Stunning Tips About Tax Payable On Balance Sheet Lending

Income tax payable is an accounting term that signifies the amount a business anticipates paying in income taxes.

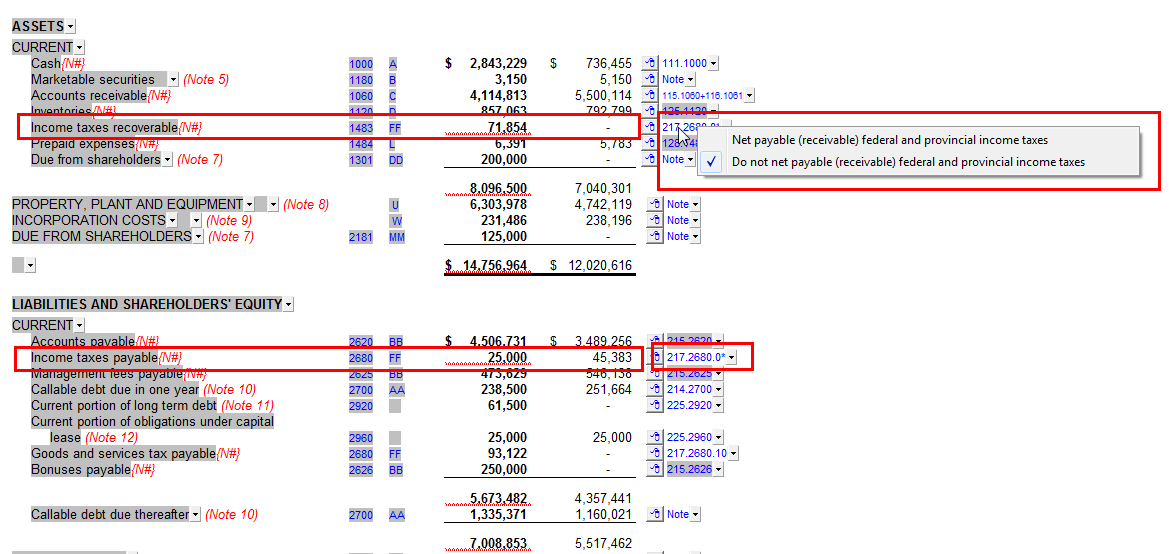

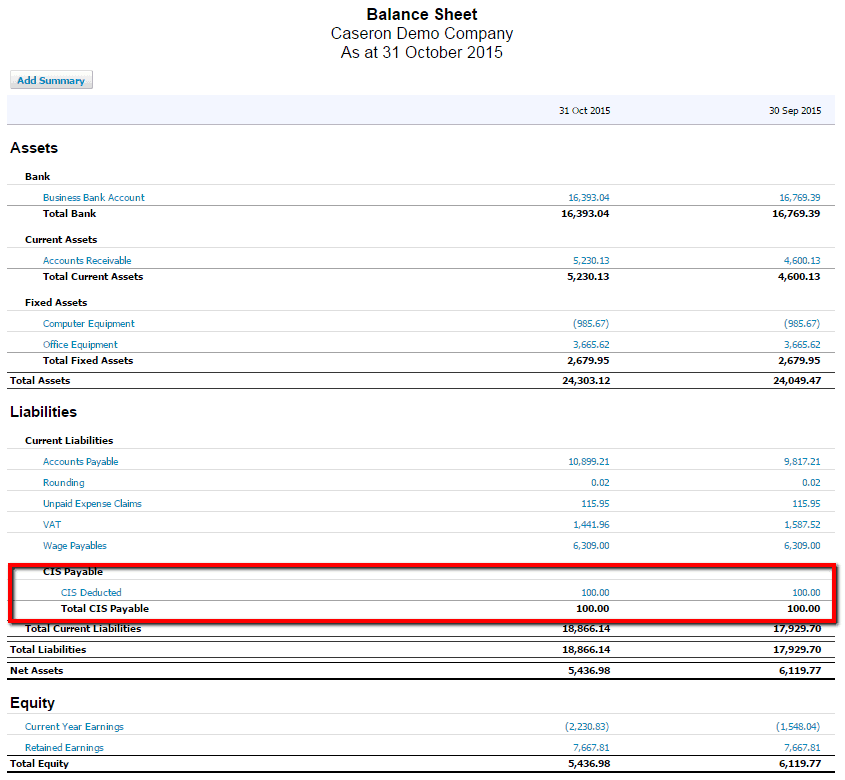

Tax payable on balance sheet. Current tax liabilities are measured at the amount expected to be paid to taxation authorities, using the rates/laws that have been enacted or substantively enacted by the. Learn why it matters for businesses. Tip you report income tax payable on your current profits as a.

