Great Tips About Current Ratio Interpretation Between Two Years Balance Sheet Of A Sole Proprietorship

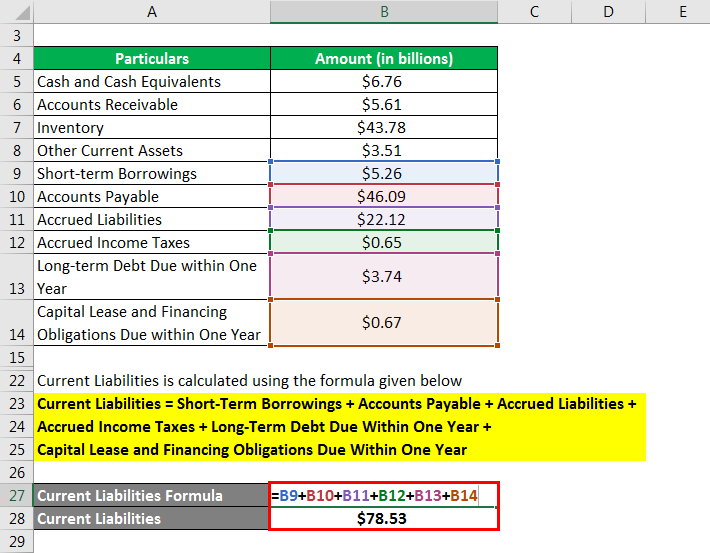

For example, in 2011, current assets were $4,402 million, and current liability was $3,716 million.

