Cool Tips About Subsidiary Consolidated Financial Statements Peer Group Analysis Ratios

:max_bytes(150000):strip_icc()/Consolidatedfinancialstatement_final-1a46c53d5f0d4eca864b30adfe22b048.png)

Consolidated financial statements (ifrs 10) last updated:

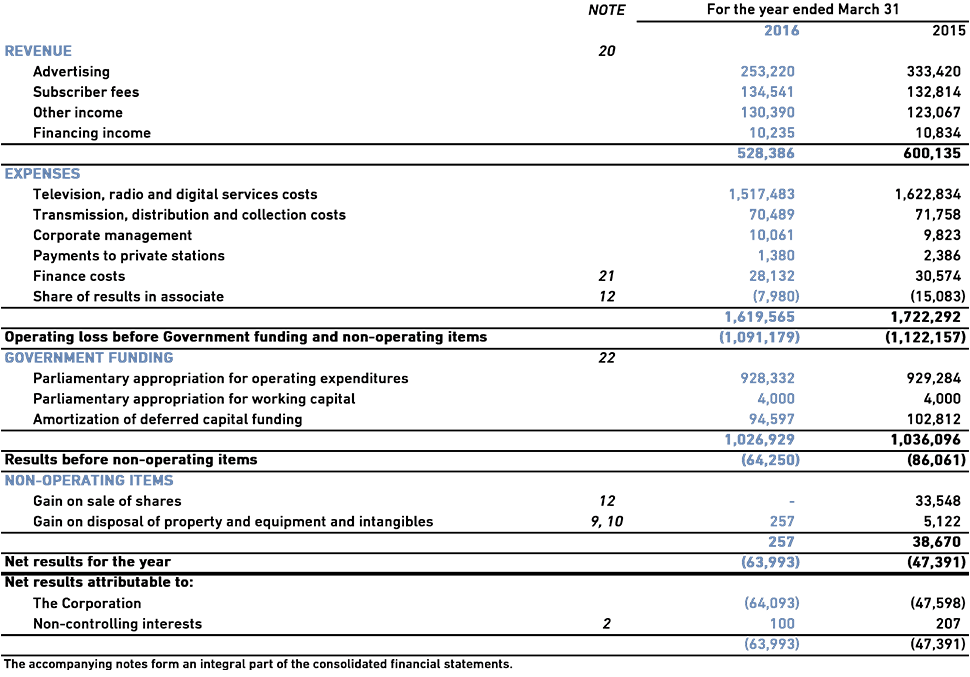

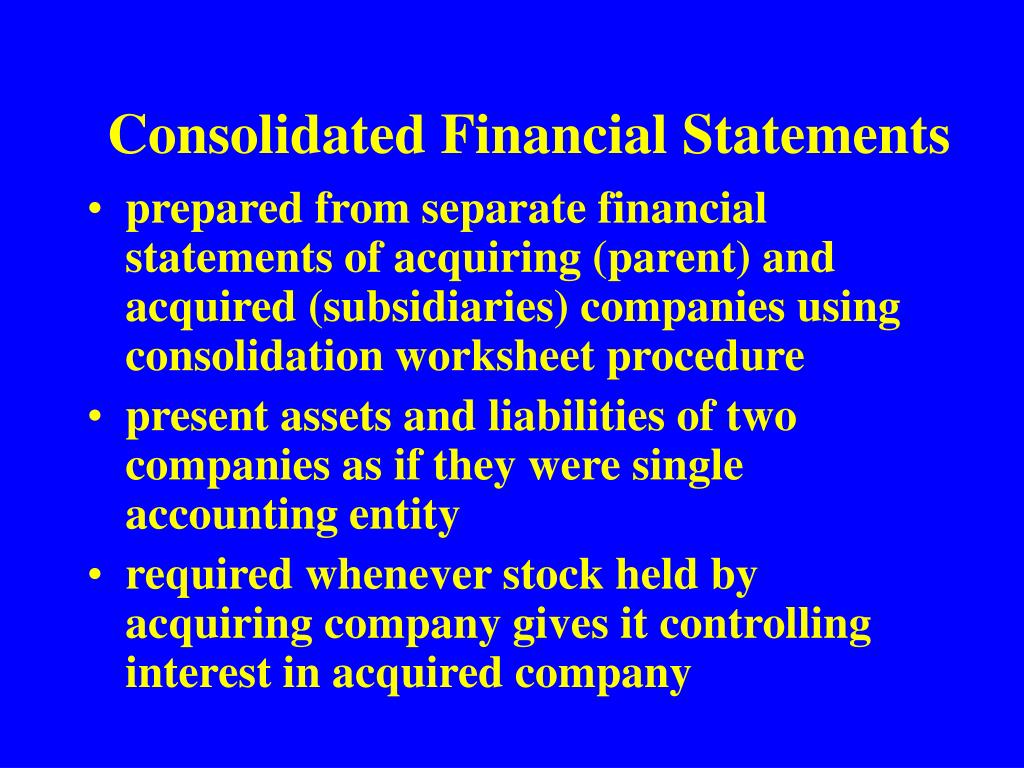

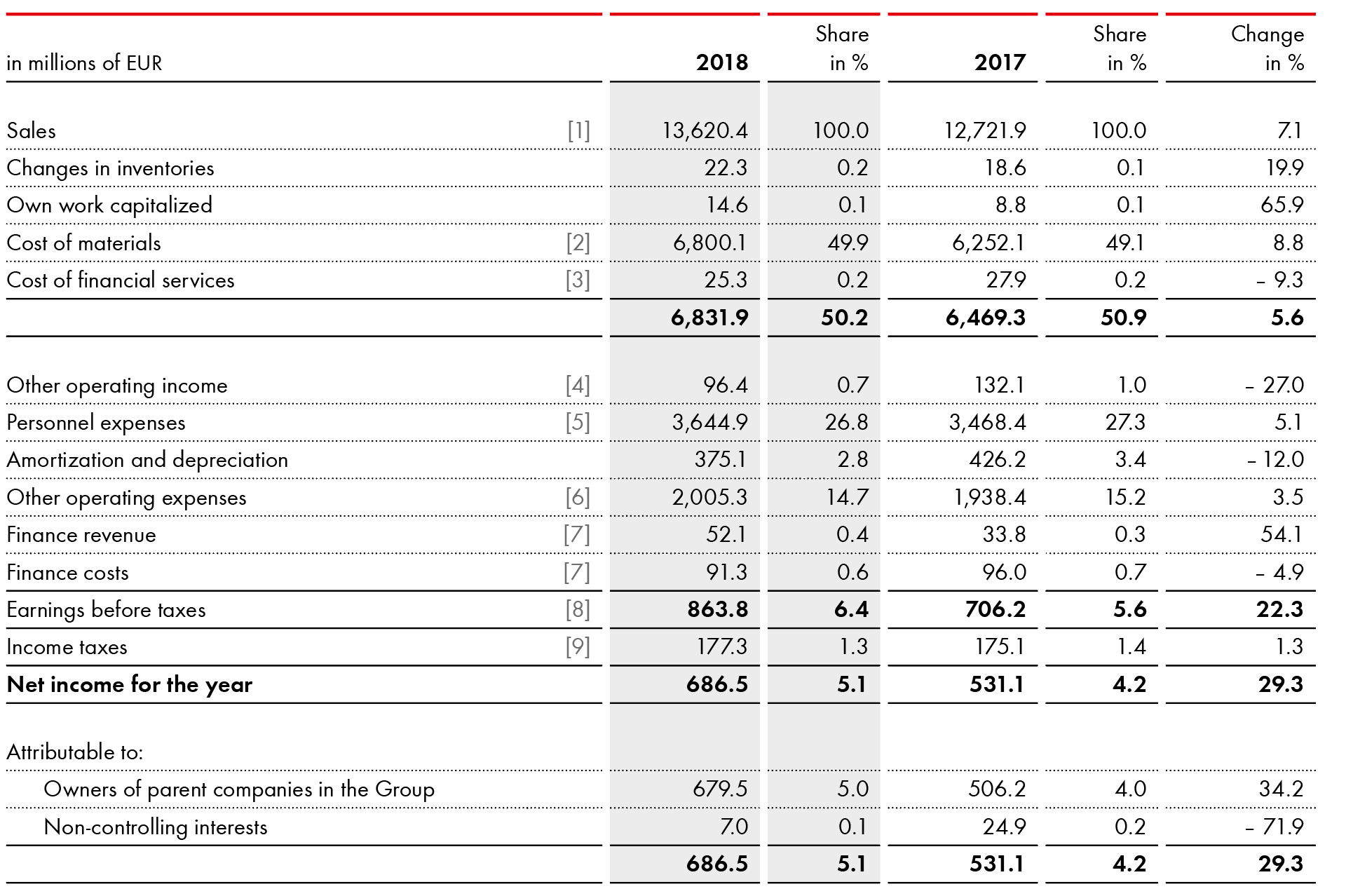

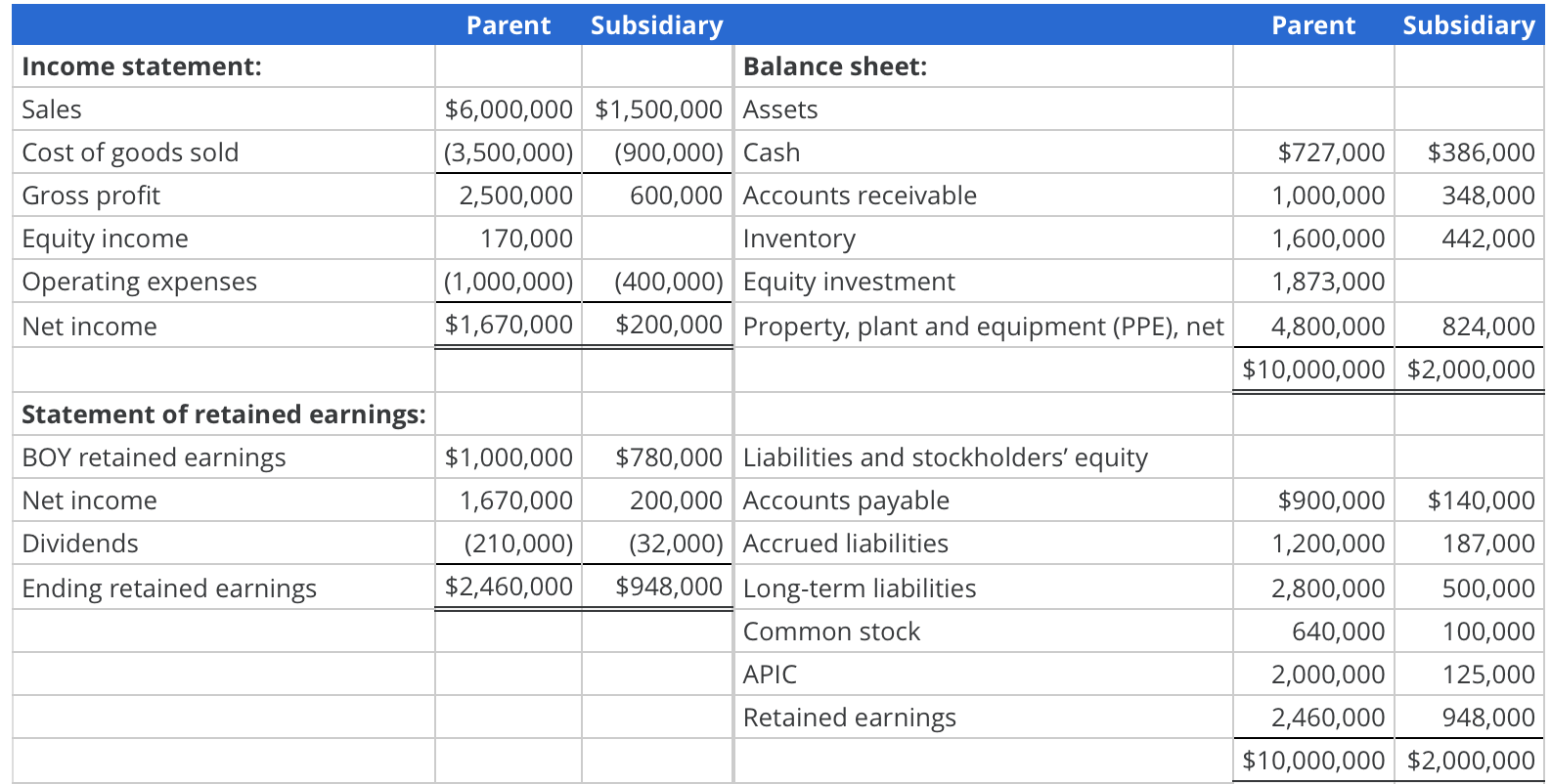

Subsidiary consolidated financial statements. It means that the parent is required to combine the financial. The consolidation method combines the parent and subsidiary’s financial statements into one set, with any overlapping factors being eliminated to ensure their. A consolidated financial statement is maintained to help parent companies and their subsidiaries to have a ready reference of all the units’ financial status consolidated at.

Ias 27 defines consolidated financial statements as ‘the financial statements of a group in which the assets, liabilities, equity, income, expenses and cash flows of the parent and. A subsidiary is a company that is controlled by its parent company. Consolidated financial statements if it meets all the following conditions [ifrs 10.4]:

