Outrageous Info About Bank Guarantee Disclosure In Financial Statements Sole Proprietor Income Statement

Notes to the financial statements 9 1.

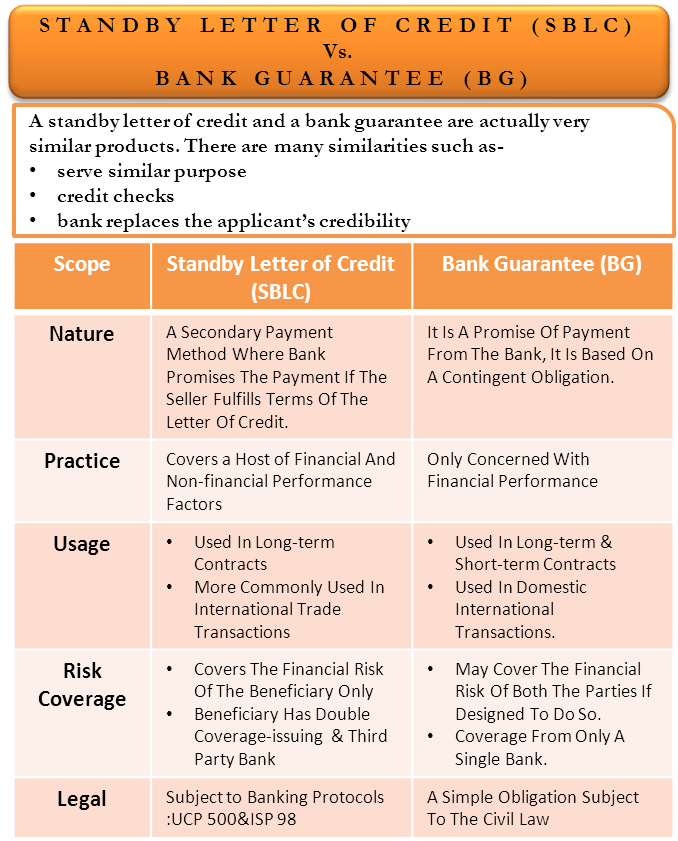

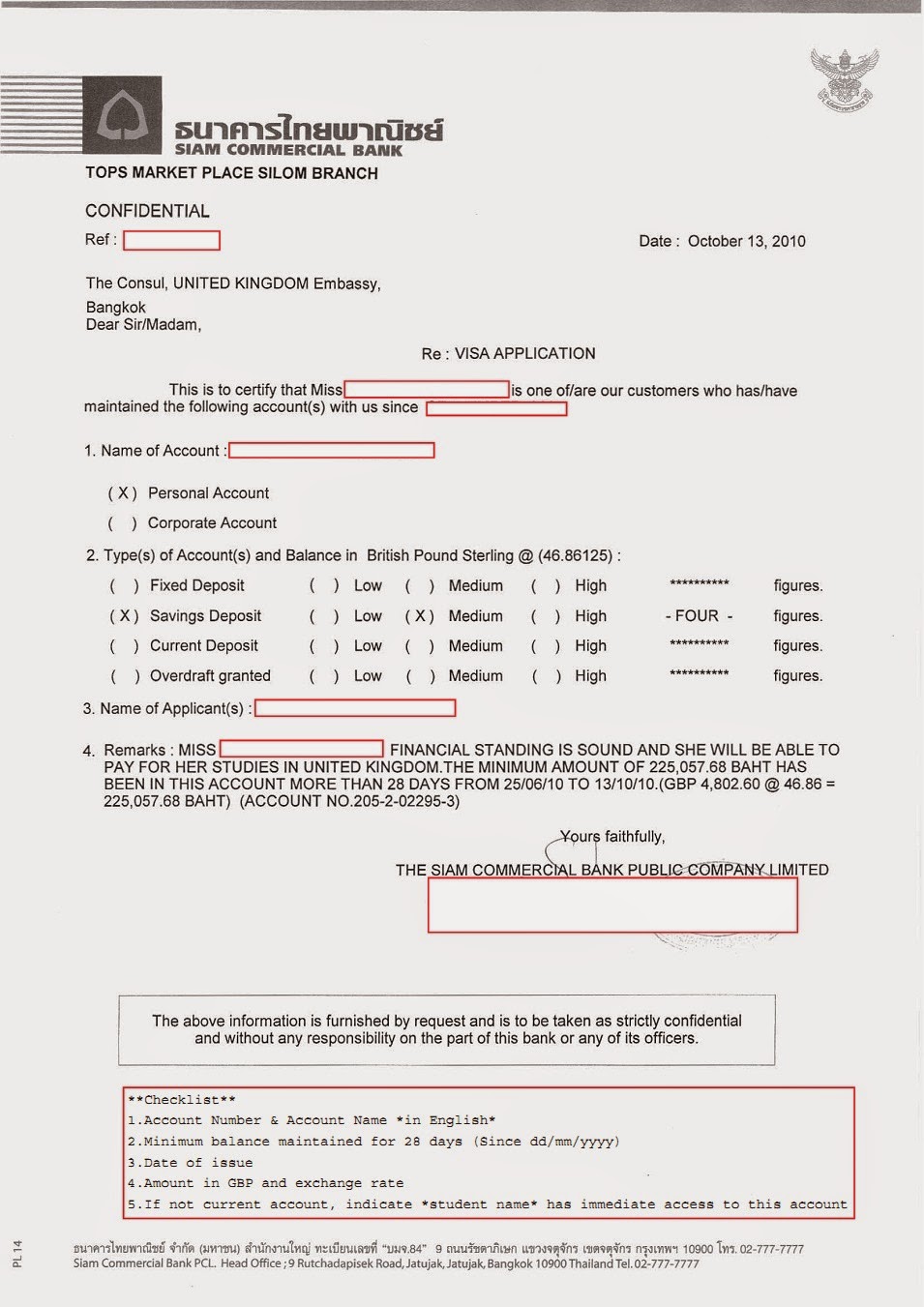

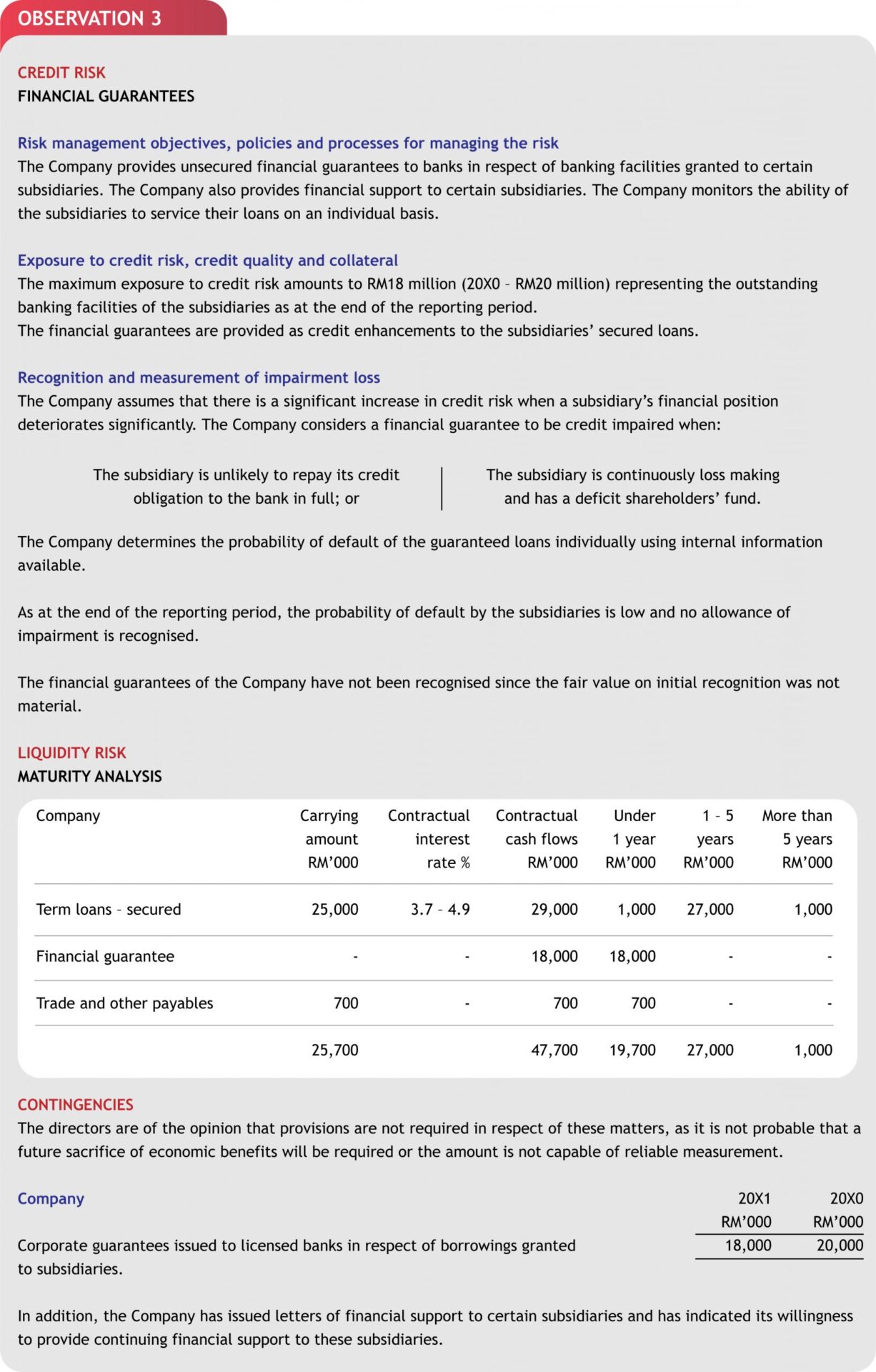

Bank guarantee disclosure in financial statements. Guarantees repayment of a loan from a bank to another entity (a financial guarantee contract). A financial guarantee contract (“fgc”) is a contractual promise made by an entity (e.g. 1.2.2 financial guarantee contracts and loan commitments 22 1.2.3 derivatives and hedging activities.

Our illustrative disclosures for banks illustrate one possible format for financial statements of a fictitious banking group that is involved in a range of general banking. In other words, if the debtor fails. And then, ifrs 9 prescribes to measure the financial guarantees at the higher of:

A bank, insurance company, a parent entity) to guarantee payment of a debt obligation by. Ifrs 9 retains the same financial guarantee definition as ias 39, ie a contract that requires the issuer to make specified payments to reimburse the holder for. A bank guarantee is a guarantee from a lending institution ensuring the liabilities of a debtor will be met.

This interpretation clarifies that a guarantor is required to disclose (a) the nature of the guarantee, including the approximate term of the guarantee, how the guarantee arose,. Guarantors are required to disclose certain information about each guarantee, or group of similar guarantees. [ias 30.24] disclosures are also.

