Looking Good Tips About Adjusted Balance Sheet Sole Trader Example Other Expenses In

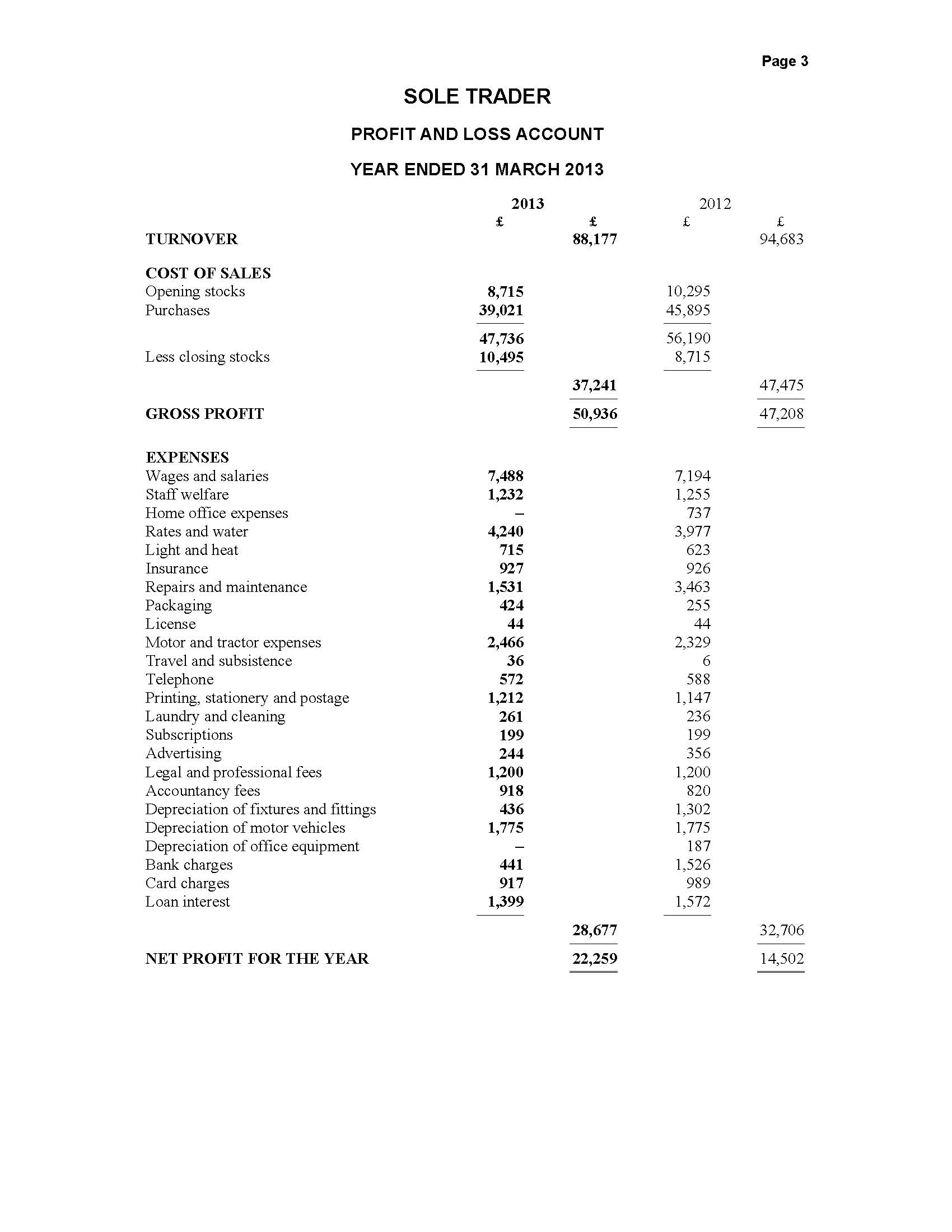

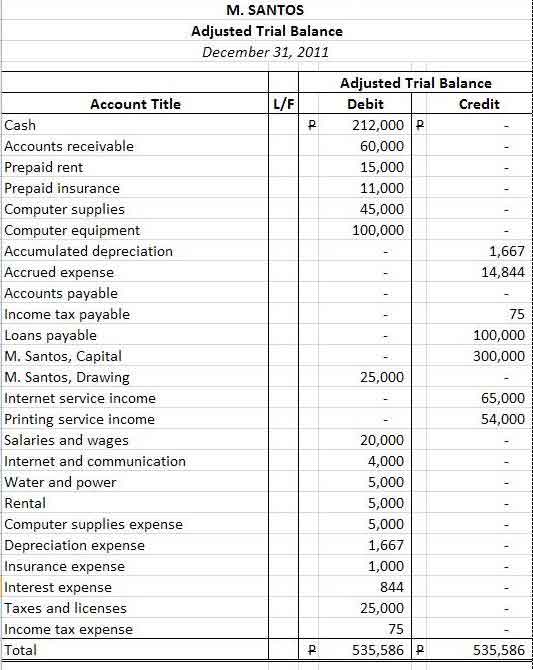

From the following trial balance of s madondo, extracted after one year’s trading, prepare a trading and profit and loss account for the year ended 31 december 20x6 and a balance sheet as at 31 december 20×6.

