Outstanding Tips About Cost Of Goods Sold On Income Statement Operating Bank Account Balance Sheet

Where does the cost of goods sold go on an income statement?

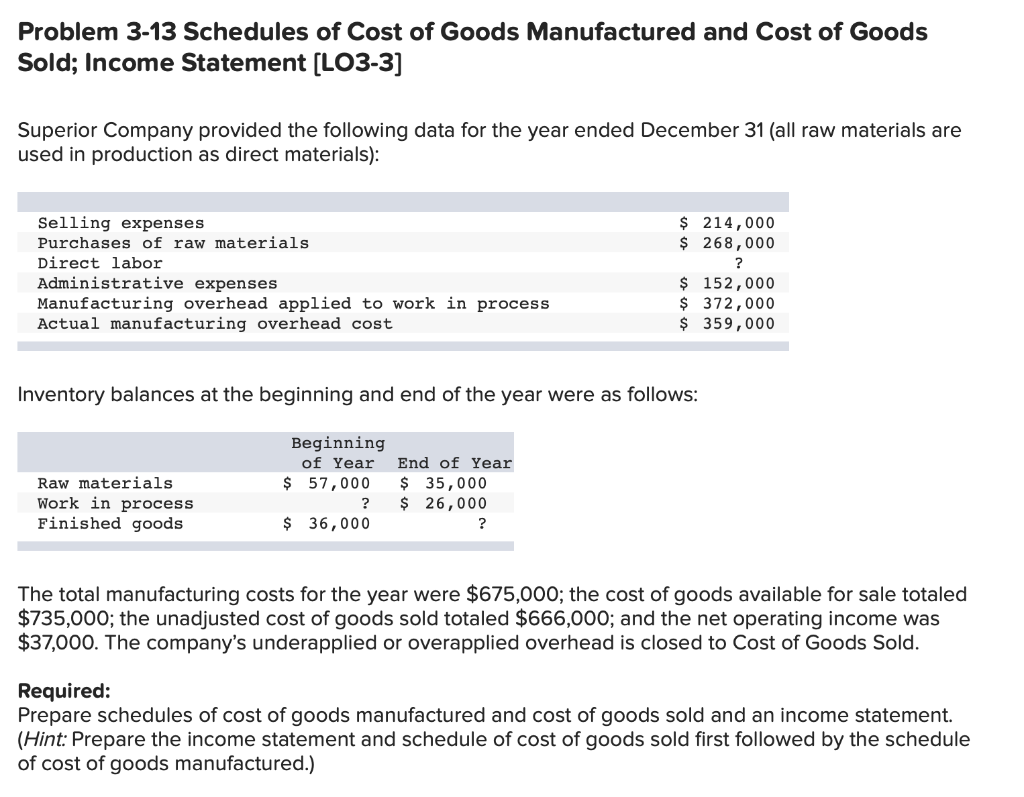

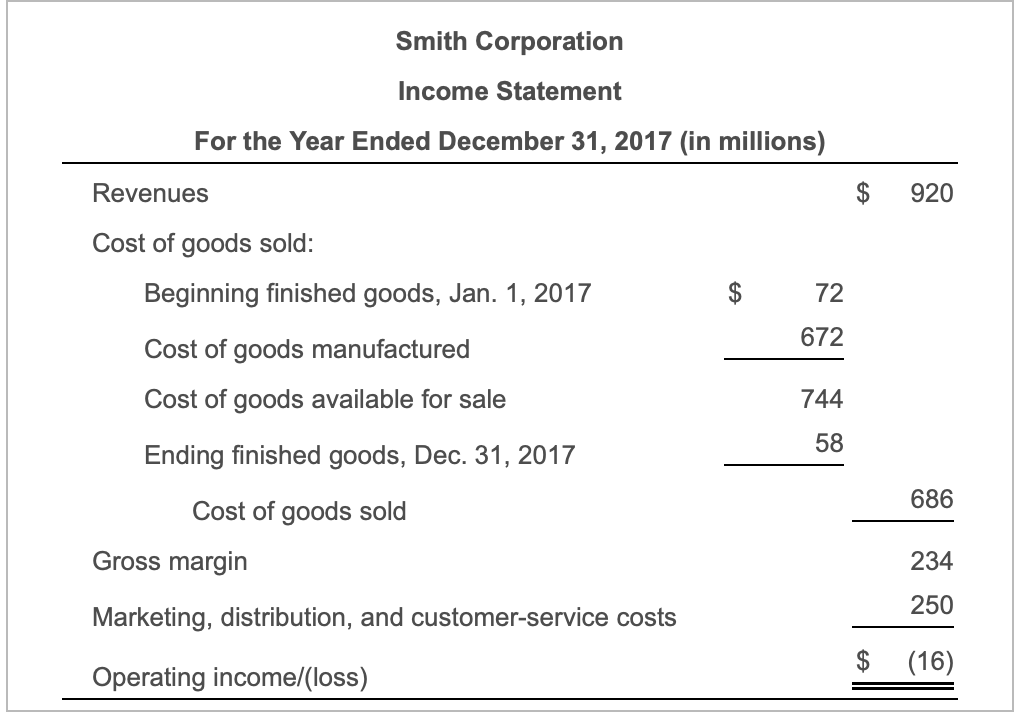

Cost of goods sold on income statement. Cogs show up on a business’s income statement or profit and loss statement. Evans's books would then notate this amount on its 2018 income statement. The cogs calculation tells you how much it costs to manufacture, harvest, or acquire the products you sell during an accounting period.

