Best Tips About Cost Of Goods Sold In Financial Statement Clean And Qualified Audit Report

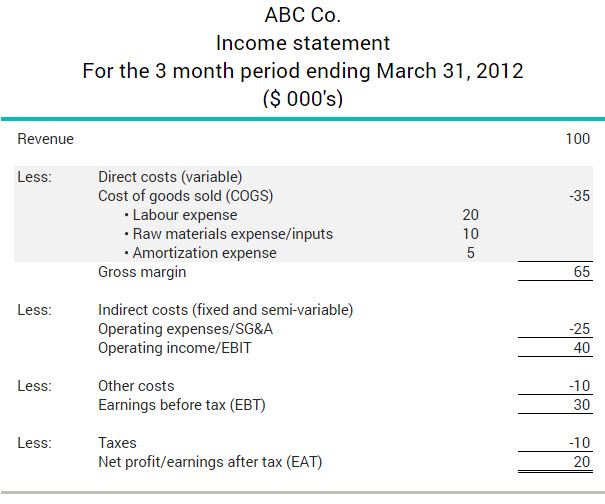

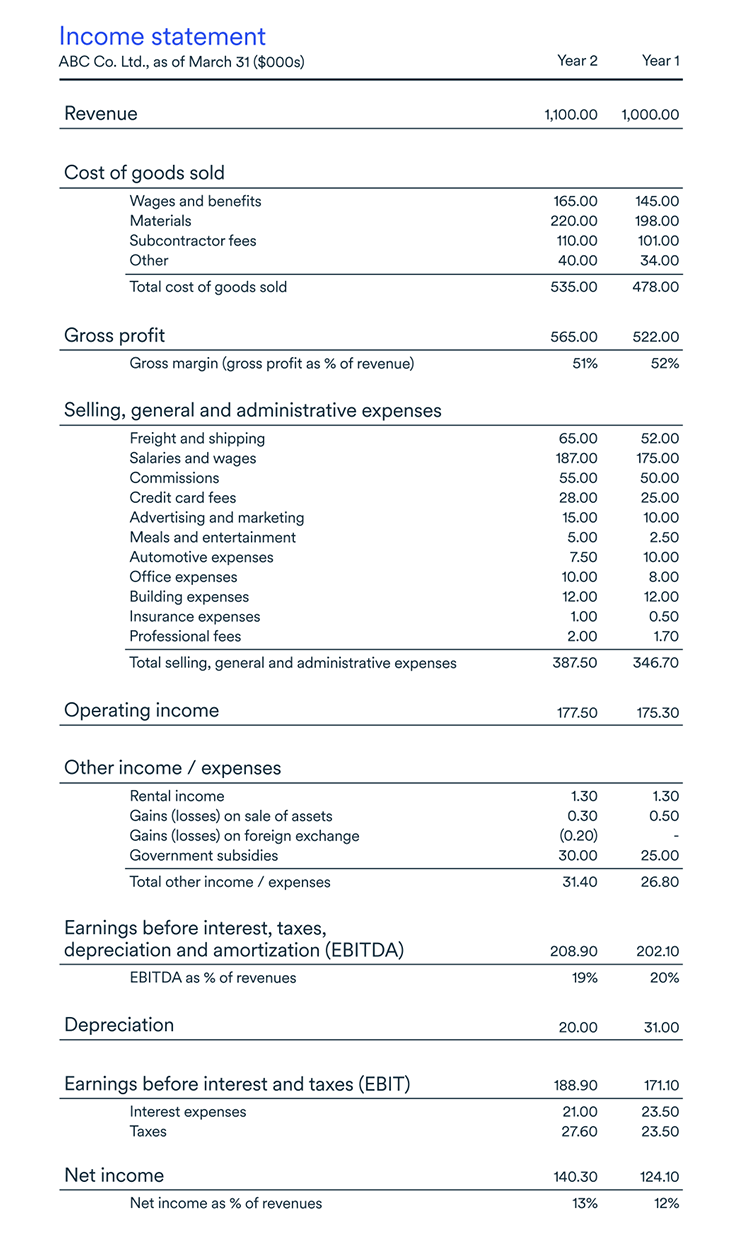

Cost of goods sold (cogs) on an income statement represents the expenses a company has paid to manufacture, source, and ship a product or service to the end customer.

Cost of goods sold in financial statement. Financial services provide services to its customers at large. By analyzing the cost of goods sold for certain products, you can change vendors to order cheaper materials or raise your prices to increase your profit. There are two ways to calculate cogs.

