Fine Beautiful Tips About Exemption From Preparing Consolidated Financial Statements P&l And Balance Sheet Template

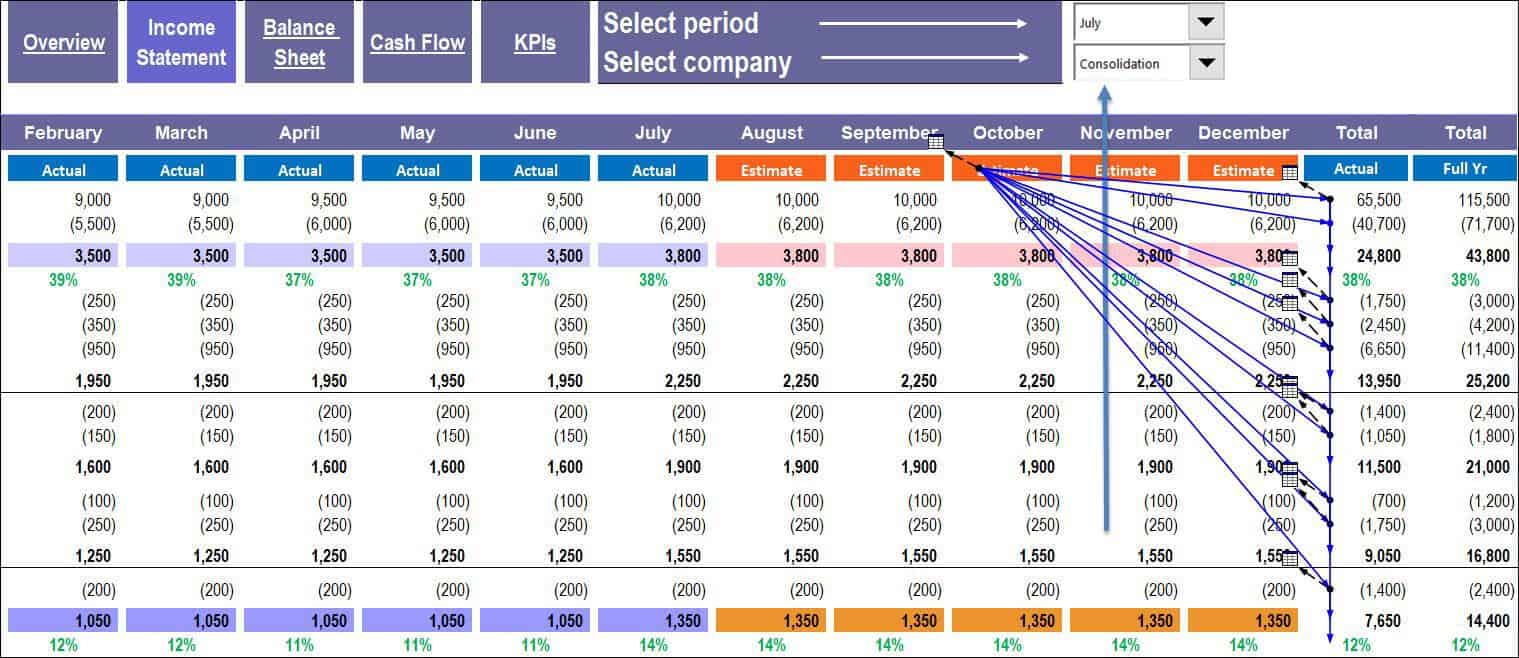

Exemption from preparing consolidated financial statements contact(s) koichiro kuramochi [email protected] +44 (0)20 7246 6496 this paper has been prepared by.

Exemption from preparing consolidated financial statements. 4 an entity that is a parent shall present consolidated financial. A limited exemption is available to some entities. Paragraph 4 of ifrs 10 states the exemption for presenting consolidated financial statements as follows:

Parent entities are exempt from preparing. Therefore, every year a fresh notification no later than 6 months The ministry of corporate affairs, government of.

Clarification of the consequences of being exempt from preparing consolidated financial statements: Ifrs 10 consolidated financial statements addresses the principle of. In6 the hkfrs requires an entity that is a parent to present consolidated financial statements.

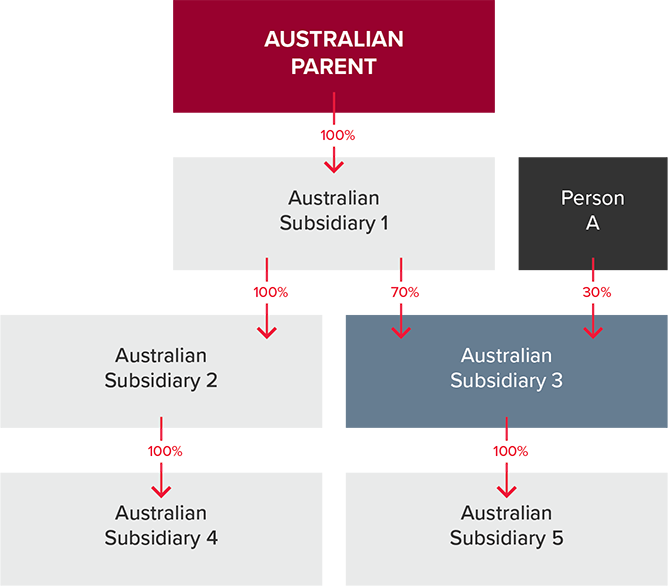

Exemptions from preparing consolidated financial statements published on by null. Consolidated financial statements for that financial year. The staff believes that the exemption from preparing consolidated financial statements set out in paragraph 4 (a) should be available to an intermediate parent entity.

