Divine Tips About Miscellaneous Expenses In Profit And Loss Account Project Report On Ratio Analysis Of Itc 2018

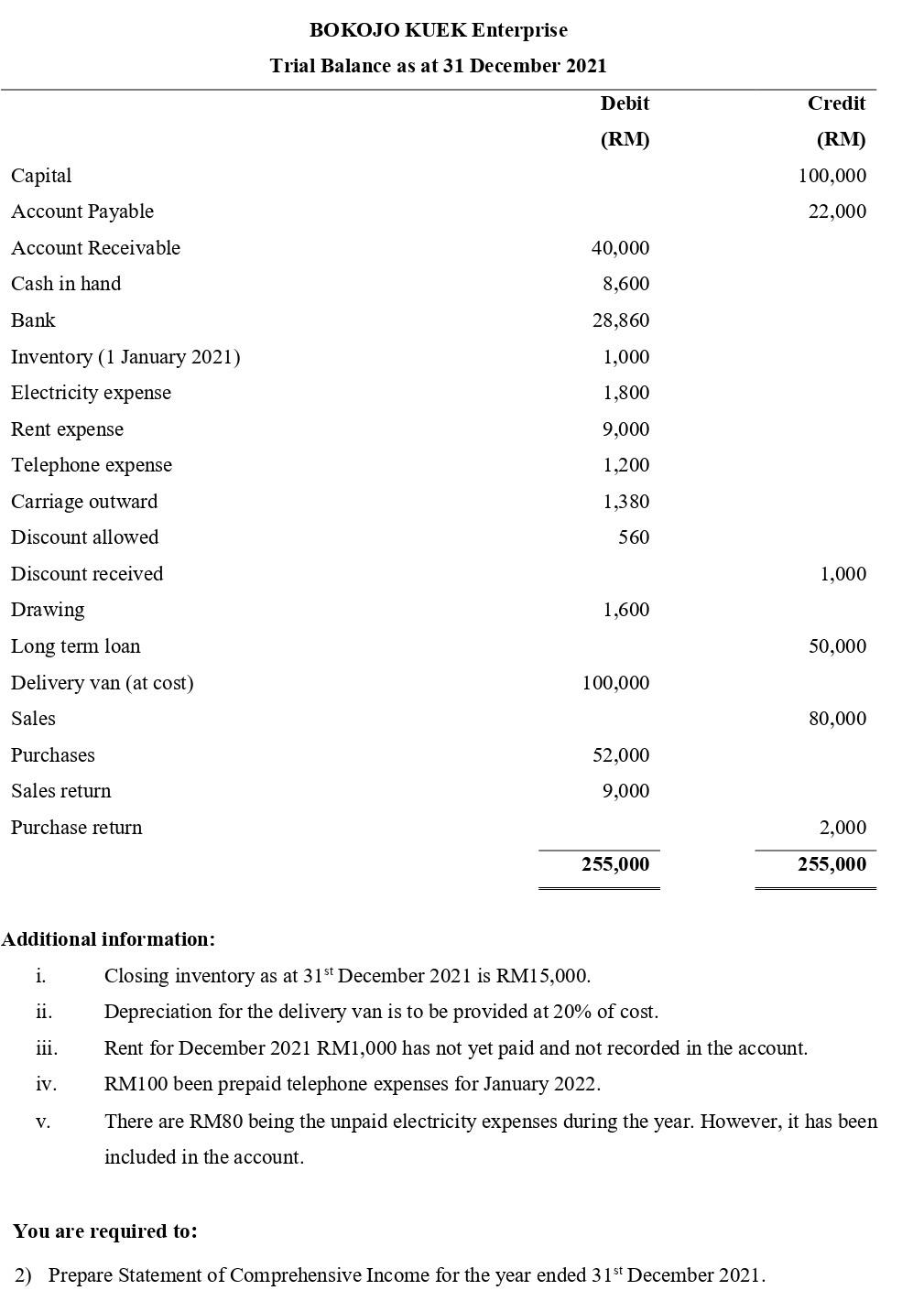

Miscellaneous expenditure in the balance sheet the expenses that are written off in the current financial year are shown on the debit side of the profit and loss account.

