Have A Info About R&d Expense On Income Statement Forecasting Balance Sheet In Excel Amita Health Financial Statements

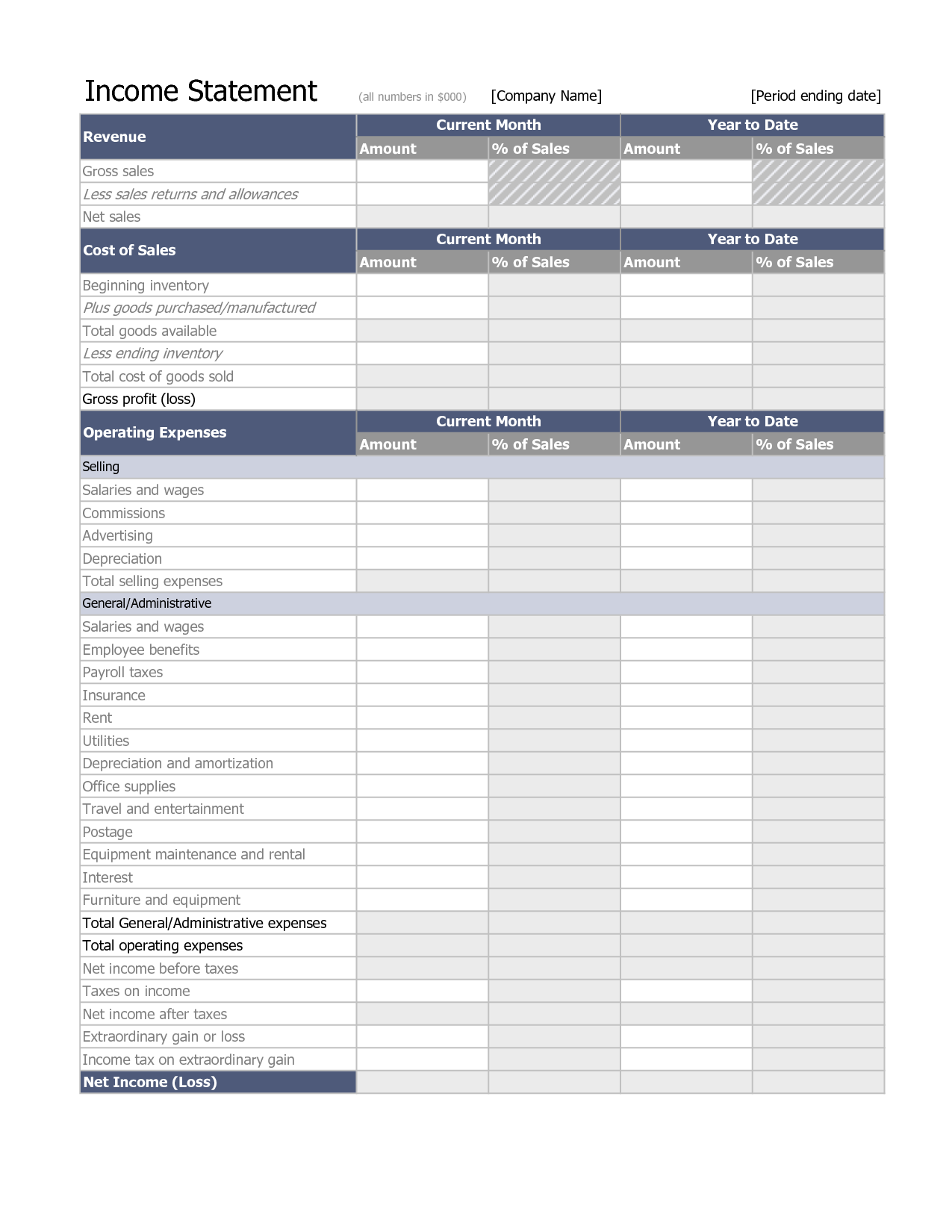

R&d, sales & marketing, general & admin costs:

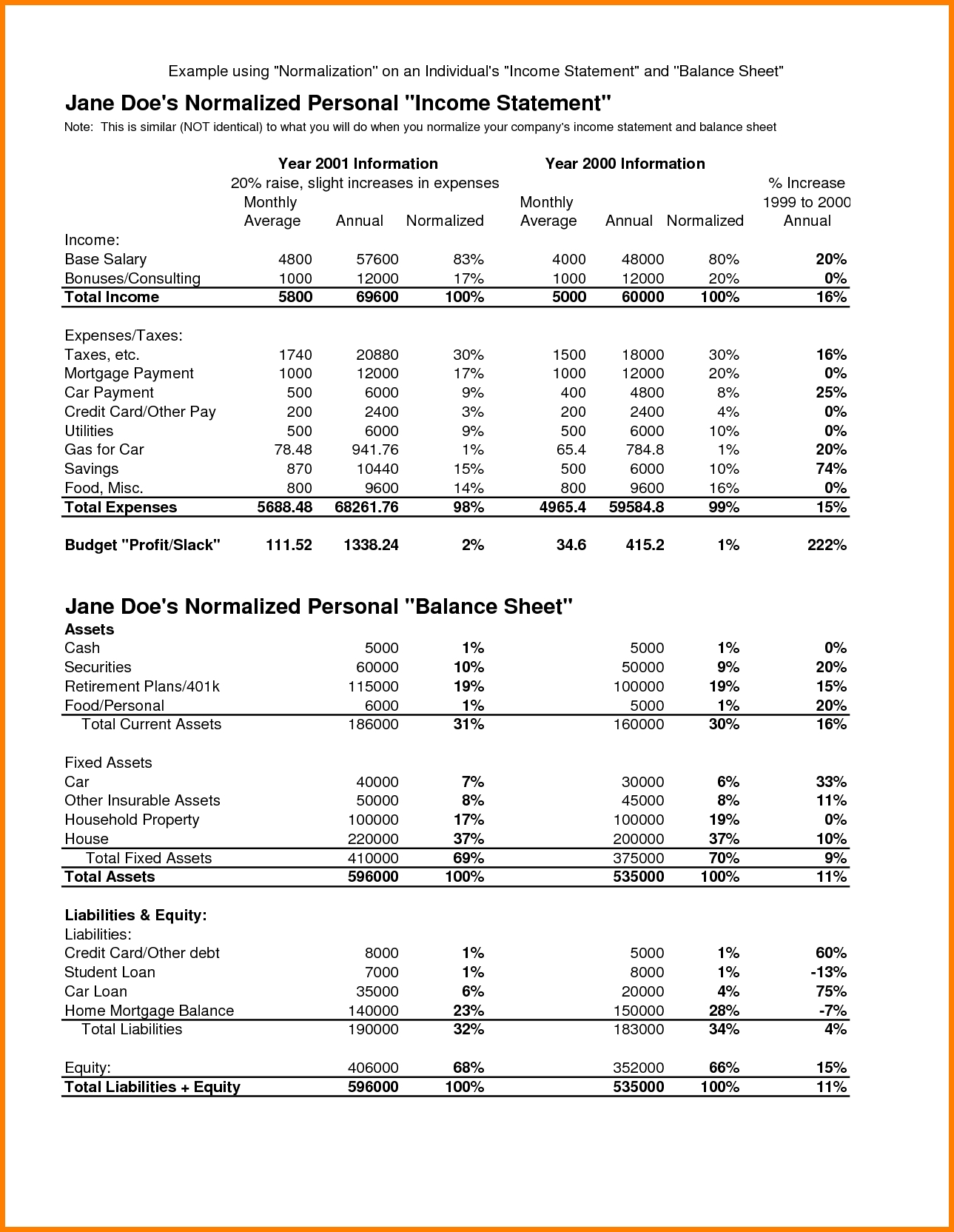

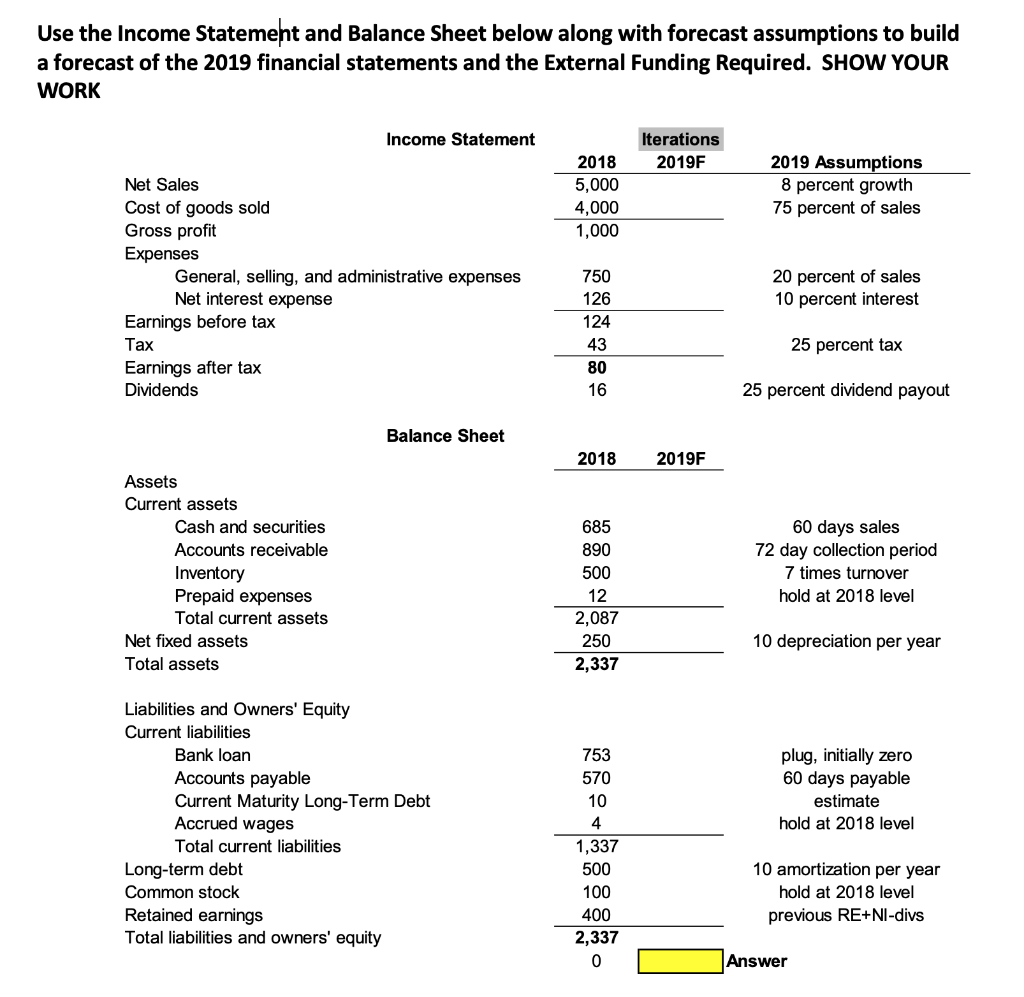

R&d expense on income statement forecasting balance sheet in excel. We assume tax is 25% of operating profit for period 1. Below, we analyze the practice of capitalizing r&d expenses on the balance sheet versus expensing them on the income statement. Everybody, but especially when you want granular financial forecasts with high accounting integrity.