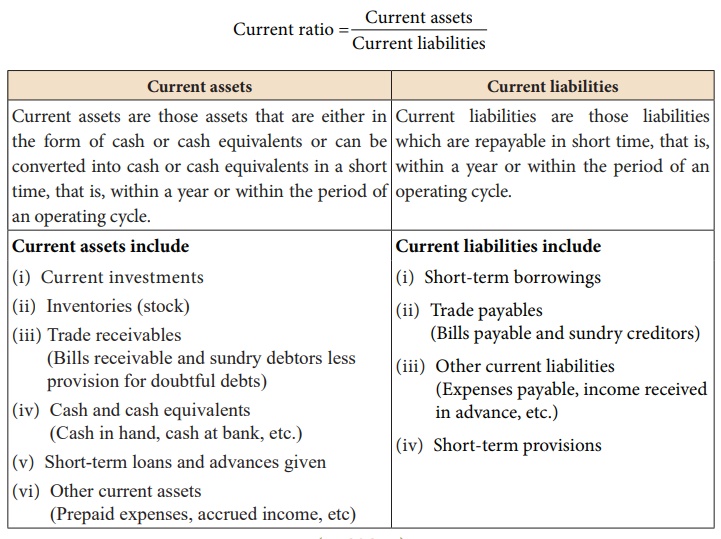

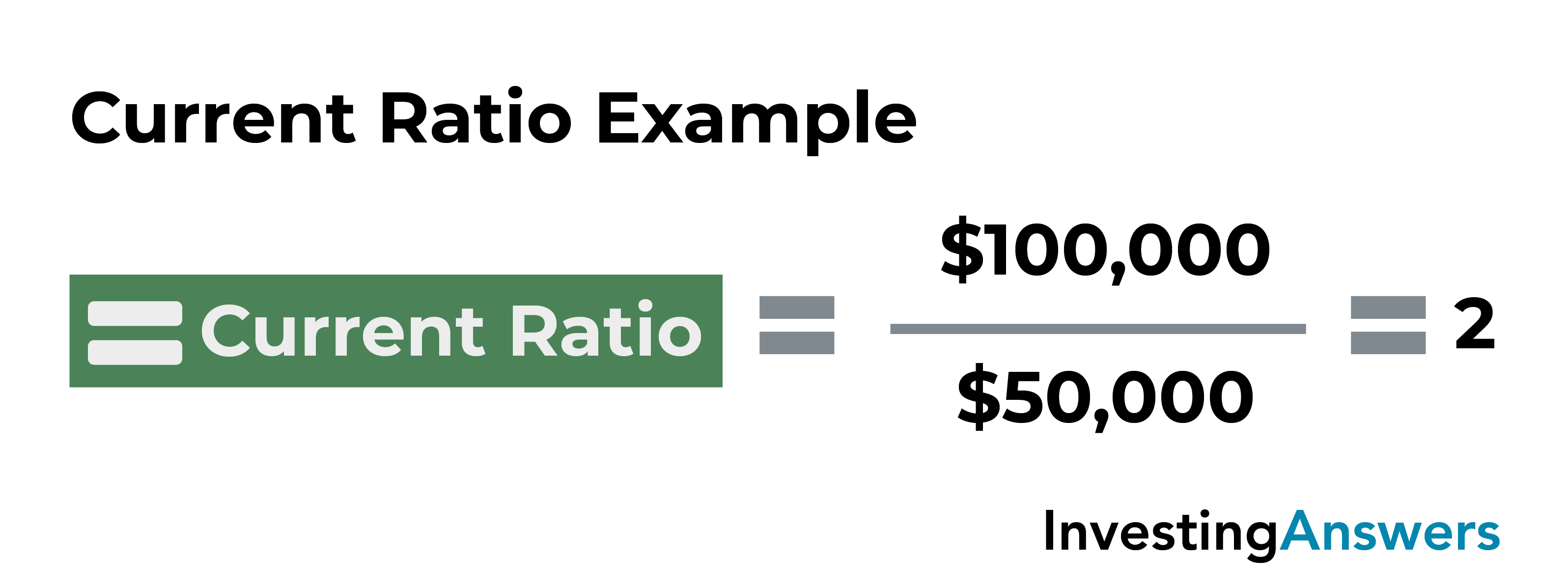

Current ratio interpretation between two years. Current ratio = $135,405m (current assets) / $153,982m (current liabilities) so, apple’s current ratio for 2022 was: You calculate the current ratio by dividing your company’s current assets by your current liabilities, i.e.: This is arrived at by dividing current assets by current liabilities.

