Brilliant Strategies Of Tips About Limitations Of Consolidated Financial Statements Prepare Cash Flow

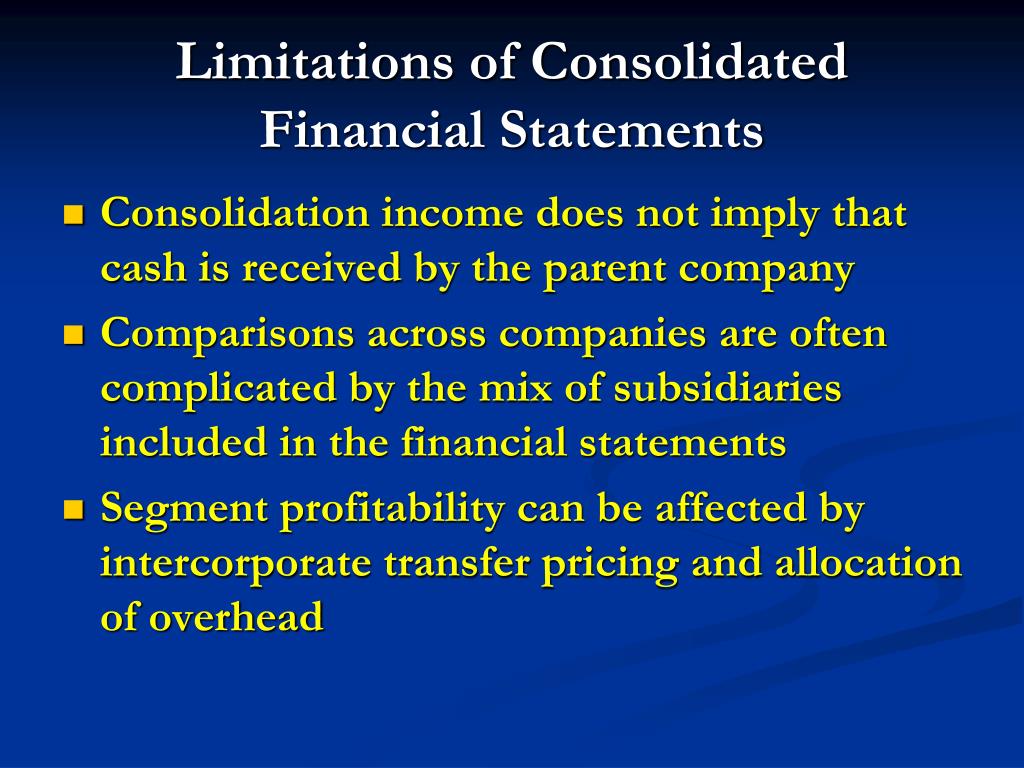

One limitation of financial statements is that they are open to human interpretation and error, in some cases even intentional manipulation of figures.