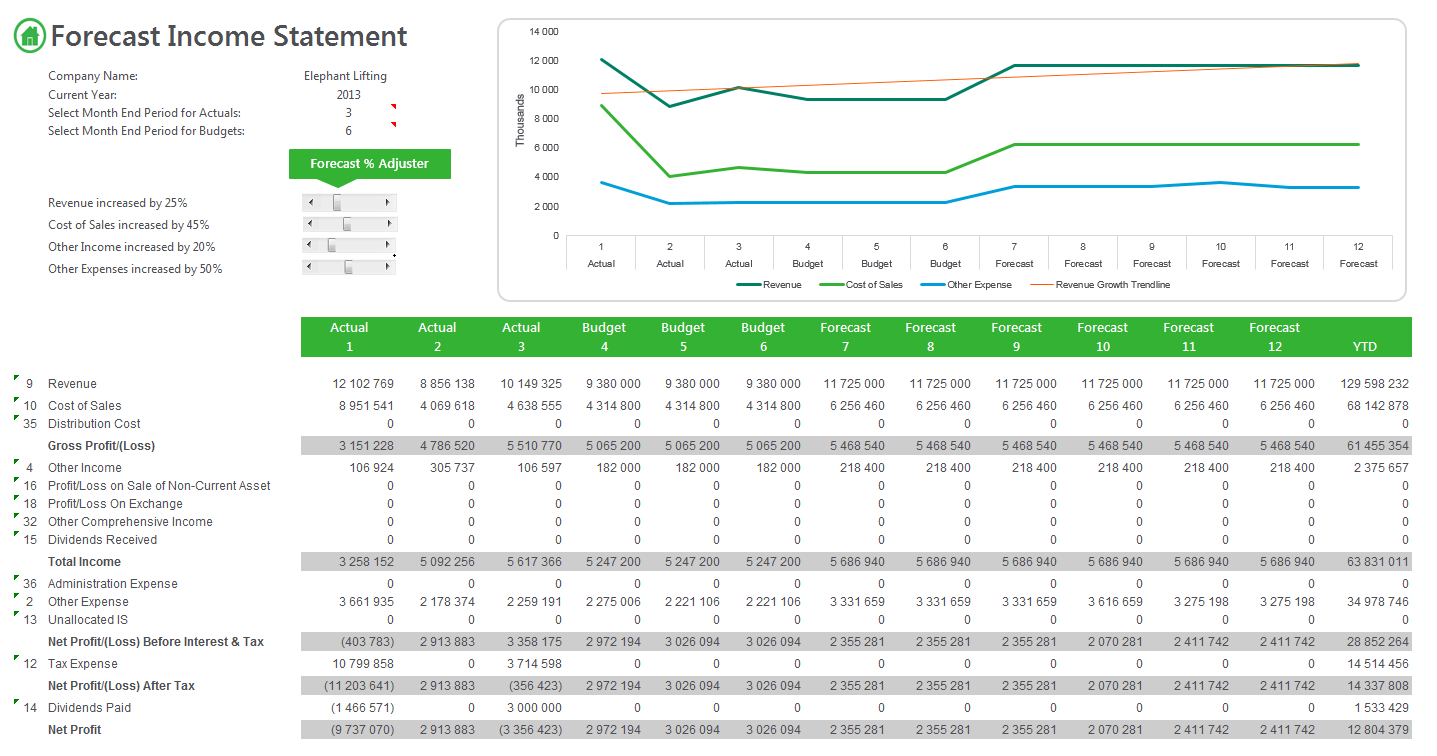

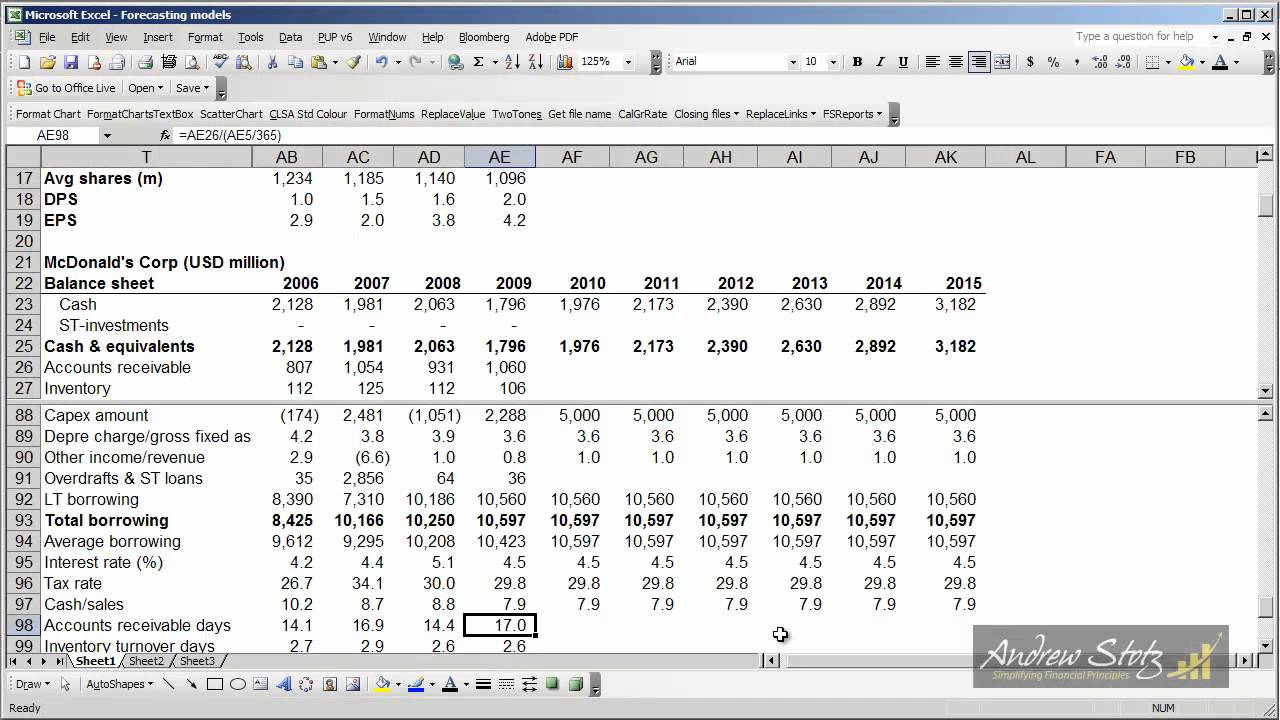

Often impossible to tell for an outside analyst accounting is ruled by law, your numbers by logic historical 1 financials revenue forecast income statement balance sheet discount rate valuation your revenue and operating cost baseline should be ruled by logic to make accurate. Forecast zeiber's 2017 income statement and balance sheets. It adjusts upward from the difference of current r&d and amortized r&d:

(1) sales grow by 6%. In other words, company a has discovered that the amortization value of that particular r&d product is $66,000 over its economic life. What is a good r&d spending ratio by industry?