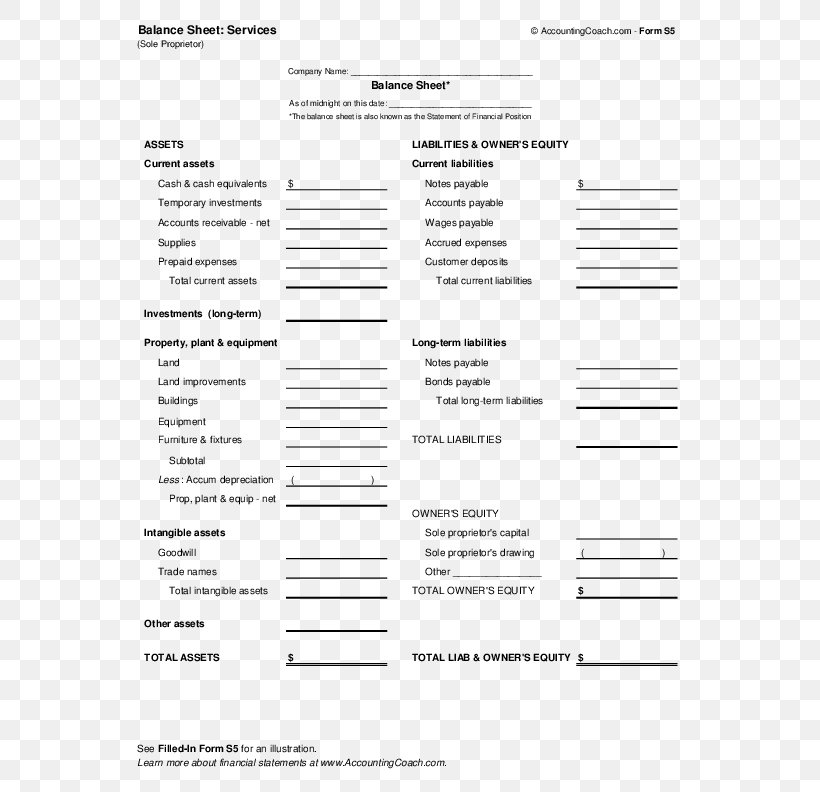

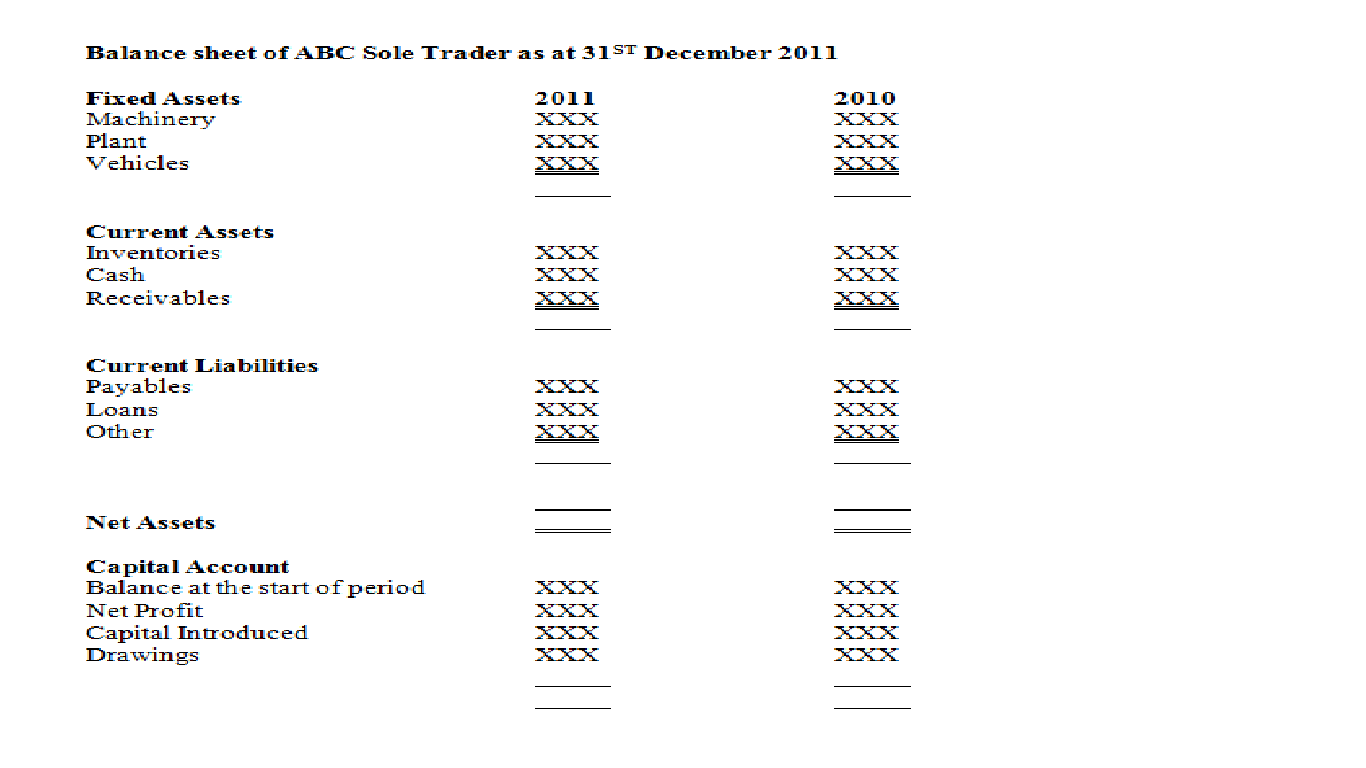

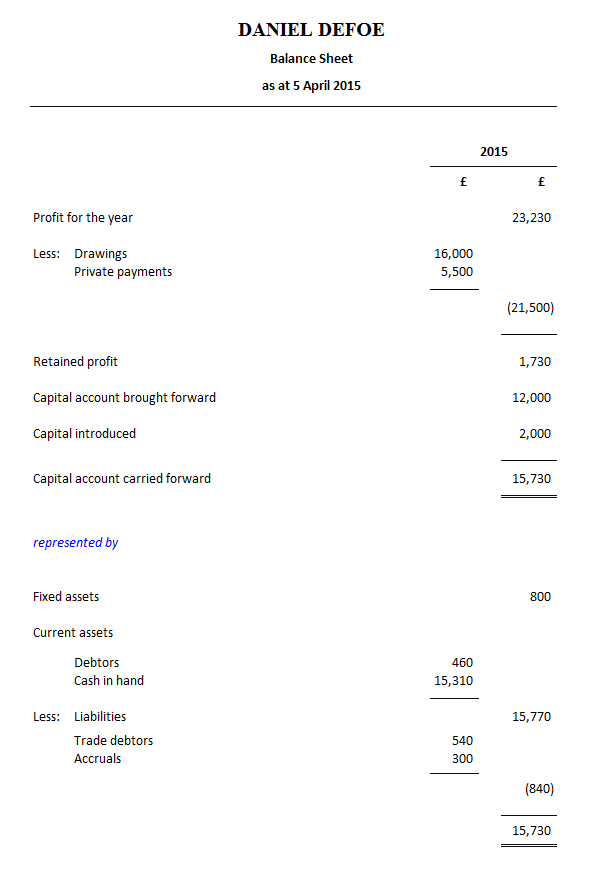

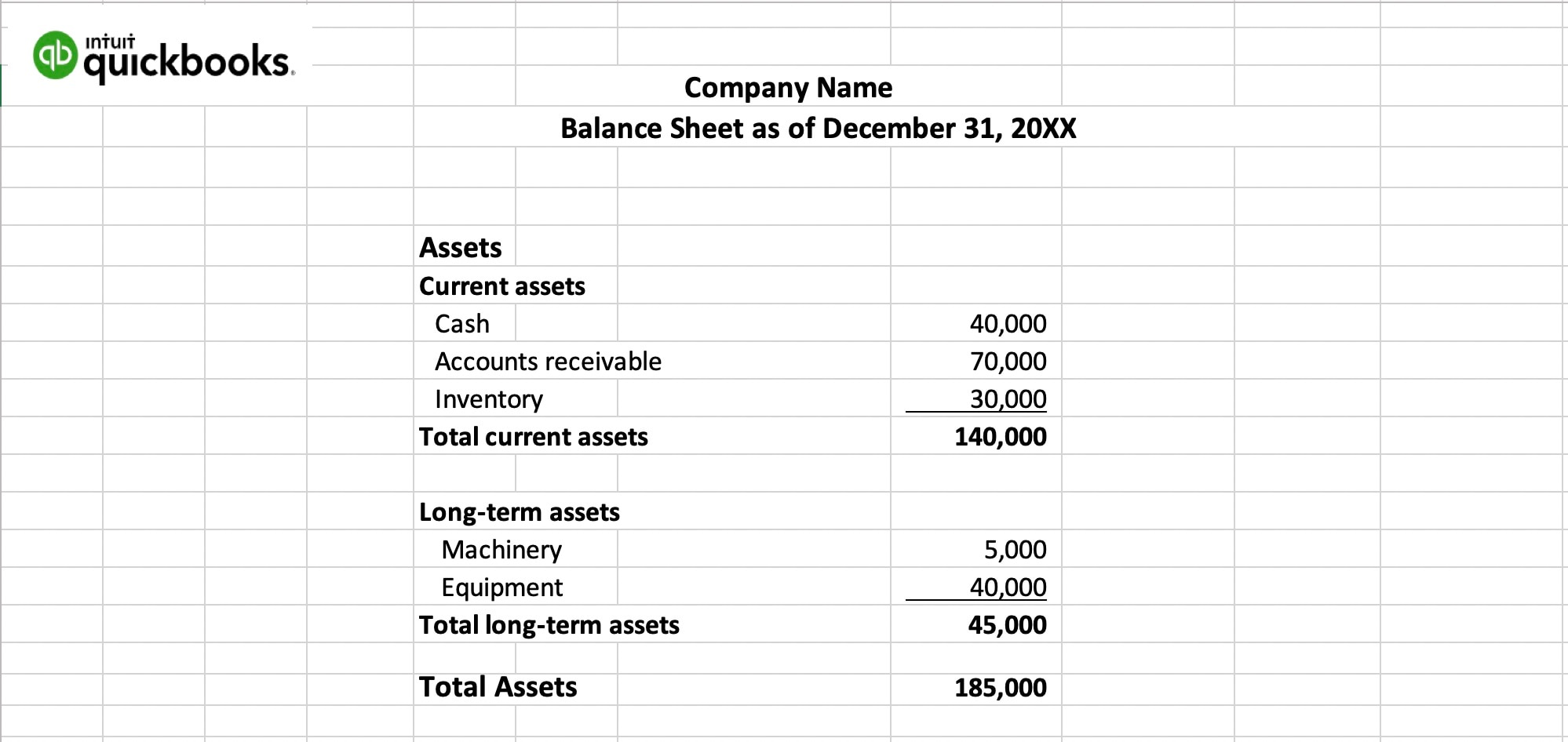

Adjusted balance sheet sole trader balance sheet example. If you can handle the financial statements of sole traders, with adjustments for accruals, prepayments, depreciation and the like, it is an easy matter to add the requirements for partnership accounts. A balance sheet is a snapshot of what a business owns (assets) and owes (liabilities) at a specific point in time. If he has a motor vehicle and some equipment, these will be recorded on the tax comp.