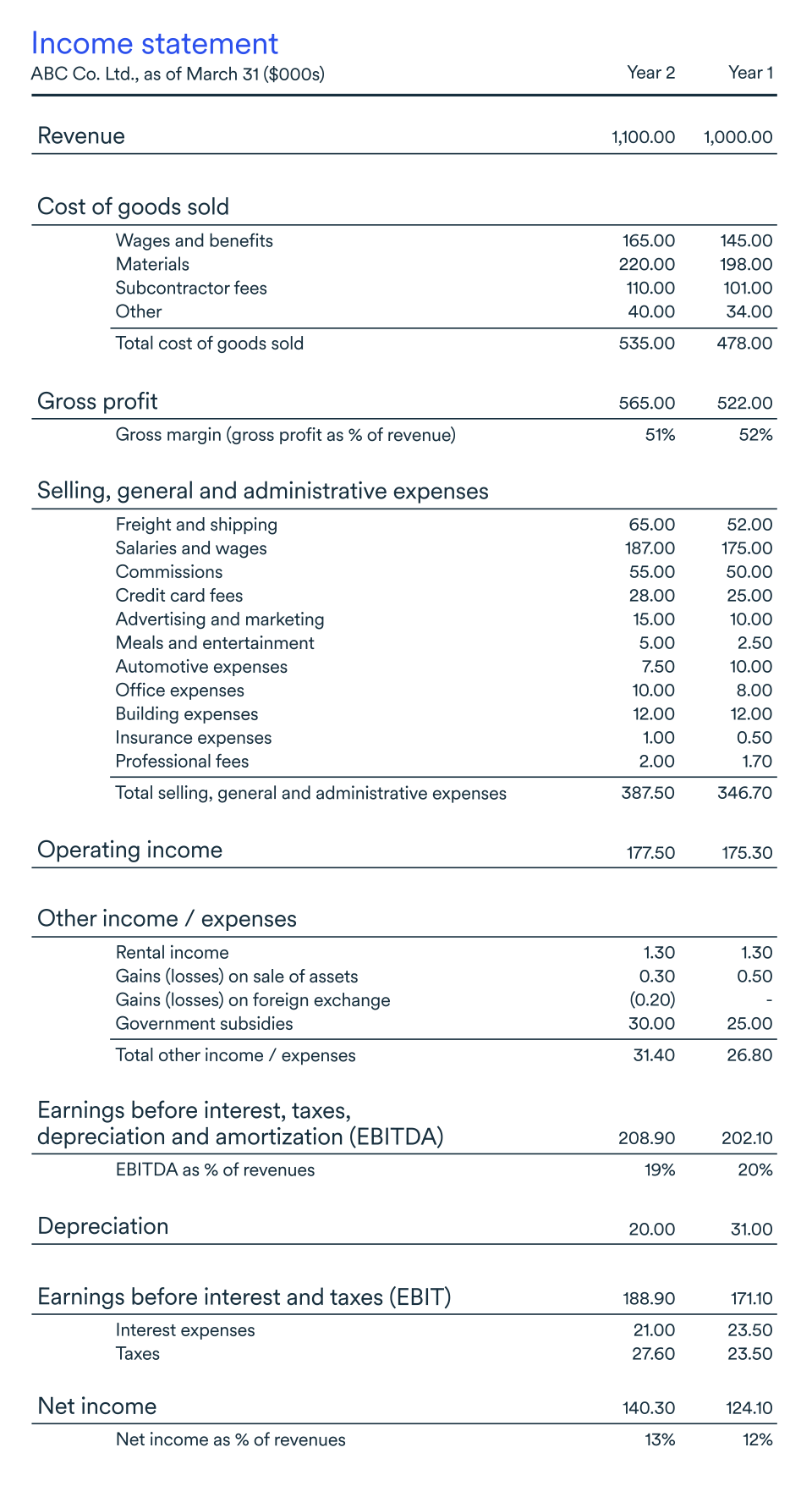

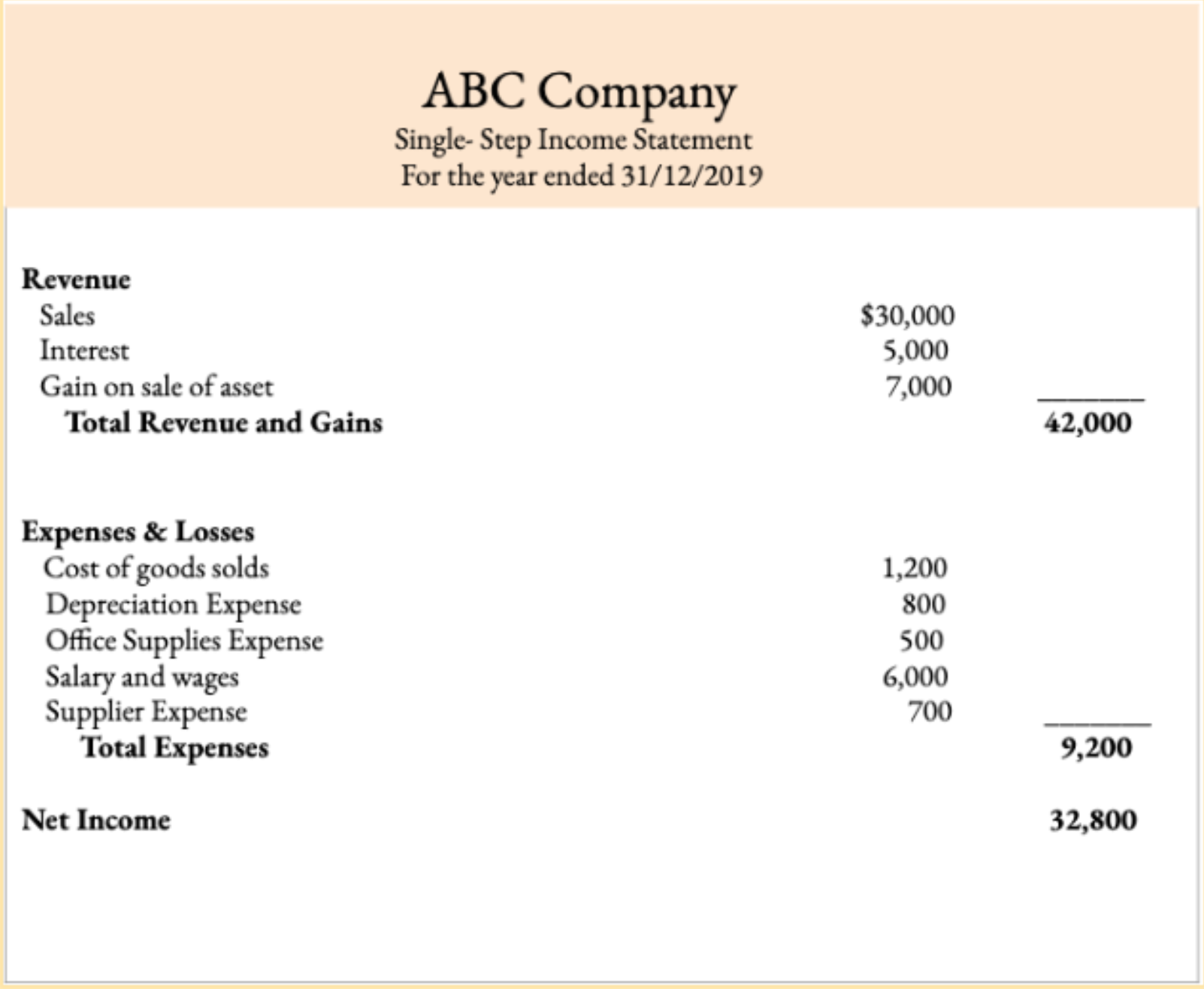

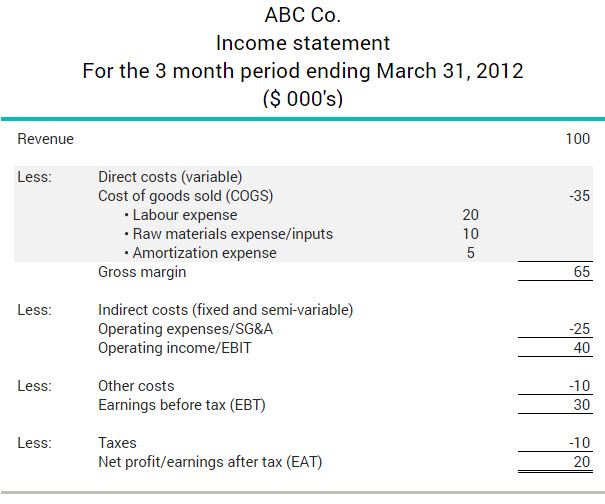

Cogs is often the second line item appearing on the income statement, coming right after sales revenue. On most income statements, cost of goods sold appears beneath sales revenue and before gross profits. Key takeaways understanding and managing cogs helps leaders run their companies more efficiently and more profitably.

Use quickbooks' cost of goods sold calculator to calculate the direct costs related to the production of the goods sold in a company. Cost of goods sold (cogs) is a crucial accounting metric used to determine the cost associated with producing goods sold by a business. This amount includes the cost of the materials and labor directly used to create the good.

Cogs, sometimes called “cost of sales,” is reported on a company’s income statement, right beneath the revenue line. On the income statement , the cost of goods sold (cogs) line item is the first expense following revenue (i.e. Cost of goods sold:

It’s an essential aspect of financial reporting since it represents the direct expenses incurred in making sales. The figure represents the expenses required in a set accounting period to manufacture and sell your products (goods). Beginning inventory for the necessary accounting period.

