Awesome Info About 3 Primary Financial Statements Off Balance Sheet Exposure Examples How To Prepare Group Accounts

The income statement a company's income statement provides.

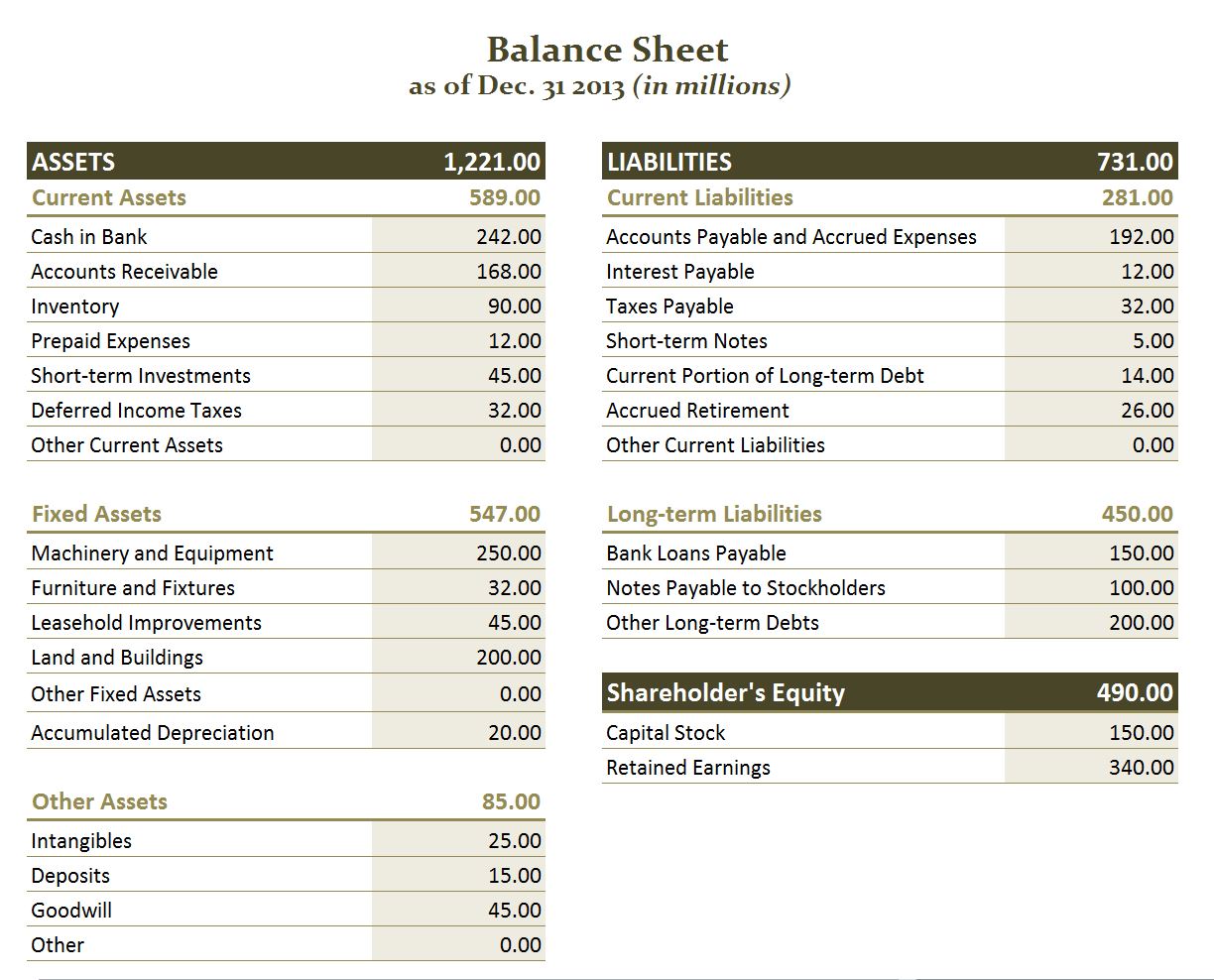

3 primary financial statements off balance sheet exposure examples. Investments of clients held by an investment company etc. An example of obs items is financial firms that provide investment management services. So on a balance sheet, accumulated depreciation is subtracted from the value of the fixed asset.

