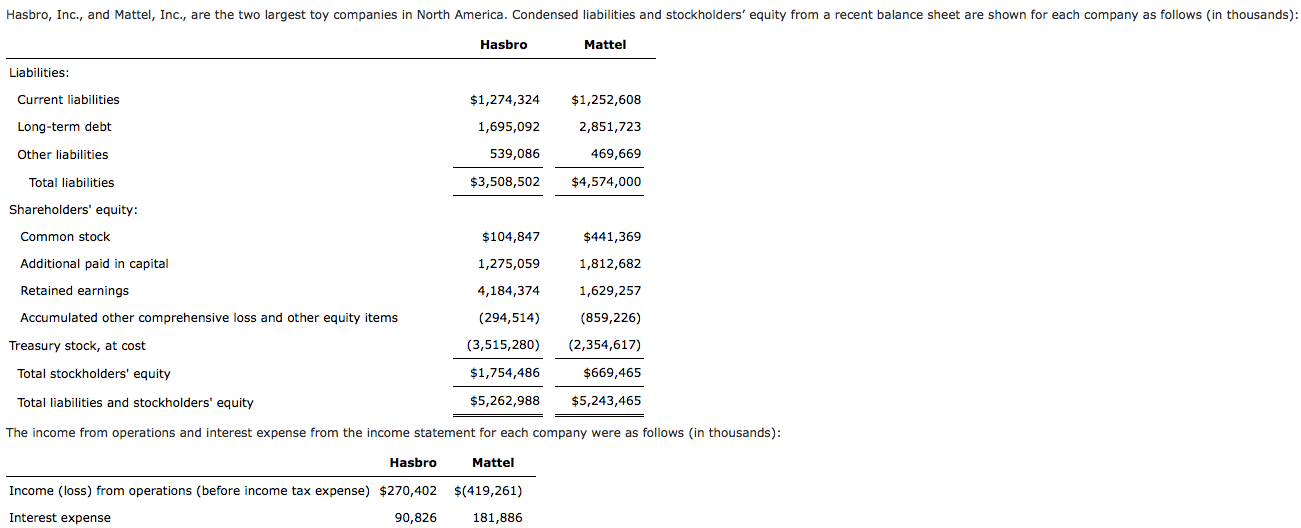

Inspirating Info About Hasbro Balance Sheet Titan Company

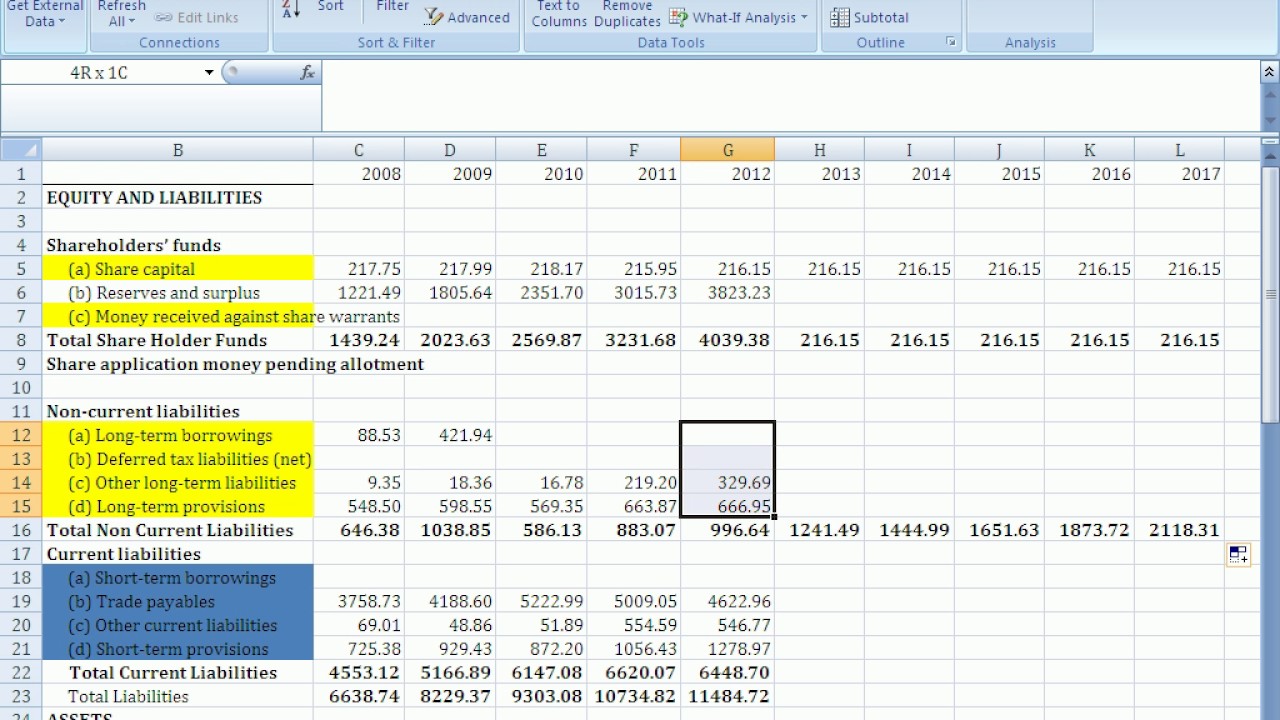

And total liabilities decreased by 0.37% in q3 23 to.