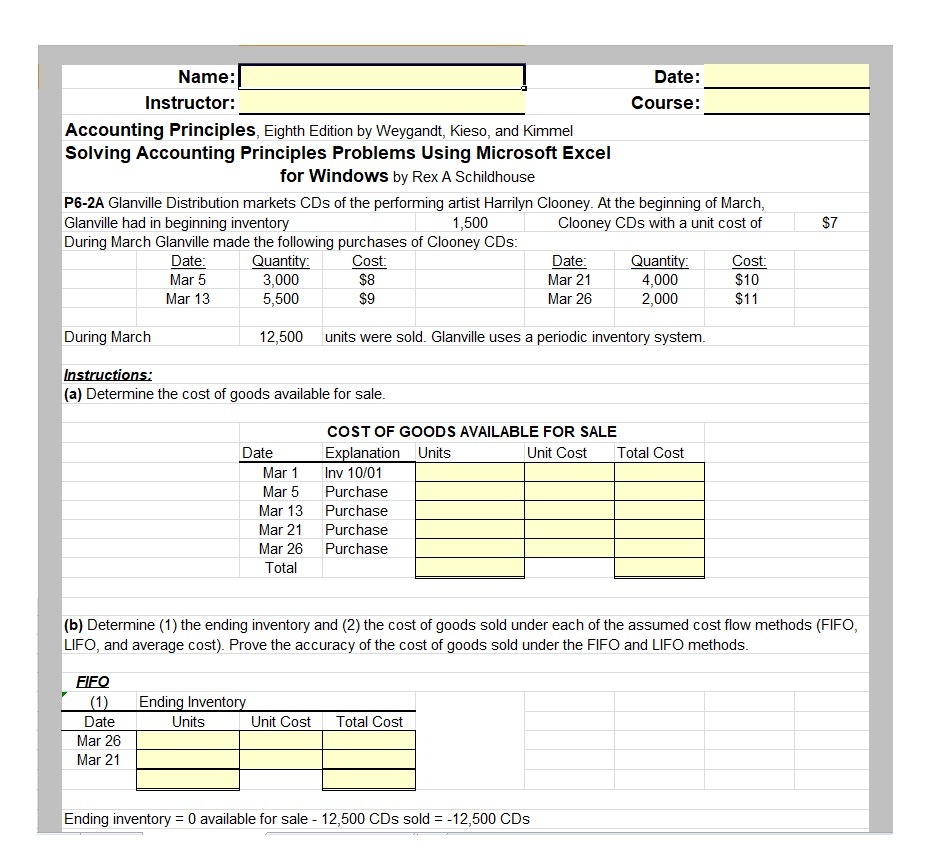

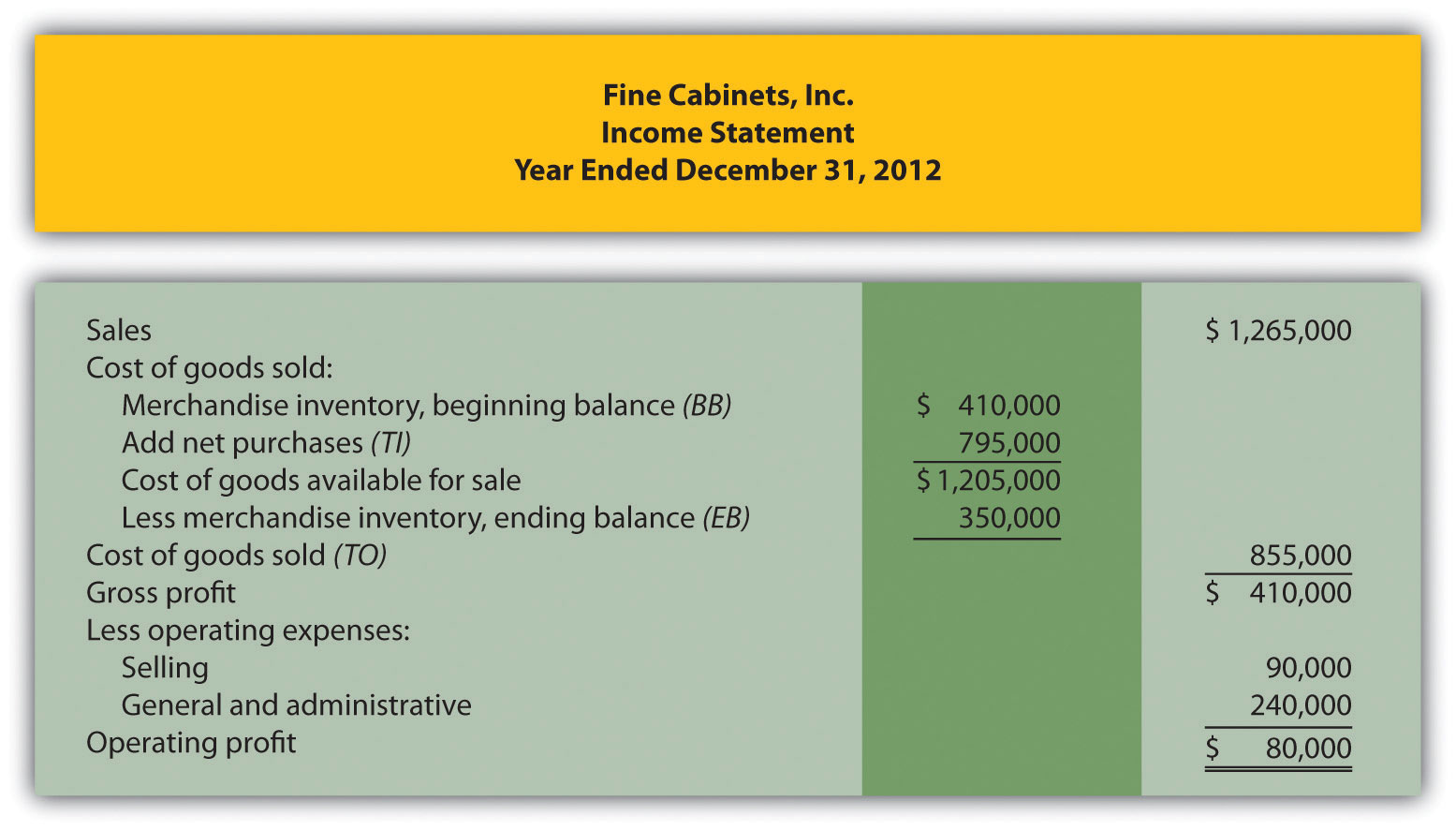

Understanding both the factors and the formula to calculate cogs) can help you visualize your profit and production cost margins. Opening inventories= 100,000$ purchase = $200,000; This statement is not considered to be one of the main elements of the financial statements, and so is rarely found in practice.

Nrf president and ceo matthew shay said that “with consumers prioritizing their spouse or significant other this year, retailers expect to see a shift in spending for certain gifting categories. Cost of goods sold (cogs) is the direct cost of a product to a distributor, manufacturer, or retailer. To calculate cogs, take the cost of initial inventory and add additional direct costs during the period you are measuring.