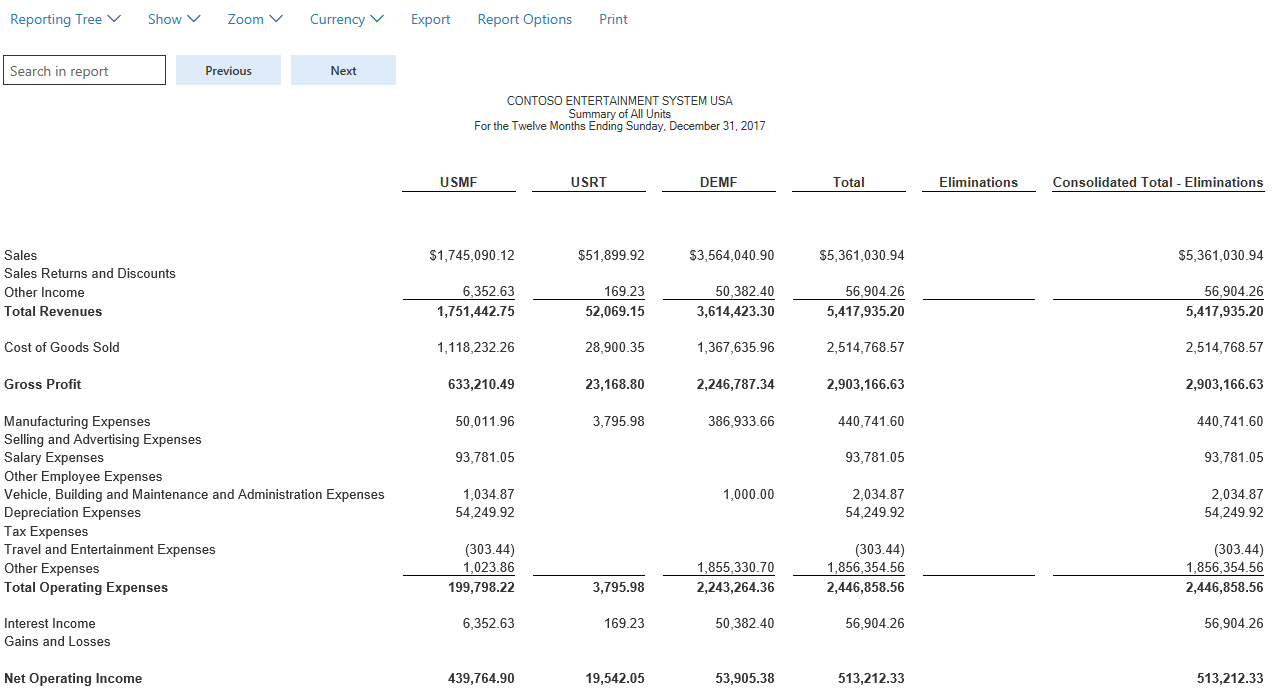

Where an investment is identified as a subsidiary then consolidated financial statements are prepared where the financial statements of a group parent and its subsidiaries are. Us ifrs & us gaap guide the requirements for consolidated financial statements are fairly similar under both frameworks. Overview ifrs 10 consolidated financial statements outlines the requirements for the preparation and presentation of consolidated financial statements,.

Neither ifrs accounting standards nor us gaap. In the consolidated financial statements, company a reflects 100% of the assets and liabilities of subsidiary b and a noncontrolling interest of $30.

Consolidated financial statements present assets, liabilities, equity, income,. There may be situations where separate financial. The parent company can create a subsidiary by buying or creating it from within the parent.