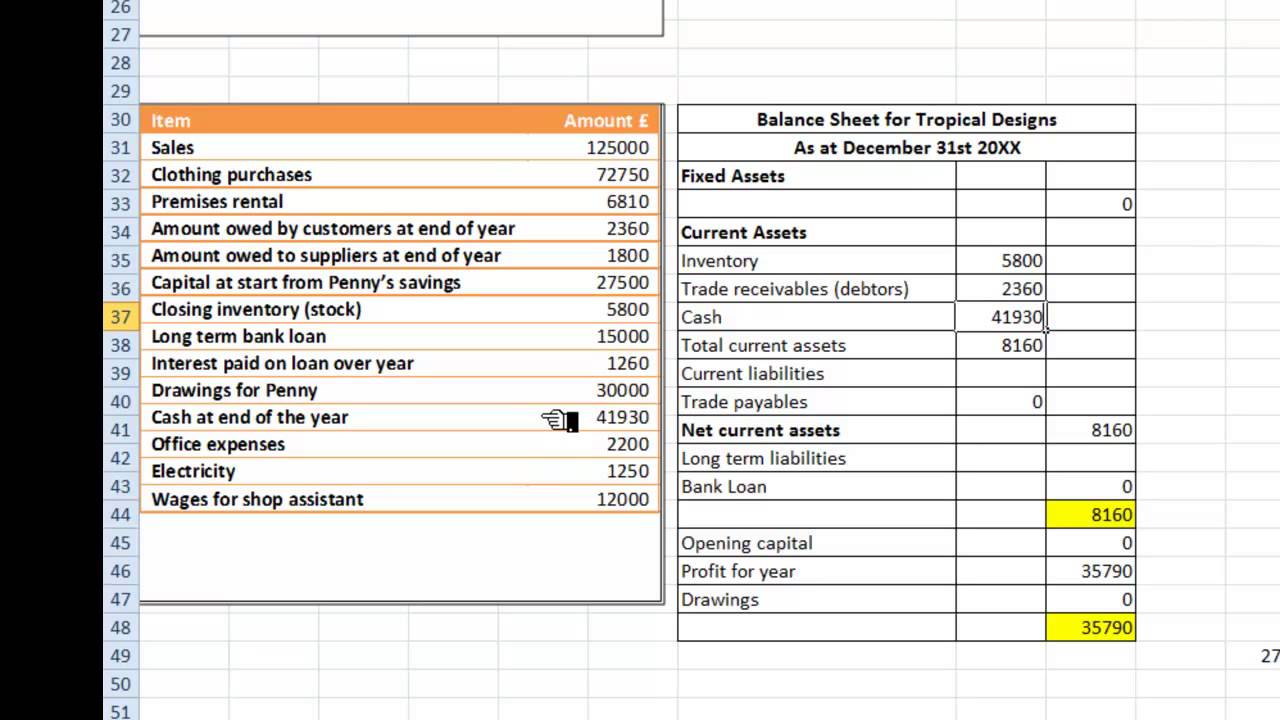

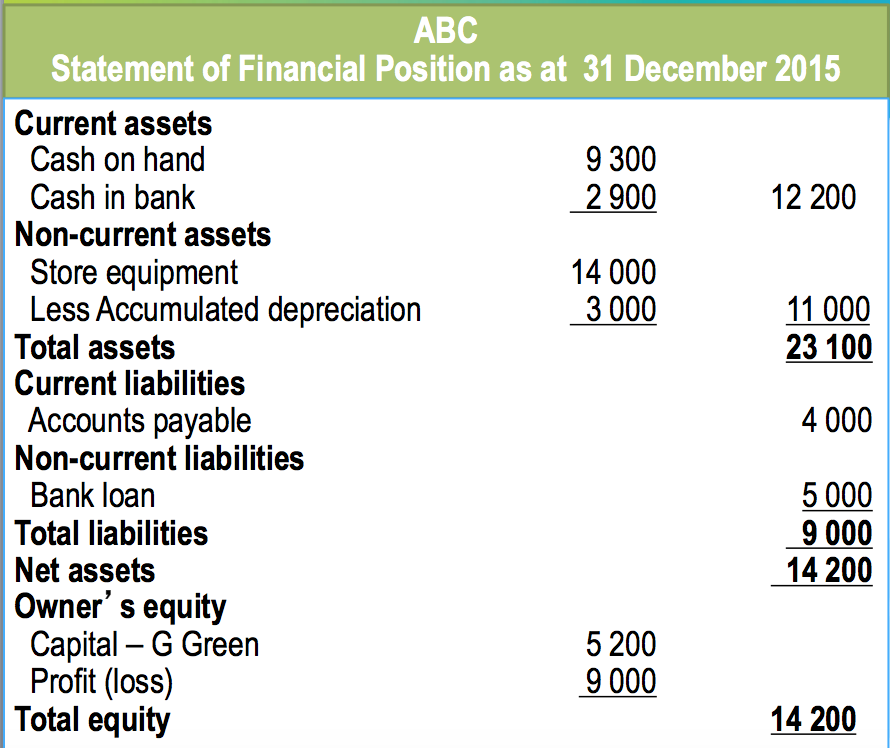

If your balance sheet does not balance, look through the example again and make certain all the figures have the right number of ticks. Assets = capital + other liabilities in the case of the balance sheet for candlewick enterprises, the only asset owned by the business is the cash in the business bank account.

It shows total assets = total capital + total liabilities. Cash, accounts receivable, office supplied, prepaid insurance, equipment, accumulated depreciation (equipment), accounts payable, salaries payable, unearned lawn mowing revenue, and. A balance sheet shows your business assets (what you own) and liabilities (what you owe) on a particular date.