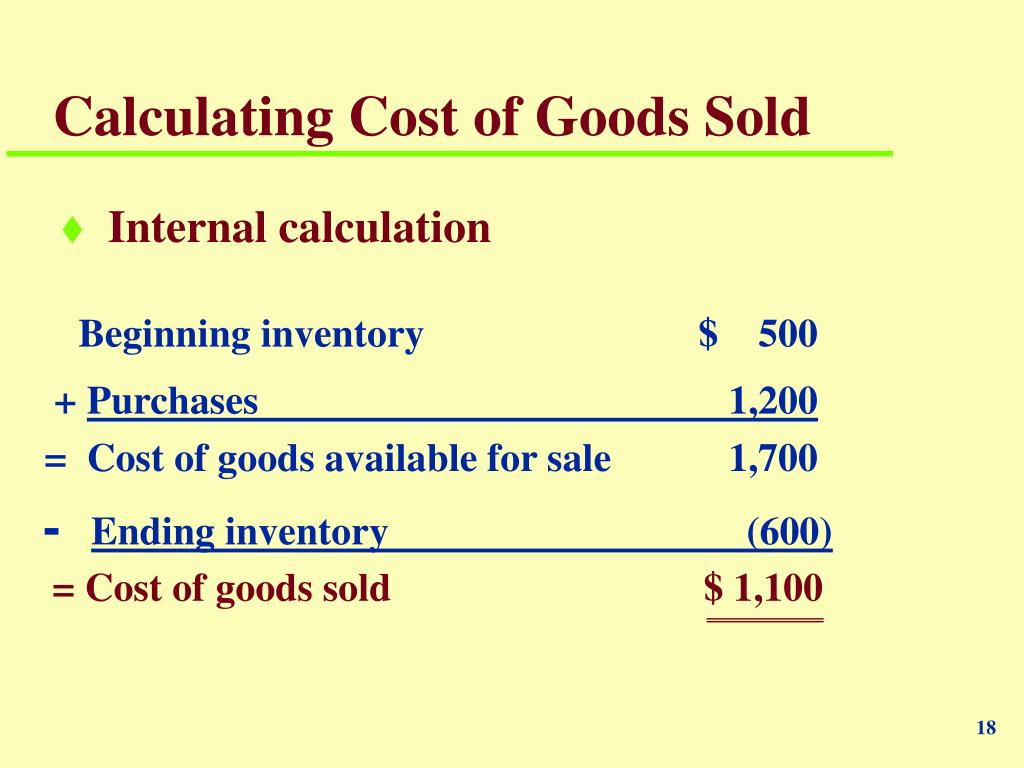

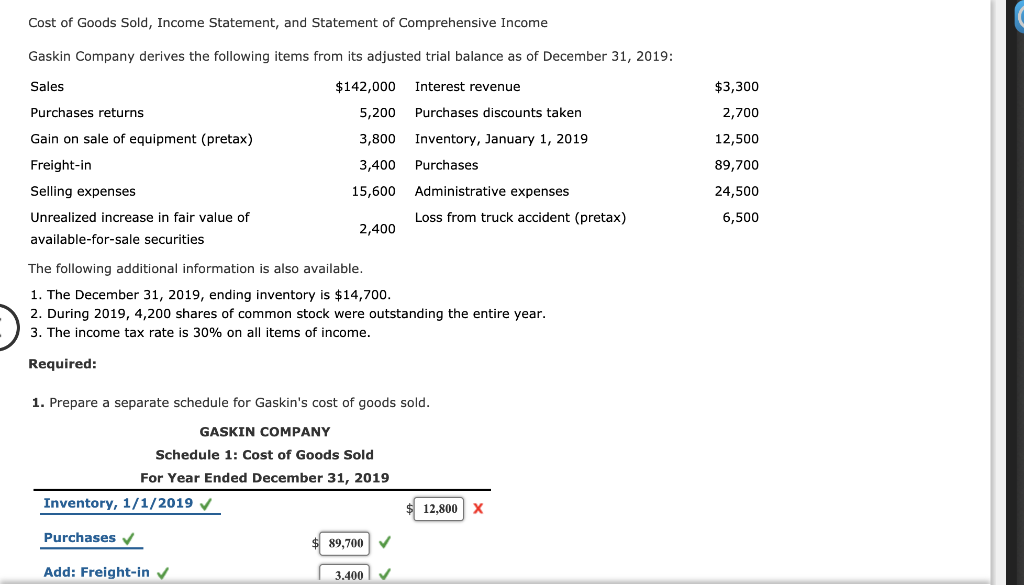

To calculate cogs, take the cost of initial inventory and add additional direct costs during the period you are measuring. To get the value of cogs from the calculator, you must enter three details: Cogs includes all direct costs needed to produce a product for sale.

Cogs is deducted from revenue to find gross profit. Oxyvo's income statement reveals a promising trajectory, marked by impressive revenue growth (66.7%). Gross profit provides insight into how.

Cogs refers to the direct costs of goods manufactured or purchased by a business and sold to consumers or other businesses. What is the cost of goods sold (cogs)? In this case, since the operations were only started during the current year, there will.

