Who Else Wants Info About Profit And Loss Statement For Dummies Fillable Balance Sheet

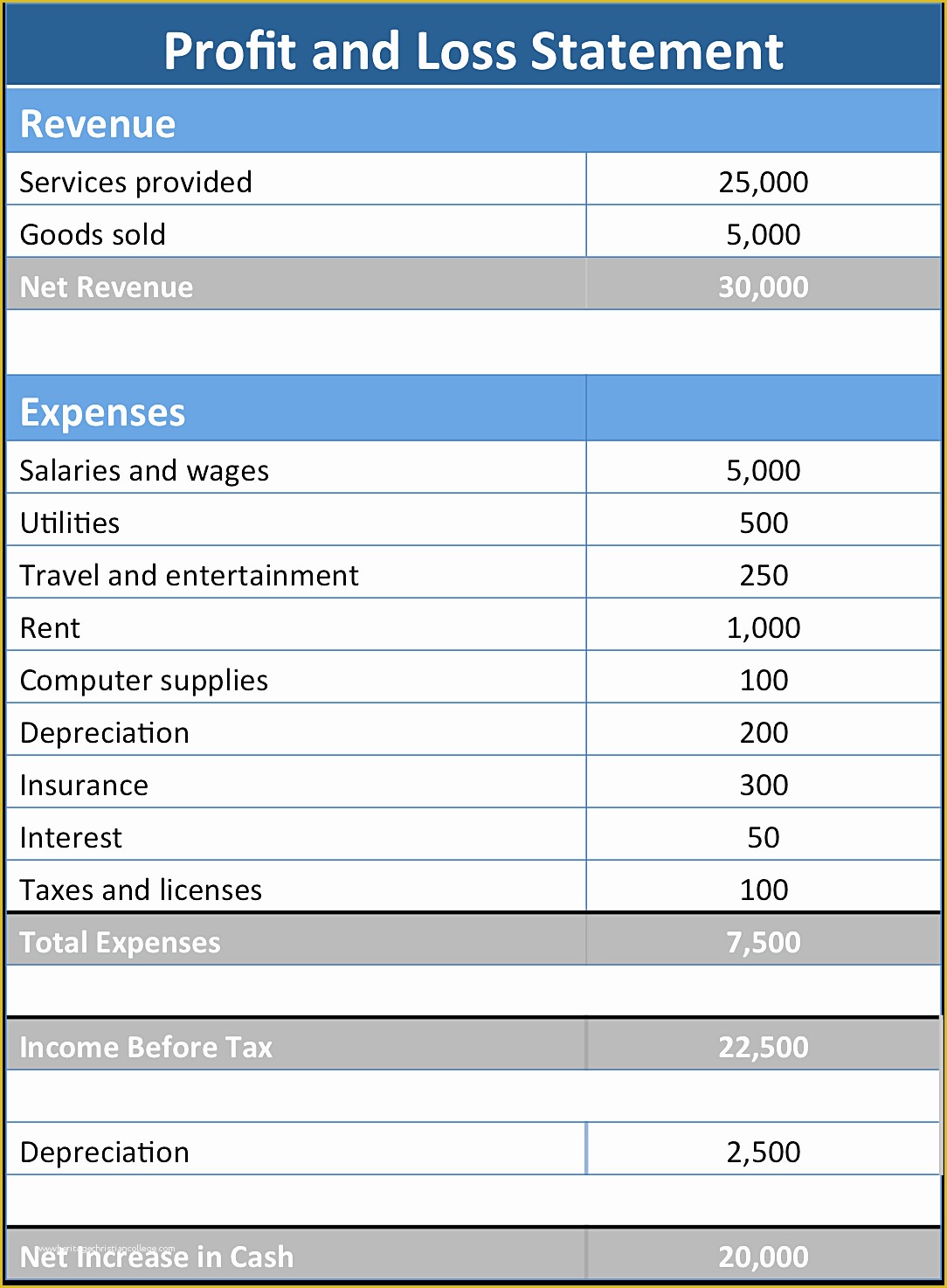

The final figure will show the financial performance and show if the business has made a profit or loss.