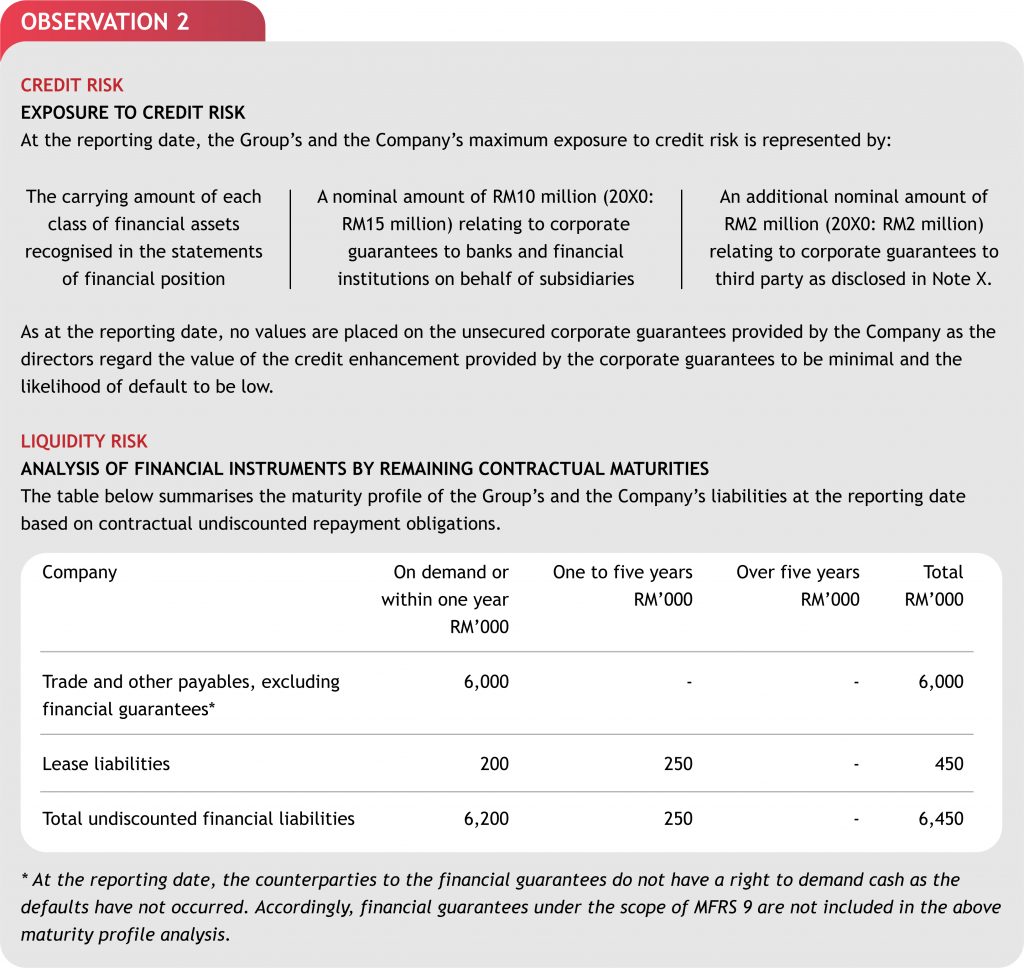

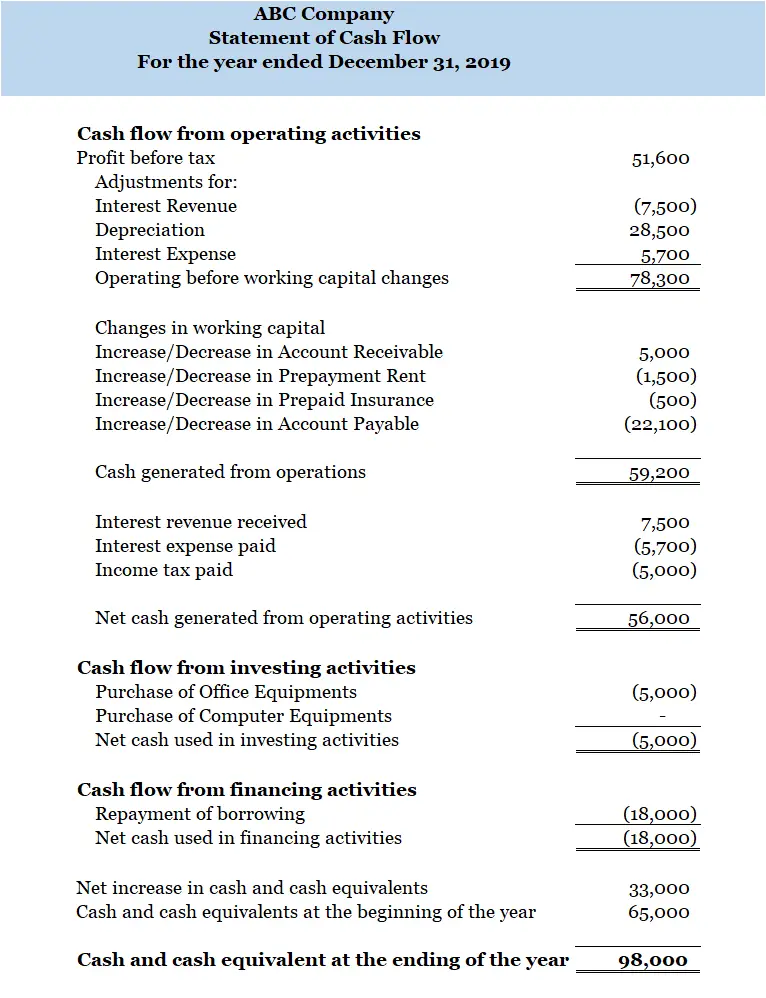

Impact on financial statement: Companies need to assess now whether to apply ifrs 17 or ifrs 9 to financial guarantee contracts they have issued. This chapter discusses the presentation and disclosure considerations related to commitments, contingencies, and guarantees.

