Here’s A Quick Way To Solve A Info About The Statement Of Cash Flows Provides Information About Vertical And Horizontal Analysis Formula

A cash flow statement tells you how much cash is entering and leaving your business in a given period.

The statement of cash flows provides information about. The statement of cash flows provides cash receipt and cash payment information and reconciles the change in cash for a period of time. The cash flow statement (cfs), is a financial statement that summarizes the movement of cash and cash equivalents (cce) that come in and go out of a company. In general, a positive cash flow statement is a sign of a healthy company.

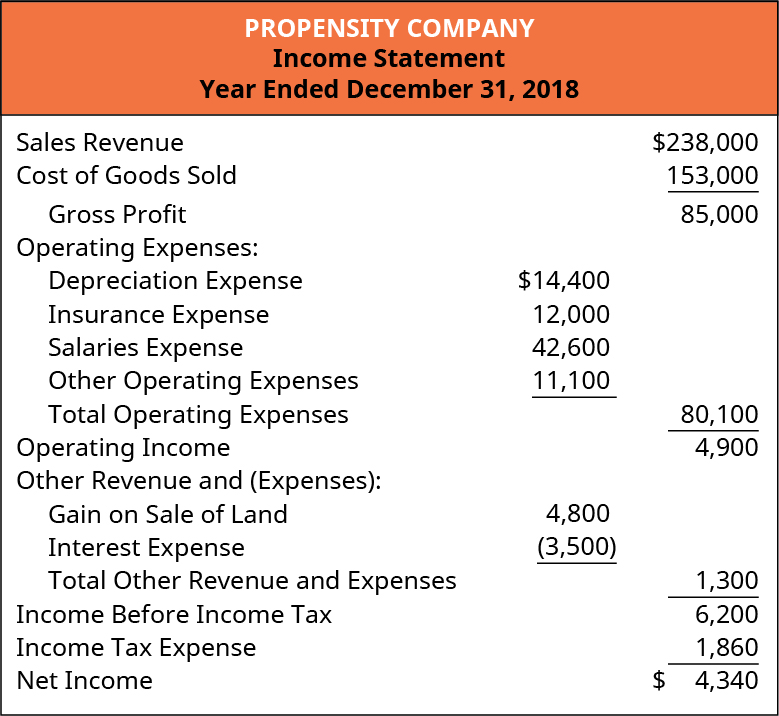

The cash flow statement reports the cash generated and spent during a specific period of time (e.g., a month, quarter, or year). The statement of cash flows provides information about a company's gross receipts and gross payments for a specific period of time. And yet a negative cash flow statement is not in itself cause for alarm.

The statement of cash flows (also referred to as the cash flow statement) is one of the three key financial statements. The cash flow statement is required for a complete set of financial statements. Uses of the statement of cash flows.

The statement of cash flows provides summary information about cash ______ and cash _____ during the year. Or, it could mean the business is in growth mode. The economic decisions that are taken by users.

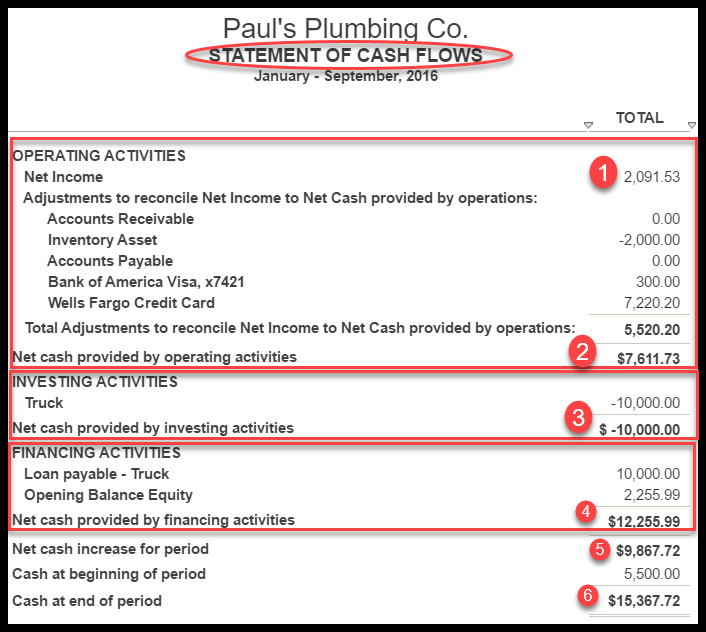

Explain the purpose of the statement of cash flow. Determine net cash flows from operating activities. Statement of cash flows provides important information for users to assess the company’s ability to generate cash and cash equivalents.

The statement of cash flows is a financial statement listing the cash inflows and cash outflows for the business for a period of time. Information about the cash flows of an entity is useful in providing users [refer: The scf reports the cash inflows and cash outflows that occurred during the same time interval as the income statement.

The cash flow statement is intended to provide information on a firm's liquidity and solvency, improve the comparability of different firms' operating performance, and to indicate the amount, timing, and probability of future cash flows. The statement of cash flows is a central component of an entity’s financial statements. What is a cash flow statement?

The main purpose of the statement of cash flows is to report on the cash receipts and cash disbursements of an entity during an accounting period. Whether updated on an annual, quarterly or monthly basis, this document tracks both cash and cash equivalents that are amassed from ongoing operations and external investments, as well as those. 2 22 terms alisoncrook1 preview

To provide clear information about what areas of the business generated and used cash, the statement of cash flows is broken down into three key categories: Accrual accounting creates timing differences between income statement accounts and cash. For example, netflix had a negative cash flow for years while.

Cash flow information is useful in assessing the ability of the entity to generate cash and cash equivalents and enables users to develop models to assess and compare the present value of the future cash flows of different entities. The statement of cash flows summarizes the effects on cash of the operating, investing, and financing activities of a company during an accounting period; Potentially misunderstood and often an afterthought when financial statements are being prepared, it provides key information about an entity’s financial health.