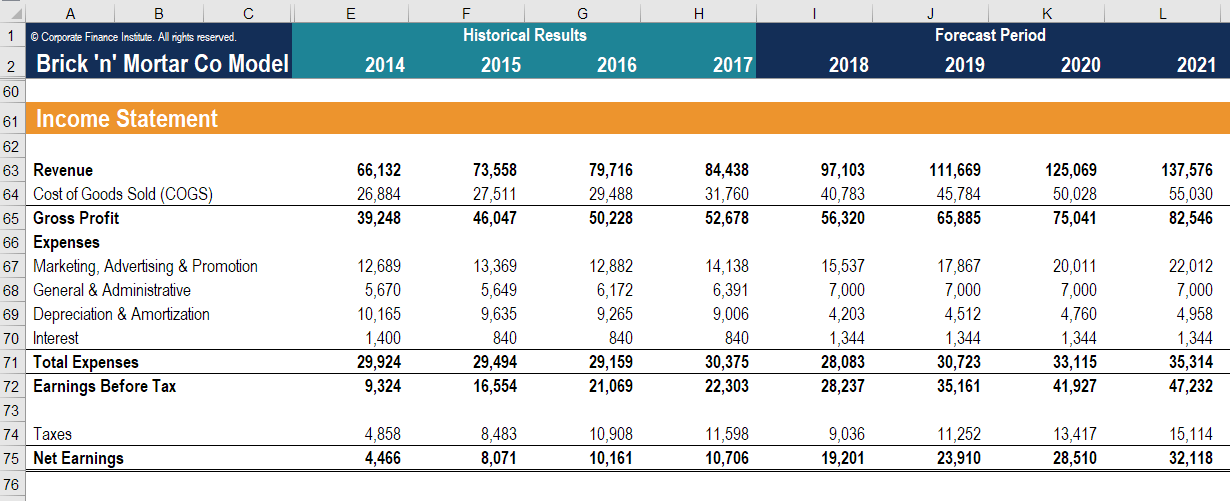

Current amortization amount = $33,000 + $25,000 + $8,333. For illustrative purposes, we’ll assume our company’s recognized $5 million in depreciation and amortization (d&a). The d&a expense is embedded within the income statement’s cogs and operating expenses (and rarely separately recognized).

Let us compare gaap with the international financial reporting standards (ifrs). So, the net income forecast for period 1 is 25.4. Now, to get the tax expense forecast for period 1, we simply multiply this assumption by operating profit forecast of 33.8 to get period 1 tax expense of (8.5).

Income of the business before taxation: Expensing a cost indicates it is recognised on the income statement and subtracted from revenue to determine profit. Balance sheet forecast items the following are the main accounts we need to cover when projecting balance sheet line items:

There are also some accounting standards related to booking research and development expenditures: Under ifrs rules, research spending is treated as an expense each year, just as with gaap. One may use such financial models in dcf valuations, mergers and acquisitions, private equity, project finance, etc.

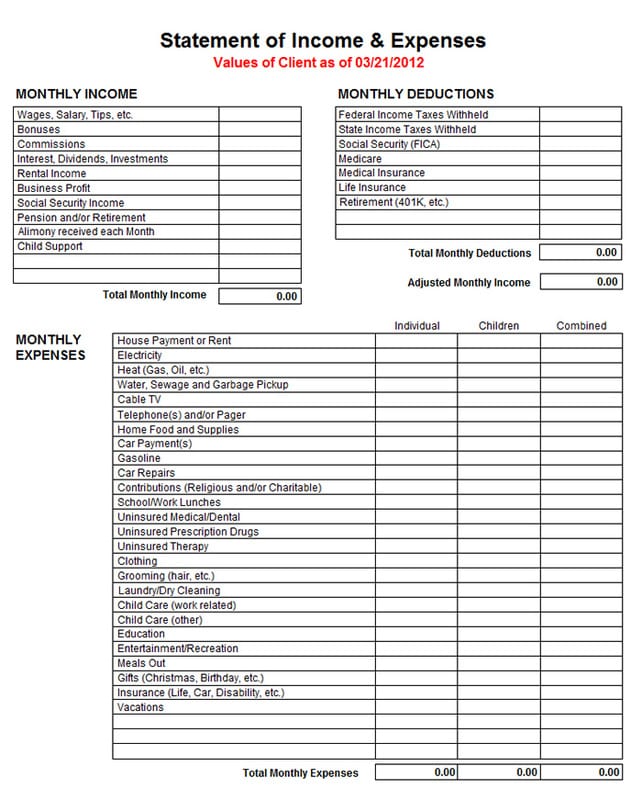

The following are the main accounts that need to be covered when projecting income statement line items: Record income & expense data at the very beginning, you have to record the income and expense data of. Cost of goods sold (or gross revenue) total or specific general expenses (sg&a) depreciation.

Research and development (r&d) costs are the costs you incur for activities intended to develop or improve a product or service. Earnings before interest and tax: The last line item is tax expense.

Depreciation and amortization (d&a) = $5 million; Purchased assets and materials that have alternative future use are recorded as assets. The point of capitalization here is to more accurately match the revenues and expenses found on the balance sheet.