Fun Tips About Cash Flow Projection For 12 Months Dunkin Donuts Income Statement 2019

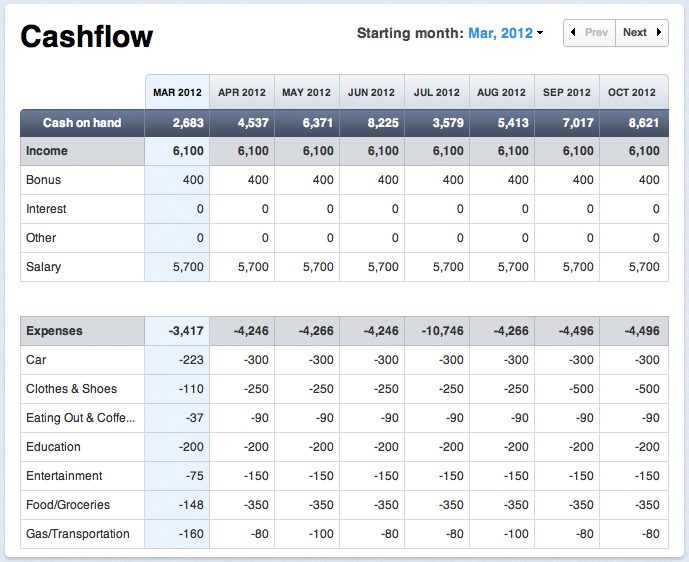

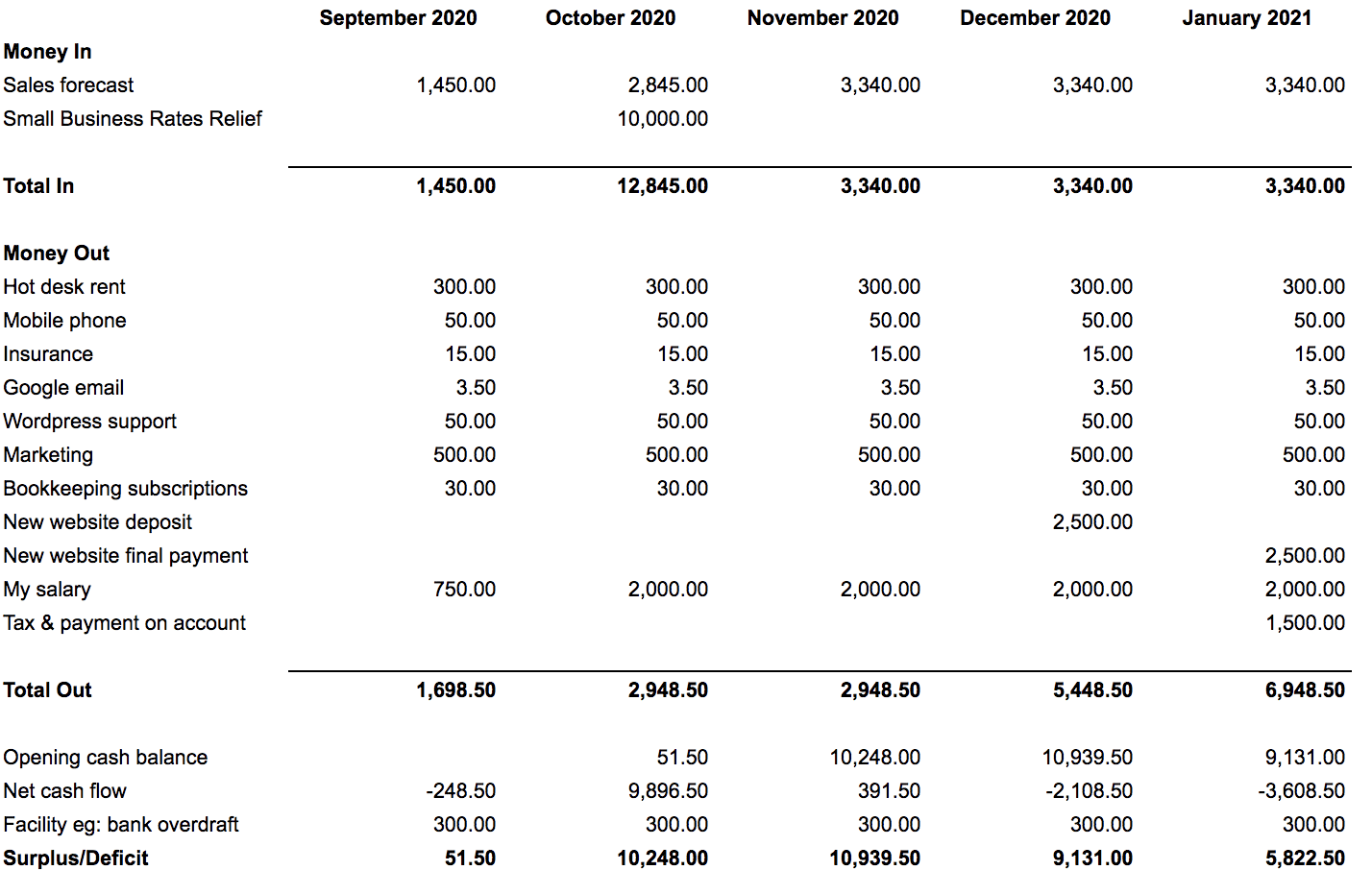

By accounting for inflows, outflows, and expected changes, you can make educated and effective decisions to maximize the success of your company.

