Breathtaking Info About Accounting Steps To Prepare Financial Statements Contoh Adjusted Trial Balance

The preparation of financial statements is easy once you've mastered the accounting elements and know the different accounts that comprise them.

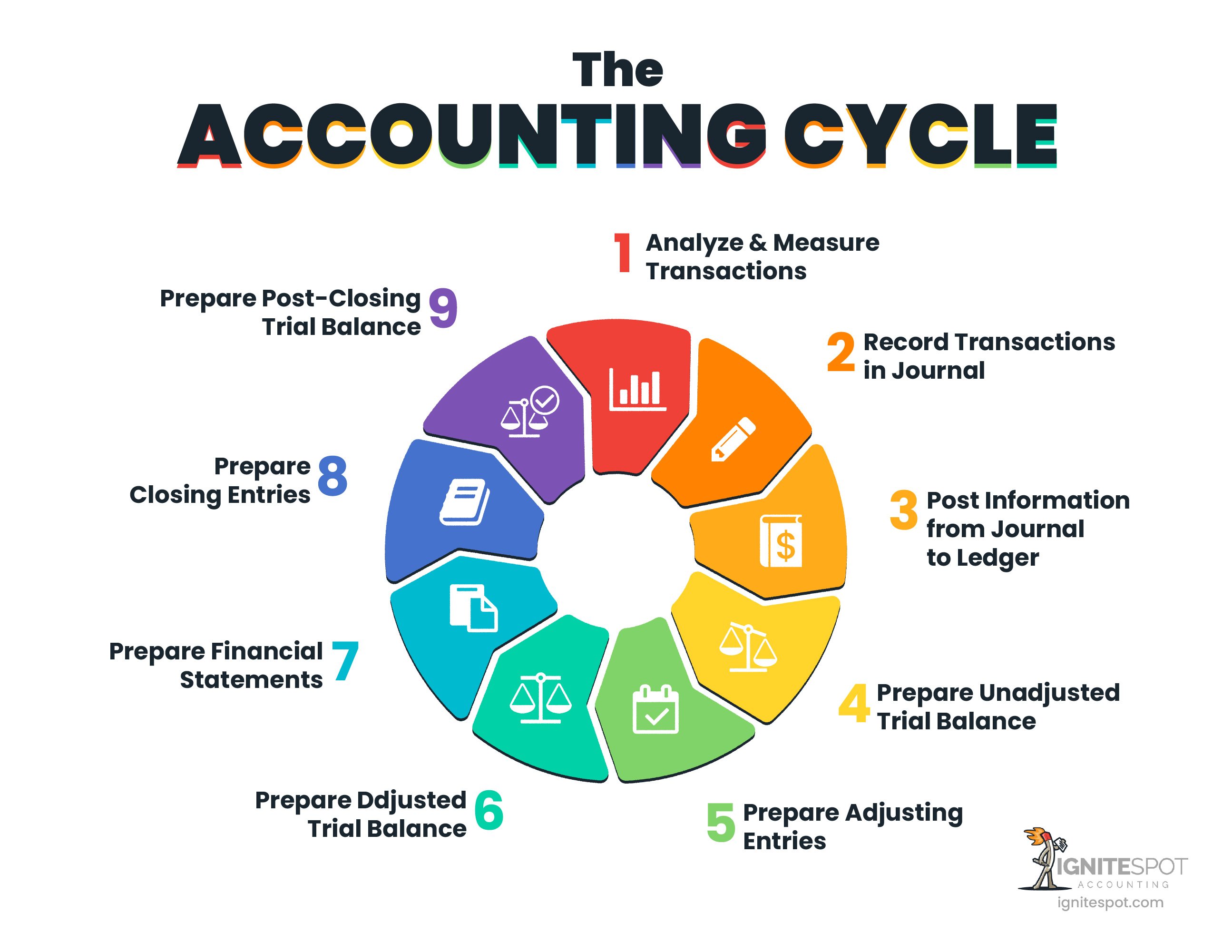

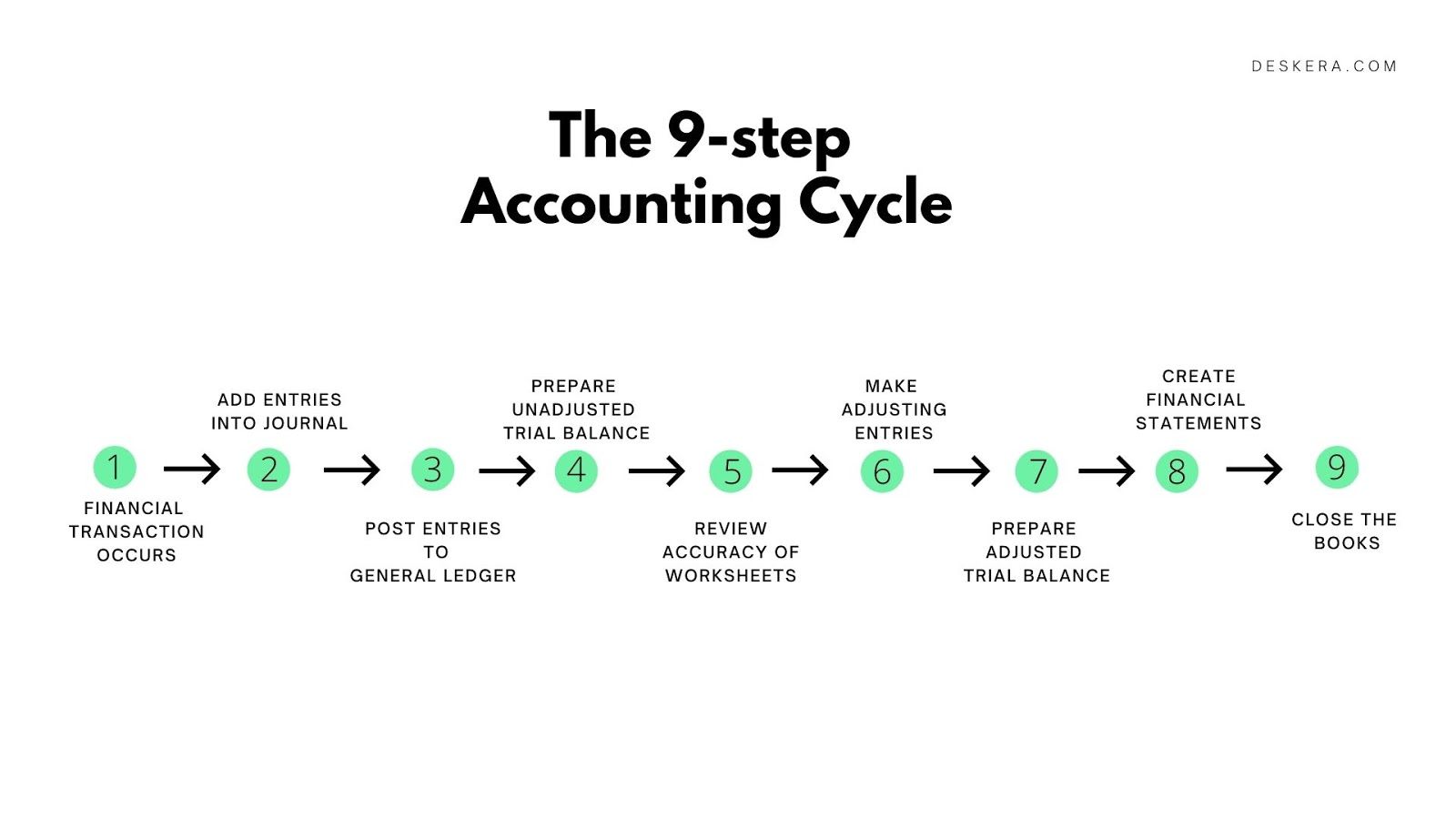

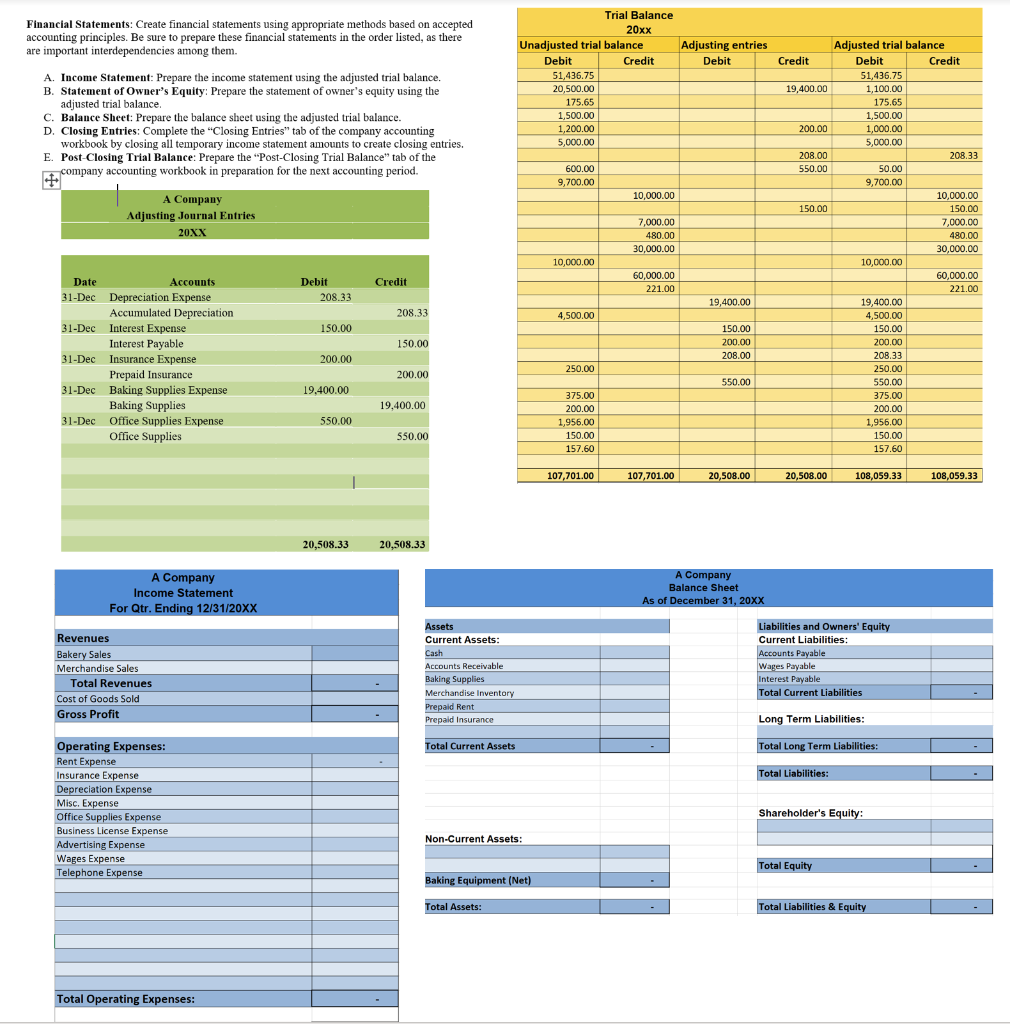