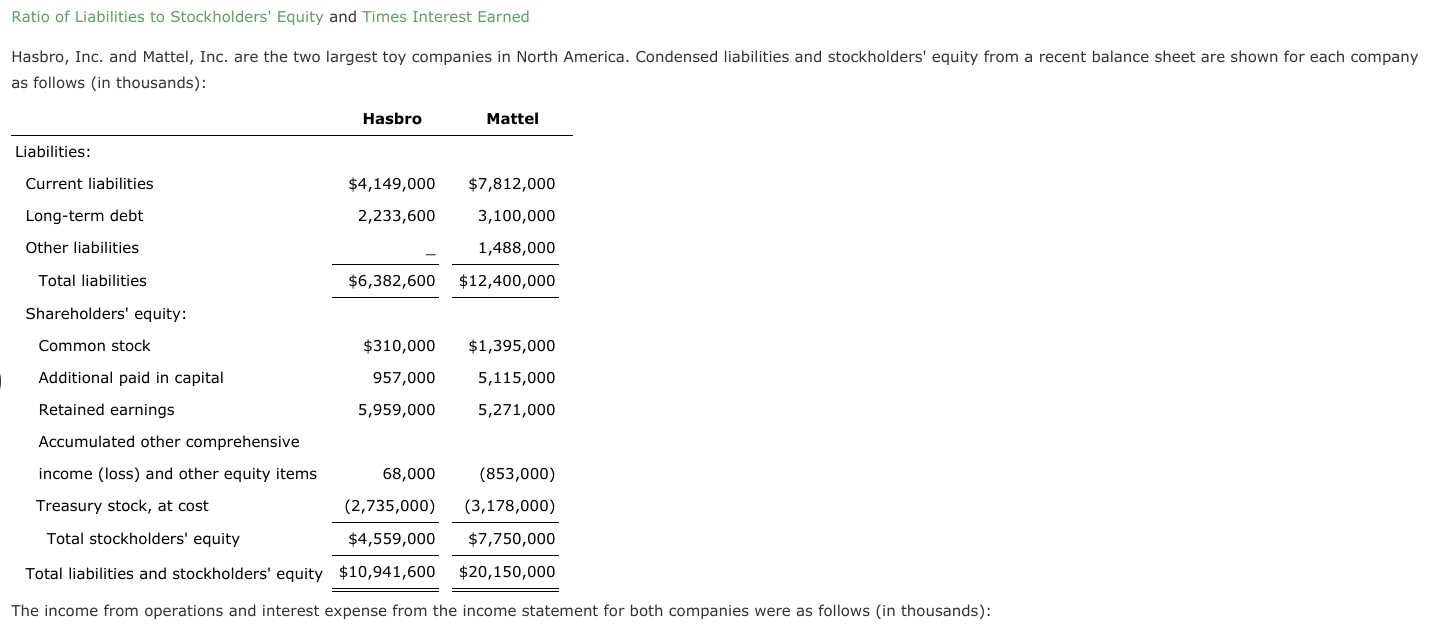

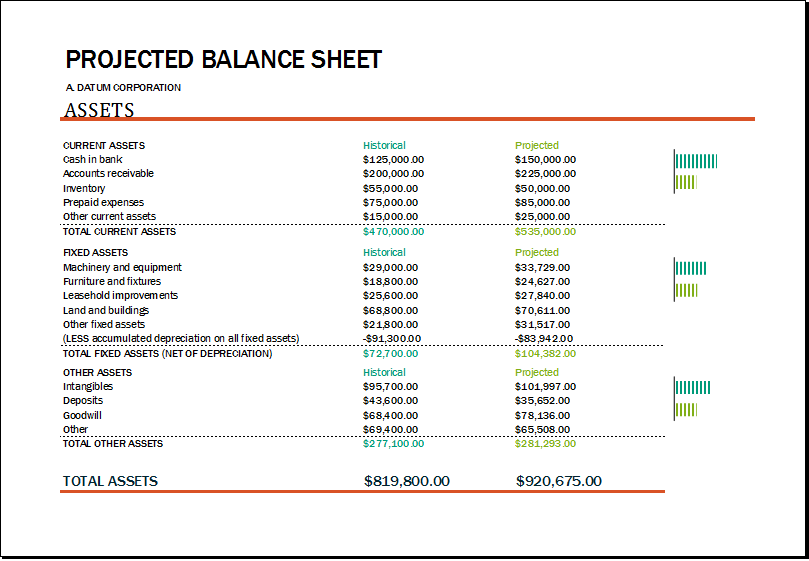

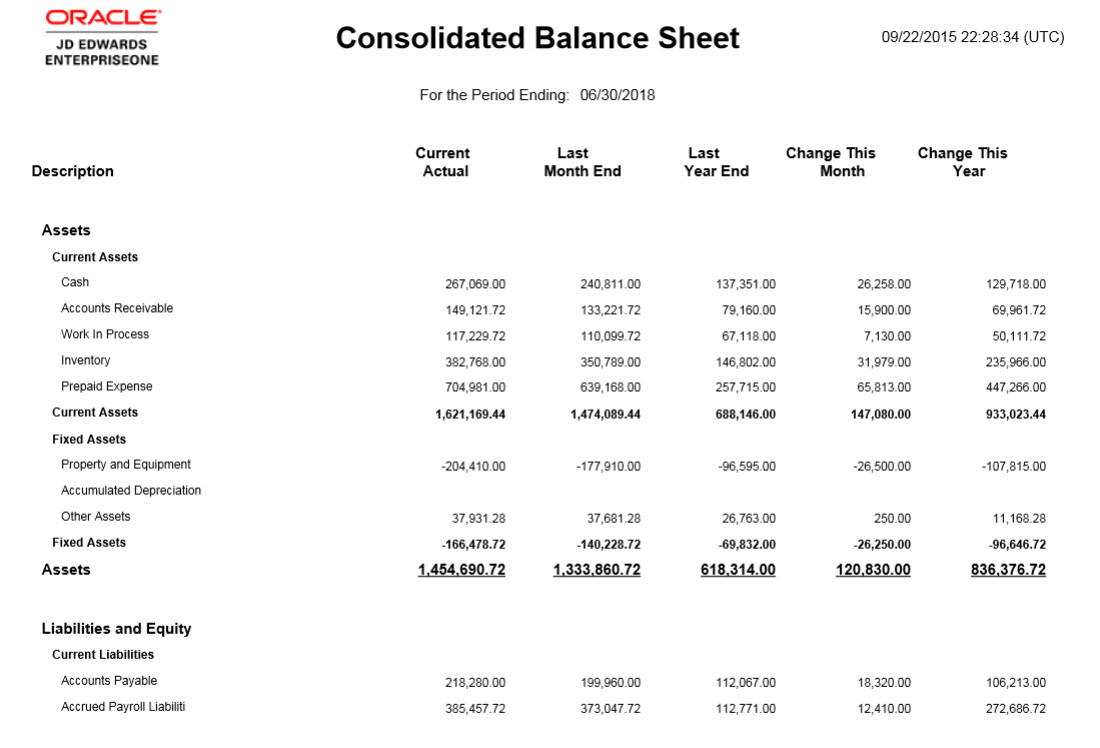

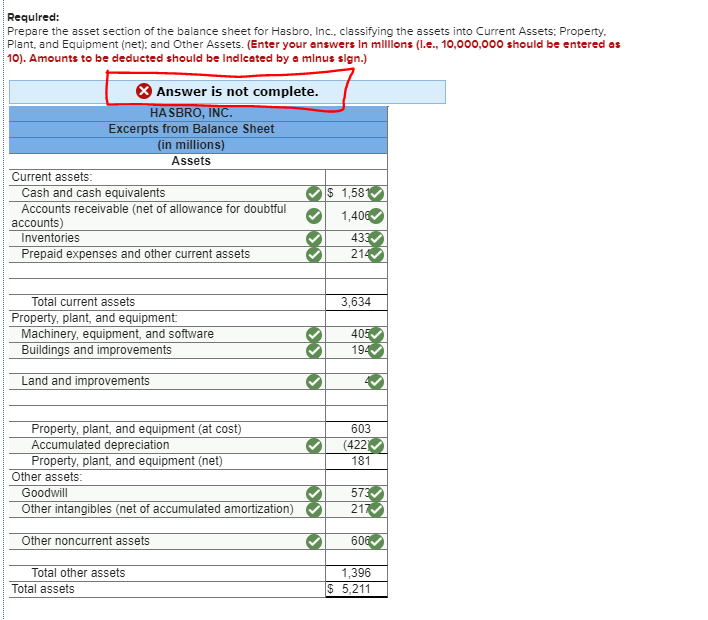