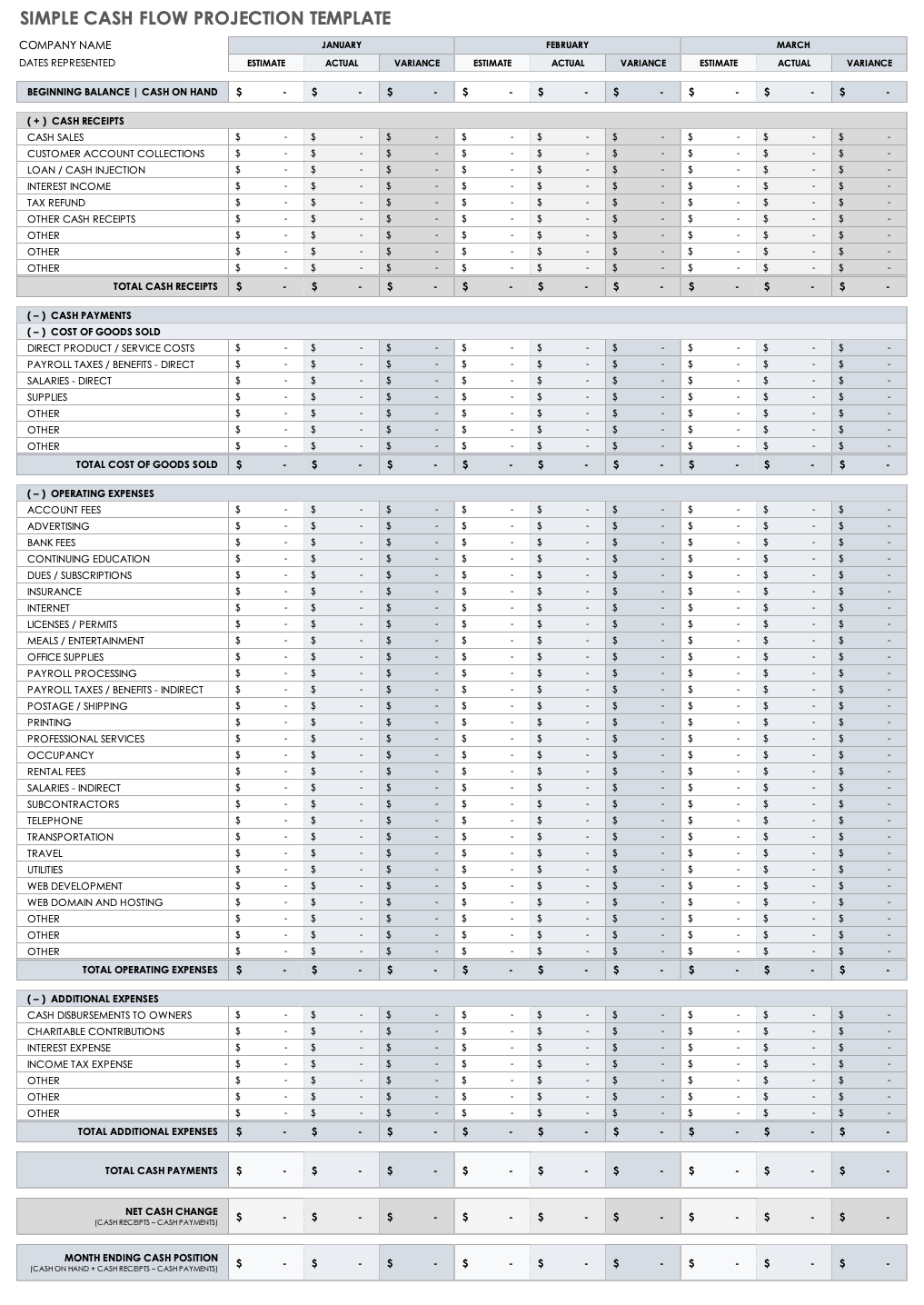

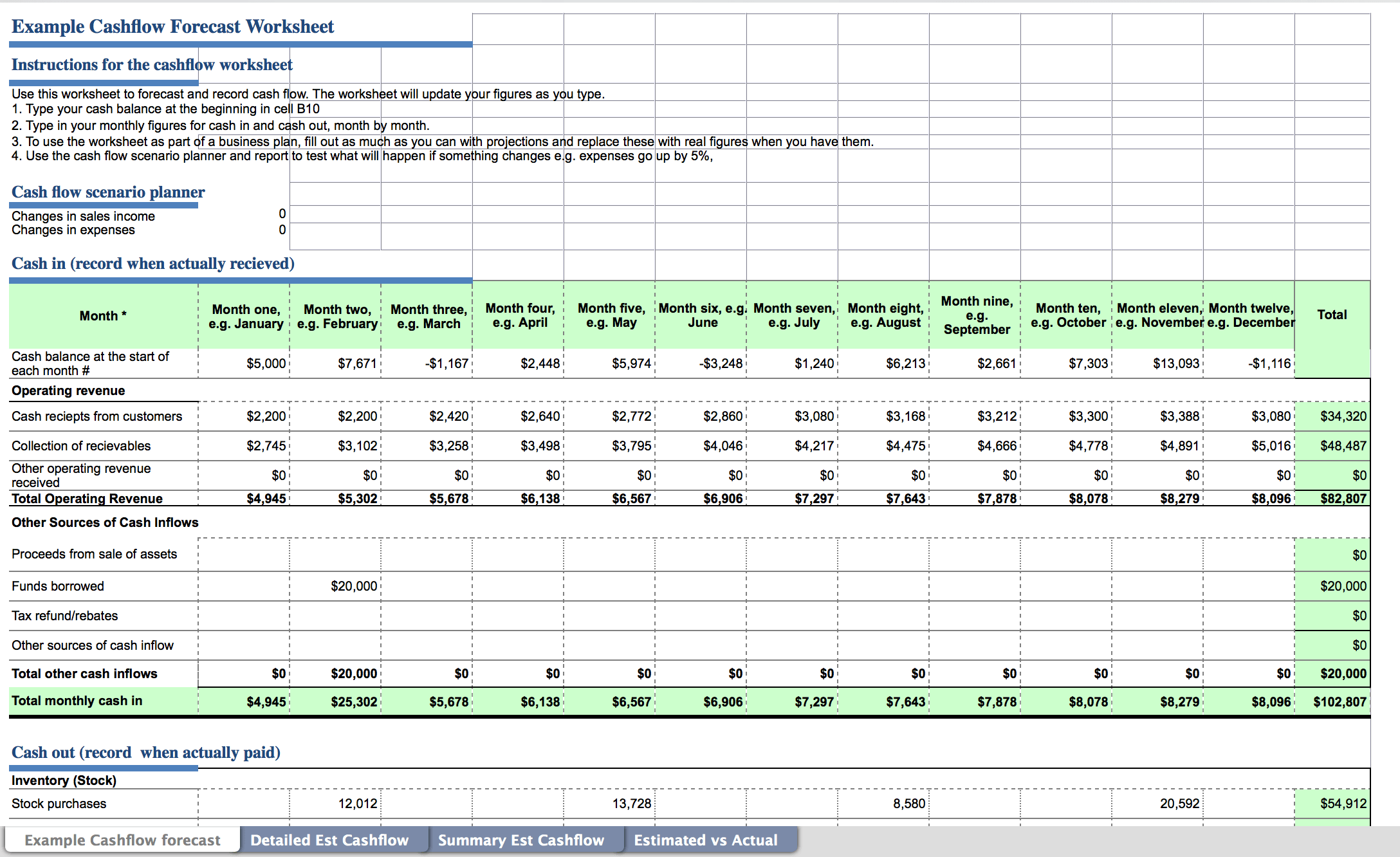

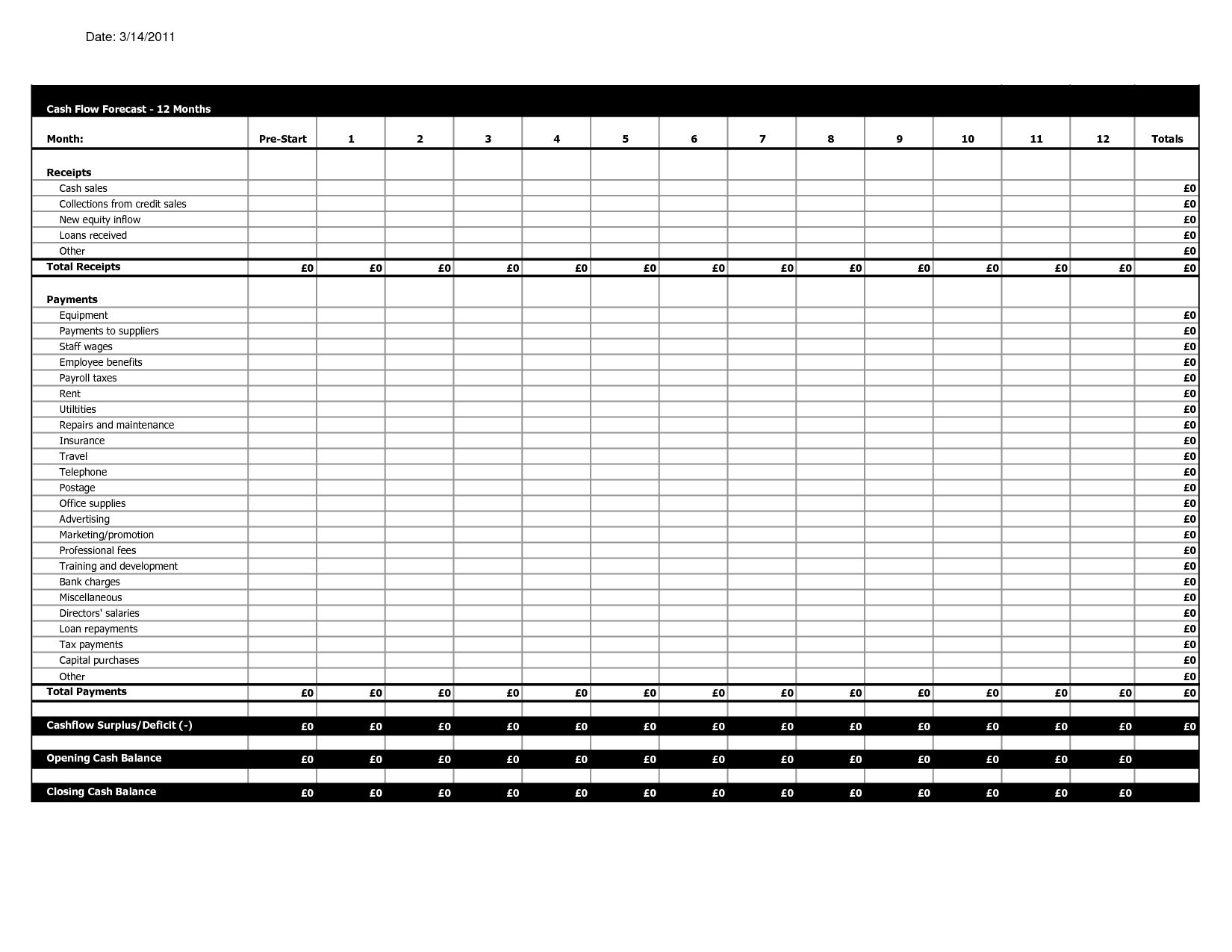

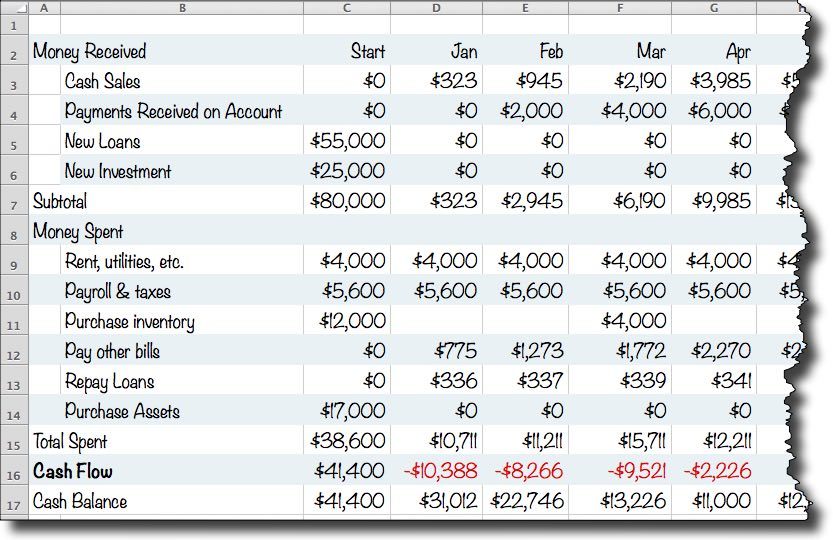

