Great Info About Business Financial Statement Of Owner Analysis By Charles H Gibson

Is a crucial financial metric for business owners.

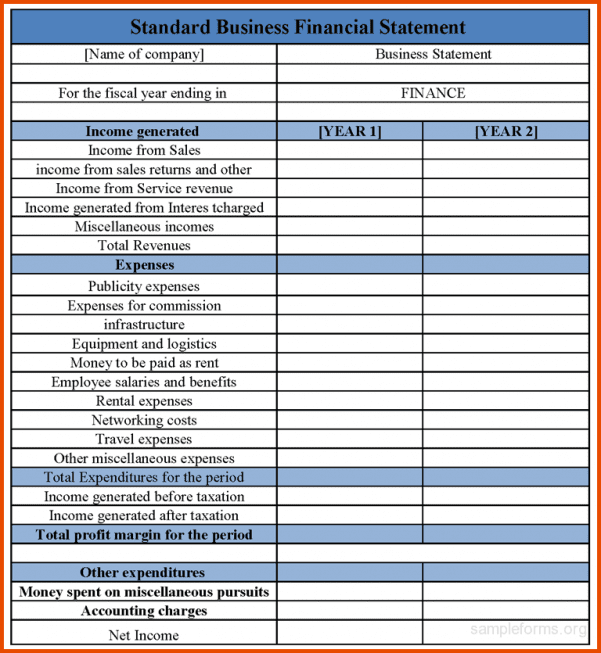

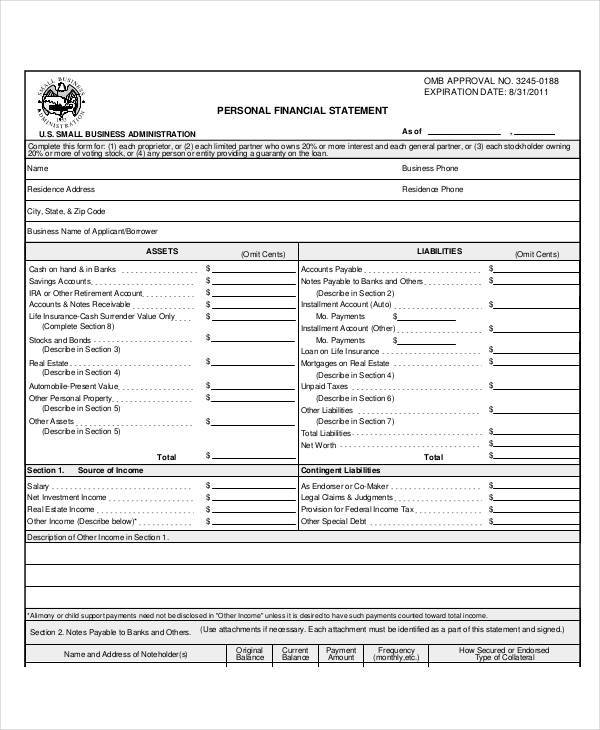