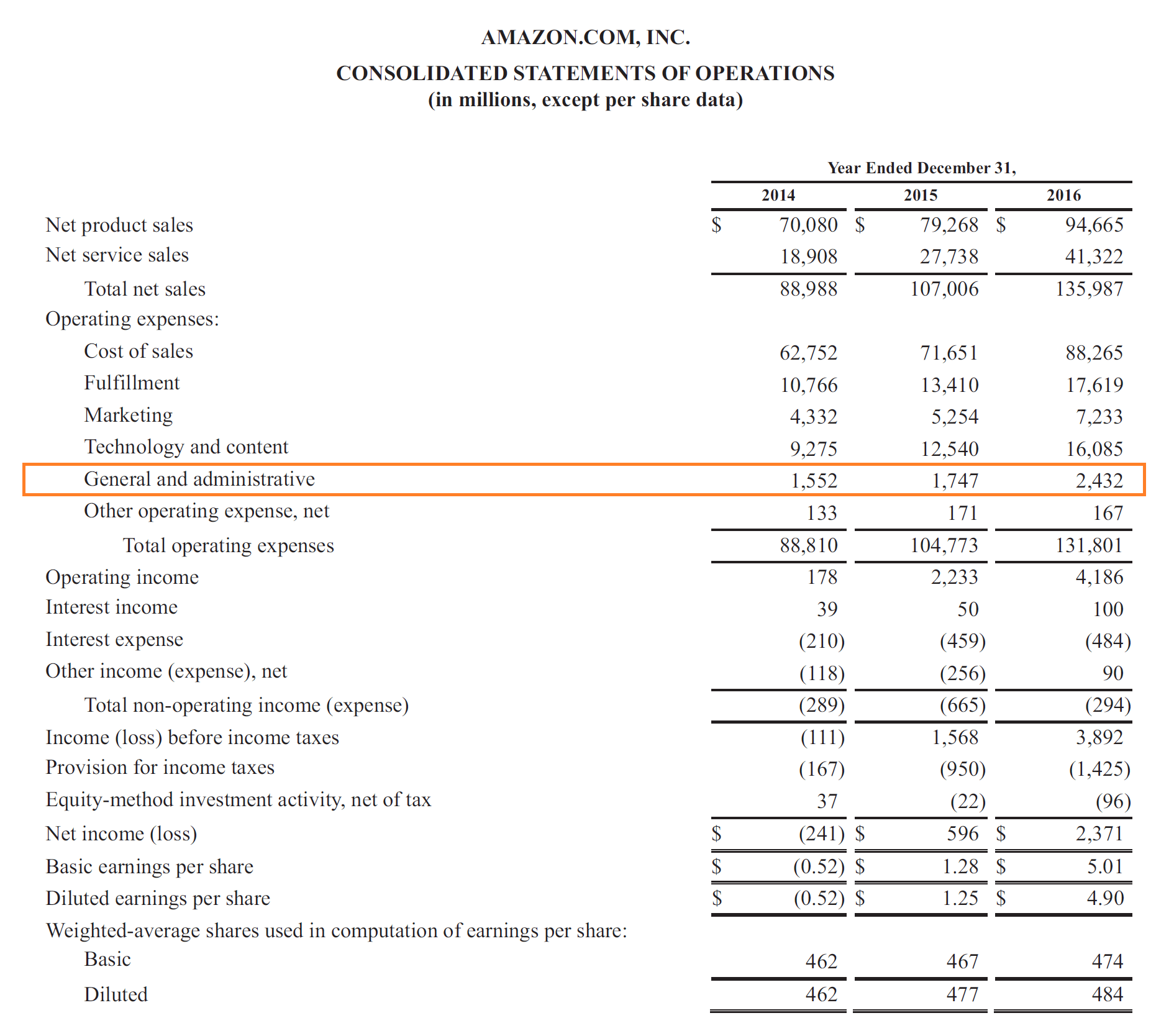

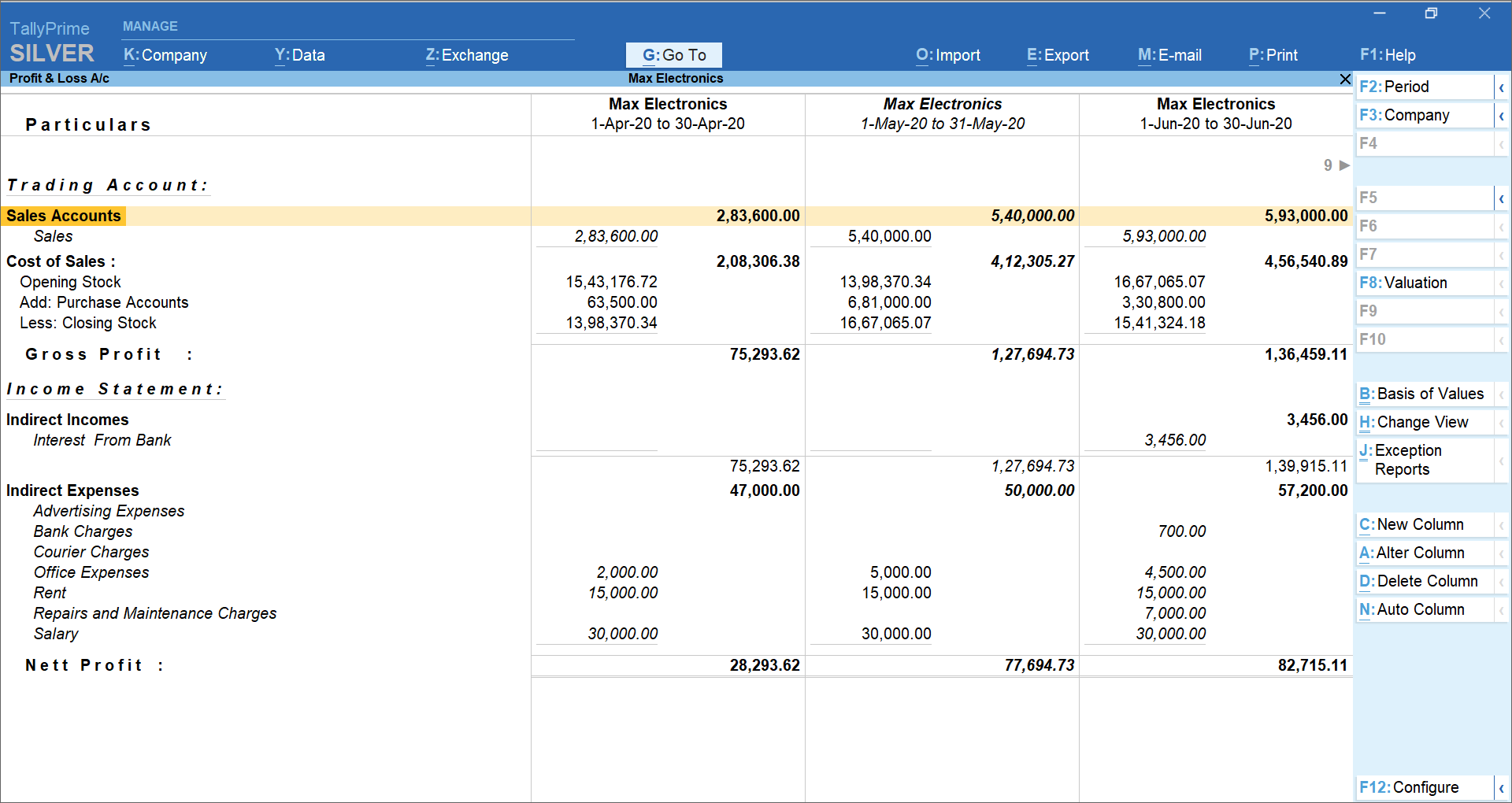

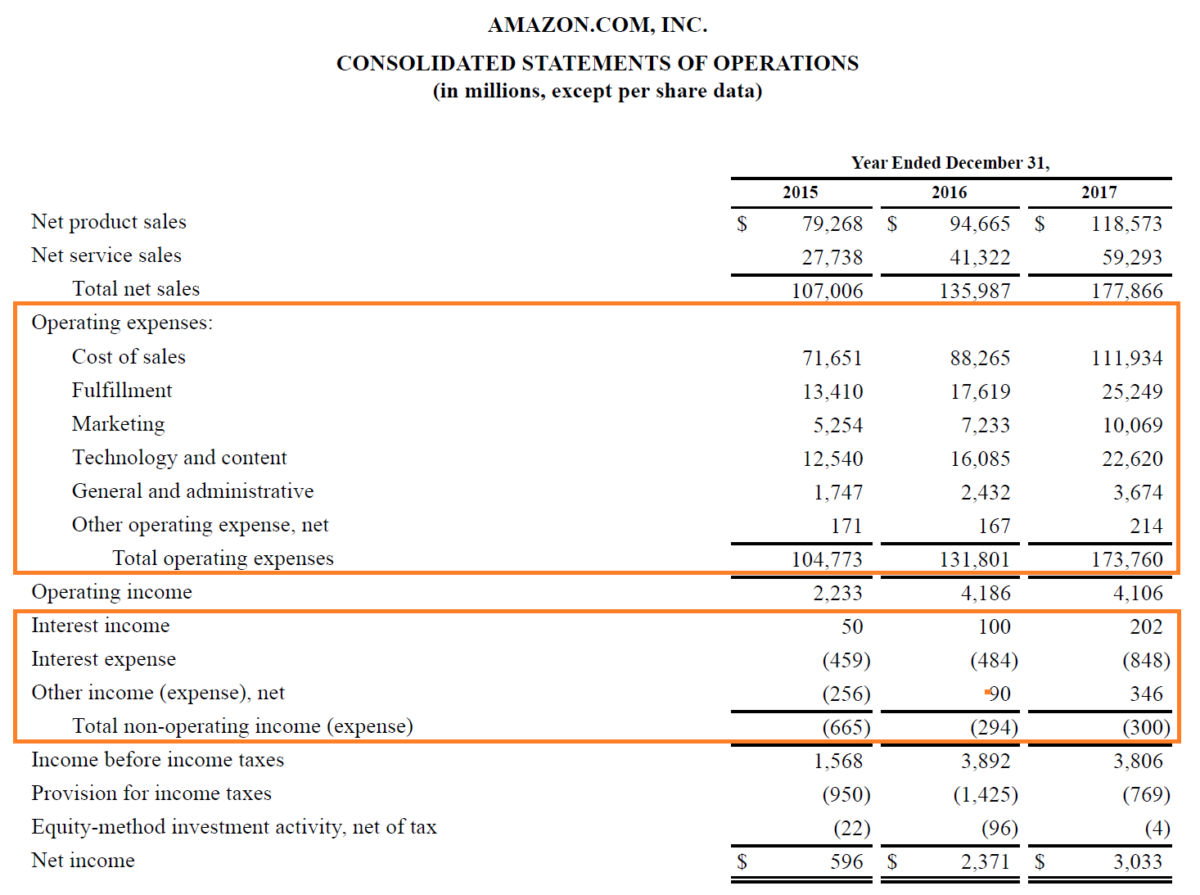

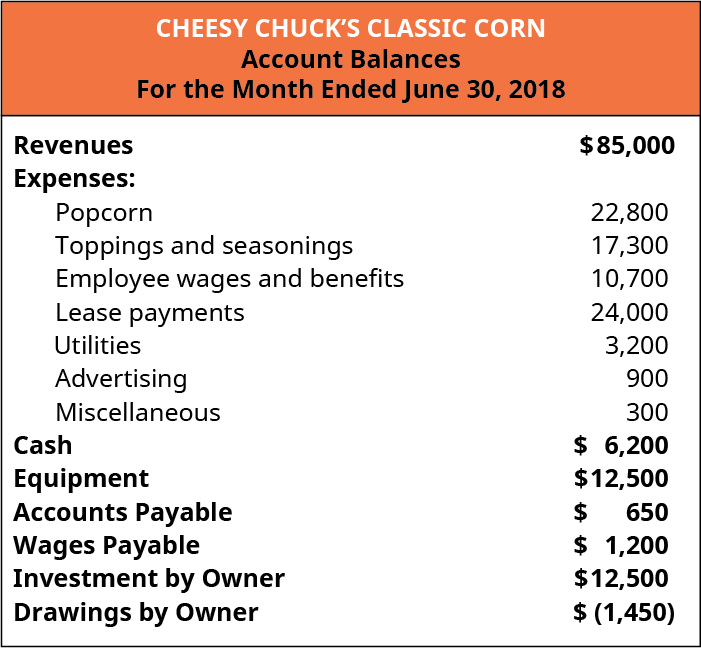

Miscellaneous expenses in profit and loss account. The account through which annual net profit or loss of a business is ascertained, is called profit and loss account. The profit & loss account reports the incomes and expenses directly related to an organisation to measure the performance in terms of profit or loss. Miscellaneous expense is a general ledger account that may contain a large number of minor transactions.