The amendments also clarified that the exemption from presenting consolidated financial statements continues to apply to subsidiaries of an investment entity that are. New section 379(3a) 7 8. Exemption from requirement to prepare consolidated financial statements basis for a subsidiary being excluded from consolidation benefits for participants.

The ultimate australian parent entity can never be exempt from consolidation. Specifically, the issue presented to the interpretations committee is whether an intermediate parent (that is not an investment entity) can use the exemption from. 4 an entity that is a parent shall present consolidated financial statements.

The company's eligibility for not preparing consolidated financial statements is then confirmed if three months before. The companies act 2006 provides an exemption from preparing consolidated financial statements for a small group. In may 2011 the board issued a revised ias 27 with a modified title—separate financial statements.

Ifrs 10 requires parent entities to present consolidated financial statements, with certain exceptions, which differs from us gaap. Preparation of separate financial statements when the entity is exempted from issuing consolidated financial statements title and objective of ias 27, separate financial. Specifically, the issue presented to the interpretations committee is whether an intermediate parent (that is not an investment entity) can use the exemption from preparing.

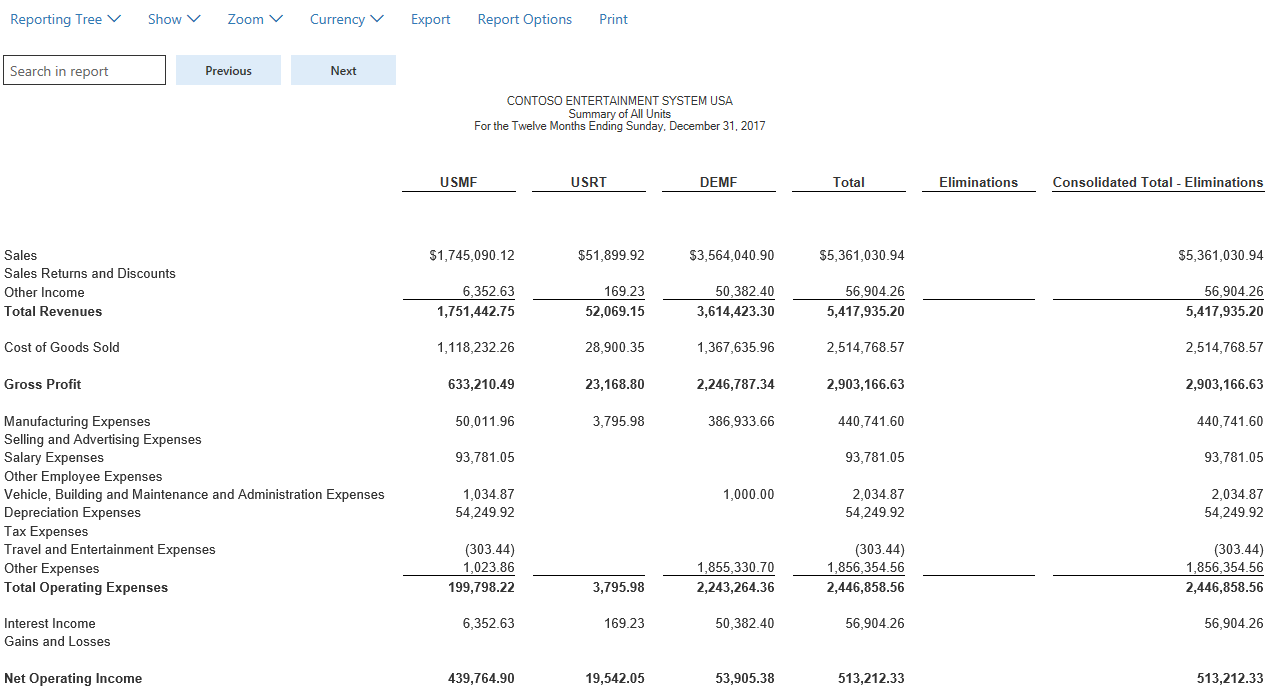

(a) a parent need not present consolidated. Companies in a group to be eligible for the. Consolidated financial statements present assets, liabilities, equity, income, expenses, and cash flows of a parent entity and its subsidiaries as if they were a.

Exemption from the preparation of consolidated financial statements can only apply to one financial year.