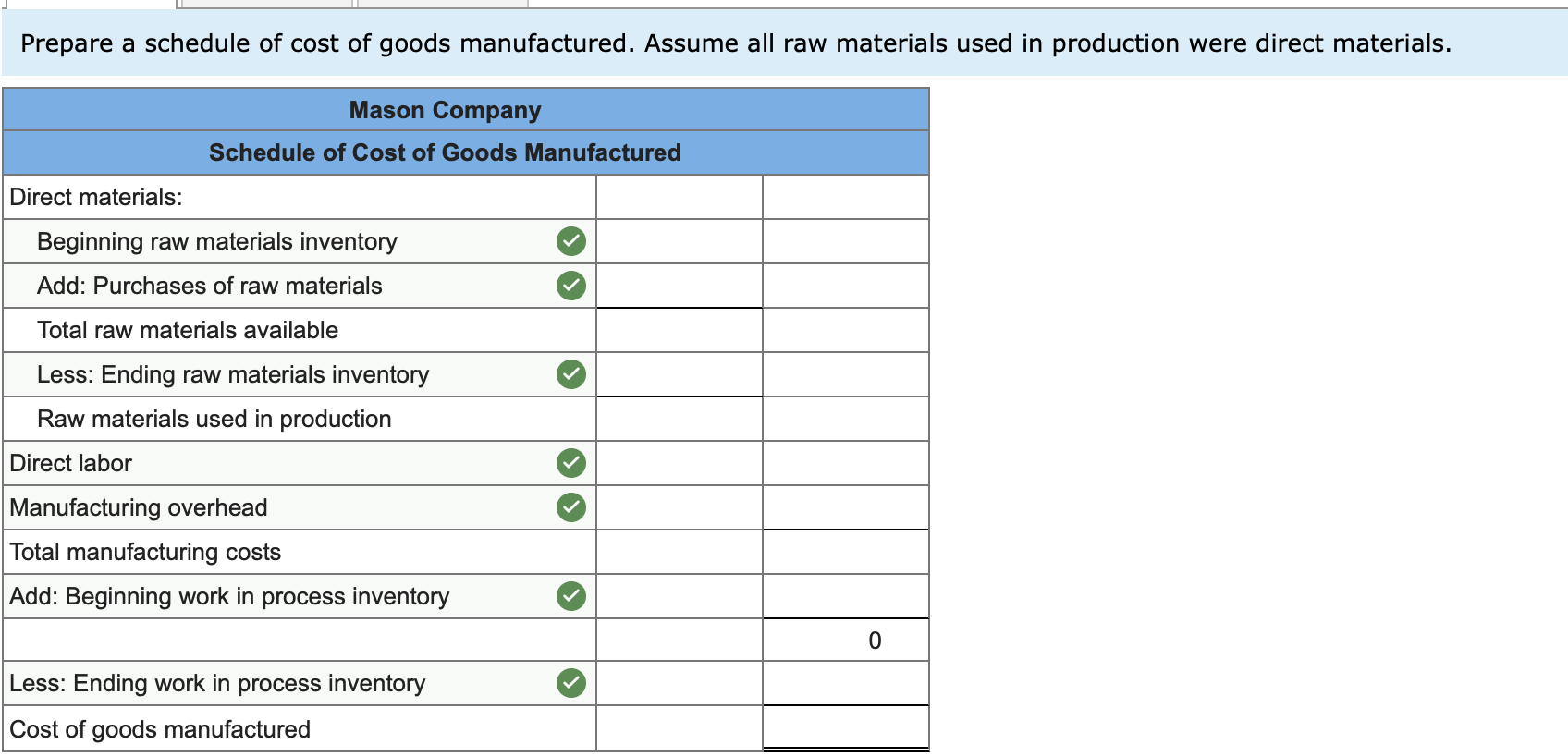

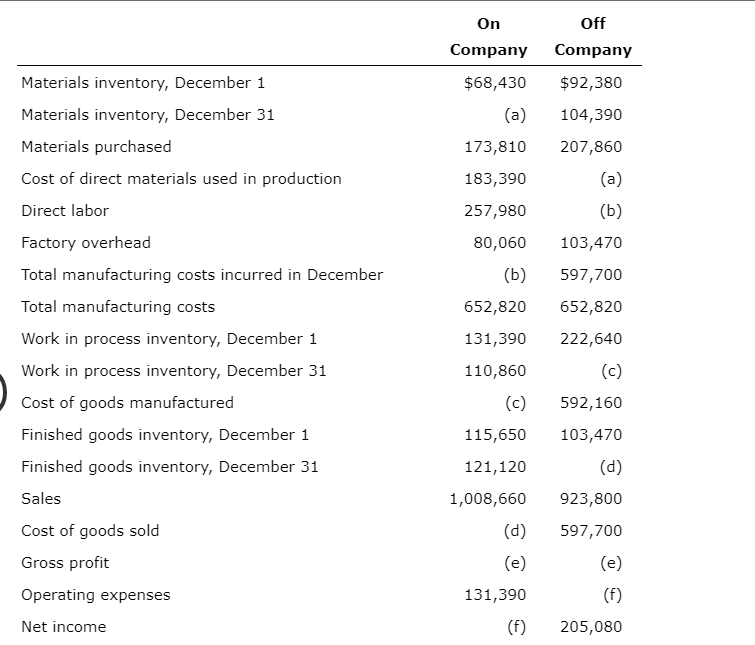

The cost of goods sold amount on the income statement is determined by considering the changes in the three inventory account balances during the period. It represents the amount that the business must recover when selling an item. Cost of goods sold consists of all the costs associated with producing the goods or providing the services offered by the company.

A cost of goods sold statement compiles the cost of goods sold for an accounting period in greater detail than is found on a typical income statement. It does not include costs associated with marketing, sales or distribution. Cost of goods sold (cogs) refers to the direct costs of producing the goods sold by a company.

:max_bytes(150000):strip_icc()/dotdash_Final_How_operating_expenses_and_cost_of_goods_sold_differ_Sep_2020-01-558a19250f604ecabba2901d5f312b31.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_How_operating_expenses_and_cost_of_goods_sold_differ_Sep_2020-01-558a19250f604ecabba2901d5f312b31.jpg)