Lessons I Learned From Tips About Intercompany Receivables Balance Sheet Expense And Income

Accounts receivable, sometimes shortened to receivables or a/r, is money owed to a company by its customers.

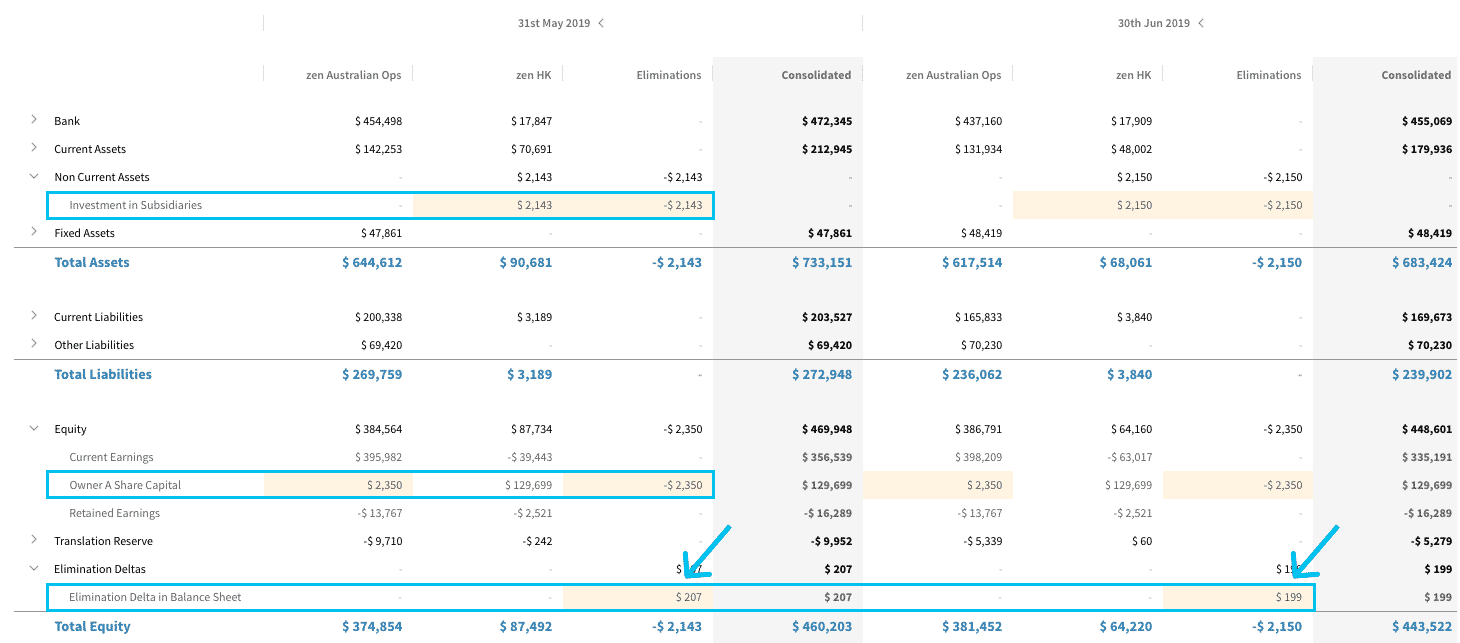

Intercompany receivables balance sheet. If a company has delivered products or. Once balances are netted between members and available cash is used for repayment, it may be necessary to transfer the receivable balances within the group. Intercompany payables and receivables.