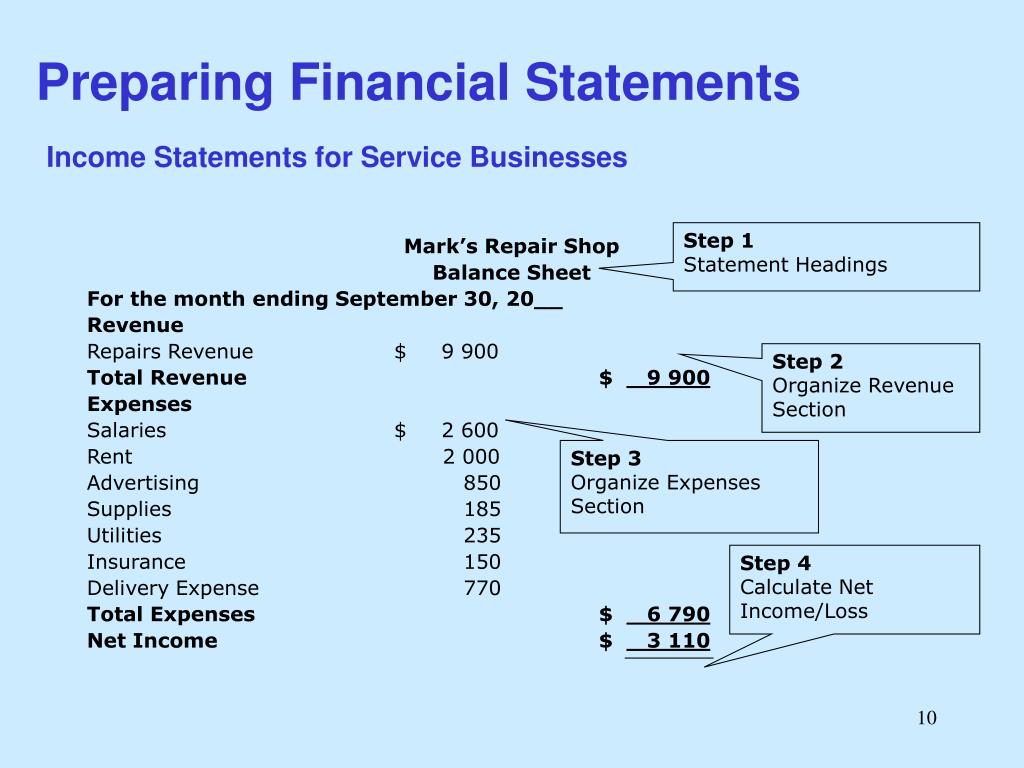

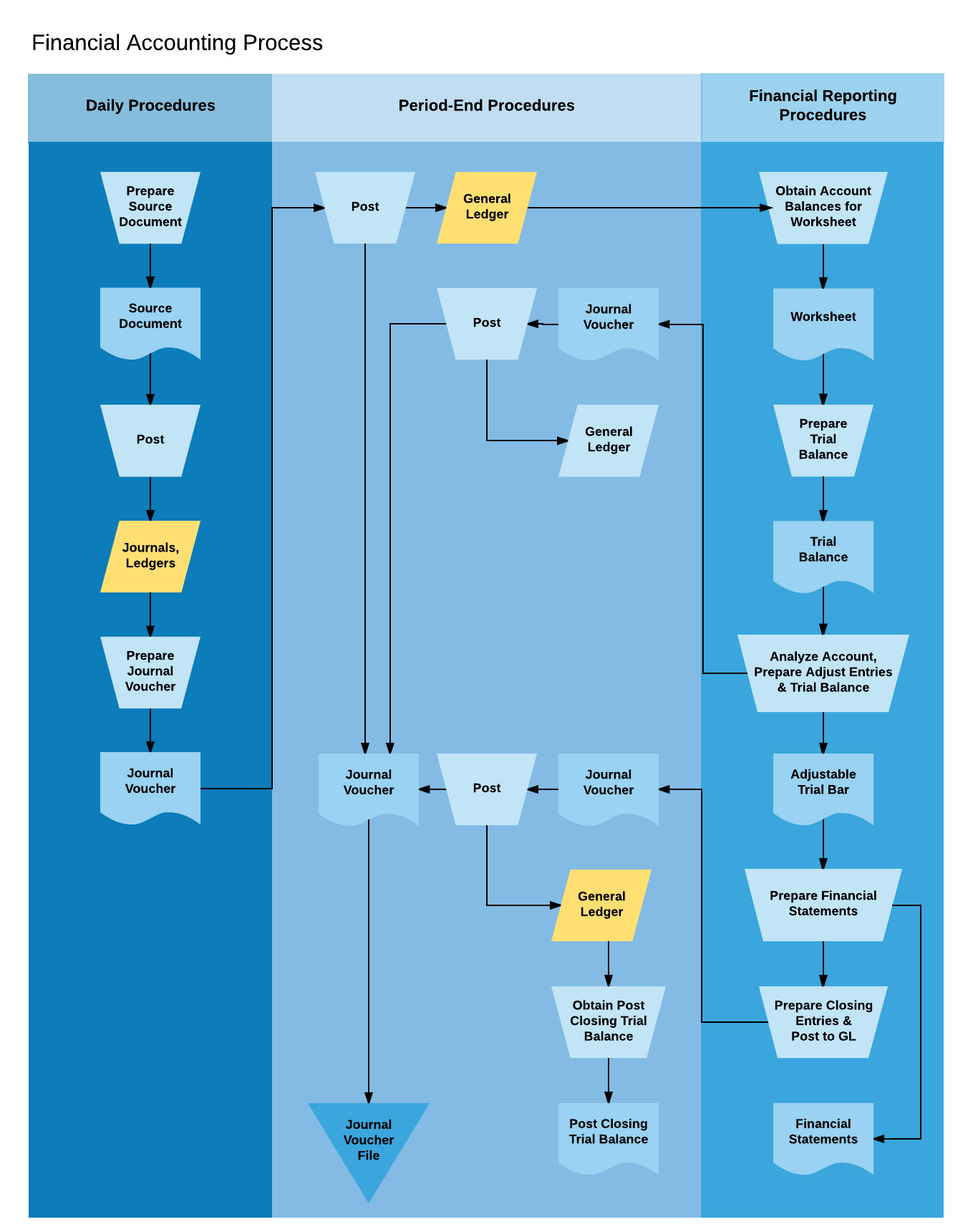

Accounting steps to prepare financial statements. The first step in financial statement preparation is identifying and gathering relevant financial data from a company's accounting records. Prepare financial statements step 1: Prepare adjusting entries at the end of the period 5.