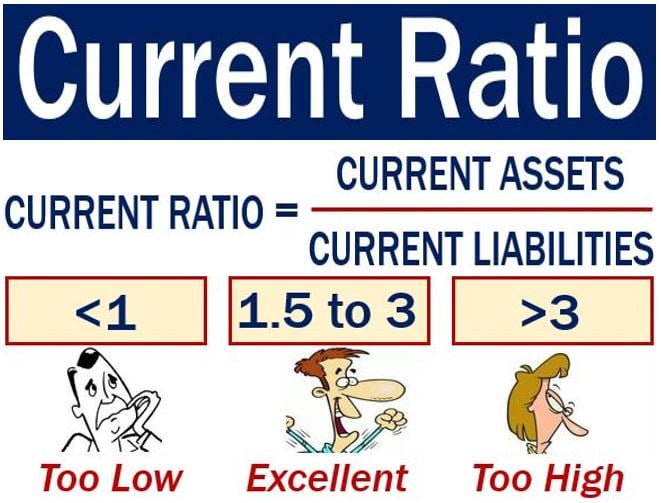

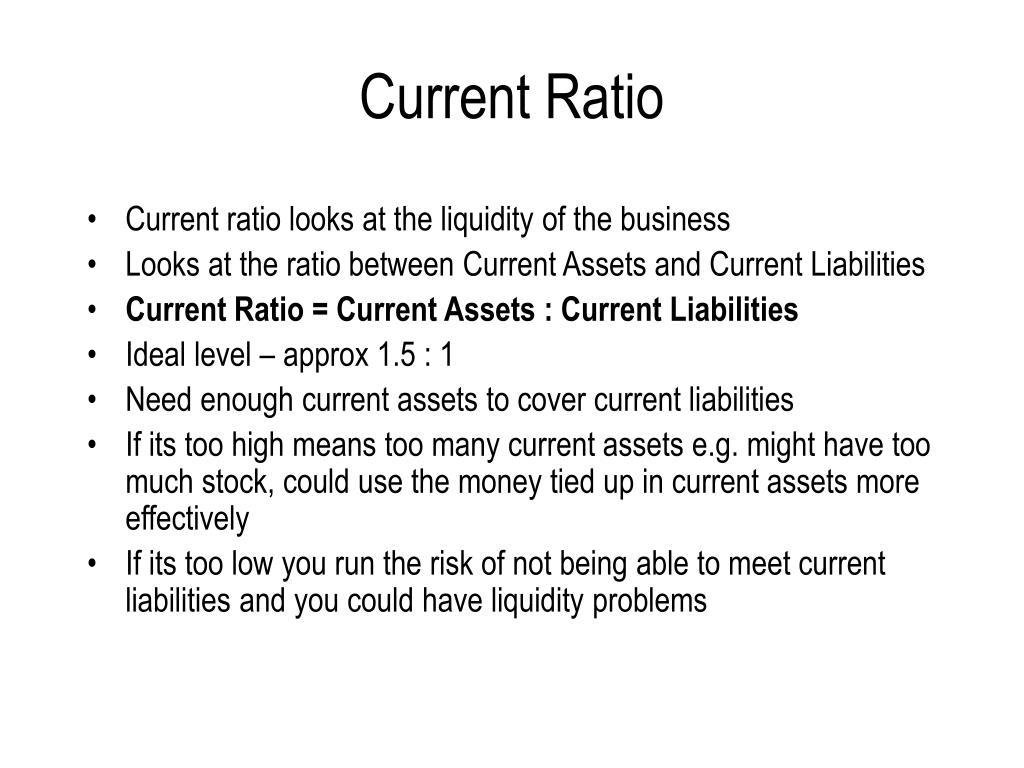

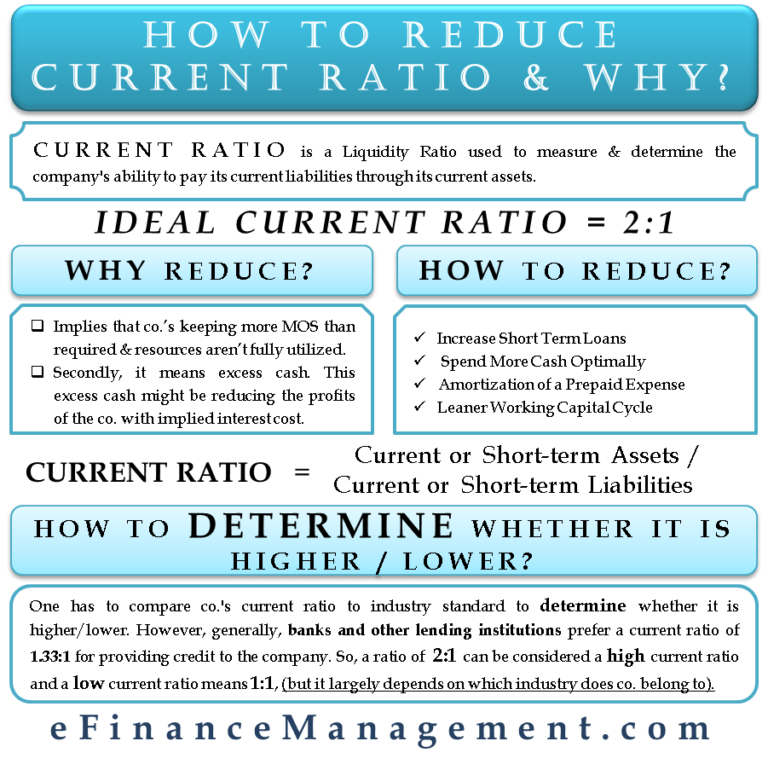

The higher the current ratio, the more liquid a company is. For example, if a company's total current assets are $90,000 and its. Key takeaways the current ratio is a very common financial ratio to measure liquidity.

More precisely, the general formula for the current ratio is:. The value of the current ratio is calculated by dividing current assets by current liabilities. At the same time, an.