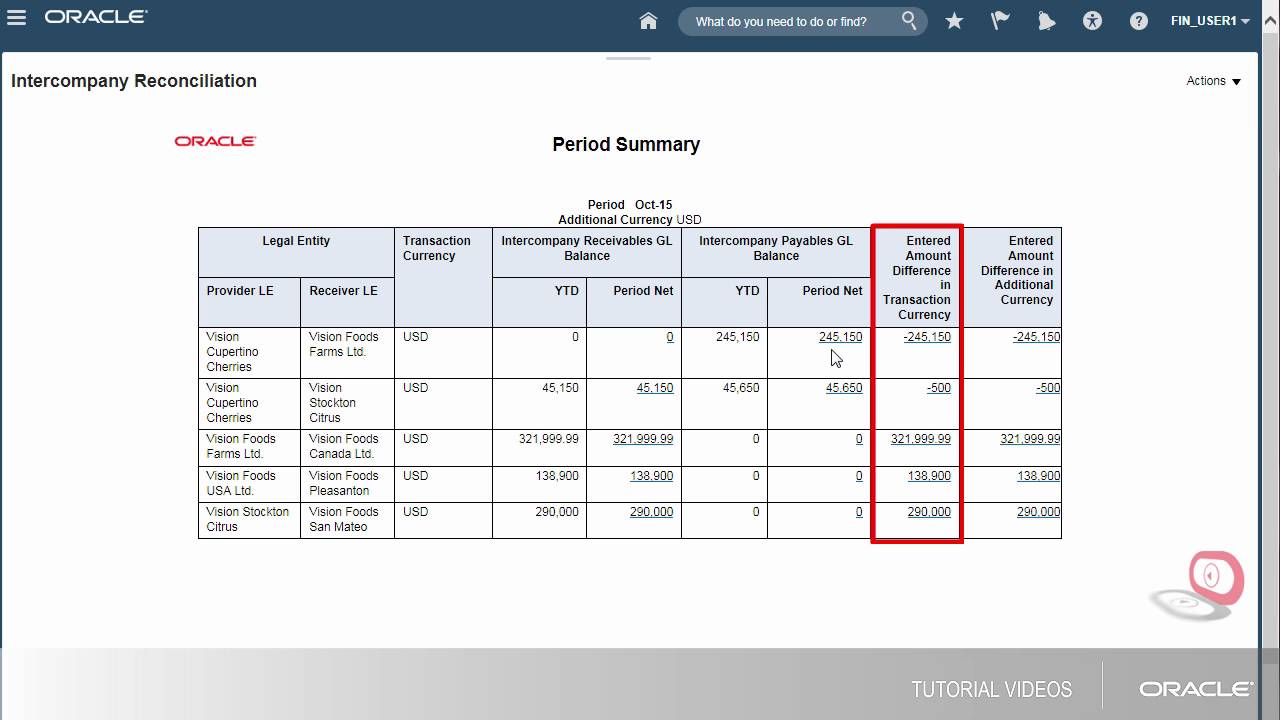

In the current liability section of the balance sheet, there are intercompany current liability categories for each one of these companies. Intercompany reconciliation is the process of verifying and adjusting financial transactions between two or more companies that are part of the same. But no matter what type of transaction it might be, there’s another problem, which is the associated intercompany.