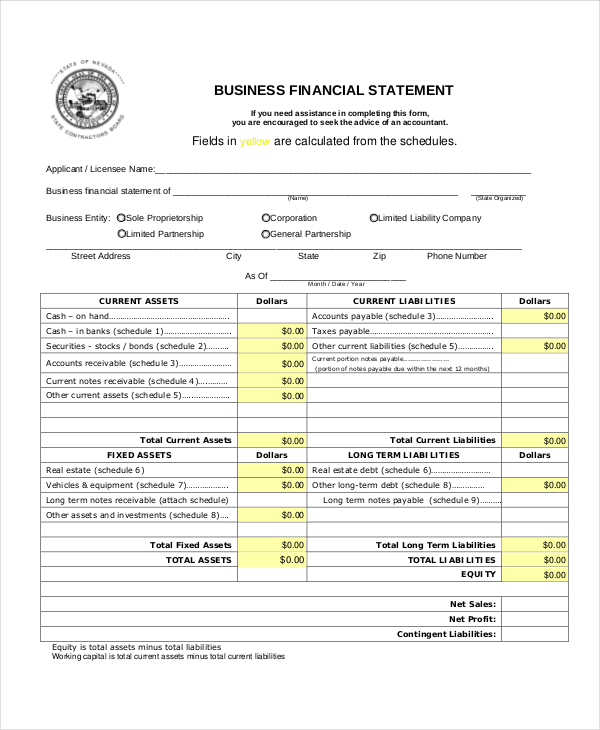

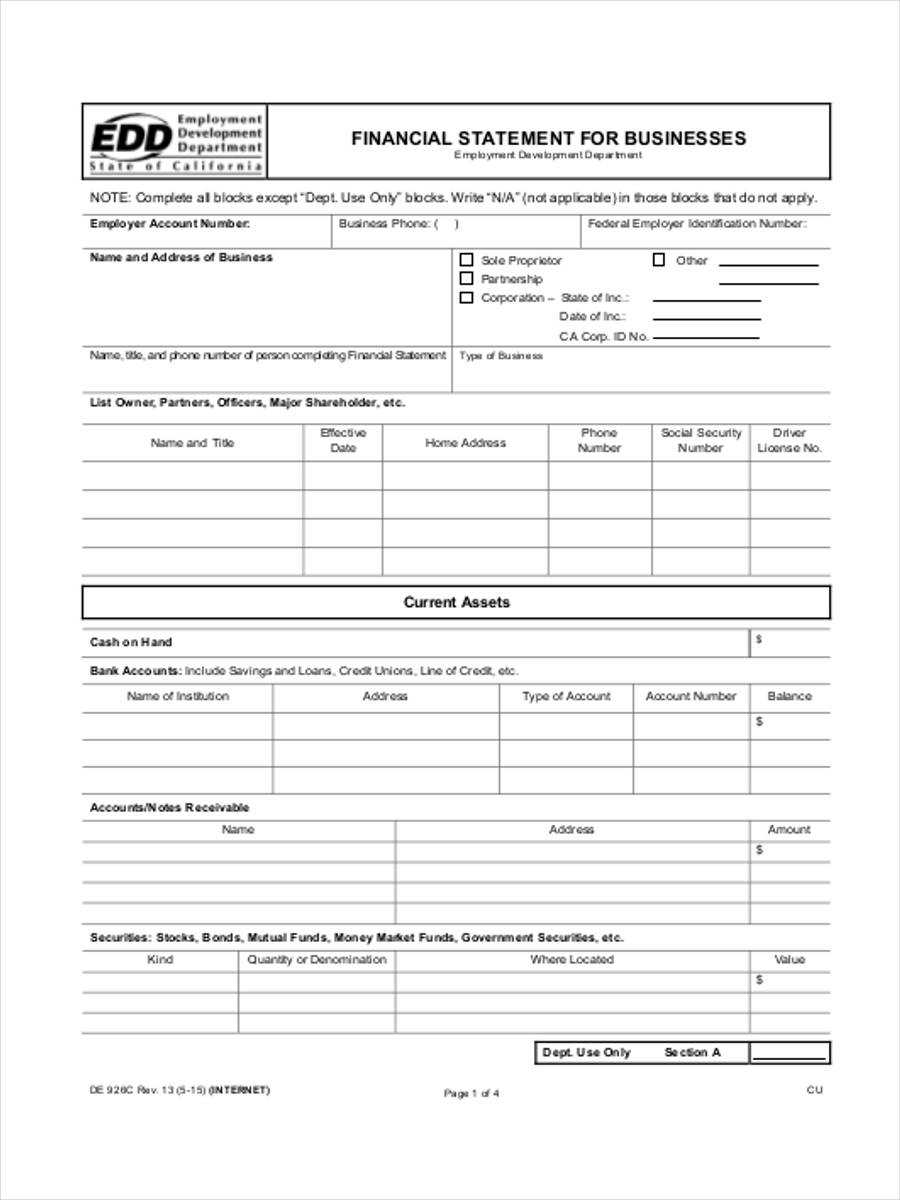

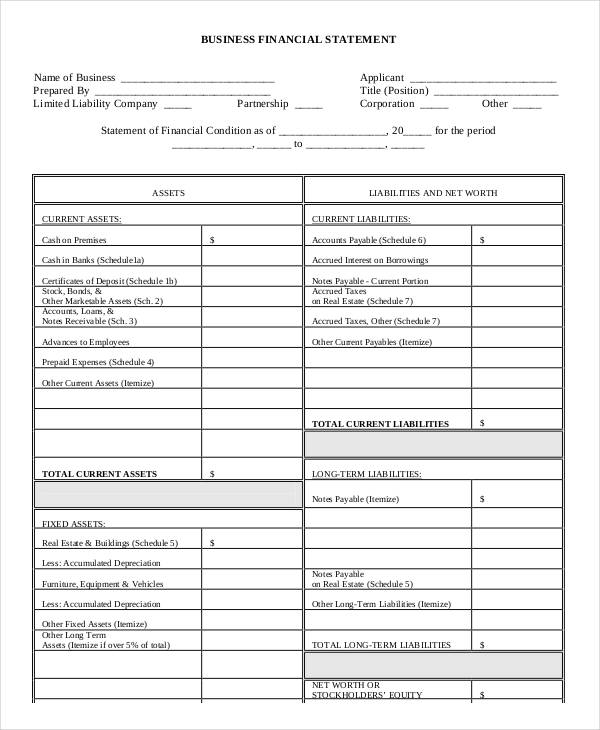

Business financial statement of owner. Financial statements are the means by which companies communicate their story. The balance sheet, income statement, and cash flow statement. To ensure that you’re on top of your business’s finances, you need to be aware of three financial statements:

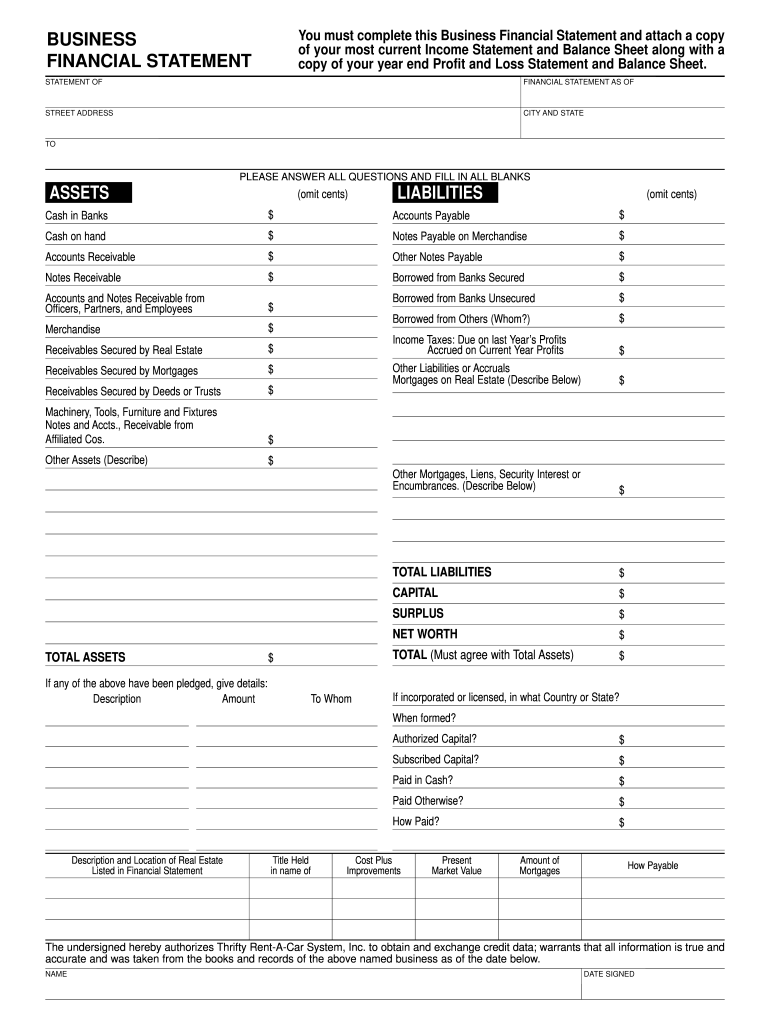

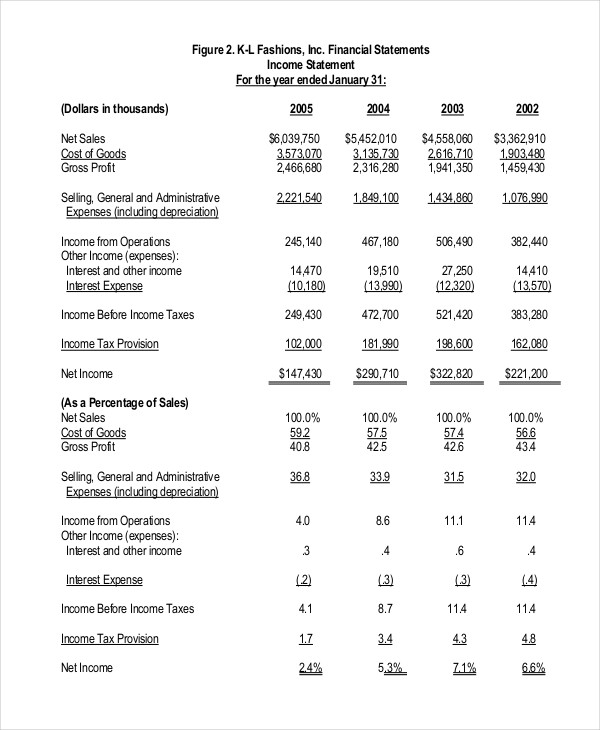

The financial report addresses the government’s financial activity and results as of and for the fiscal years ended september 30, 2023, and 2022. The income statement shows a company’s financial performance over a specific period of time, typically a quarter or a year. It shows its assets, liabilities, and owners’ equity (essentially, what it owes, owns, and the amount invested by shareholders).