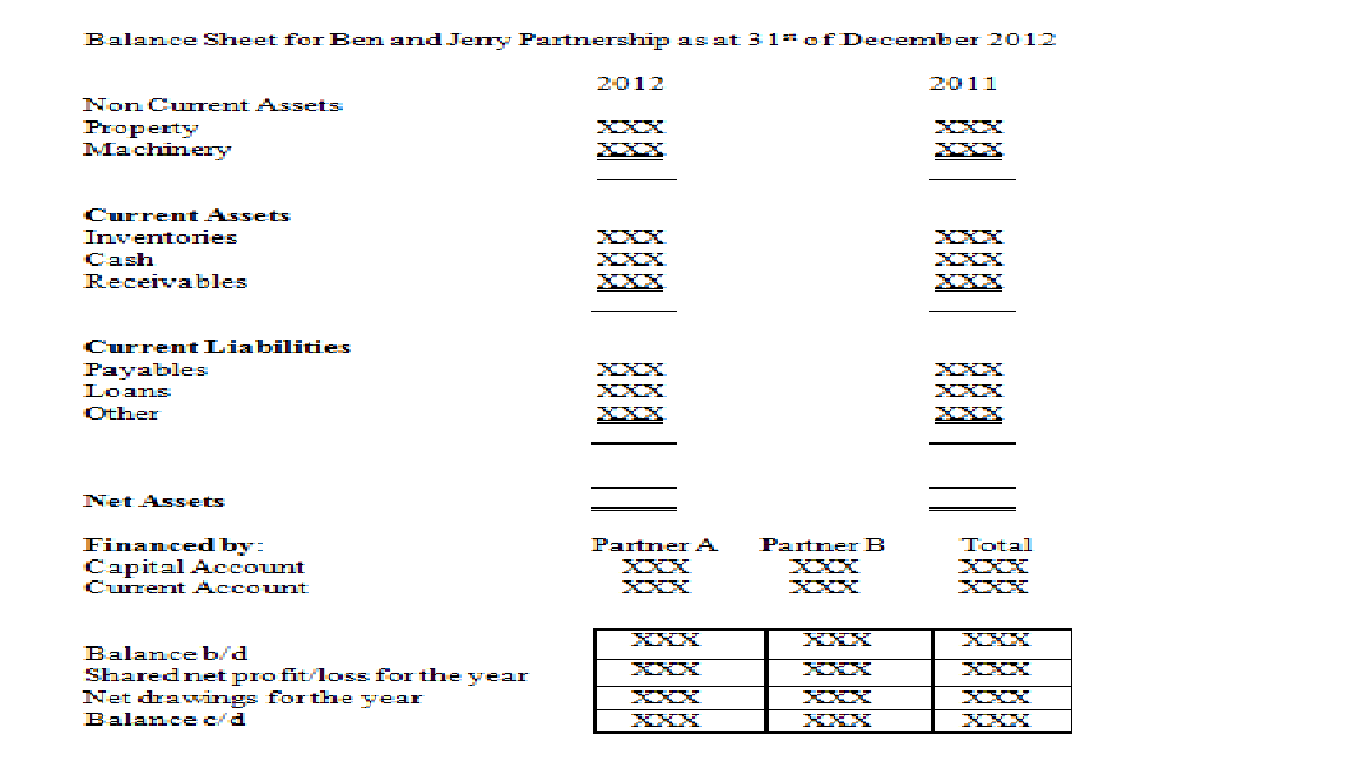

Balance sheet (a) there is a separate capital account for each partner instead of just the one required for a sole trader Identify which financial statement each account will go on: Current assets are shown at their historical costs.