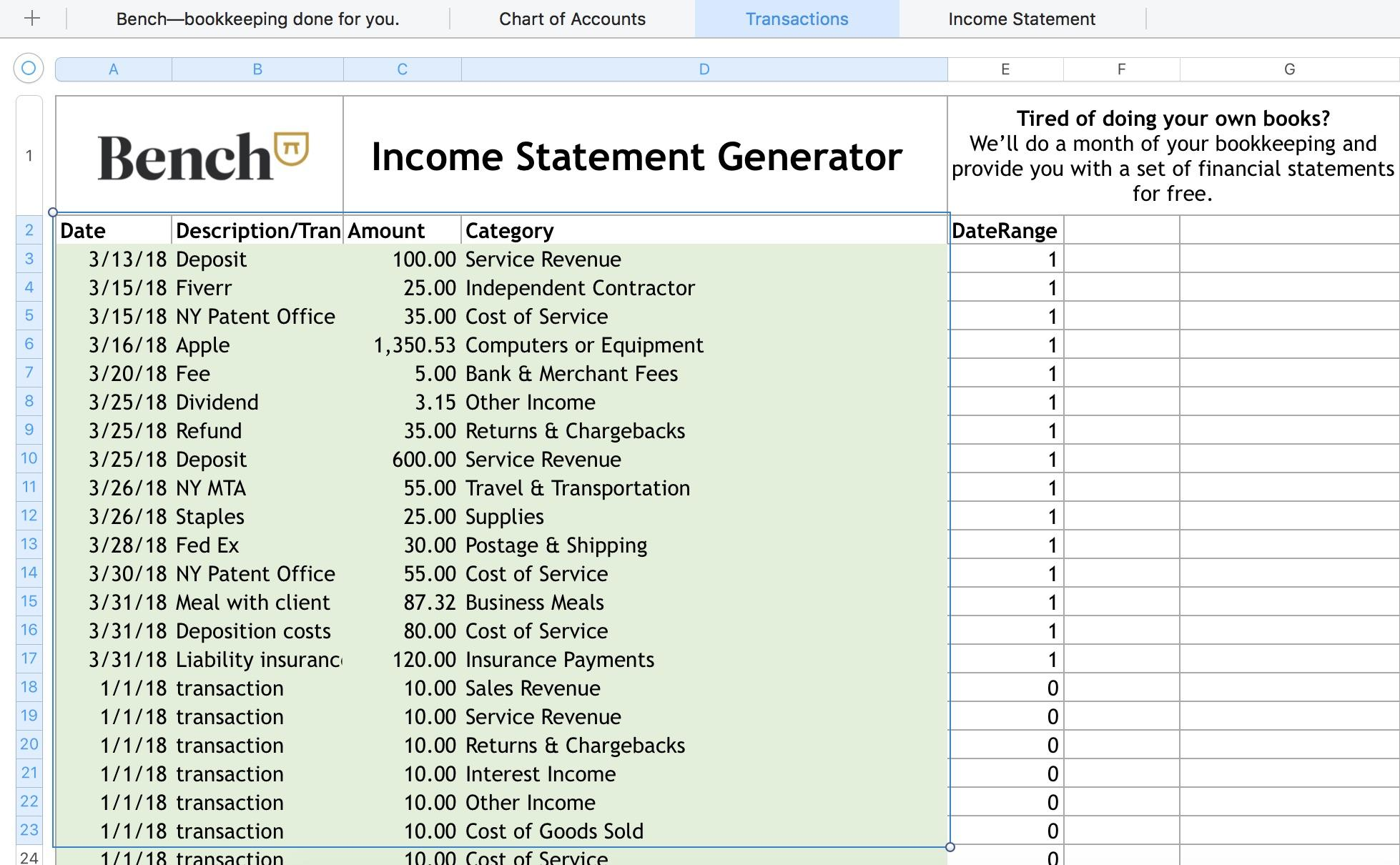

Let's uncheck the payroll expense accounts to exclude the state and federal. What is capex and opex? Miscellaneous expenses can be defined as a cost that generally does not fit any specific account ledger or tax category.

An analysis of various expenses included in the profit and loss account and their comparison with the expenses of the previous periods helps in taking steps for effective. A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a. Miscellaneous expense is a term used to define and refer to costs that typically do not fit within specific tax categories or account ledgers.

The p&l statement reveals the company's realized profits or losses for the specified period of time by comparing total revenues to the company's total costs and. These transactions are for amounts so small that they are. What is the difference between loss and expense?

These expenses are not revenue. Cost incurred before the start of business operations is. What are preliminary expenses?

What is net profit ratio? To expenses a/c (individually) (being the accounts of all the expenses closed) 2. What is carriage inwards and carriage outwards?