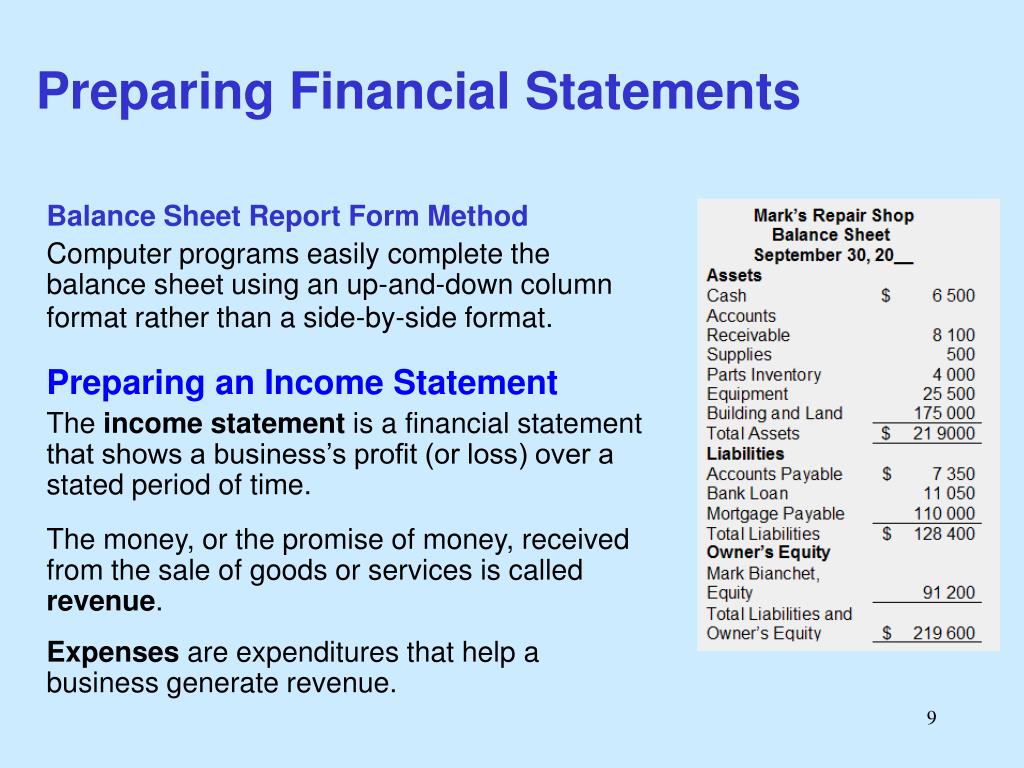

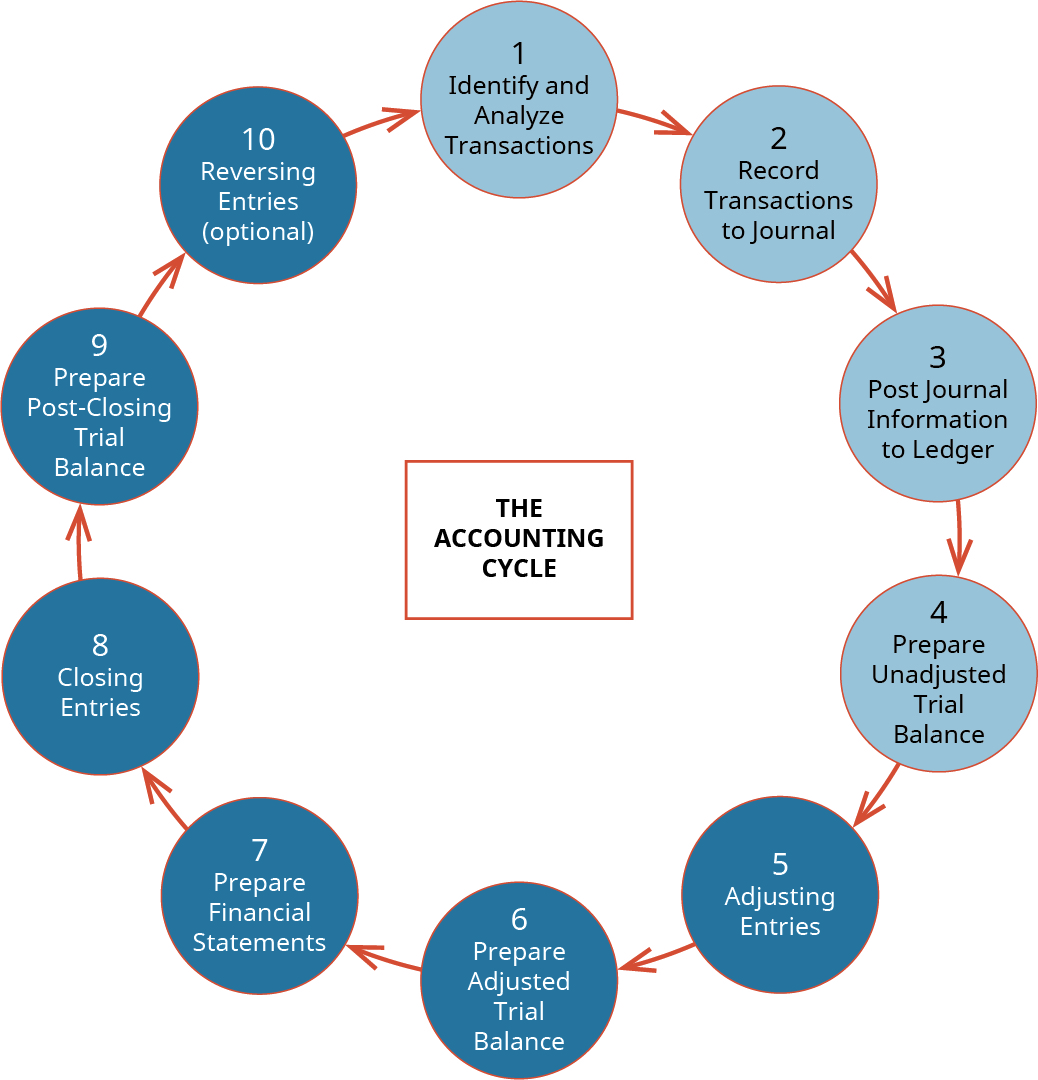

The three main types of financial statements are the balance sheet, the income statement, and the cash flow statement. These three statements together show the assets and liabilities of a business. The eight steps of the accounting cycle are as follows:

Prepare an unadjusted trial balance 4. These records will include expense receipts, bank statements, and credit card statements. Chapter iii of the accounting 101:

Create and post reversing entries, if needed Preparing financial statements is the seventh step in the accounting cycle. Identifying transactions, prepare general journal, general ledger, trial balance, adjusting entries, adjusted trial balance, financial statements and the closing accounts.

