Underrated Ideas Of Tips About Cash Position Of A Company P&l For Projects

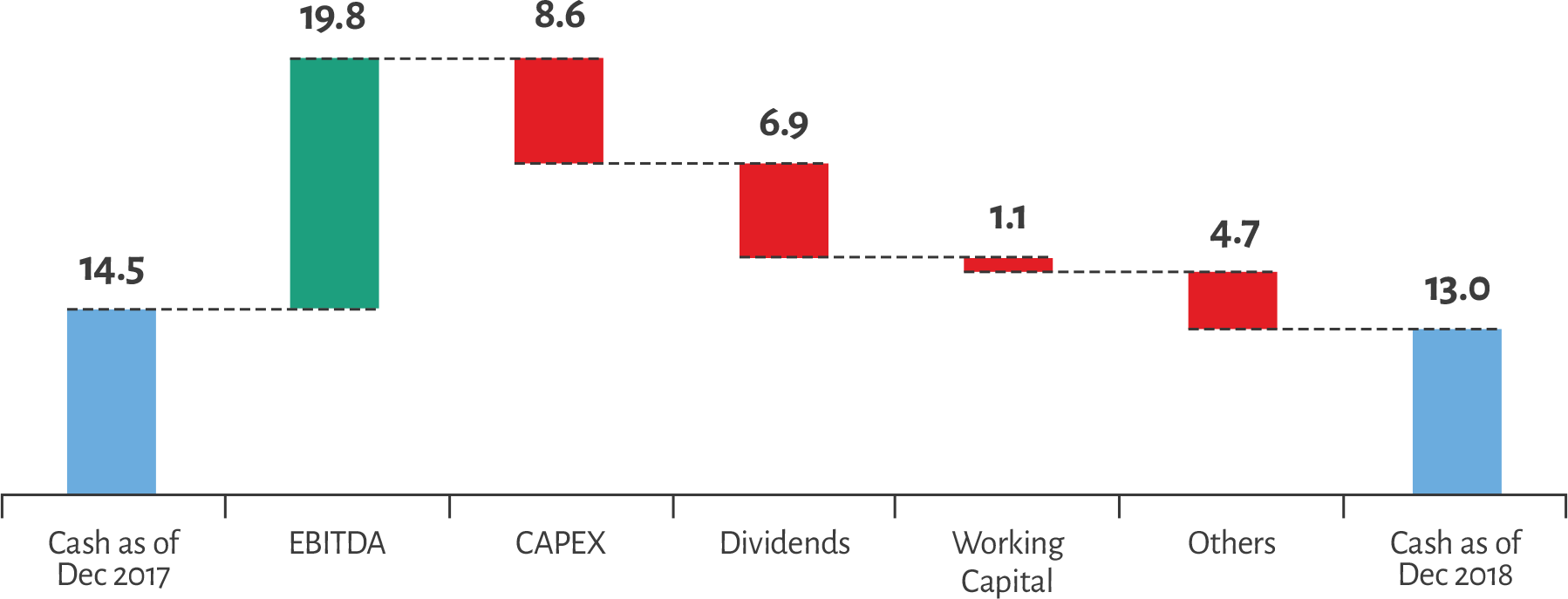

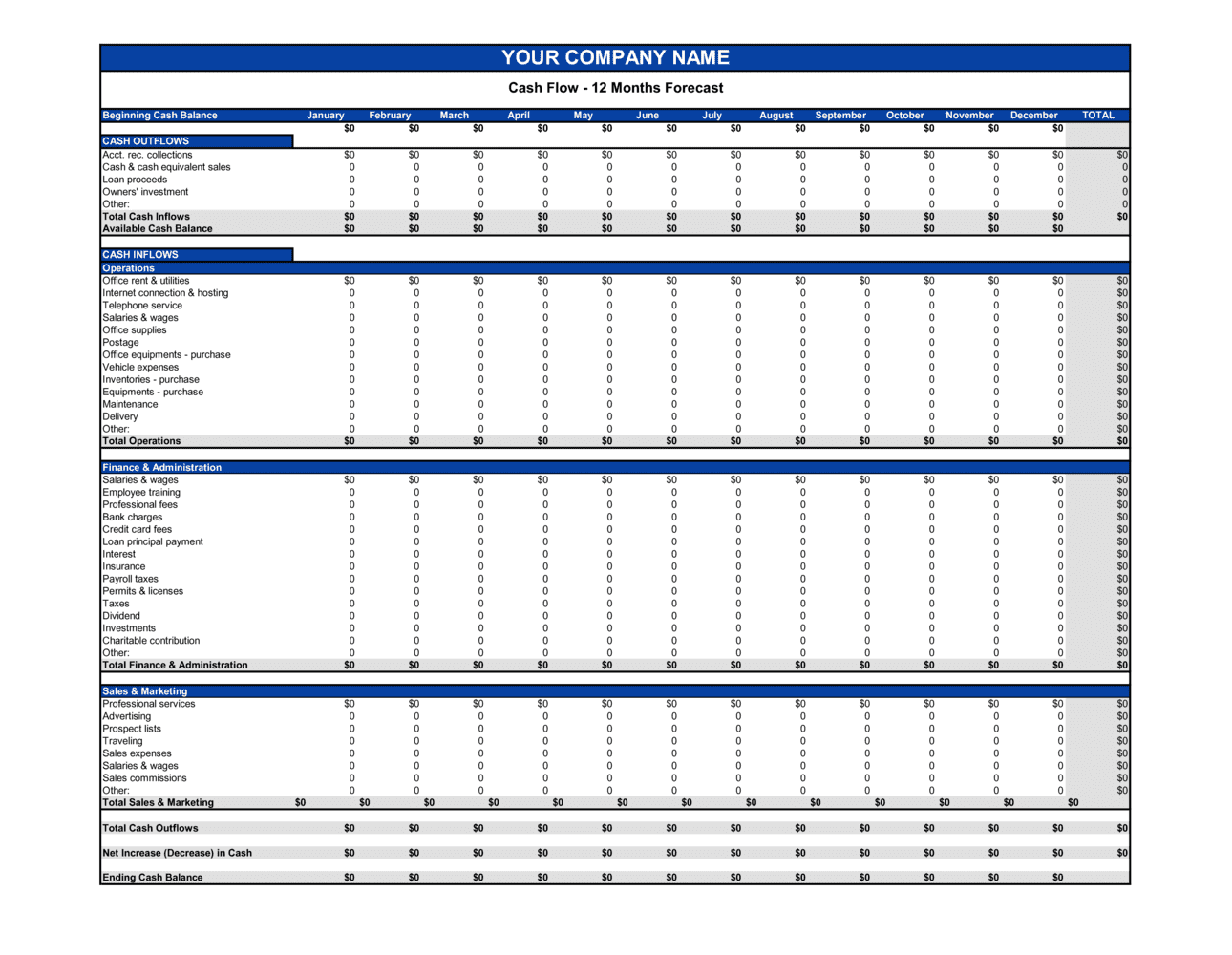

Key takeaways cash flows refer to the operational turnover of a business and its ability to generate revenues.

Cash position of a company. The deal lets employees cash out their. Having enough money to pay the bills, purchase needed assets, and operate a business to make a profit is vital to a company's. A cash position refers to the amount of actual cash a given corporation, bank or other entity has in its possession at a particular point in time.

The quantity of cash that a trader, investor, business, investment fund, or bank has on hand at a certain time is known as a cash position. The cash position is the amount of cash your business has at a given moment in time relative to your expenses and liabilities. The most liquid assets such as.

Overall, cash position is a solid, general evaluation of a company’s overall financial health. The cash position is a sign of financial strength and liquidity. Company leaders tend to keep more focus on cash position at.

The cash position of a company refers to the amount of cash it has on hand at any given time. The correct answer is b. Net cash refers to the position of a company with regard to its liquidity position.

Cash position indicates how much cash or liquid assets a company holds at a certain time. Gather the most recent cash position from the cash flow statement, which provides a snapshot. The cash position determines the financial strength of a company and its liquidity.

To calculate net cash, a company will need to deduct its current liabilities from its cash. This includes cash in bank accounts, as well as cash equivalents such as treasury. It is measured relative to expenses and liabilities, and it helps reveal a company’s liquidity.

Companies usually take this approach to find their cash position: These incur at different times in different states, so it’s important to understand your current state law. In addition to cash itself, this position often takes into consideration highly liquid assets, such as certificates of.

Proceeds from maturing investments represent a cash inflow, which has the effect of increasing a company’s net daily cash. Sales tax, because you’re buying with a resale license. Cash position is the amount of cash a company has at a specific moment in time.

Many companies sit on piles of cash, even when rates of return suggest they shouldn’t. A company’s decision to maintain a large cash position is influenced by several factors, including its growth strategy, industry dynamics, and risk management approach. Betriebswirtschaftlich ist ein unternehmen mit ausreichend.

Researchers have pointed to multiple reasons, including. In a cash flow statement, the cash position at the end of the month represents the amount of cash that the company has on hand, at that moment in time. A cash position represents the amount of cash that a company, investment fund, or bank has on its books at a specific point in time.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

:max_bytes(150000):strip_icc()/Cash-position-4199787-FINAL-ebc64de485034d8a99d3dcd74b85ce15.png)