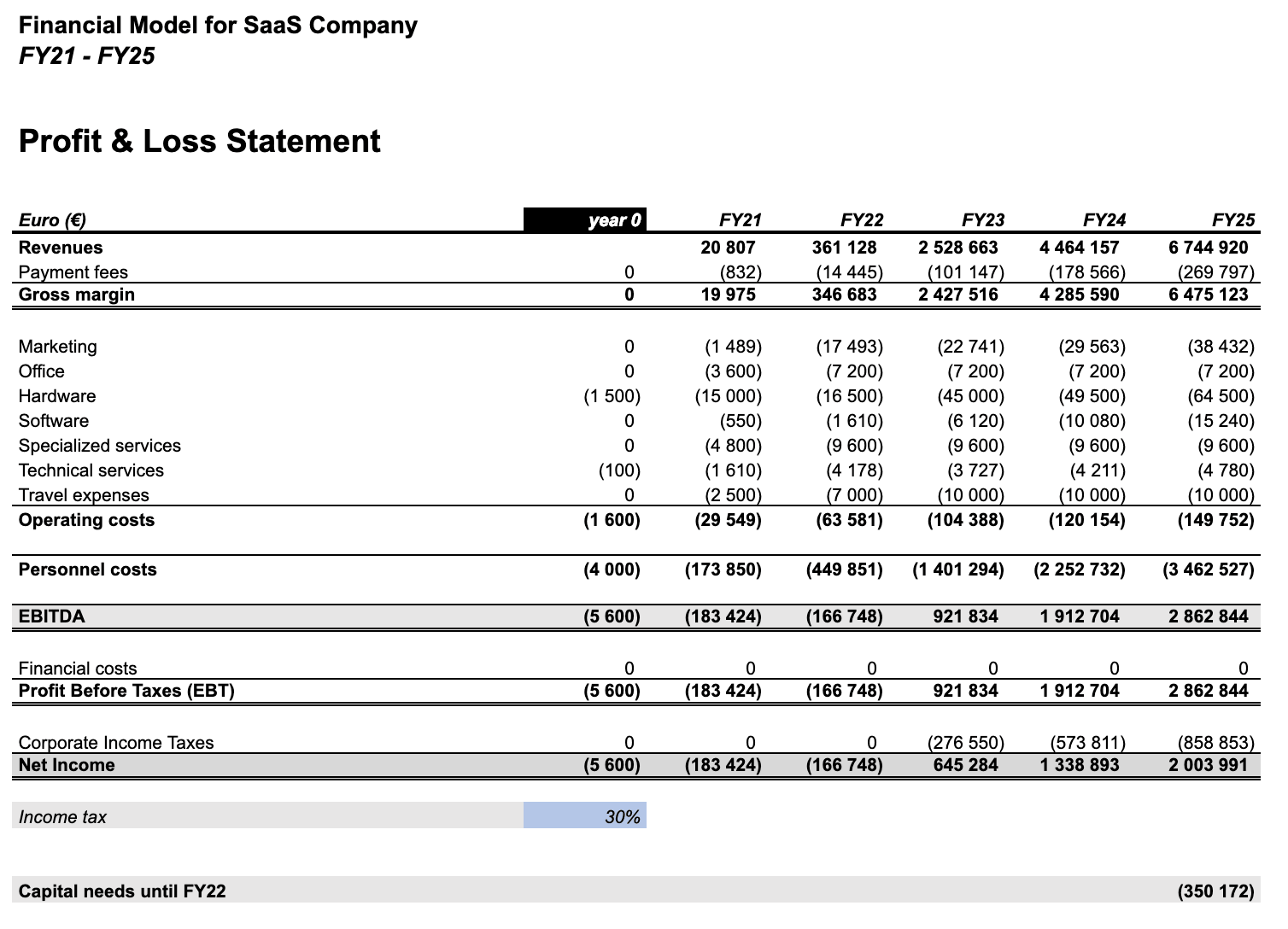

Inspirating Info About Saas Company Financial Statements Why Do We Prepare Profit And Loss Account