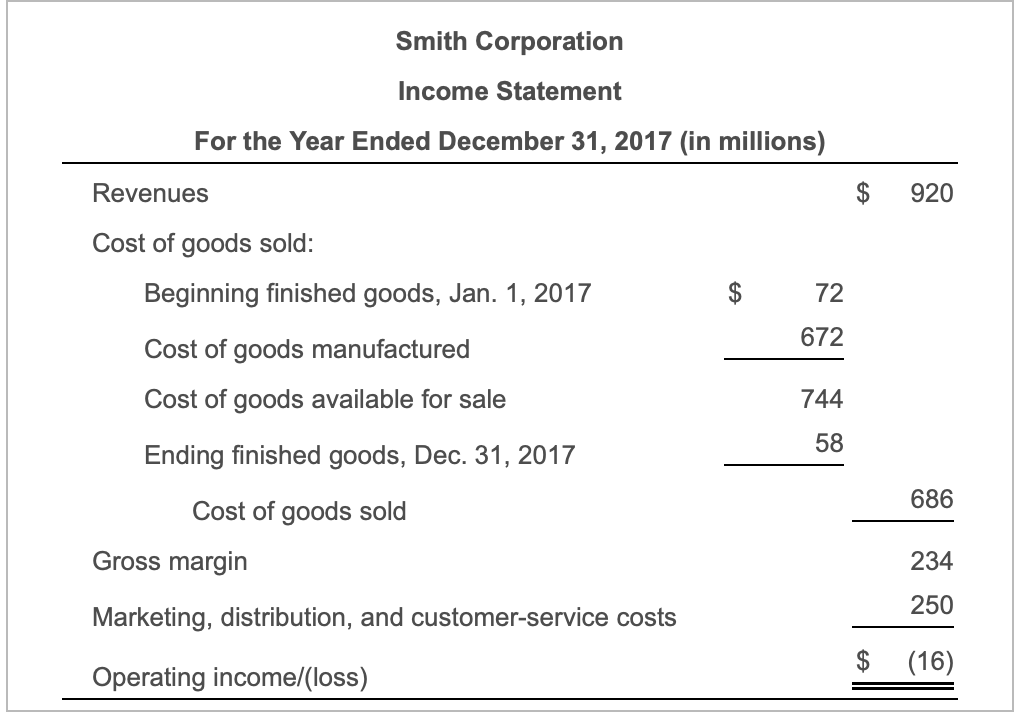

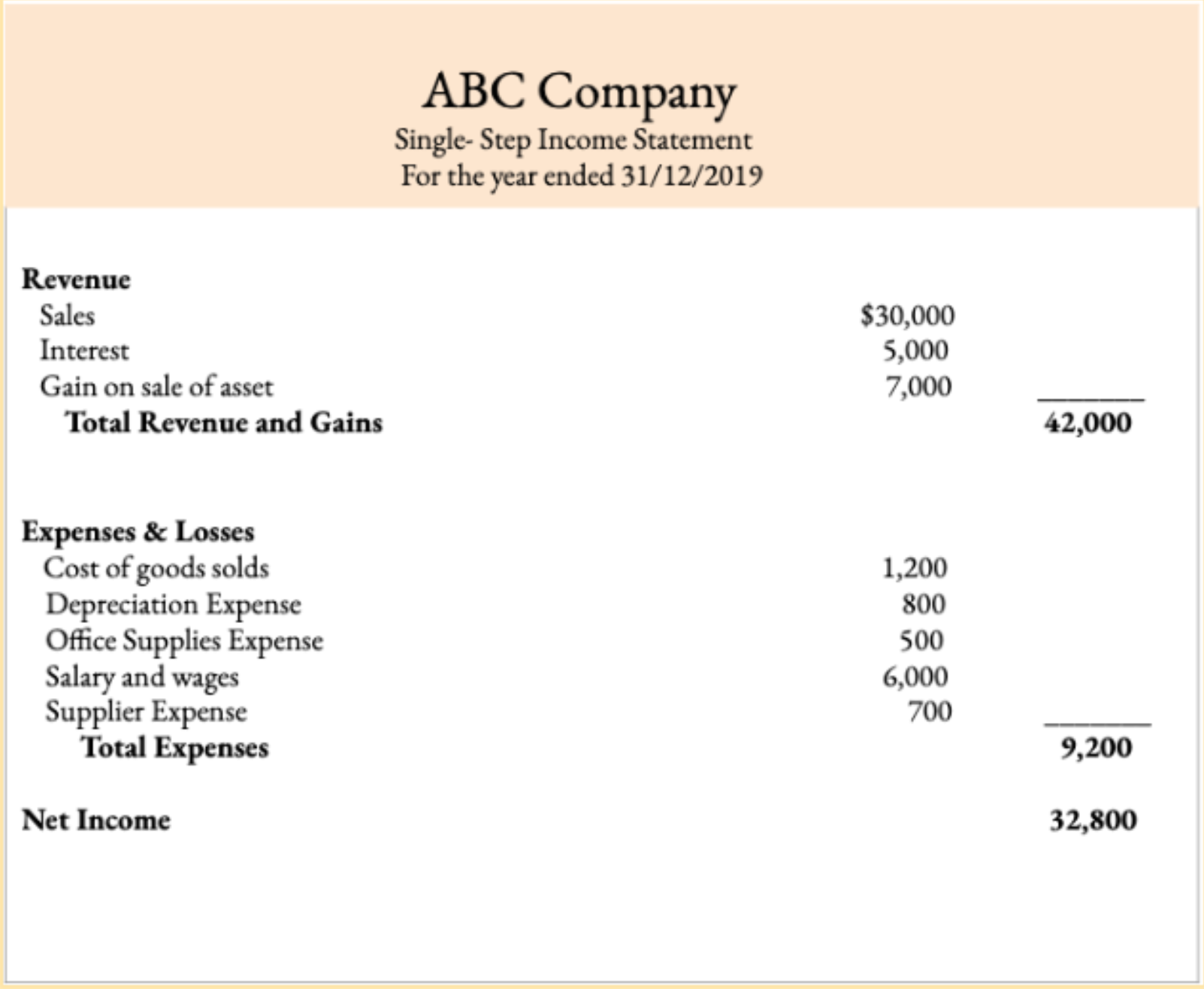

As revenue increases, more resources are required to produce the goods or service. Sales revenue minus cost of goods sold is a business’s gross profit. Key takeaways understanding and managing cogs helps leaders run their companies more efficiently and more profitably.