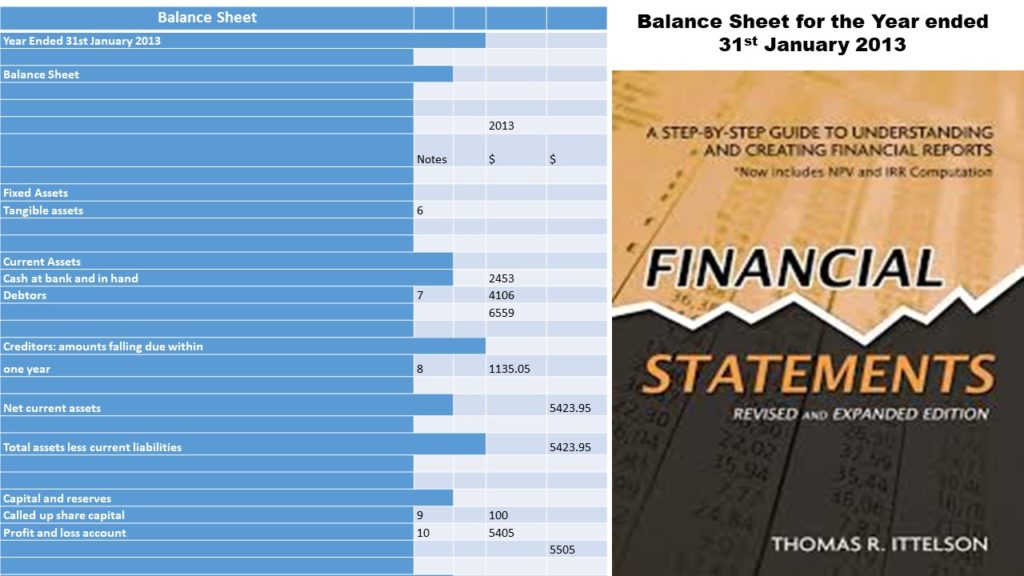

Simple balance sheet example 1. Use our template to set up a balance sheet and understand your business's financial health. Revenue set of accounts, including the detailed profit and loss account.