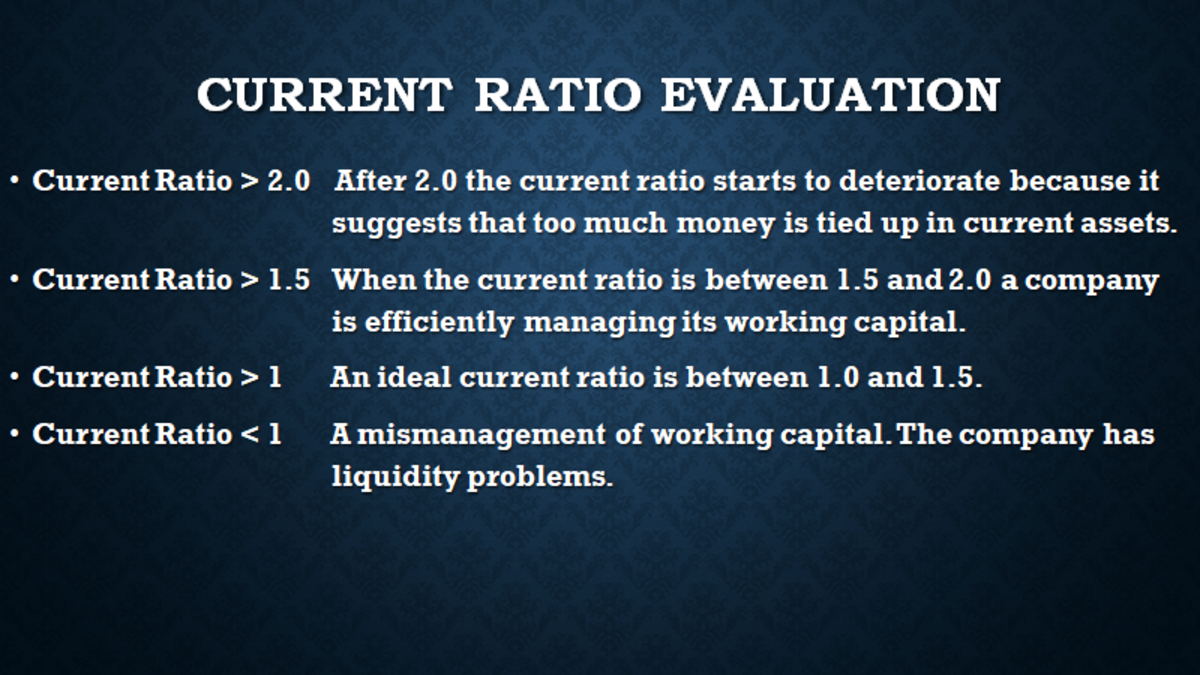

Interpretation of current ratio. Written by tim vipond what is the current ratio? Current ratios can be written in.

In current ratio, we divide current assets by current liabilities. The current ratio compares the company’s current assets with current. Expressed as a number.

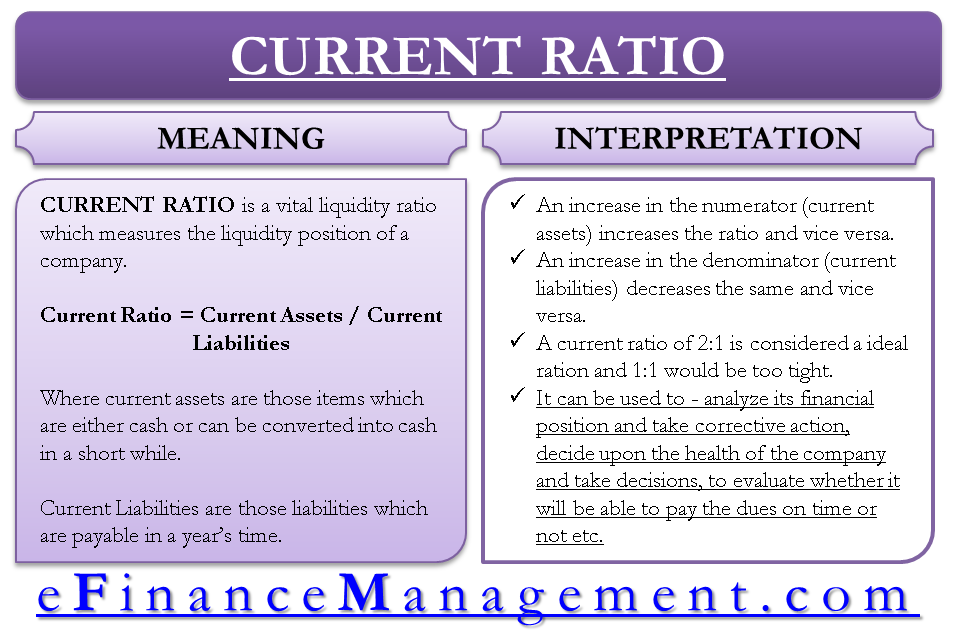

It reflects whether the companyis in a position to. An increase in the numerator (current assets) increases the ratio in the current ratio and vice versa. Current ratio = total current assets / total current liabilities let’s imagine.

