Amazing Tips About Three Basic Accounting Statements Important Ratios

This is also a common question for investment banking interviews, fp&a interviews.

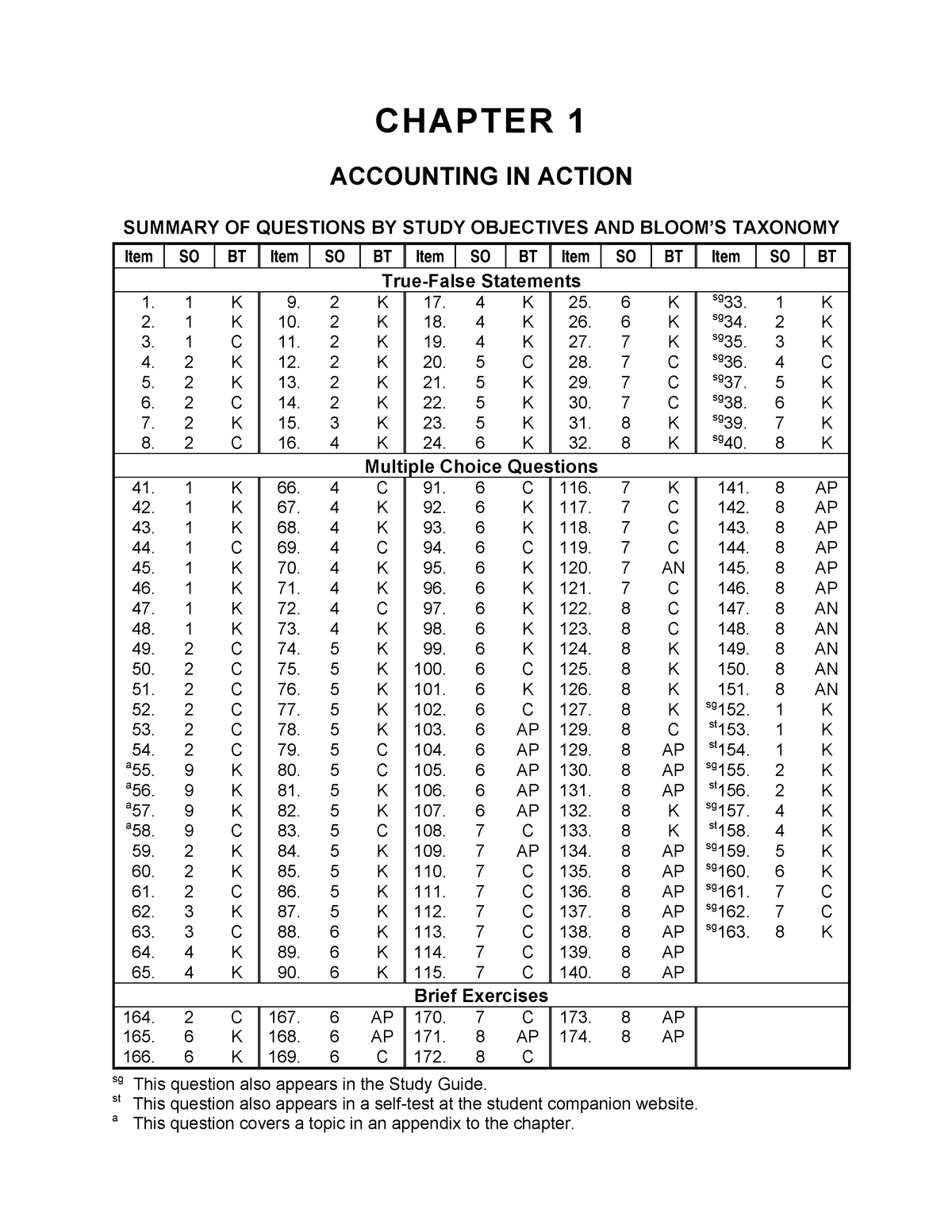

Three basic accounting statements. The income statement, statement of retained earnings, balance sheet, and statement of cash flows, among other financial information, can be analyzed. Finance and capital markets 10 units · 2 skills. The three basic financial statements used by businesses are (1) the income statement, also called the profit and loss statement or p&l which demonstrates the “bottom line” of net gains or losses;