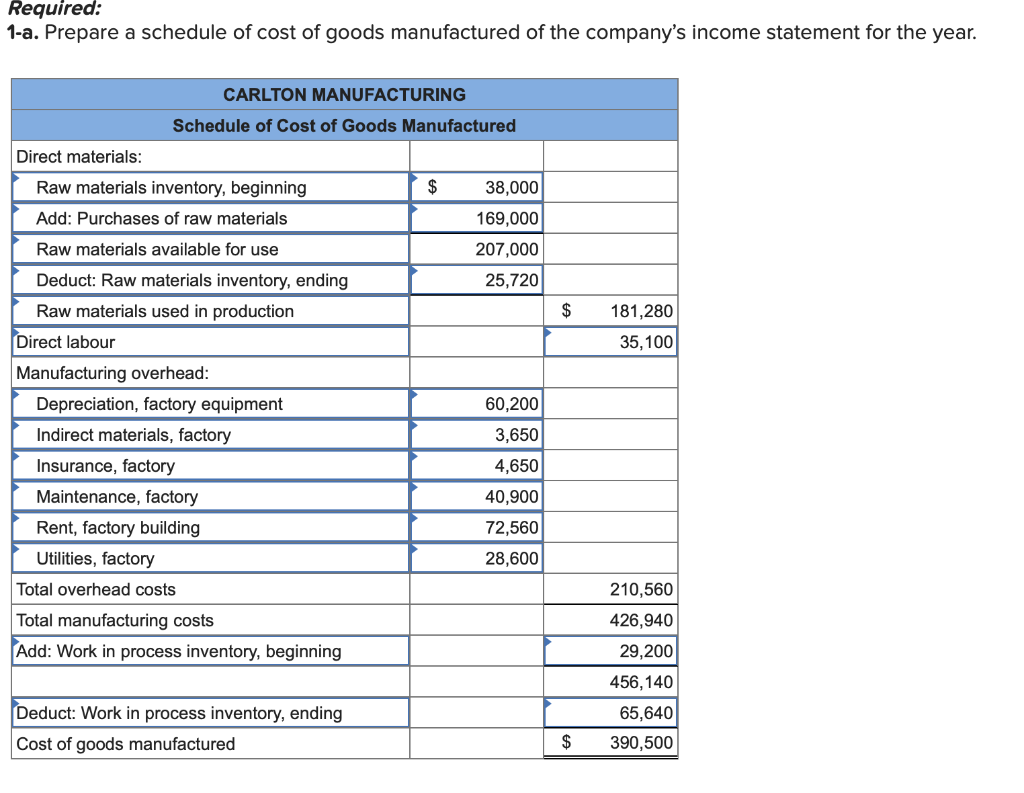

What goes into cost of goods sold Looking further down the financial statements, you'll notice that's a far cry from the $1.4 billion of. The cost of goods sold (cogs) is an accounting term used to describe the direct expenses incurred by a company while attempting to generate revenue.

The cost of goods sold (cogs) is a significant part of a business income statement and plays an essential role in calculating the net income for a business. Tracking cogs allows companies to properly value inventory and determine gross profits. One of the ways they assess financial strength is by looking at the cost of goods sold (cogs) in financial statements.

This is usually a month, quarter or year. Hence, cost of services needs to be computed instead of cost of goods sold. It includes material cost, direct labor cost, and direct factory overheads, and is directly proportional to revenue.

Cogs is considered a business expense and impacts your profit — the higher your cogs, the lower your profit margin. Understanding the cost of goods sold (cogs) helps businesses to find out. Financial services company provides services in the form of providing loans, accepting deposits and other.

To calculate cogs, business owners need to determine the value of their inventory at the beginning and end of every tax year. When should cost of goods sold be determined? Accounting methods for cost of goods sold the calculation for cogs depends on the inventory costing method used by a company.

Cogs reveals an organization’s total direct costs of producing or procuring goods and services they sell during a financial period. As cogs is calculated using only direct costs, we should ignore the indirect costs related to these products. Financial and income statements usually list cogs according to the.

:max_bytes(150000):strip_icc()/dotdash_Final_How_operating_expenses_and_cost_of_goods_sold_differ_Sep_2020-01-558a19250f604ecabba2901d5f312b31.jpg)