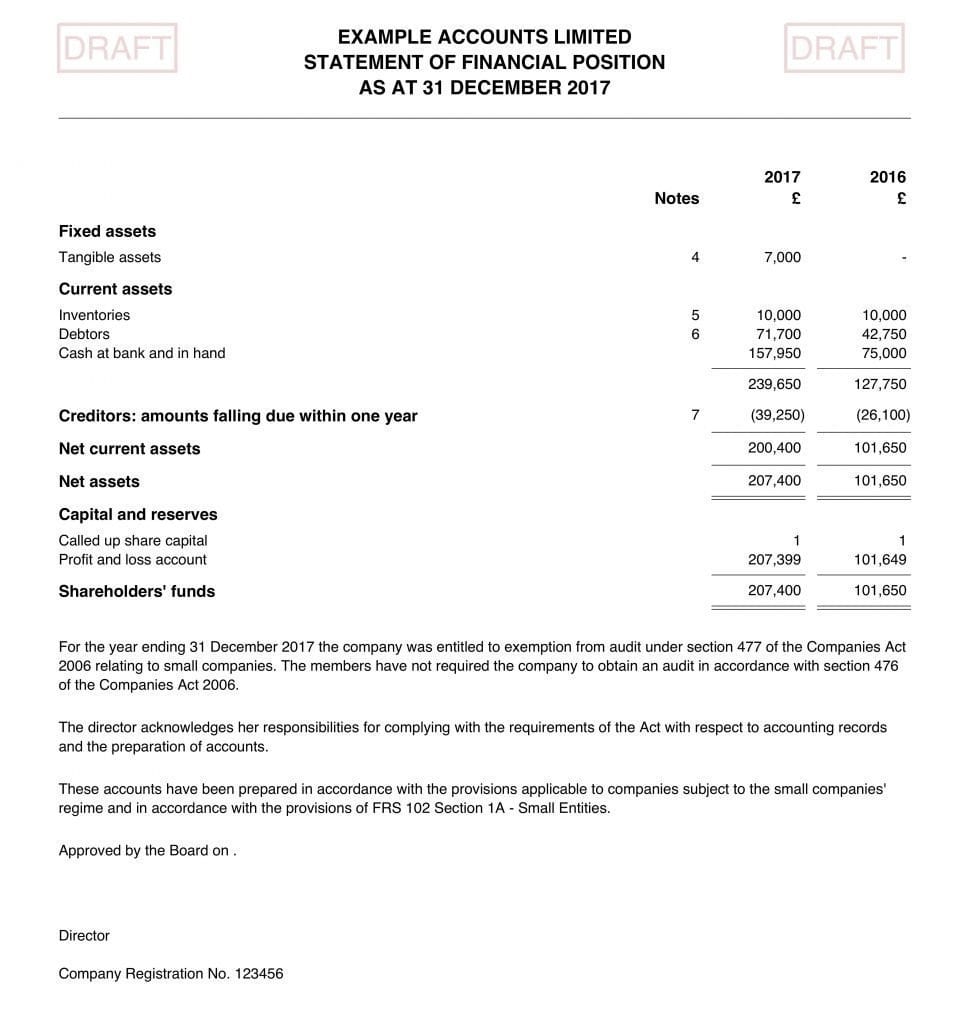

The balance sheet of a sole trader jill hussey & roger hussey chapter 121 accesses part of the macmillan business masters book series (mmsb) abstract If you can handle the financial statements of sole traders, with adjustments for accruals, prepayments, depreciation and the like, it is an easy matter to add the requirements for partnership accounts. Shows vat, fixed assets, bank accounts, and accruals, are these balances brought into the limited company via the director's loan account even if they weren't generated by the limited company?

Ive always done them on paper before but since using a personal budget spreadsheet from this website i'd like to use one for my business. Position of the sole traders the owner contributed all capital (borrowed capital or own capital) to A balance sheet will be a complete waste of time.

Balance sheet, statement of retained earnings, or income statement. Sole trader set of accounts. Hi, has anyone got a link to a simple but decent free spreadsheet to use for my accounts?

The balance sheet summarises the. Sample republic of ireland micro company (frs 105) sets of accounts with examples for all options available: Also learn the classifications of assets and liabilities and the order by which they are put in the balance sheet.

It is made up of the following three sections: Understand the items to be shown in the balance sheet. 5 comparing sole trader and company financial statement formats.

![Patrice Benoit Art [View 23+] 24+ Template For Business Balance](https://w7.pngwing.com/pngs/250/982/png-transparent-balance-sheet-business-service-sole-proprietorship-business-template-text-service.png)