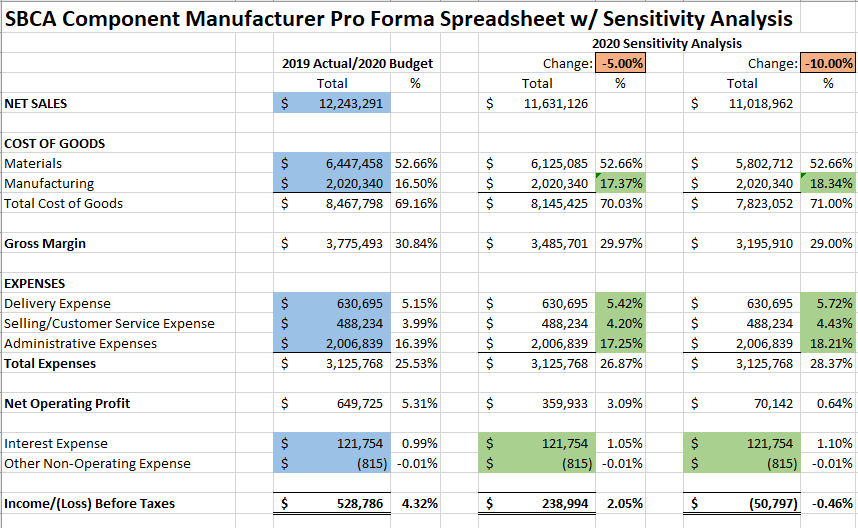

Most importantly, you can use this financial instrument to make future projections and hypotheses.