When the parent has legal control over the subsidiary, parent will consolidate subsidiary. Consolidated financial statements are financial statements that present the assets, liabilities, equity, income, expenses and cash flows of a parent and its subsidiaries as. Ias 27 was reissued in january 2008 and applies to annual periods beginning on or after 1 july 2009, and is superseded by ias 27 'separate financial statements' and ifrs 10.

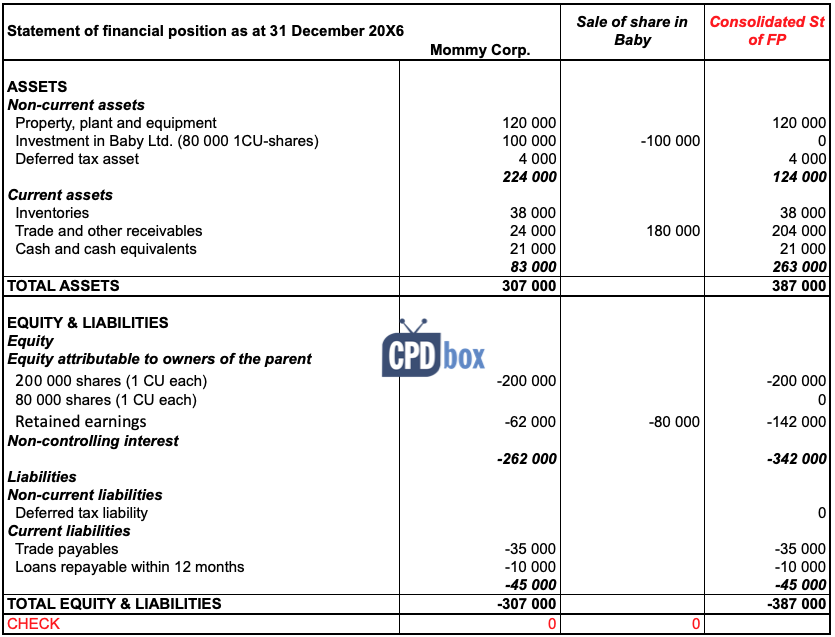

However, the subsidiary accounts as of a different. Pfrs 10 requires parent company to present consolidated financial statements to external reporting. Prepare consolidated statement of financial position, consolidated statement of profit or loss and consolidated statement of changes in equity of mommy.

![[Solved] b. Prepare all consolidating entries need SolutionInn](https://s3.amazonaws.com/si.experts.images/questions/2021/02/602cba3815710_1613543993759.jpg)

![[Solved] Comparative consolidated financial statem SolutionInn](https://s3.amazonaws.com/si.question.images/image/images14/1191-B-C-A-B(2837).png)