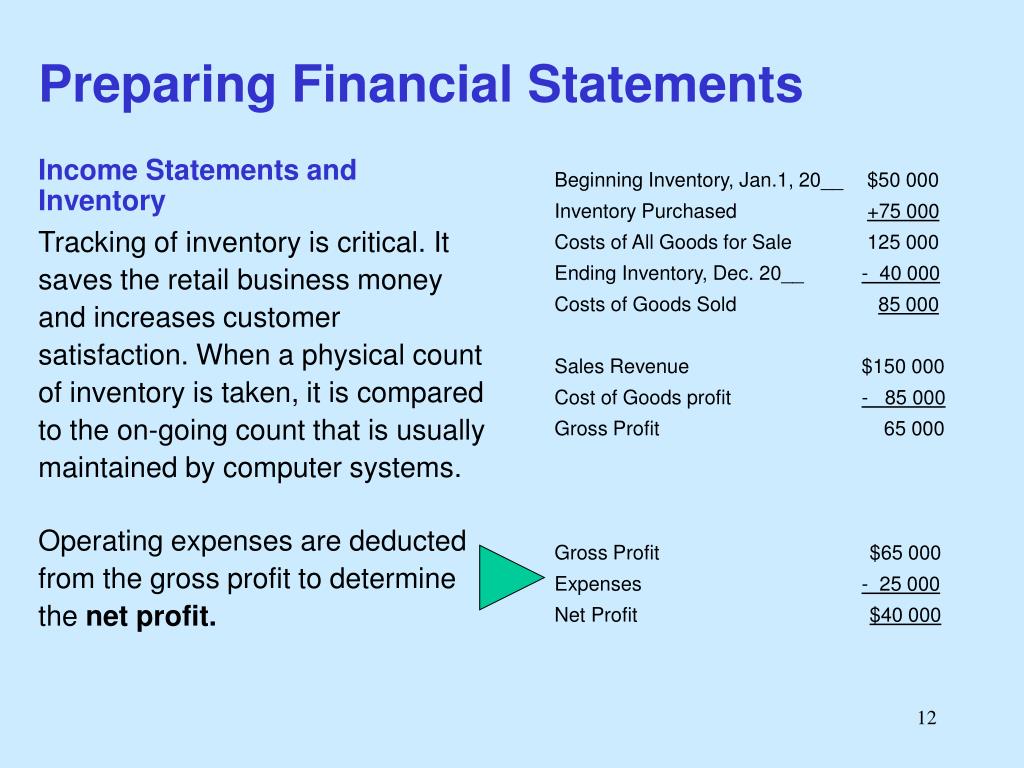

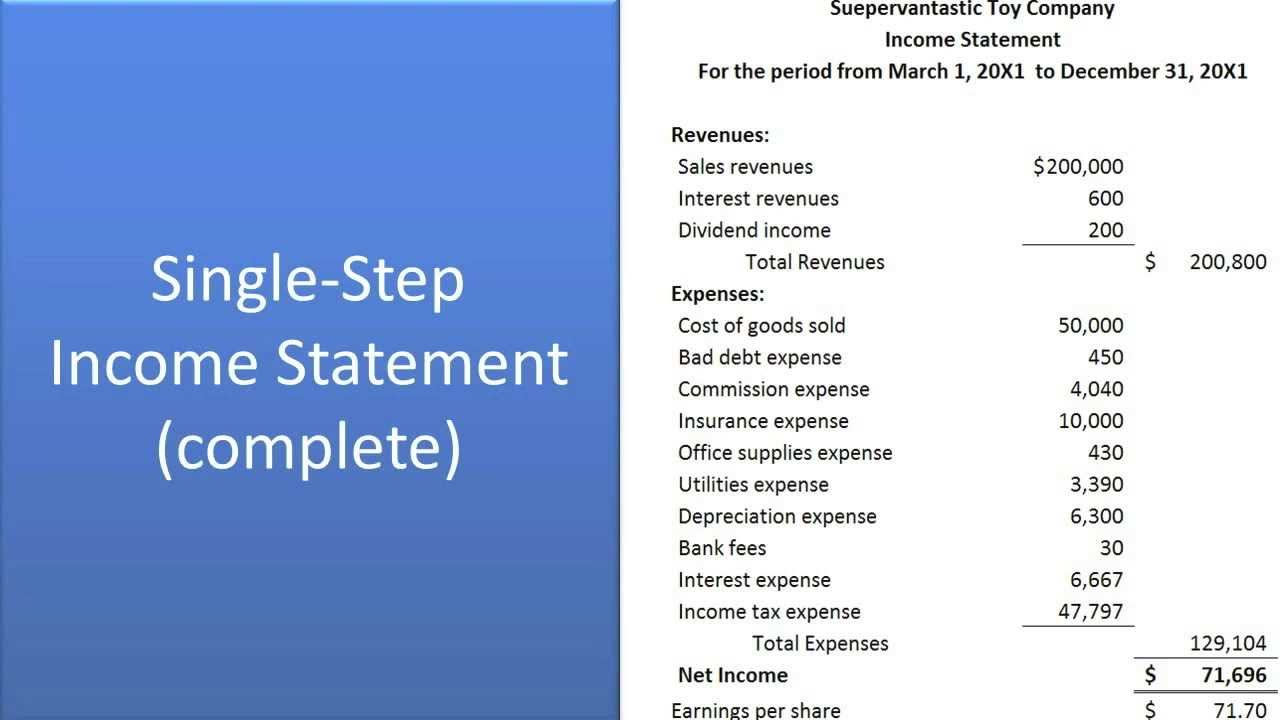

This process involves collecting information on transactions, such as sales , expenses , investments , and borrowings, and organizing it in a systematic manner. Here are the three most popular types of financial statements: Once you have the adjusted trial balance, you should use it to create your financial statements.