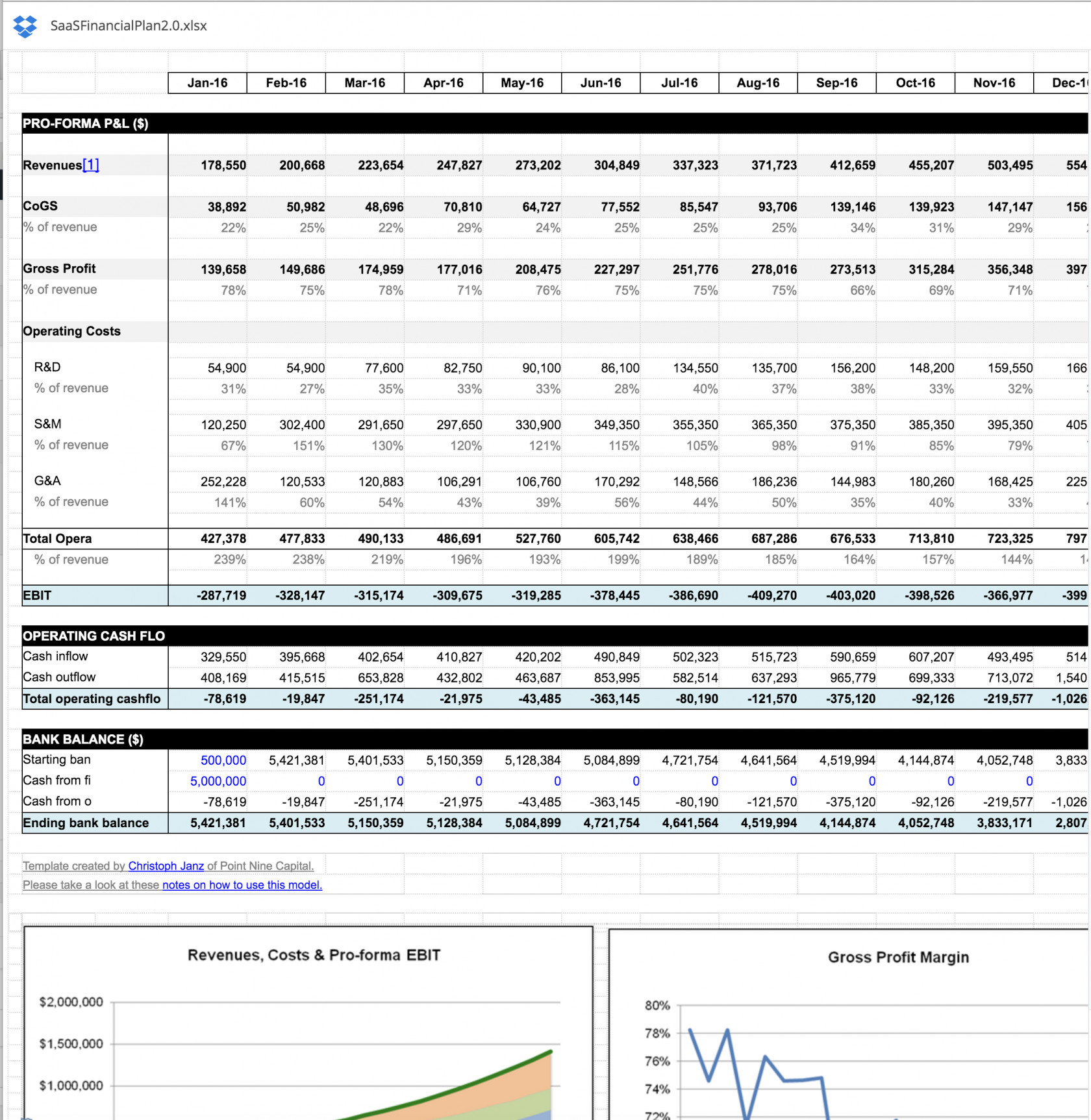

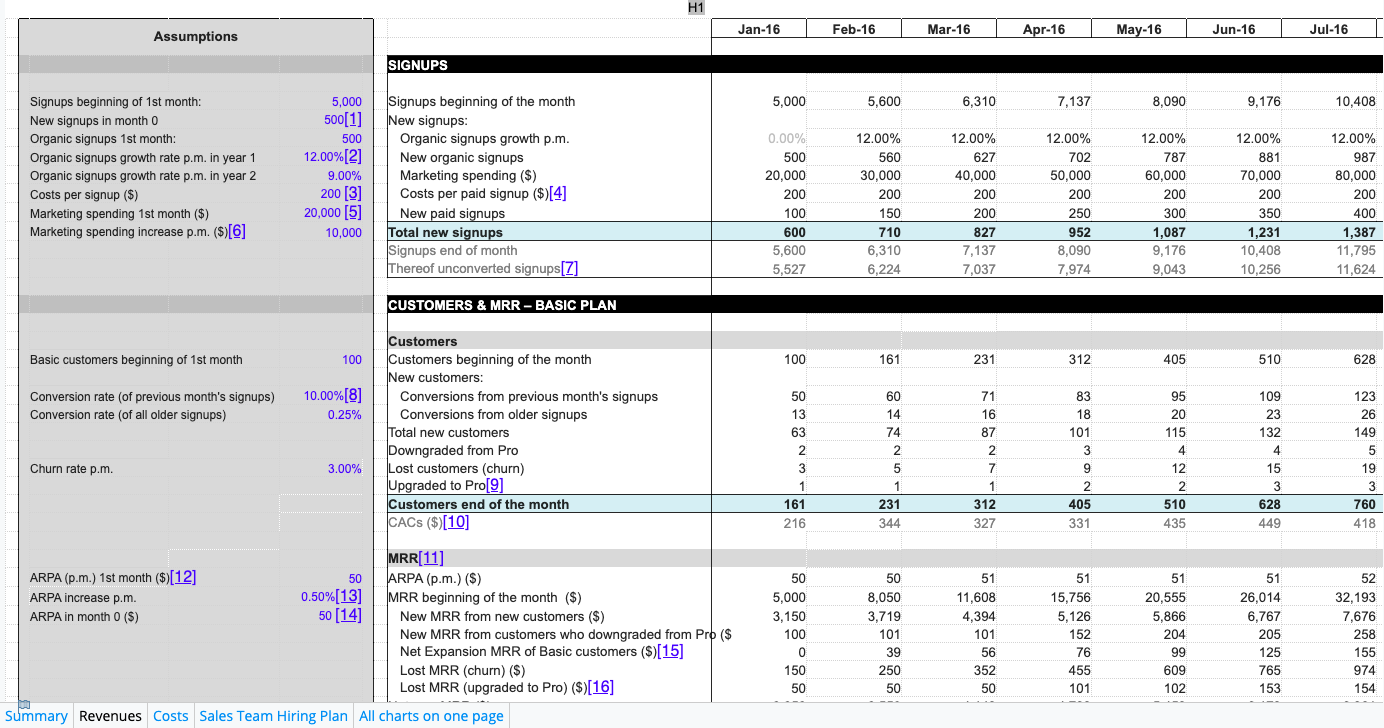

Saas company financial statements. And with that, let’s begin with understanding the key components of a saas financial model and an excel model template we have prepared for you. A saas financial model is used to understand the full financial position of your business and project into the future. Saas balance sheets are one of the three main financial statements you need for your saas company.