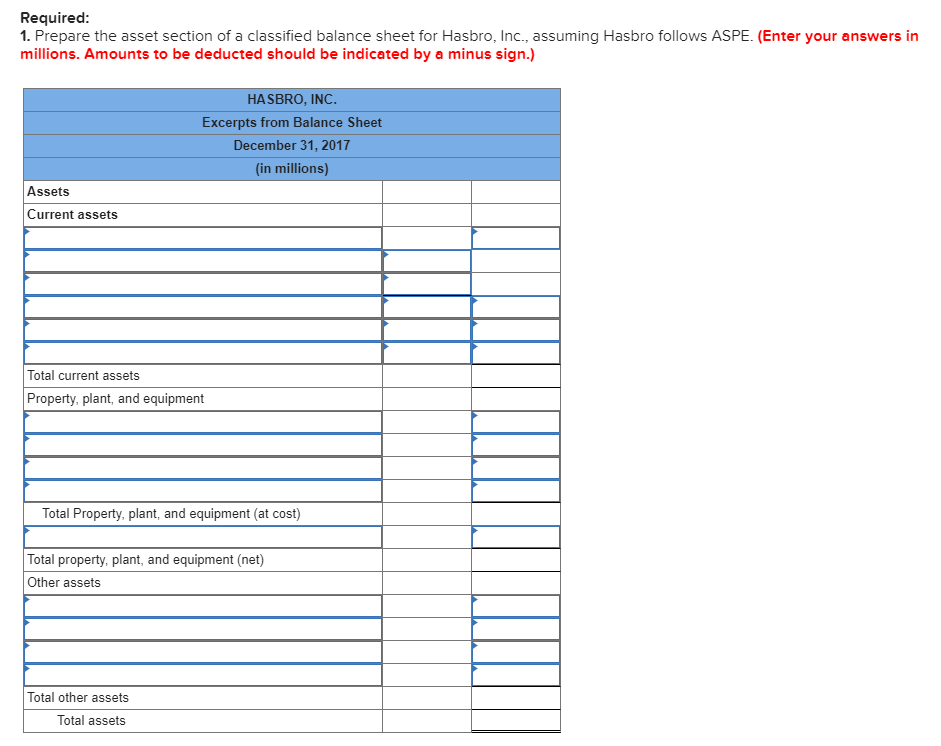

Hasbro balance sheet. Condensed consolidated balance sheets (unaudited) (millions of dollars) march 27, 2022 march 28, 2021. Has balance sheet assess the latest hasbro balance sheet. The balance sheet is a financial report that shows the assets of a business (i.e.