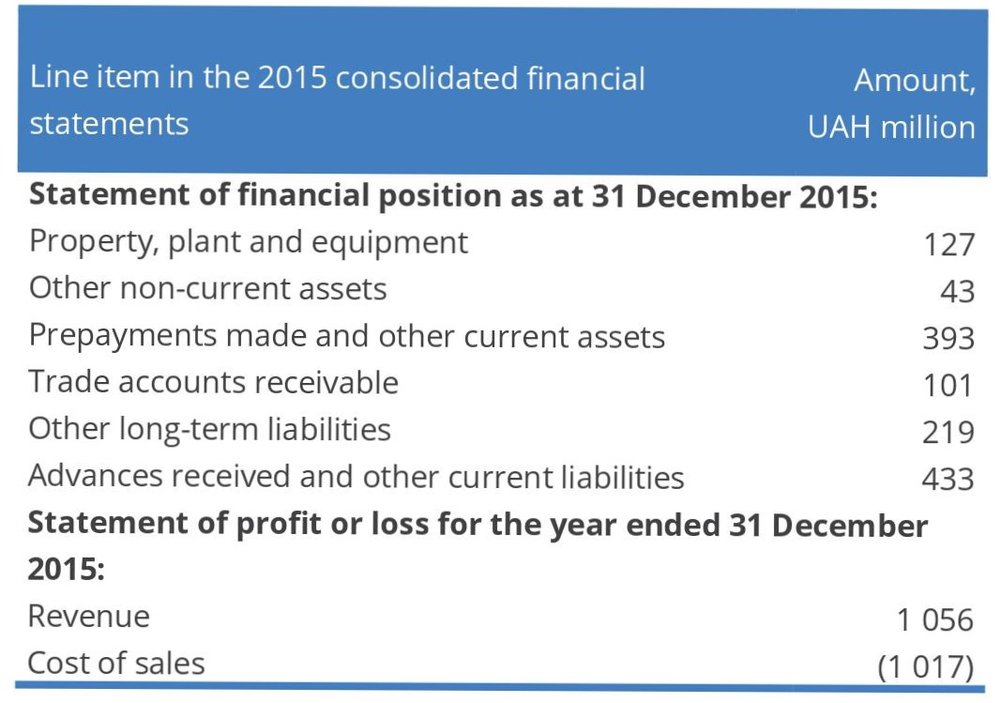

Limitations of consolidated financial statements. Consolidated financial statement refers to the financial data from all entities associated with a parent company reflected at one single consolidated and organized record book representing the group as one single entity. (in millions of euros) notes 2023 2022 % change net sales 6.1 83,270 81,385 2.3% loyalty program costs (993) (842) 18.0% 1 become a study.com member to unlock this answer!

