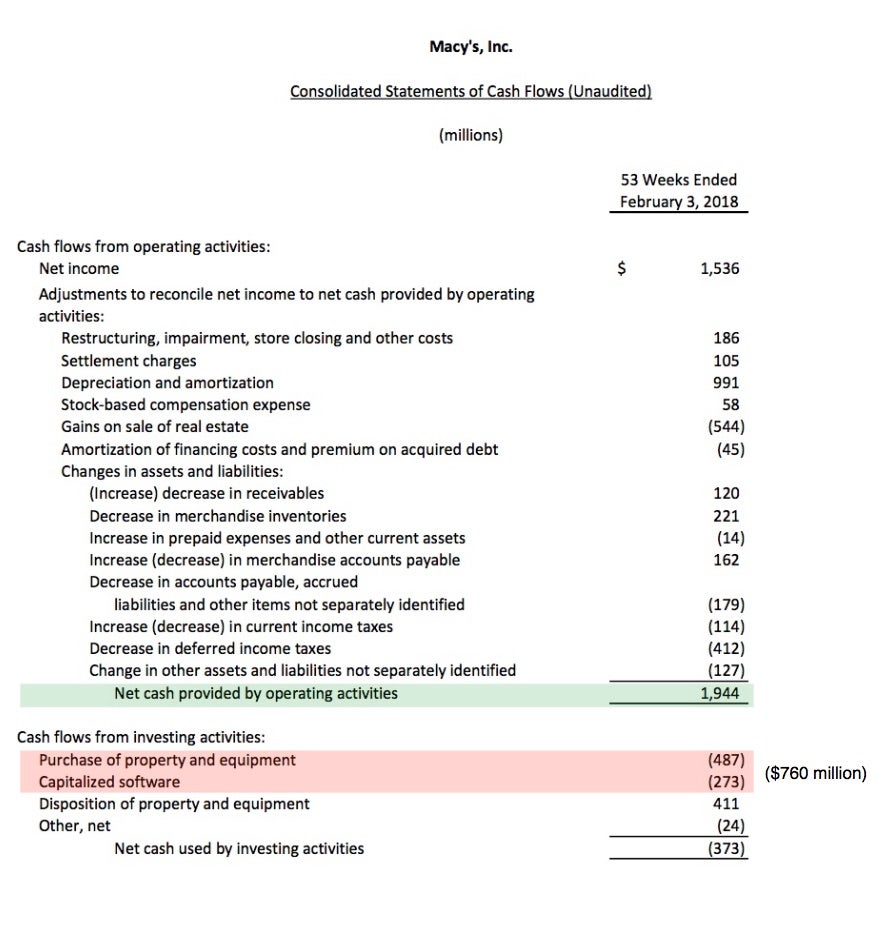

Under ifrs 16 8, a lessee classifies cash payments for the principal portion of a lease liability as financing activities in the statement of cash flows. Interest and dividends received and paid may be classified as operating, investing, or financing cash flows, provided that they are classified consistently from period to period [ias 7.31] Others treat interest received as investing cash flow and interest paid as a financing cash flow.

Interest paid is the amount of cash that company paid to the creditor. Common cash flow calculations include the tax paid, which is an operating activity cash out flow, the payment to buy property plant and equipment (ppe) which is an investing activity cash out flow and dividends paid, which is a financing activity cash out flow. Cash inflows from sale of equity/shares;

A company creates value for. Cash flow is the net cash and cash equivalents transferred in and out of a company. The inclusion of interest paid or received and dividends received within operating activities aligns with the rationale that these items impact the profit or loss of the entity.

On top of this looming penalty, however, he already owes the writer e jean carroll $83.3 million in. While in the cash flow statement it is treated under the operating activities. This is due to the fact that $12,500 of interest expense is included in net income, the first line on the cash flow statement.

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)