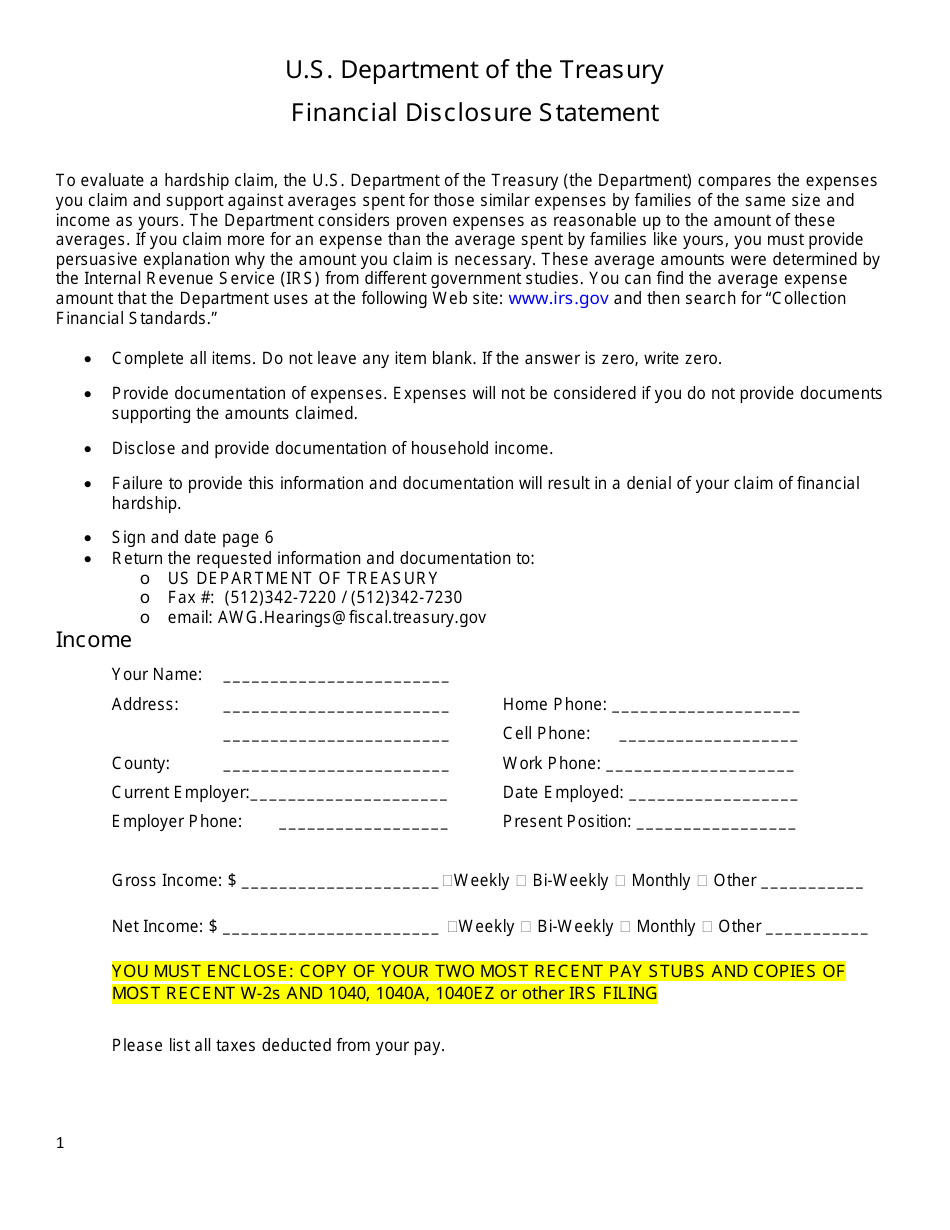

Helps you to prepare financial statements in accordance with ifrs, illustrating one possible format for financial statements based on a fictitious banking group involved in. Asc 460 is silent as to whether the disclosures relate to the current. Basis of accounting 18 3.

See also fsp 23.9 for cross references to. A contingent liability has no impact on the financial statement and. 1 january 2019 the guarantee must be recognised at fair value.

The scope does not include guarantees that the guarantor should record in equity. First of all, you need to amortize the amount of your financial guarantee in line with ifrs 15 revenue from contracts with customers. Financial guarantee contracts (sometimes known as ‘credit insurance’) require the issuer to make specified payments to reimburse the holder for a loss it incurs if a.

The fair value of the guarantee will be the present value of the difference between the net contractual cash. A bank must disclose the fair values of each class of its financial assets and financial liabilities as required by ias 32 and ias 39. Both financial and nonfinancial contracts can be guarantees within the scope of asc 460.

Read our talkbook (pdf 560 kb) to.

:max_bytes(150000):strip_icc()/ScreenShot2022-04-26at10.48.43AM-b060c24322b74084aa691c24b753b3fc.png)