This value is obtained from the balance which is carried down. The p&l is made up of two types of transactions: These are typically minor transactions that are identified and tracked by the companies.

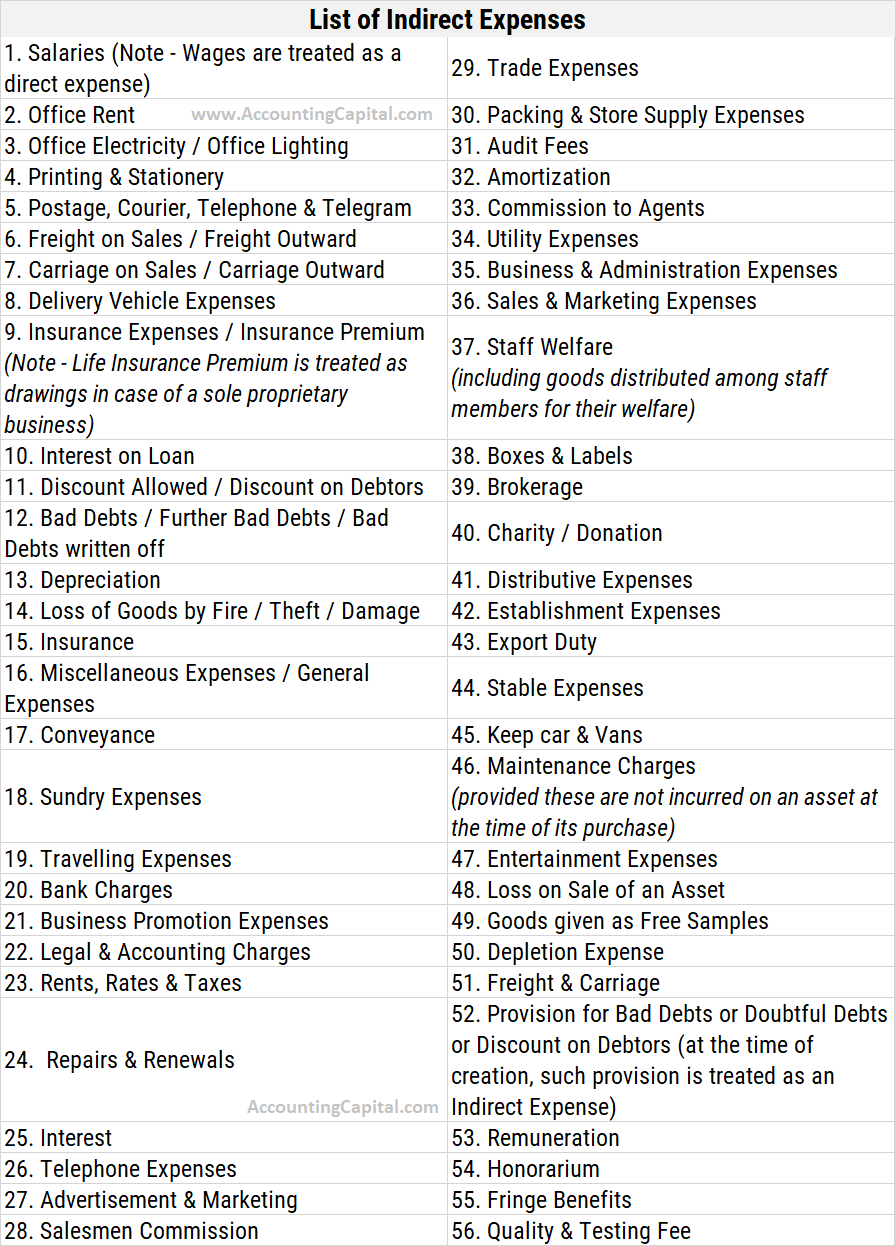

The sections of the profit and loss account. Gross profit or loss of a business is ascertained through. Miscellaneous expenditures are the incidental expenses which cannot be classified as manufacturing, selling, and administrative expenses.

Profit and loss account a/c: E electronics in its trading section of trading and p&l a/c will account for a sales return of rs.1,25,000 (rs.25,000*5) and this amount will be deducted from the total sales. A p&l statement (sometimes called a statement of operations) is a type of financial report that tells you how profitable your business was.

What is a profit and loss statement? Miscellaneous profit and loss guide for the financial accounting income statement | accountant town in every business there are necessarily profits more or less. An income statement, also known interchangeably as a profit and loss account, provides a summary of a company’s revenues, expenses, and profits over a.