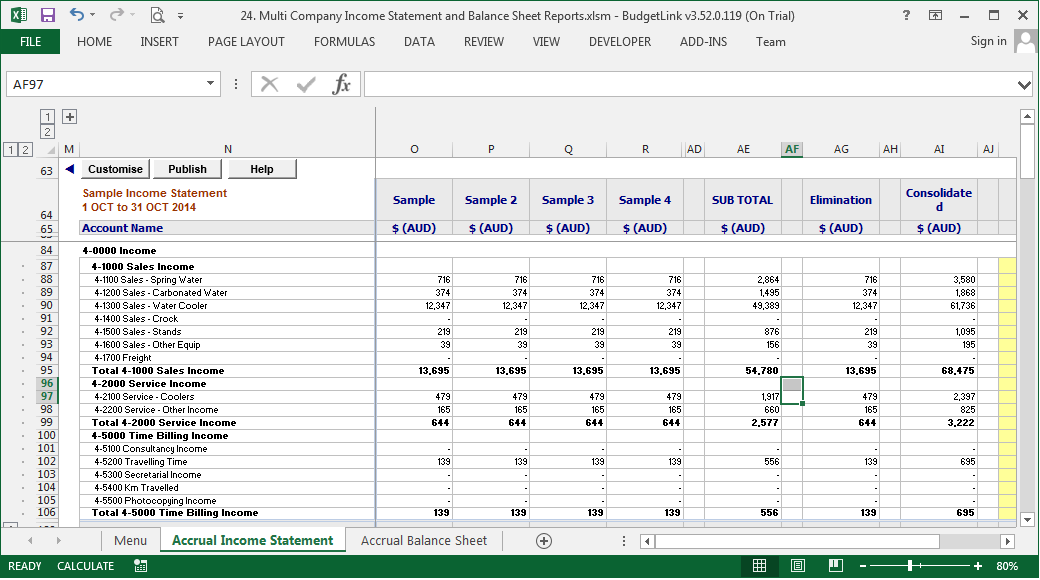

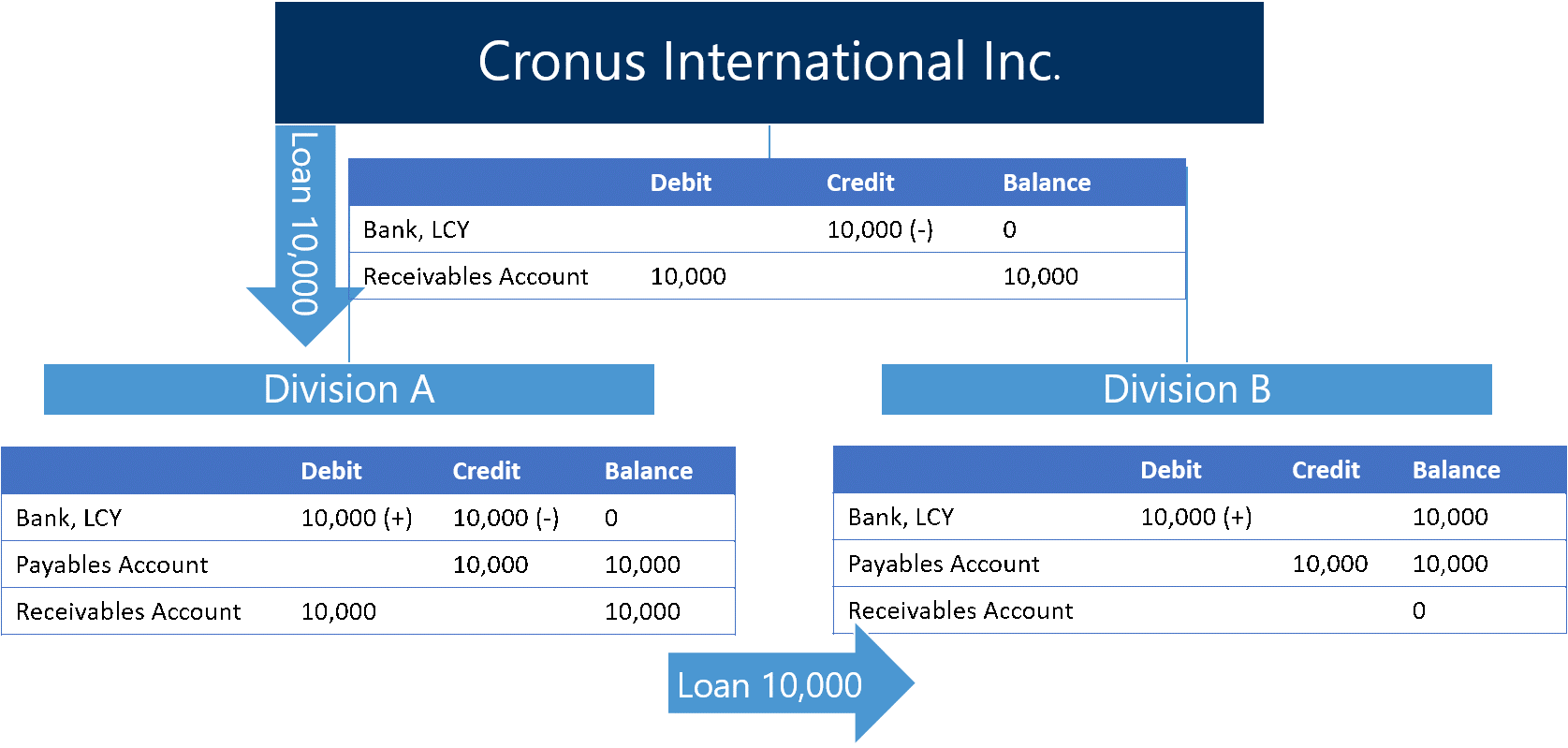

Intercompany accounting (ica) refers to the processing and accounting for internal financial activities and events that impact multiple legal entities within a company. No intercompany receivables, payables, investments, revenue, capital, cost of sales, or profits and losses are recognised in consolidated financial statements till a transaction. Intercompany receivables occur when one of your company's organizations incurs a payable or receivable on behalf of another organization.

5.9.1 interest expense on intercompany debt. Comparison of account balances between various independent verification of statements and reports. The post intercompany receivables process will post down only to the balance sheet level specified in the define org structures screen;

Intercompany reconciliation is the internal accounting process wherein financial data and transactions between subsidiaries, divisions, or entities within a larger. See tx 2.4.5 for a discussion of the. This typically happens during a.

All these transactions have an impact on the financial situation of the companies involved, but there is no profit or loss for the group. It is a lateral transaction. It will not post to the lower levels.

If you know in advance that one co will always be borrowing and another will be lending,.