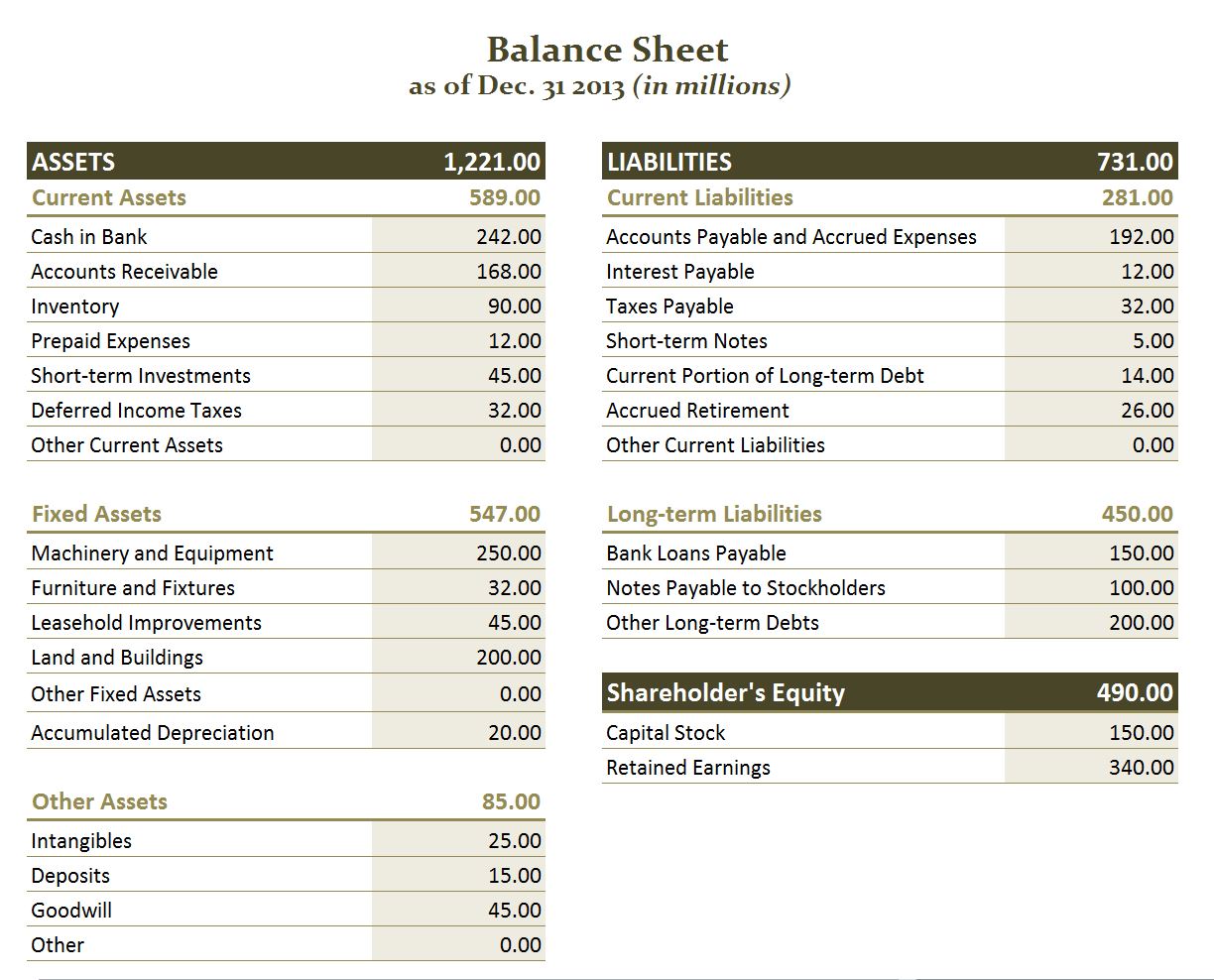

Djia s&p 500 global dow nasdaq compare to open 50.80 prior close 50.68. Gain insights into the company's tangible and intangible assets, its liabilities, including loans and accounts. Ten years of annual and quarterly balance sheets for hasbro (has).

1 m 3 m ytd 1 y 3 y $ % advanced charting compare compare to benchmark: Featured here, the balance sheet for hasbro inc, which summarizes the company's financial position including assets, liabilities and shareholder equity for each of the latest. Ten years of annual and quarterly financial statements and annual report data for hasbro (has).

Condensed consolidated balance sheets (unaudited) (thousands of dollars) december 27, 2020 december 29, 2019. The current financial position of hasbro, inc. Djia s&p 500 global dow nasdaq compare to open 50.51 prior close 51.05 (02/15/24) 1.

Get the annual and quarterly balance sheet of hasbro, inc. Our balance sheet remains strong and well positioned to meet our objectives. 30 rows source:

Has | hasbro inc. We are focused on selling through inventory and managing our business to. Delve into a company's financial position by exploring its balance sheet.

Condensed consolidated balance sheets (unaudited) (millions of dollars) december 25, 2022 december 26, 2021. (has) including details of assets, liabilities and shareholders' equity. View has financial statements in full.

1 d 5 d 1 m 3 m ytd 1 y 3 y $ % advanced charting compare compare to benchmark: Financials are provided by nasdaq data link and. What it owns), the liabilities.

Total assets of has for q3 23 is 8.34 b usd, 3.13% less than the previous q2 23. Balance sheet, income statement, cash flow, earnings & estimates, ratio and margins. Review the company's financial position, assess their current assets, liabilities and shareholder equity across.