It lists the company’s assets, liabilities, and shareholders’ equity. A saas company’s p&l statement covers all the financial vital signs of the company. A financial statement is a report that gives investors, lenders, and management a detailed picture of your startup’s financial health and performance.

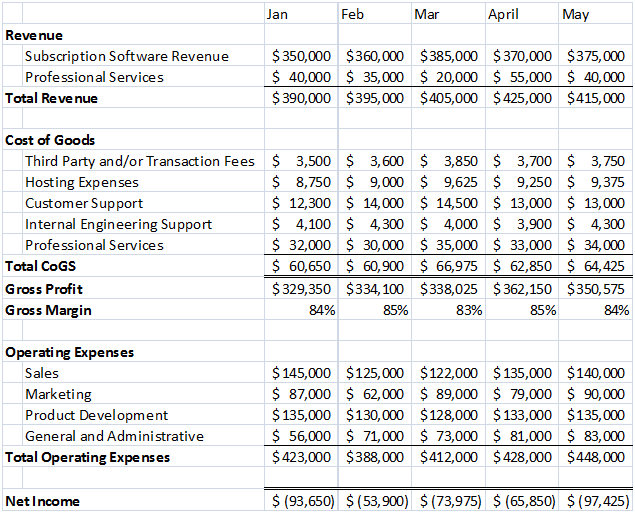

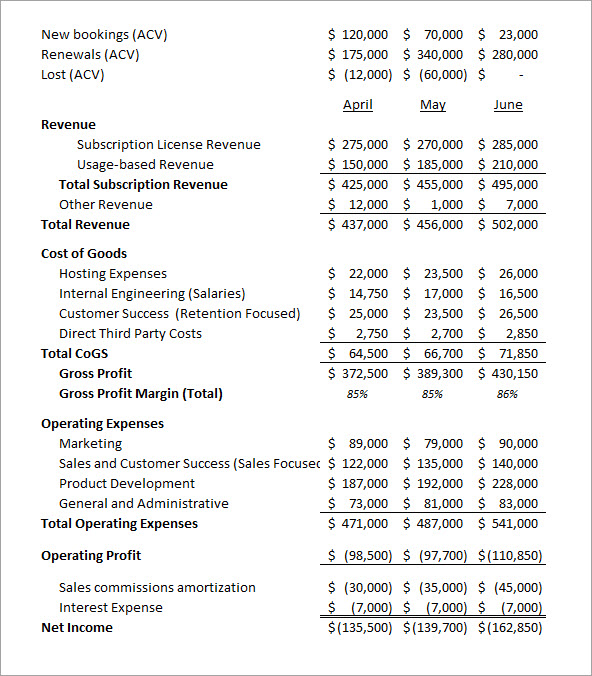

There are four different financial statements that gaap requires companies to report: Income statement (in thousands) year ending 12/31/2021. A saas profit & loss (p&l) statement needs to be organized in order to be meaningful to both internal stakeholders and potential external partners, such as capital providers.

I talk about the saas p&l (profit and loss statement) almost every week with saas founders, finance, and accounting teams. Learn how to correctly structure your saas p&l. Learn how to make one with this saas balance sheet example.

Saas financial models are documents that outline your saas business’s financial performance and projections for you and your investors. $3 to $10 million over $10 million the income statement a gaap income statement is the best source for understanding growth and burn: Balance sheet the balance sheet provides a snapshot of the company’s financial position at a specific point in time.

Now, join us as we explore the world of saas and its financial viability. Their financial statements will also have very different metrics and ratios than other online business types. It’s structured to produce a proper gross margin for your saas business.

The company measures the tems included in the financial statements of each i component using the currency of the primary economic environment in which each operatesit (“functional currency”). The model allows businesses to forecast future revenue, expenses, and cash flows, enabling informed financial planning and investment decisions. What are the different kinds of startup financial statements?

Summary the model includes the following tabs to drive the forecast. Revenue tab inputs on customer counts, arr,. Income statement (or p&l statement), balance sheet, cash flow statement/statement of cash flows, and the statement of owner’s equity.

Average revenue per user (arpu) 6. This can be challenging for entrepreneurs (and even some cfos) because the saas business model poses unique challenges in terms of traditional financial modeling. As the saas business model has evolved, it is worth examining what an income statement should look like in 2023.

The saas p&l is a foundational pillar of saas financial management. P&l statement or income statement. Then, as sort of a practical exercise, we will review saas company financial reports and highlight the specific financial profile associated with these businesses.