Cash flow projection for 12 months. Here’s a quick cash flow projection example: Use cash flow statement templates or financial software for the calculations. Monthly cash flow forecast model importance

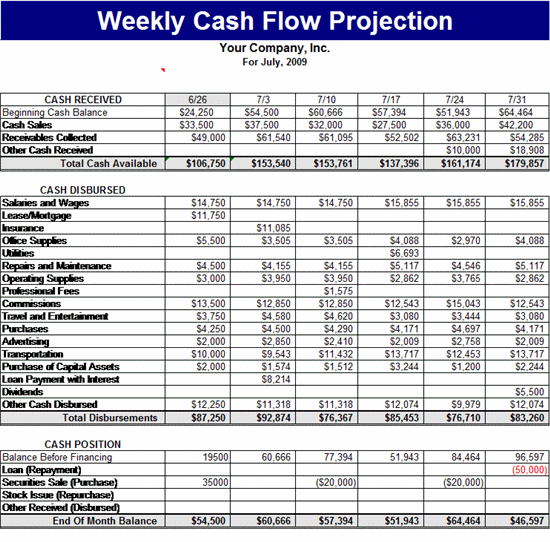

A 12 month cash flow projection is a forecast of the funds coming into and out of a business over a 12 month period. Here are all the categories you’ll need for your cash flow projection: In this task, you will develop a cash flow forecast for the next 12 months.