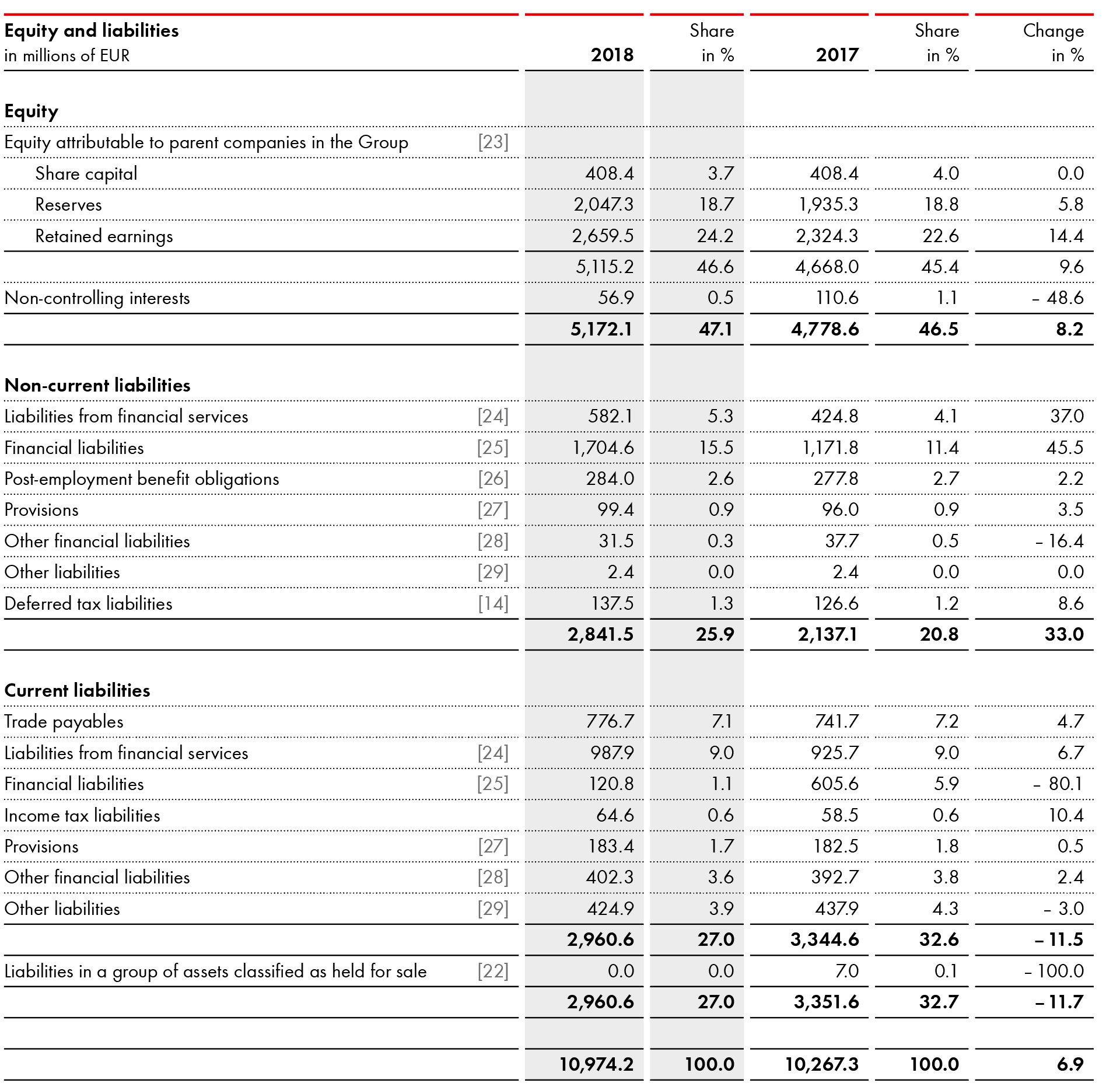

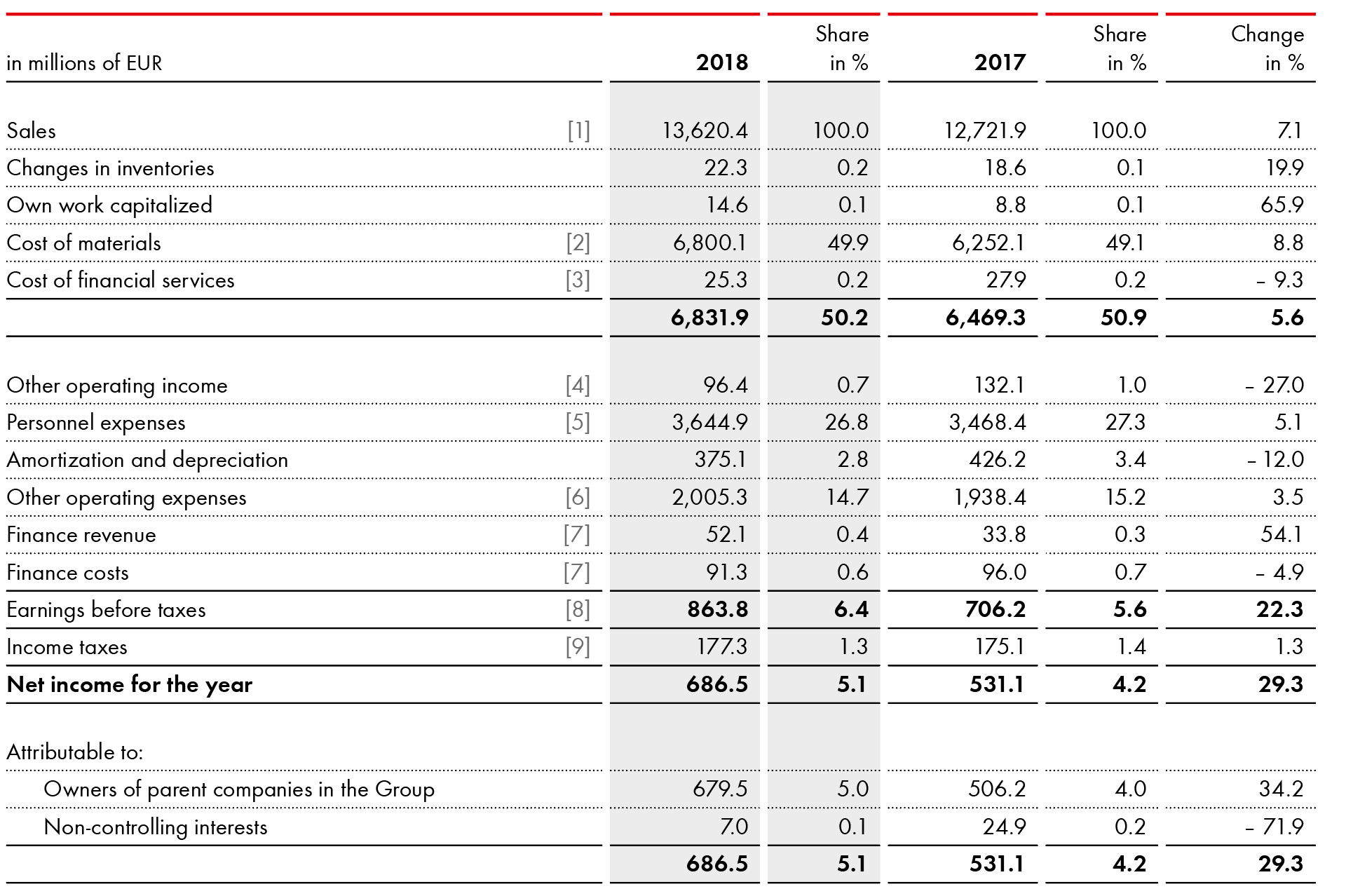

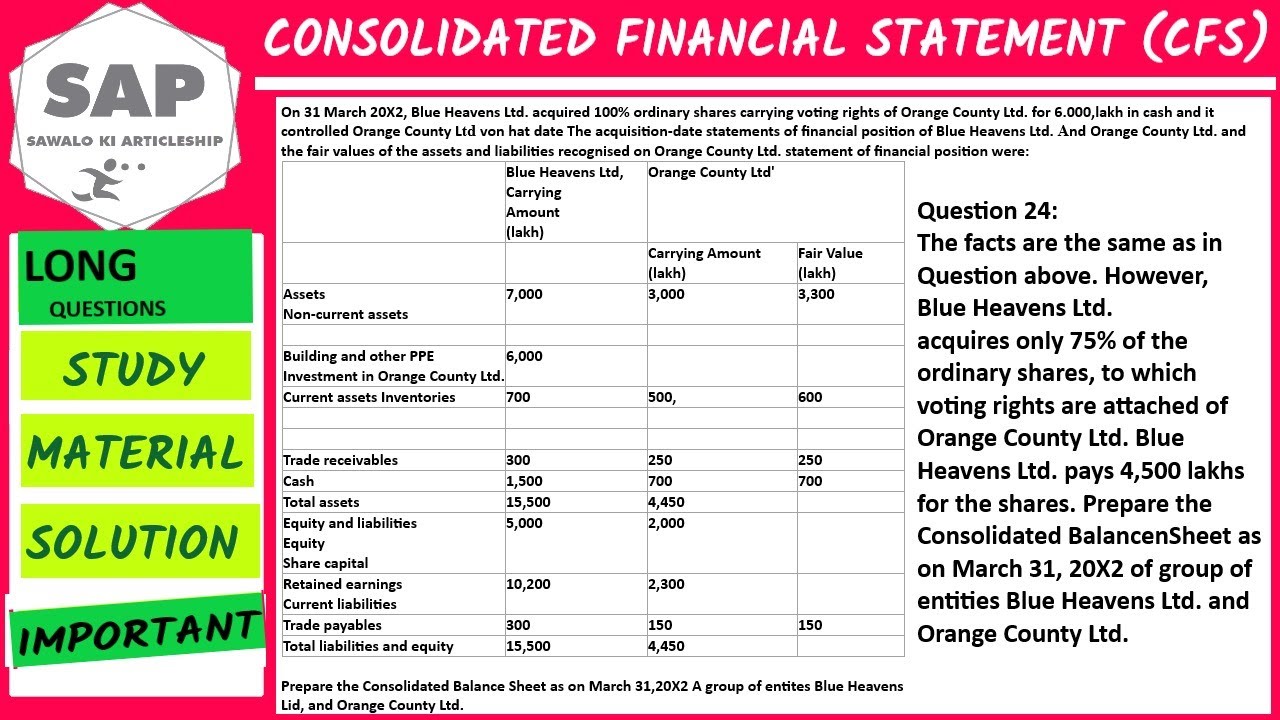

Uses and limitations of consolidated statements consolidated financial statements are of primary importance to stockholders, managers, and directors of the parent company. The limitations of consolidated financial statements arise partly from the information that may be left out. Financials summary of consolidated financial statements for the nine months ended december 31, 2023 under japanese gaap(pdf/959kb) february 1, 2024.

Click the card to flip 👆 1. The main problem comes from mid year acquisitions / disposals. The determination of the consolidation area.

The consolidated financial statement’s objective is to achieve a truthful and fair view of reporting a firm’s standing in a given fiscal year. These statements provide a thorough understanding of a company's financial position, including their assets, expenses, and profits. Due to these issues, annual reports always come with the financial statements of the consolidated company, and in certain cases, those of the subsidiary companies alone, but never the parent company’s individual statements.

Important limitations of consolidated financial statements are: 3 disadvantages of consolidated financial statements 3.1 confusion about true financial position of subsidiaries 3.2 concealment of financial information 3.3 chances of fraud by holding company Ifrs 10 outlines the requirements for the preparation and presentation of consolidated financial statements, requiring entities to consolidate entities it controls.

The parent company benefits from the income and other financial strengths of the subsidiary. Accounting scandals in the past decade such as the enron scandal have arisen partly because much of the group debt was left out of the accounts by the use of off balance sheet financing involving special purpose vehicles. The process of eliminating controlling interests and the accounting treatment of positive and negative cancellation differences.

37) and on the ecb’s website. Ifrs 10 was issued in may 2011 and applies to annual. Updated august 12, 2020 what are consolidated financial statements?

A consolidated financial statement manifests the financial position and operational outcome of both parent and subsidiaries as if they are a single business entity. These statements are prepared in accordance with ifrs 10. The consolidation of financial statements integrates and combines all of a company's financial accounting functions to create statements that show results in standard balance sheet,.

Create your account view this answer the limitations of consolidated financial statements are as follows: The masking of poor performance 2. Limited availablity of resources 3.

Consolidated financial statements are of primary importance to stockholders, managers, and directors of the parent company. As a result, there may be rounding differences between the amounts reported in the various statements. The areas of use of the consolidated financial statements:

:max_bytes(150000):strip_icc()/Consolidatedfinancialstatement_final-1a46c53d5f0d4eca864b30adfe22b048.png)