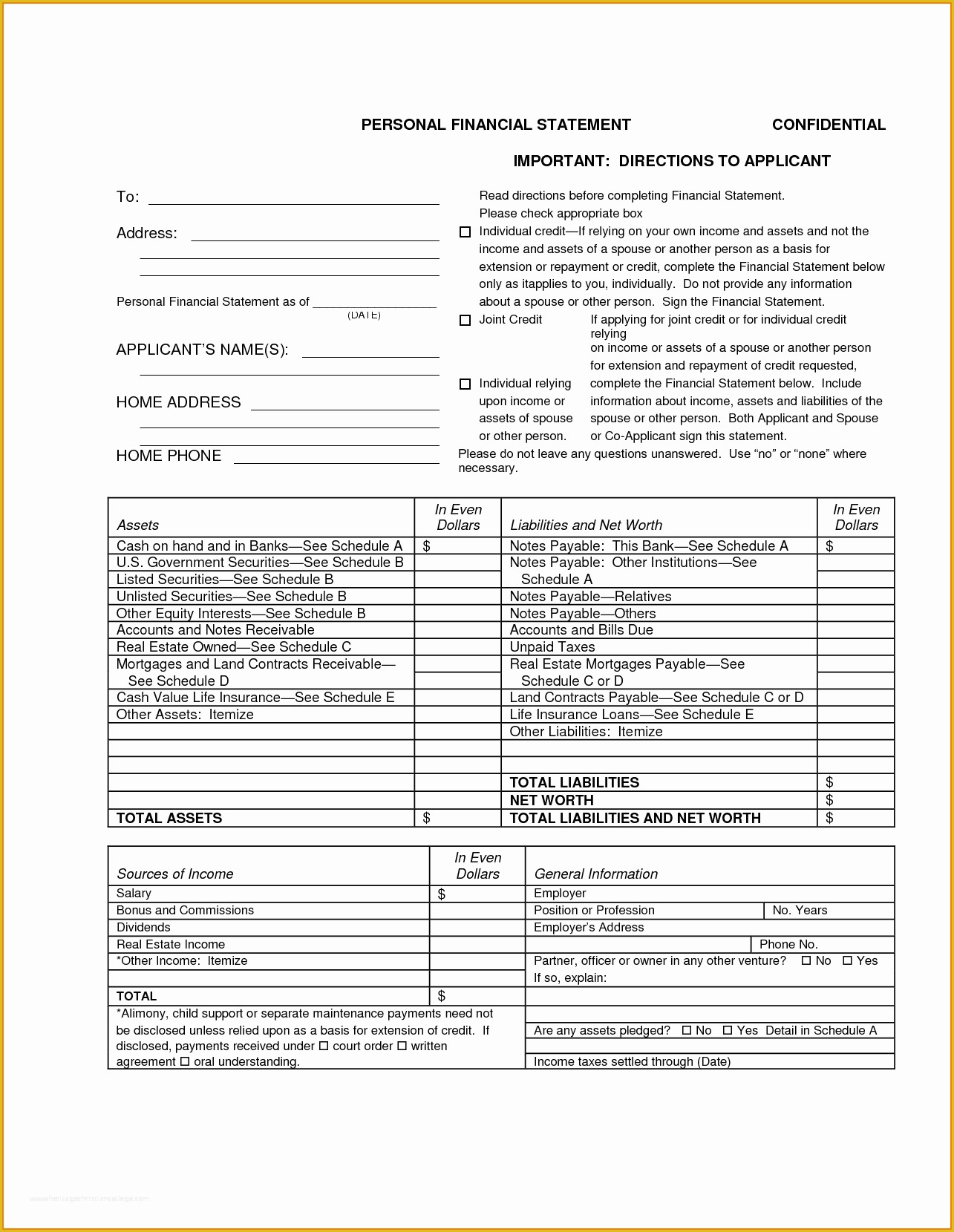

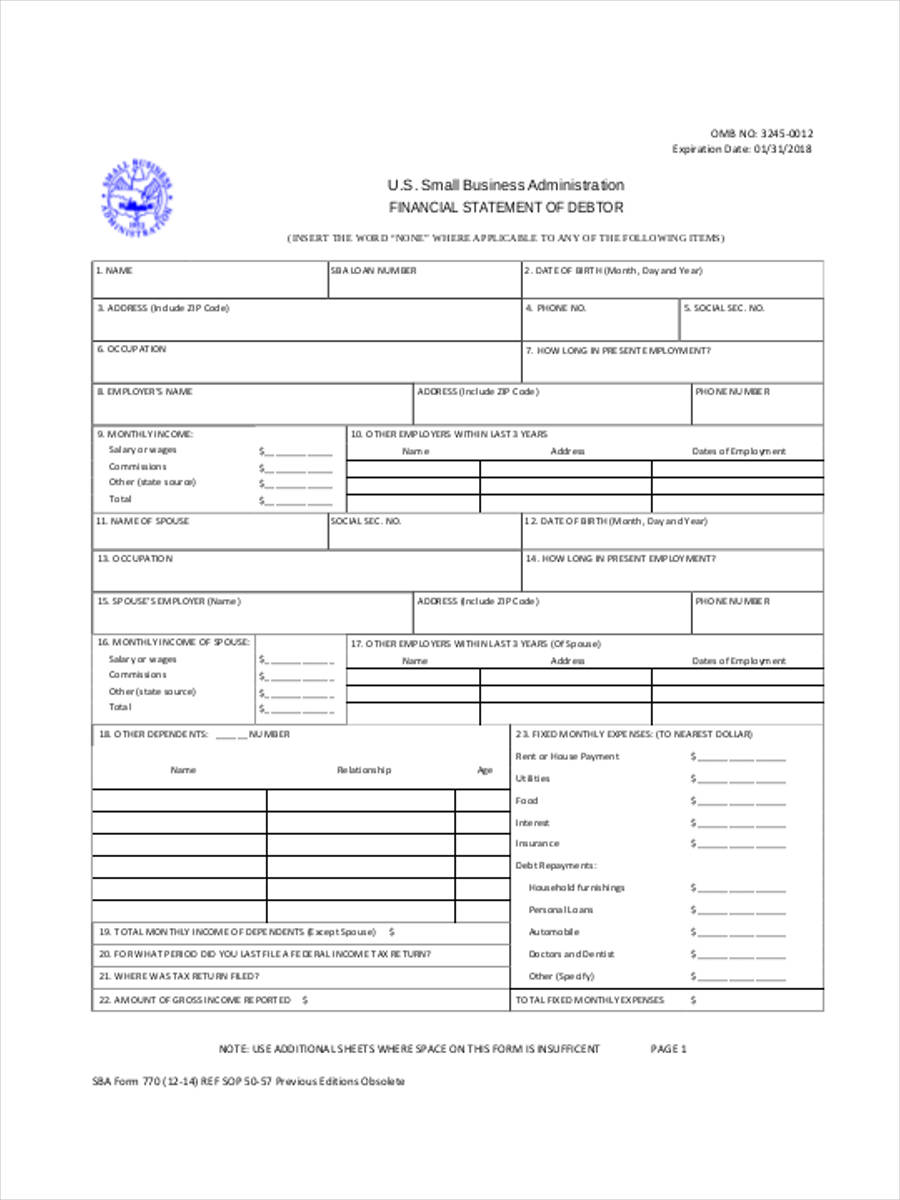

Financial statements are the means by which companies communicate their story. The reporting is designed to limit taxpayers’ ability to abuse ownership structures for criminal activity. Equity represents the ownership of.

They provide a basis for the business owner to introduce the. As a business owner, keeping tabs on your financial statements is essential to the success of your company. Business owners and their accountants use income statements, balance sheets and cash flow statements to analyze a company’s financial performance.

Air canada produced very strong results for the fourth quarter and full year 2023, delivering on its key financial goals and strategic priorities. The statement of owner’s equity —also called the statement of retained earnings. This view is key to knowing your net worth (valuation) and the true health of your business.

And that involves understanding cash flows, operating expenses, and net profit, all found in your financial statements. There are three common types of financial statements: For the quarter, gaap earnings per diluted share was $4.93, up 33% from the previous quarter.

The three key financial statements. It documents the company’s revenue, expenses, and profit or loss. The balance sheet, income statement, and cash flow statement.

The statement of owner’s equity, which is the second financial statement created by accountants, is a statement that shows how the equity (or value) of the organization has changed over time. Reading and updating these statements regularly is important. A balance sheet (or statement of financial position) is a financial statement that lists a company’s assets, liabilities, and equity balances.

Recently, the federal government passed a law requiring business owners to file a new report called the beneficial ownership information report. Note 30—subsequent events discusses events that occurred after the end of the fiscal year that may affect the government’s financial position and condition. The balance sheet is composed of.

Business owners use other financial reports, such as the statement of retained earnings, less frequently. The financial crimes enforcement network (fincen) is behind the 2024 law, which aims to help authorities crack down on financial crimes. Businesses, including llcs, created before jan.