As fixed assets age, they begin to lose their value. Other considerations as with all things, difficulty can be in the details. Scope, link to public communications & tax and nci effect.

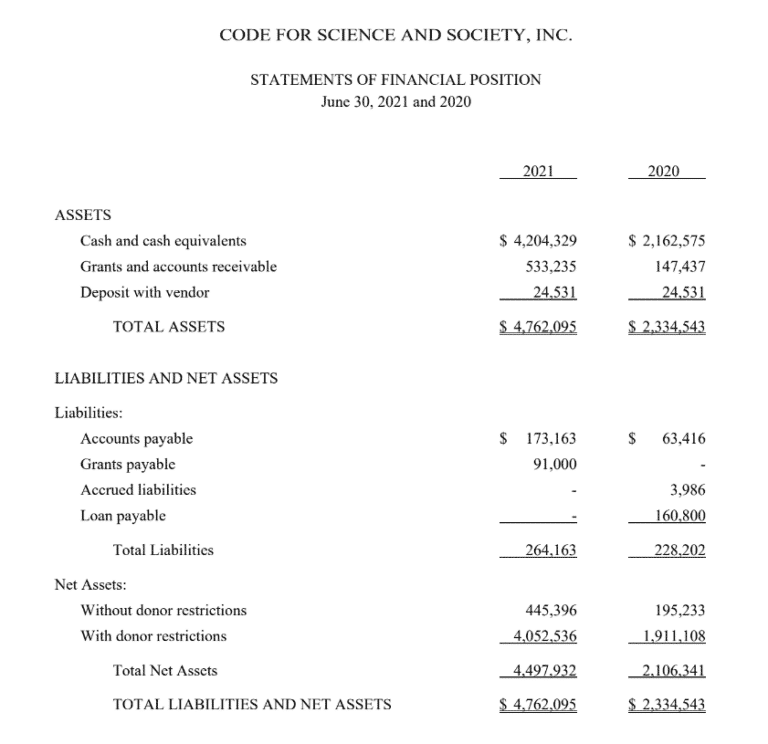

The objective of the new ifrs accounting standard is to improve how information is communicated in the financial statements, with a focus on information in the statement of profit or loss. Offsetting (netting) is the presentation of one or more financial assets and financial liabilities as a single net amount (the difference between them) in the statement of financial position (balance sheet) These assets and liabilities may be used by a company;

The most common monetary items that are considered balance sheet exposures include: Which are contingent in nature are some of the examples off. However, the legal ownership may or may not belong to them.

Us financial statement presentation guide 23.7. Using obs activities may improve earnings ratios like the asset turnover ratio.

Companies would be required to provide three new profit subtotals, including ‘operating profit’. Objective of the financial statements and roles of the primary financial statements and the notes 19 aggregation and disaggregation 25 offsetting 29. Some of the most common include asset turnover, the quick ratio, receivables turnover, days to sales, debt to assets, and debt to equity.

The standards bring into broad alignment the accounting treatment for off balance sheet activities in international financial reporting standards (ifrss) and us generally accepted accounting principles (gaap), and are the iasb’s response to the financial crisis. This helps improve their accounting ratios or avoid breaking.

We include both bank fixed effects and time fixed effects in all specifications. New subtotals in the statement of profit or loss. Has a d/e ratio d/e ratio the debt to equity ratio is a representation of the company's capital structure that determines the proportion of external liabilities to the shareholders' equity.

For example, if you buy a car for $40,000 and expect it to last for five years, you might depreciate it at $8,000 per year. This table represents the results for bank performance, obs exposure and its impact on banks risk by dividing bank annual returns into high and low return based on the median value. These three financial statements are intricately linked to one another.

Let us understand the concept of off balance sheet exposure with the help of some suitable examples. 3 the exposure draft also sets out a proposal to change the title of ias 8 from ‘. Input on how it has balanced costs and benefits when developing those proposed

:max_bytes(150000):strip_icc()/ScreenShot2022-04-26at10.45.59AM-aab9d8741c8f4ee1aff95f057ca2ab3a.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)