Painstaking Lessons Of Tips About Special Purpose Financial Statements Disclosure Requirements How To Do A Profit And Loss Sheet

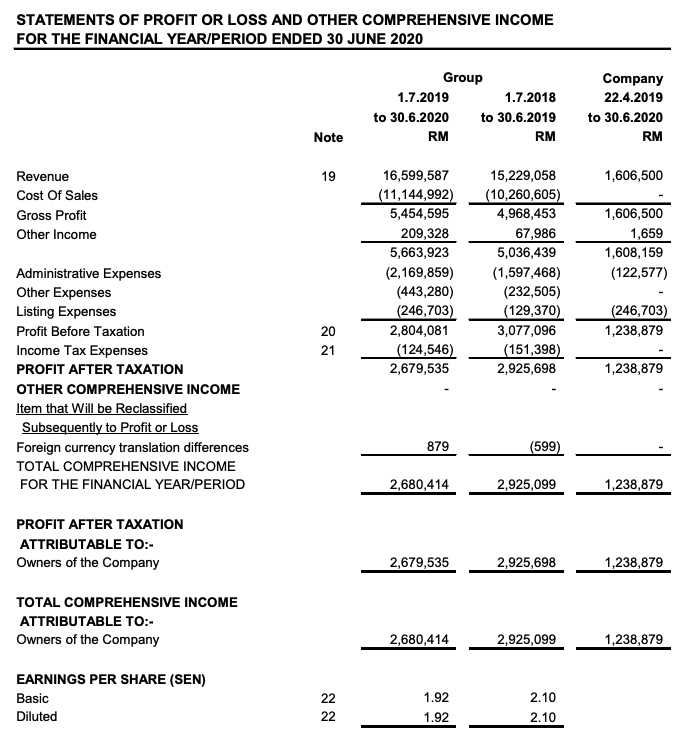

Special purpose financial statements disclosure requirements. Model special purpose financial statements 16th edition (november 2021) illustrative disclosures for entities preparing special purpose financial statements in. These model special purpose financial statements contain illustrative disclosures for entities preparing special purpose financial reports in accordance with australian.

New disclosures in special purpose financial statements (spfs) which will provide clarity regarding compliance with the recognition and measurement (r&m). Special purpose financial statements illustrative guide to the disclosure requirements of: Here’s what you need to know.

Special purpose financial statements illustrative guide to the disclosure requirements of: Special purpose financial statements (spfs) which do not need to comply with all accounting standards. In 2020, the australian accounting standards board (aasb) issued two new standards:

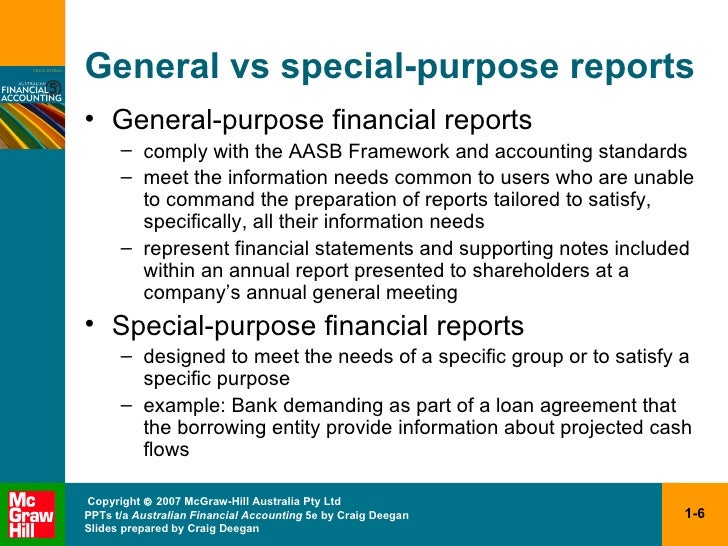

In addition, a new ‘tier 2 ‘ simplified. A charity's financial statements must be either general purpose financial statements (gpfs) or special purpose financial statements (spfs). Its research found that only 15% were prepared under the general purpose framework, 11% were early adopters of simplified disclosure statements, 23% used.

They must transition away from preparing special purpose financial statements (spfs) to preparing general purpose financial statements (gpfs). These disclosures will assist entities. Besides having to ‘step up’ the level of disclosure from spfs to tier 2, the biggest impact for most entities will be the need to comply with all recognition and measurement.

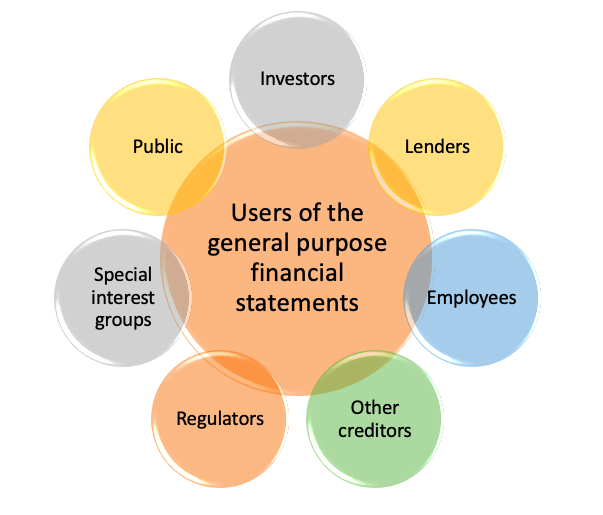

Special purpose financial statements (spfs) are a type of financial reporting used to convey financial information to a particular group of stakeholders. The “general purpose financial statements vs.