The Secret Of Info About Statement Of Total Comprehensive Income Balance Sheet Explained

Statement of changes in equity;

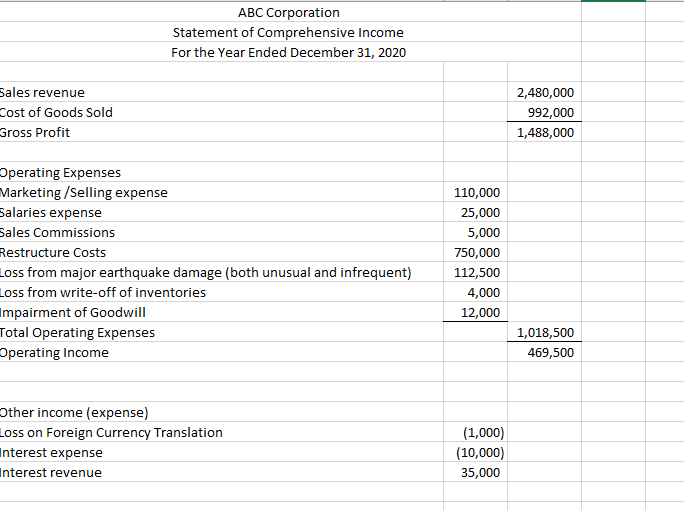

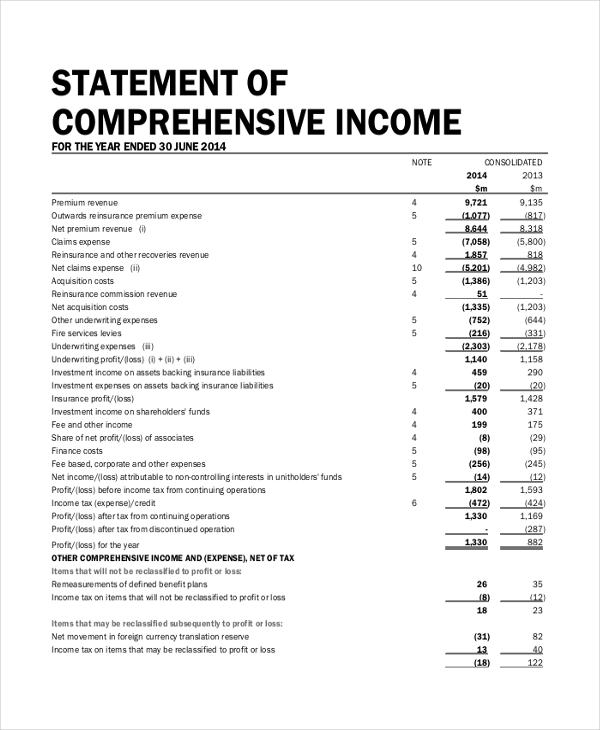

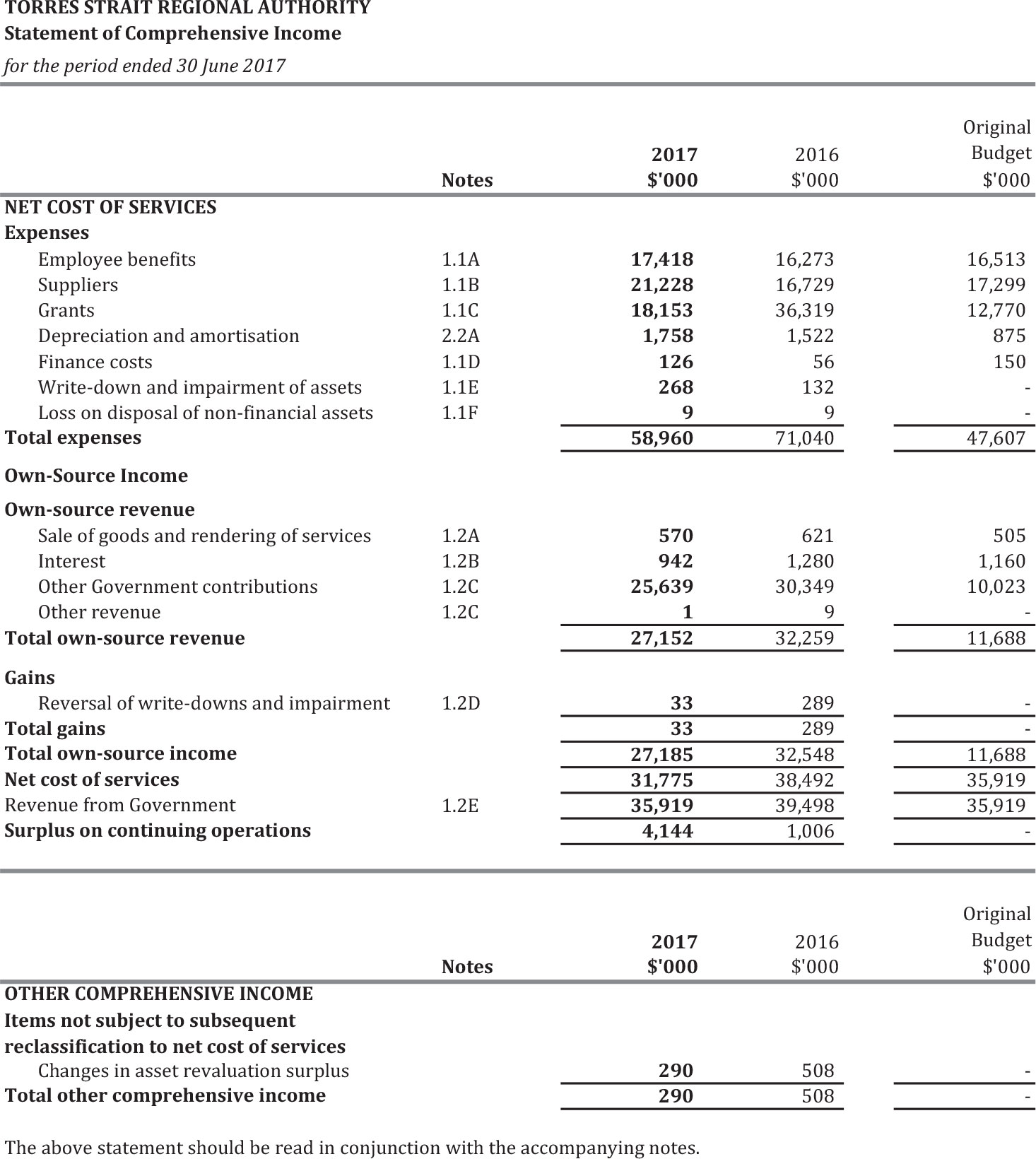

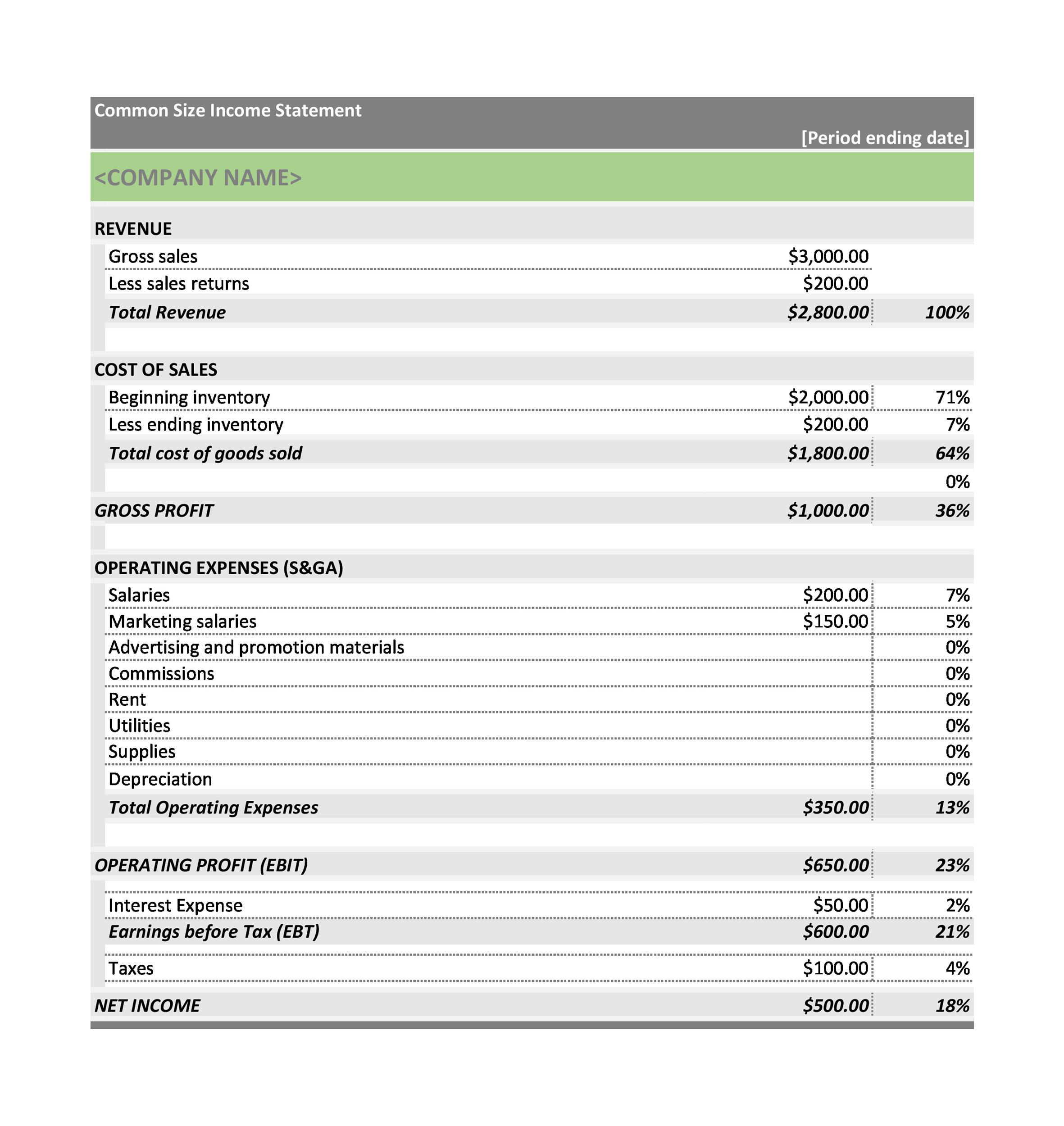

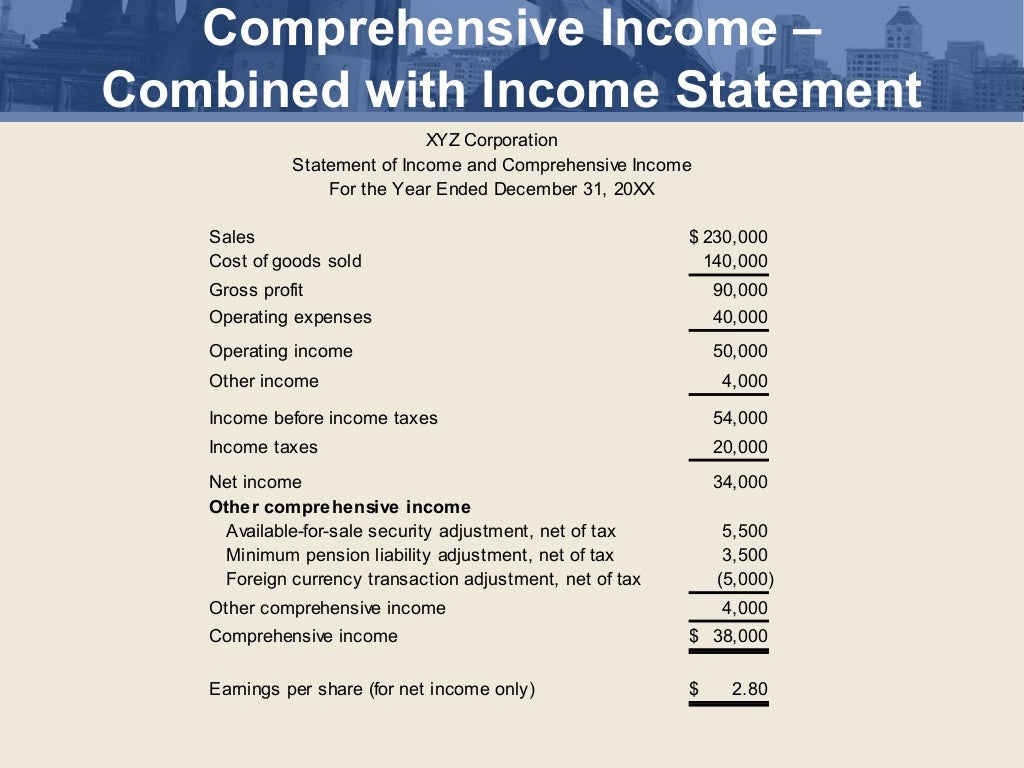

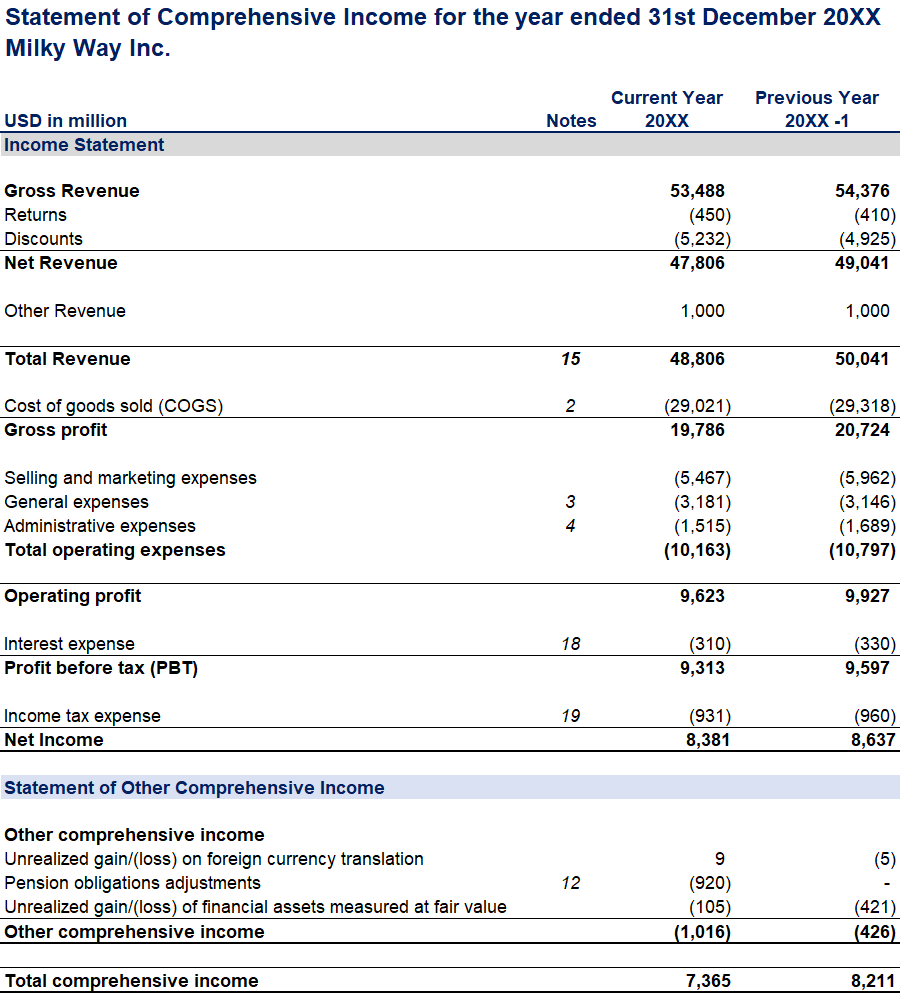

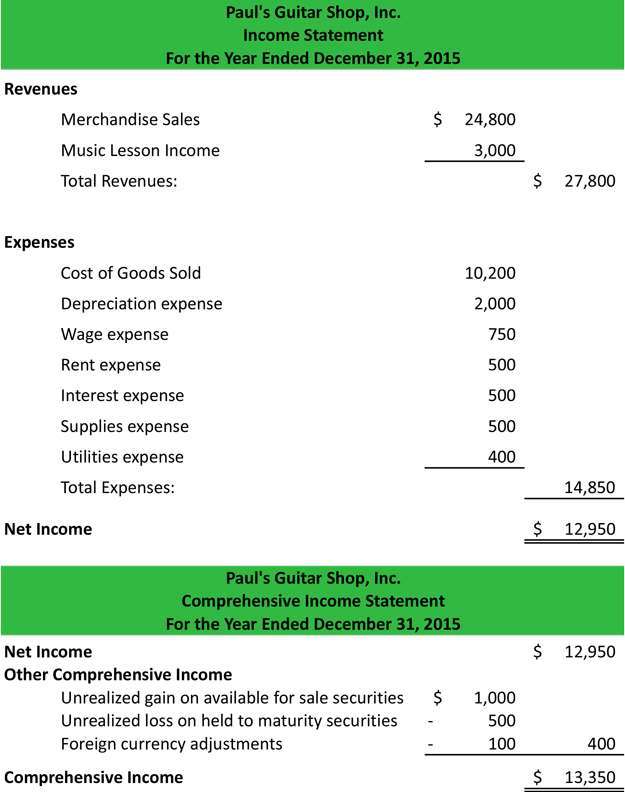

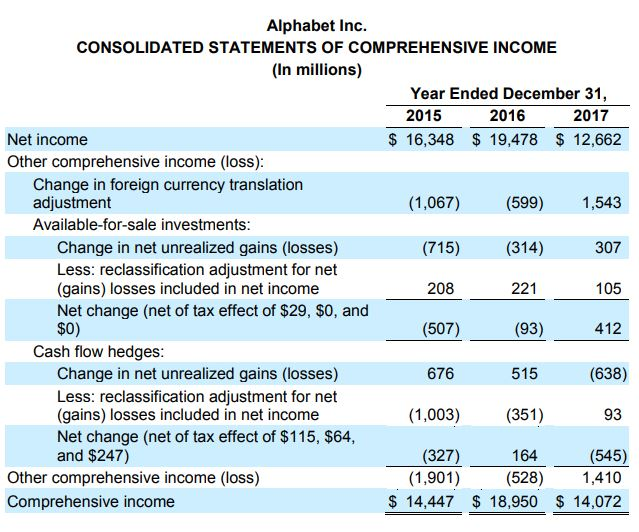

Statement of total comprehensive income. Total comprehensive income/(loss) for the period : Report net income in one financial statement. Comprehensive income is the sum of net