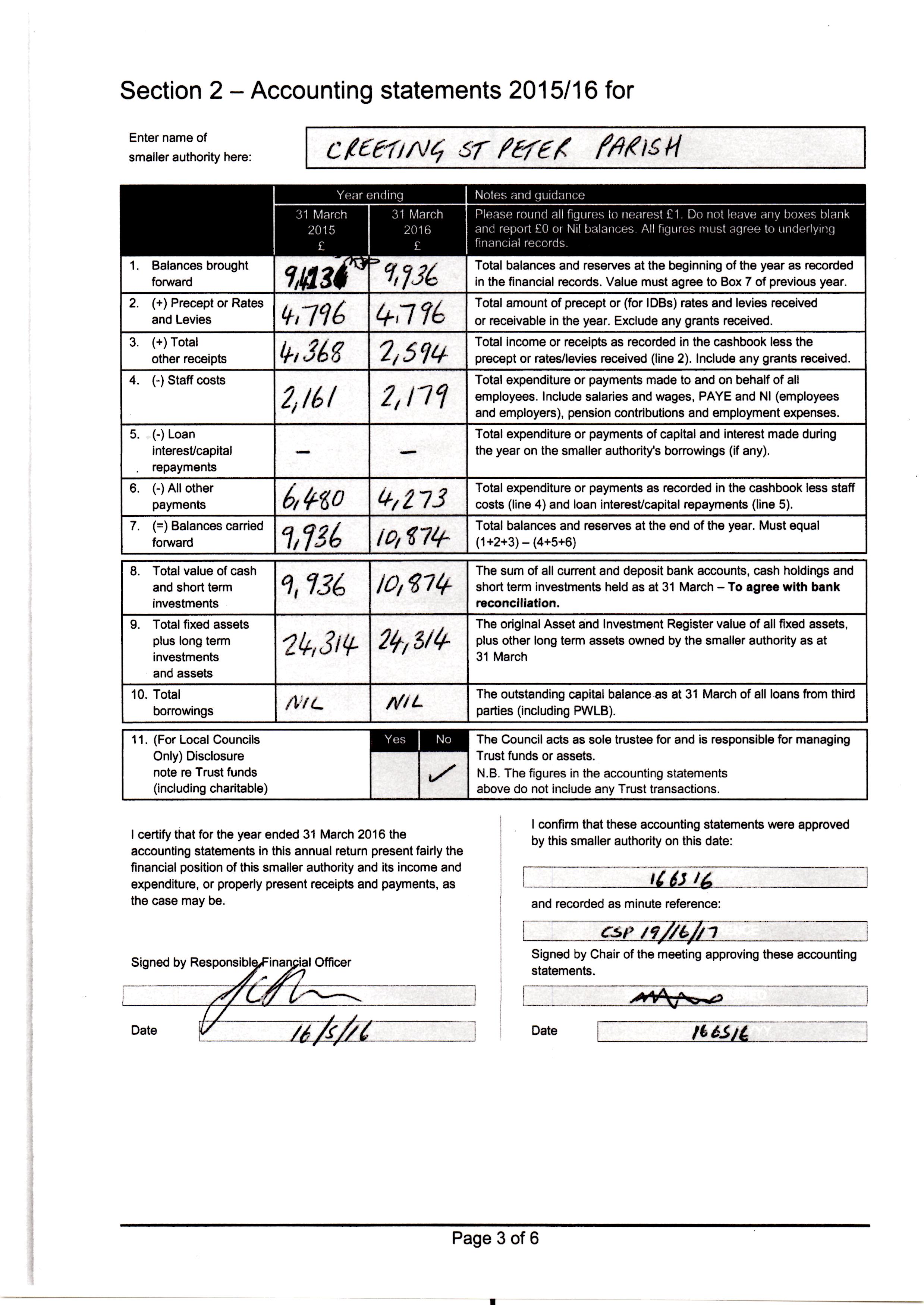

The four basic financial statements are the income statement, balance sheet, statement of cash flows, and statement of retained earnings. The income statement lists income and expenses. (2) the balance sheet which uses the basic accounting equation and lists assets, liabilities, and retained earnings (equity);

The first is the balance sheet , shown in figure 3.1, which summarizes the assets owned by a firm, the value of these assets and the mix of financing, debt and equity, used to finance these assets at a point in time. Unit 6 stocks and bonds. The three main types of financial statements are the balance sheet, the income statement, and the cash flow statement.

It begins with the revenue line and after subtracting various expenses arrives at net income. There are three basic types of notes. Because these statements detail a company at a macro level, being familiar with these three primary statements is essential for anyone working in.

Forecast financing activity (e.g., debt and equity) This financial statement highlights the net increase and decrease in total cash in each of. These records should be in a structured, easy to understand form as they often need to be audited by accountants, tax firms, government agencies or potential investors.

Unit 1 interest and debt. Determine the assumptions that will drive the forecast. The three major financial statements are prepared as a summary of figures and facts showing the financial condition of a business.

The income statement is a statement that illustrates the profitability of the company. Results for a period are shown on the income statement and the cash flow statement. The three standard financial statements — income statement, balance sheet, and cash flow statement — are the foundation of corporate accounting.

The three financial statements—income sheet, balance sheet, and statement of cash flows—provide granular financial forecasts that explain the future of your company's financial performance. The three basic financial statements are; The basic accounting statements there are three basic accounting statements that summarize information about a firm.

Three commonly used financial statements are the income statement, the cash flow statement, and the balance sheet. There are three basic accounting statements that summarize information about a firm. The 3 financial statements are all linked and dependent on each other.

Of all financial documentation reviewed by analysts, the three statements that are typically the primary focus include: They are not only used to show how a business uses its funds committed by the shareholders and the lenders, but also to see where the business stands in terms of its financial position. The interpretation of this principle is highly judgmental, since the amount of information that can be provided is.