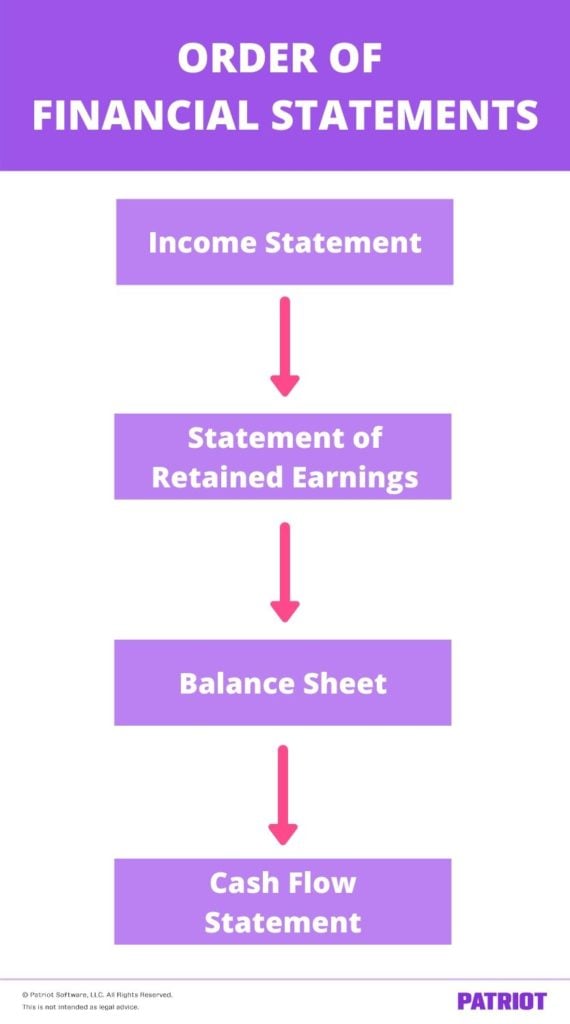

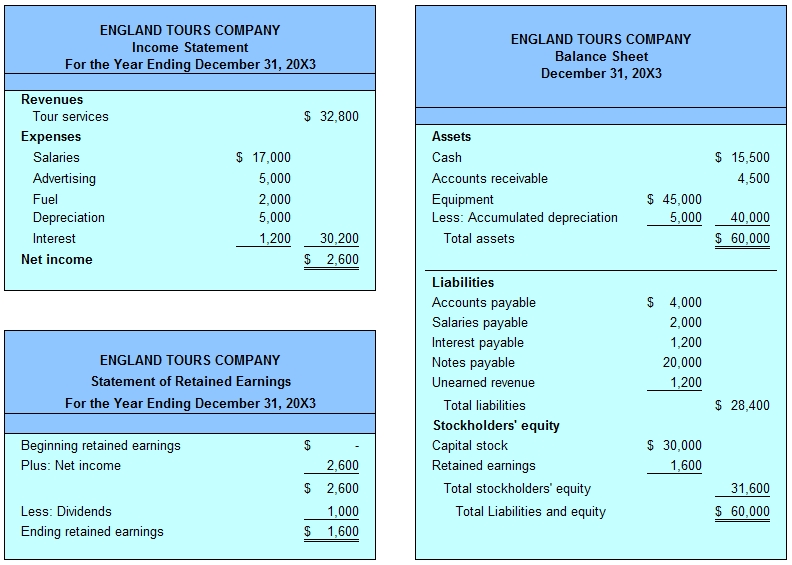

Balance sheets, income statements, cash flow statements, and annual reports. As she guides you through a comprehensive exploration. Each of the financial statements provides important financial information for both internal and external stakeholders of a company.

The six steps of the accounting cycle: A complete set of financial statements is made up of 5 components:. The preparation of the financial statements is the summarizing phase of accounting.

An income statement, a statement of retained earnings, a balance sheet, and the statement of cash flows. We will focus on the first three financial statements, and for a service type business. The balance sheet, income statement, and cash flow statement can be prepared using the correct balances.

This shows the value of the shareholders’ portion of a company. Verify receipt of supplier invoices compare the receiving log to accounts payable to ensure that all supplier invoices have been received. The income statement illustrates the profitability of a company under accrual accounting rules.

Remember that we have four financial statements to prepare: Sales, purchases, returns—every transaction impacts your financial. Before beginning any actual paperwork, get all of your financial records organized by month and type of document.