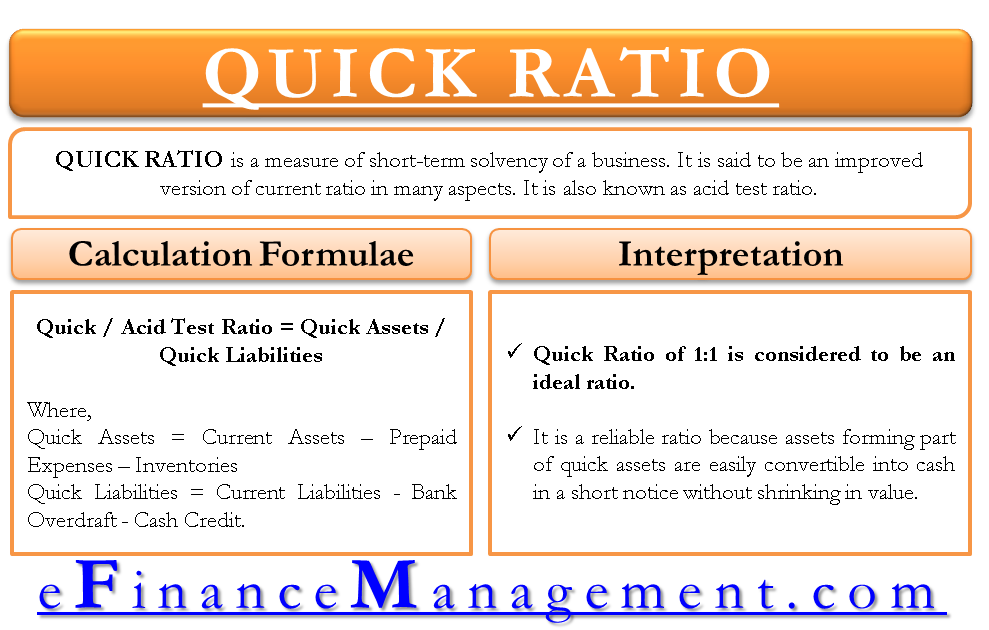

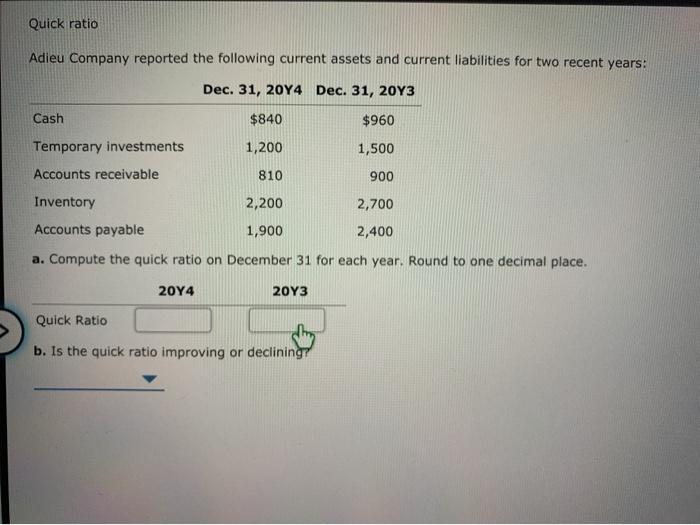

Current ratio is equal to total current assets divided by total current liabilities. It is measured using several ratios, including current ratio, quick ratio, and cash ratio. Interpretation here the results of analysis are used to judge a business’ performance.this is done by making comparisons with other similar businesses, usually within the same.

The current ratio is an important measure. Two frequently used liquidity ratios are the current ratio and the quick ratio. Likewise, we calculate the current ratio for all other years.

The current ratio is calculated as the current assets of colgate divided by the current liability of colgate. To calculate current assets you should add all those asset that can easily be convertible into cash within one year.

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Ratio_Jul_2020-03-54eeb2ed66a546ad8c2f1e5e86366170.jpg)

:max_bytes(150000):strip_icc()/Current_Ratio-eb91b25d3dcb46439d4f733dc19d0a0f.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Ratio_Jul_2020-01-2261aa1f53a947508e23a4b93b350cdb.jpg)