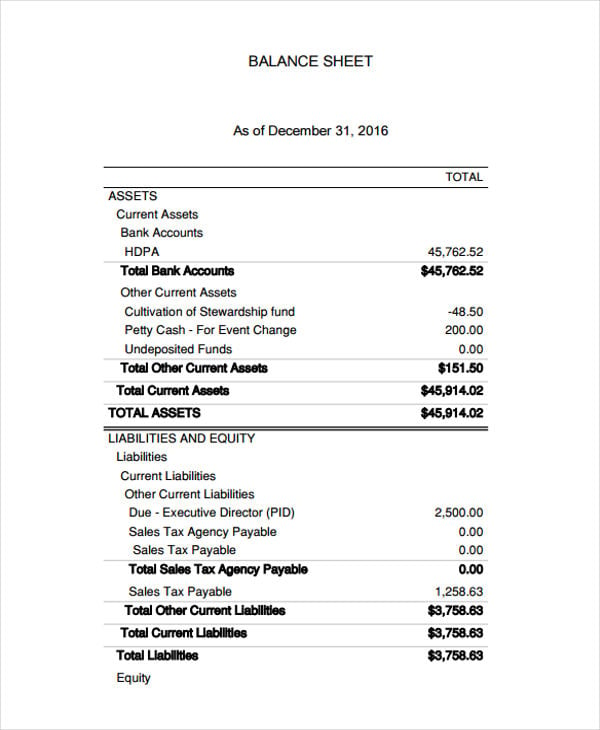

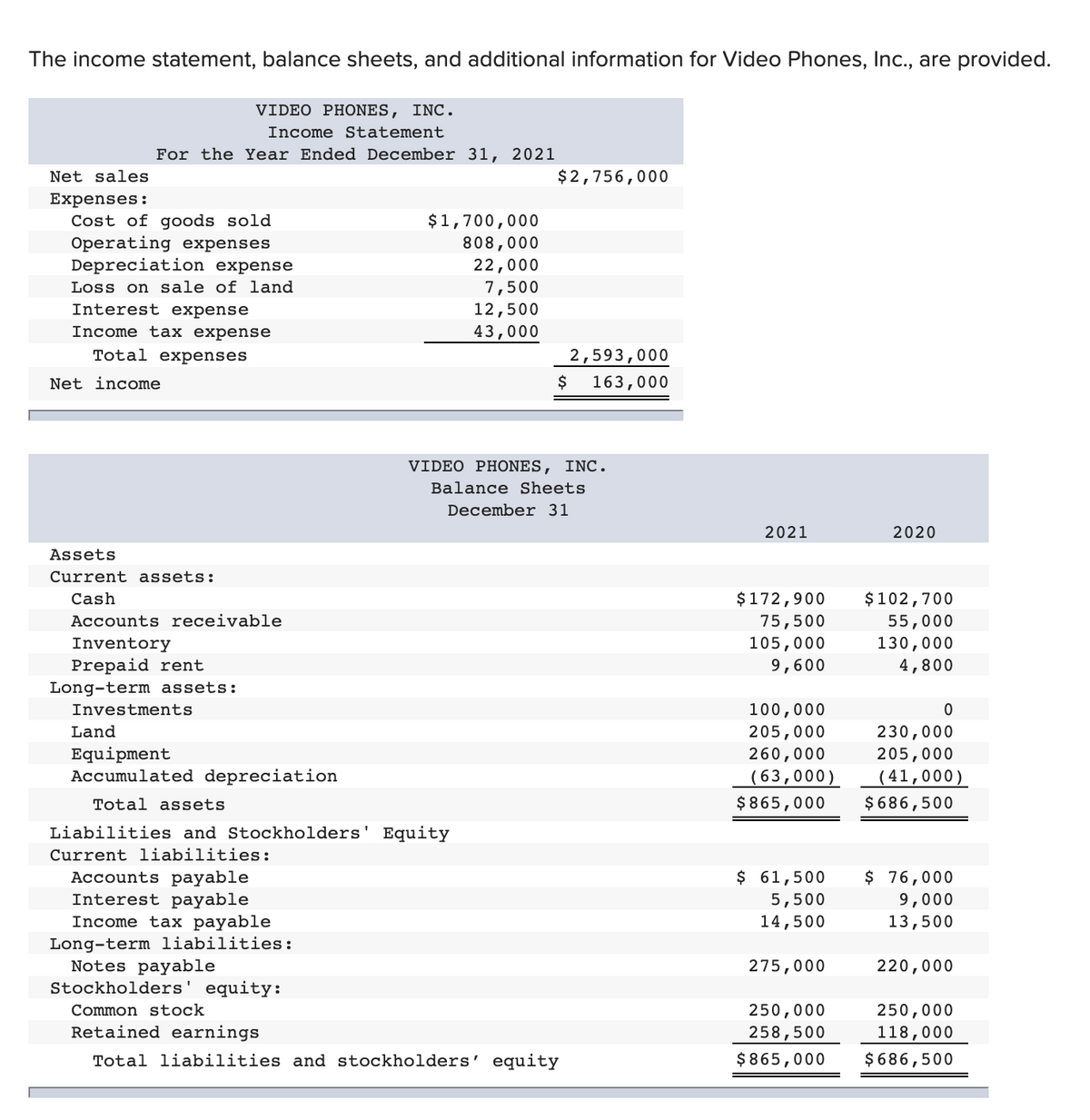

Tax paid is the amount of actual cash paid to the. The tax base of an item is crucial in determining the amount of any temporary difference, and effectively represents the amount at which the asset or. Income tax payable is the line in a balance sheet's current liability section for income taxes due to the irs within 12 months.

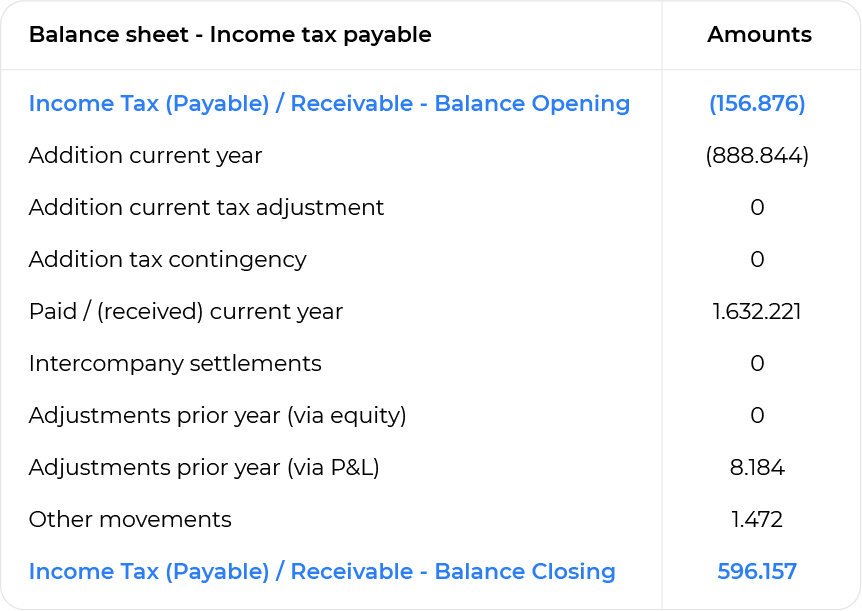

It shows the amount that an organization expects to pay in income taxes within 12 months. Obtain balances for your payable federal income tax, social security taxes, medicaid taxes and unemployment insurance payable. In this case the balance sheet liabilities (income tax payable) has been increased by 14,000, and the income statement has an income tax expense of 14,000.

Tomorrow it’s another new month and we’re getting ever closer to the dreaded tax return deadl. Something you owe that should be repaid within a year. A balance sheet is a financial statement that reports a company's assets, liabilities, and shareholder equity.

Income tax payable is calculated using generally accepted. The balance sheet is one of the three core financial. What is the journal entry for sales.

To record your sales tax payable: Income tax payable goes on the balance sheet while you find tax paid in the cash flow statement. Income tax payable is an amount of taxes due to be paid within 12 months, which is reported as a current tax liability on a company’s balance sheet.

100 x 10/100 = $10 you will debit cash for $110. Add the balances of these accounts. This amount shows up as a liability on a.

So on a balance sheet, accumulated depreciation is subtracted from the value of the fixed asset. The income tax payable is usually classified as a current liability in the balance sheet, since it is normally payable to the applicable government (s) within one. Taxes payable are almost always considered to be current liabilities (that is, to be paid within one year), and so are categorized within the current liabilities section of.

It is reported in the current liabilities section on a company's balance sheet. As fixed assets age, they begin to lose their value. The taxes payable account on the balance sheet is a current liability, or simply:

Debit your cash account for the amount of sales tax you collected on your sales tax payable balance. You will also credit sales for $100 and sales tax payable for $10. Income tax payable is a liability reported for financial accounting purposes.