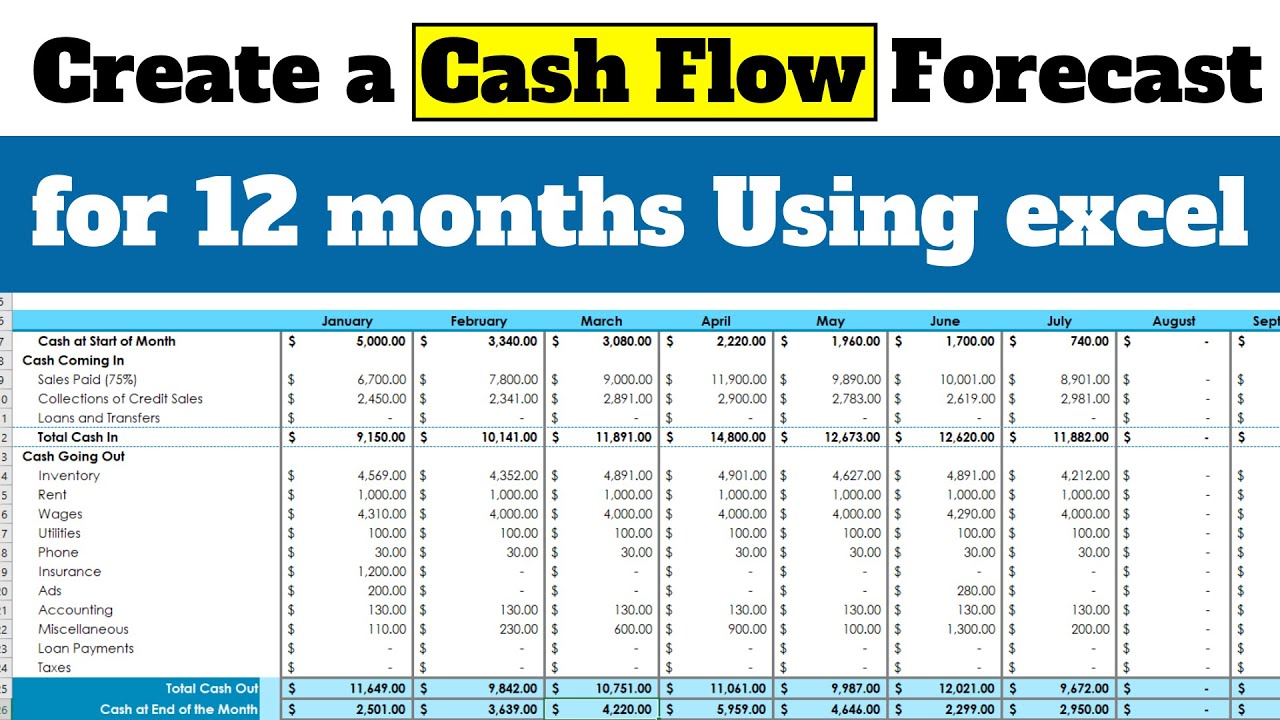

To get started, create 12 columns across the top of a spreadsheet, representing the next 12 months. It helps business owners understand anticipated cash availability to plan for operations and understand potential shortfalls. Cash flow projection for 12 months template has 4 menus displayed in each sheets or as the buttons on the right top corner.

Note that gaap prescribes a more specific cash flow statement format for forecasts with more complex inputs and for businesses with over $5 million. Cash flow projection for 12 months can help you in managing your financial and accounting. Record your figures in the month you reasonably wait for them to take place.

A cash flow statement tracks how much your business makes and spends. You can modify the spreadsheet by adding rows or changing the row labels. It helps the company assess its financial health and provides an indication of its cash flow needs over the next 12 months.

A projection is a valuable tool for planning and managing the cash resources of a business. Before you begin your cash flow projection, you need to have a clear overall strategy in place. If you’ve been in business, you can use the previous sale history to substantiate your sales and expense assumptions—and if you’re just starting out, you can use economic surveys and logic.

Here we show you how to create such a forecast and actively work with it. Our cash flow formula would look like this: With these realistic assumptions in hand, you can begin drafting your cash flow projection.

Building a projection requires forecasting cash inflows and outflows to determine the financial needs of. When you decide to make a new hire, launch a new marketing campaign. The main idea to create a cash flow projection format is to calculate cash inflows and outflows.

It is an important and vital tool for strategic financial planning and is an integral component of any business plan. Create cash flow projection for 12 months in excel: Let’s say our receivables for next month totals $26,000, and our payables totals $15,000.

A cash flow projection is an estimate of the amount of cash you expect to flow into and out of your business over a set period of time, typically 12 months. Include operating activities, investing activities, and financing activities. It can be an effective tool for developing and tracking budgeting plans, measuring collection performance, and examining cash flow trends.