income and other items that must bypass the income statement because they have not been realized, including items like an.

A second statement, called the statement of comprehensive income, would start with net income and. A statement of comprehensive income, immediately following the statement of profit or loss and beginning with profit or loss [ias 1.10a] the statement(s) must present: Marketable securities (at fair value through other comprehensive income) * prior year’s figure adjusted.

Comprehensive income includes net income and oci. Report other comprehensive income and comprehensive income in a second separate, but consecutive, financial statement. Financials statement of comprehensive income.

1 this section requires an entity to present its total comprehensive income for a period—ie its financial performance for the period—in one or two financial. Oci consists of revenues, expenses, gains, and losses to be included in comprehensive income but excluded. Net income is the profit that remains after all.

Presentation of total comprehensive income 5.2 an entity shall present its total comprehensive income for a period either: This module focuses on the general requirements for the presentation of the statement of comprehensive income and the income statement in accordance with section 5. Statement of comprehensive income;

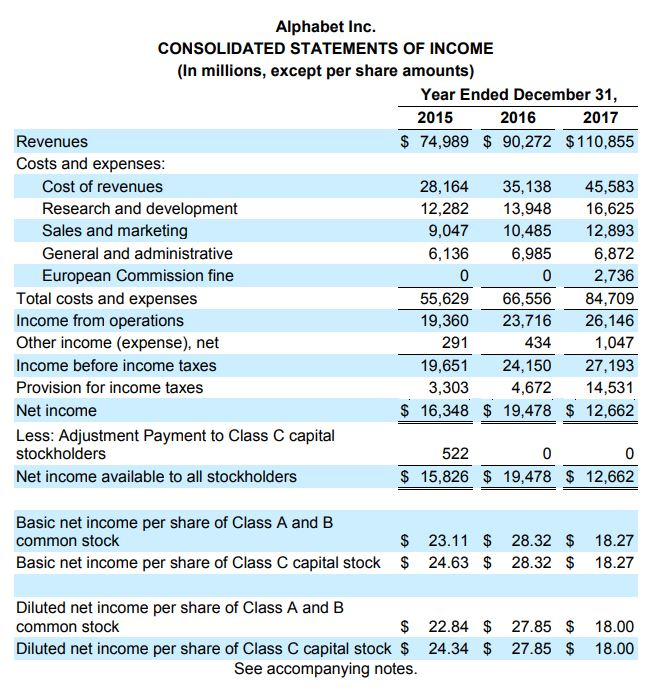

The income statement is one of the most essential parts of the statement of comprehensive income. On the way to an. 7,346 (2,519) (2,130) other comprehensive.

Other comprehensive (loss)/income for the period, net of tax (6 631) 1 922 : Statement of comprehensive income for group. Figures in millions unless otherwise stated.

A single statement of comprehensive income; It summarizes all the sources of revenue and expenses, including taxes and interest charges. A separate profit and loss account.

It includes all revenue and expenditure resources, as well as. The purpose of the statement of profit or loss and other comprehensive income (ploci) is to show an entity’s financial performance in a way that is useful to a wide range of. (a) in a single statement of.

One of the most important components of the statement of comprehensive income is the income statement. The statement of income ends at net income (highlighted in yellow). The statement of comprehensive income illustrates the financial performance and results of operations of a particular company or entity for a period of.

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)