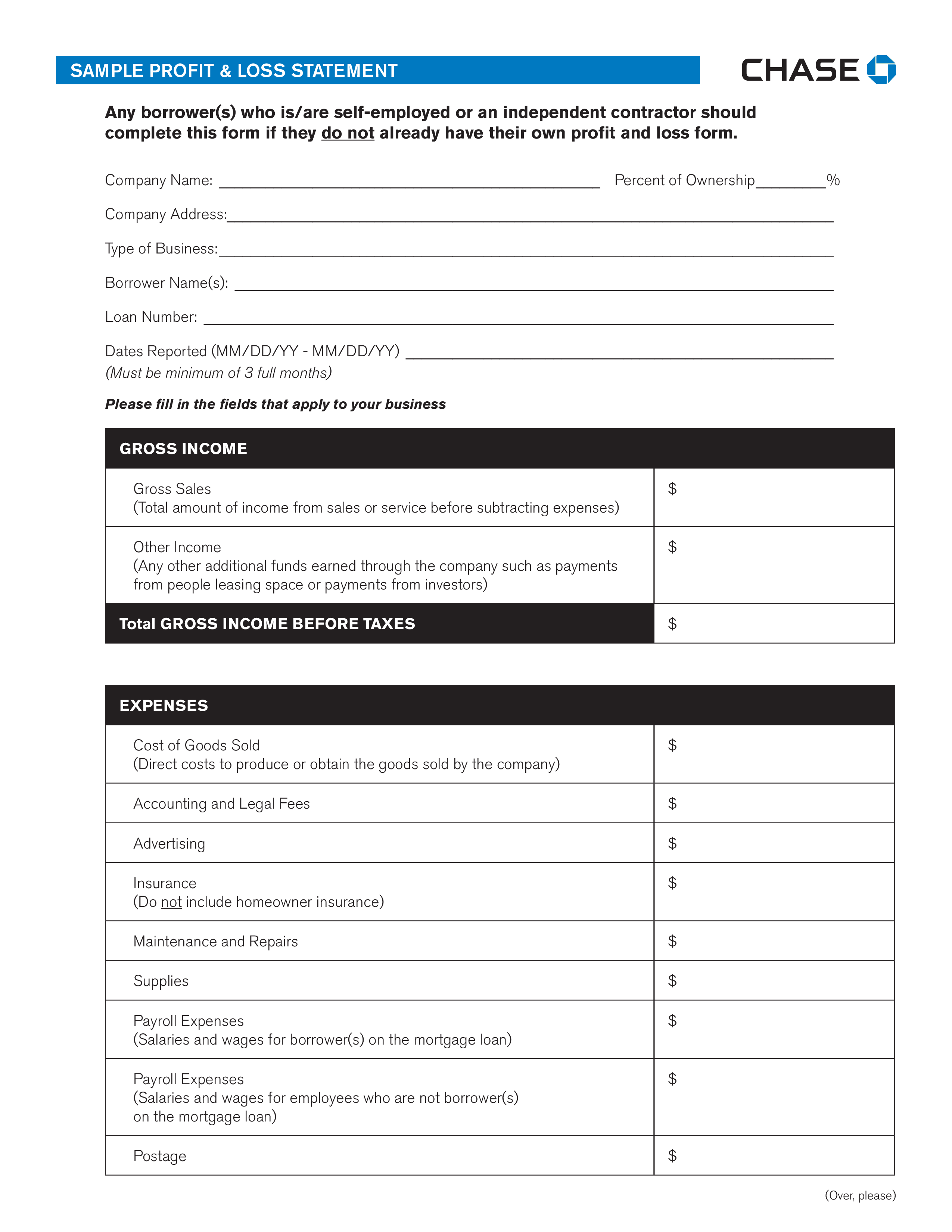

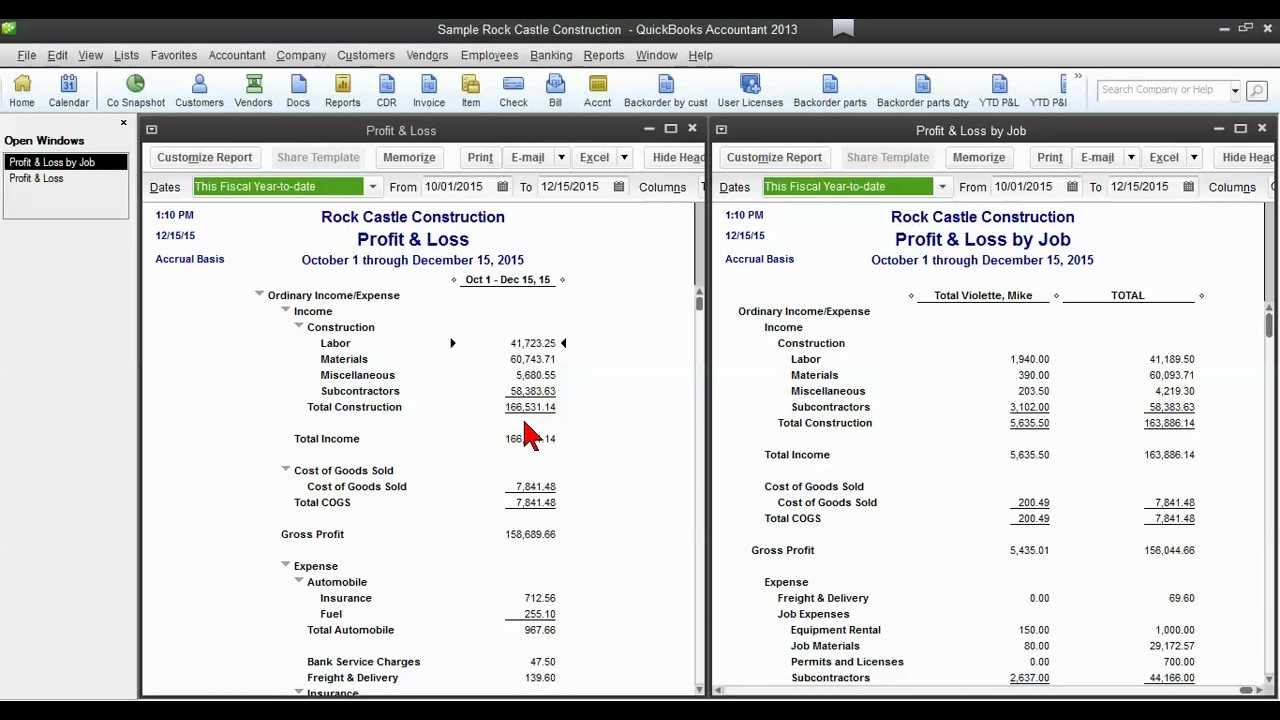

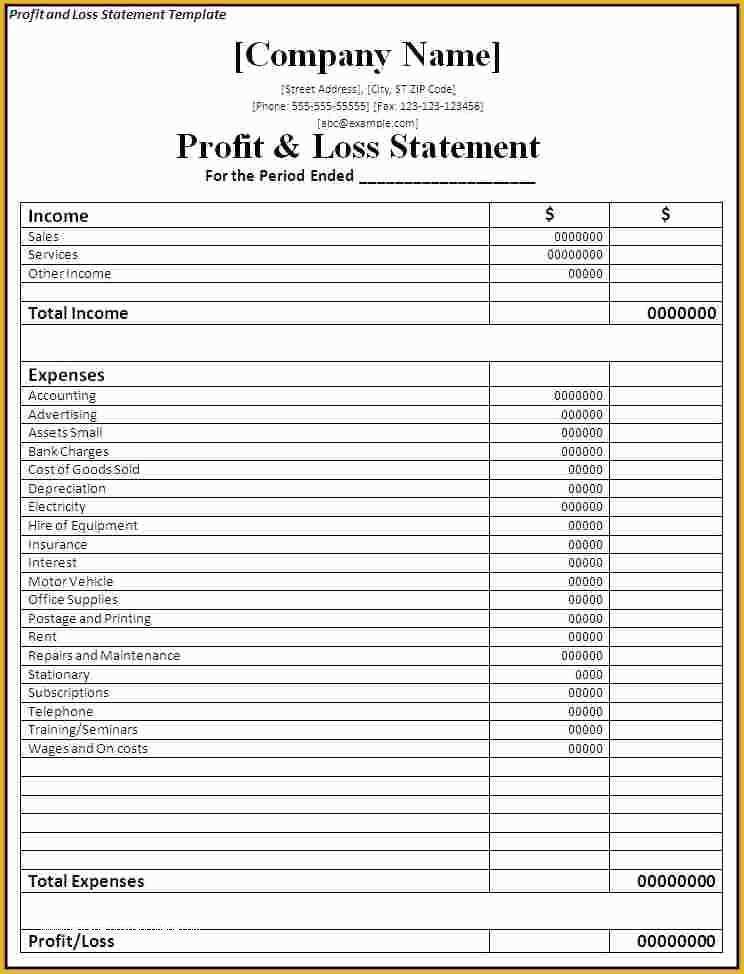

Profit and loss statement for dummies. How to read the income statement for profit and loss types by: Because a profit and loss statement is a financial document, there are simple math formulas that you can use to determine your gross margin, net operating profit, net profit before taxes, and your actual net profit. The p&l statement shows a company’s ability to generate sales, manage expenses, and create profits.

A p&l statement (sometimes called a statement of operations) is a type of financial report that tells you how profitable your business was over a given period. Profit performance reports prepared for a business’s managers typically are called p&l (profit and loss) reports. Profit and loss (p&l) management is the process of determining how to cut costs and increase revenue.

The result is either your final profit (if. Inside a business, but not in its external financial reports, the income statement is commonly called the profit and loss statement, or p&l report. Sales revenue > cash and debtors cost of goods sold expense < stock operating expenses > cash operating expenses < prepaid expenses operating expenses > creditors operating expenses > accrued expenses.

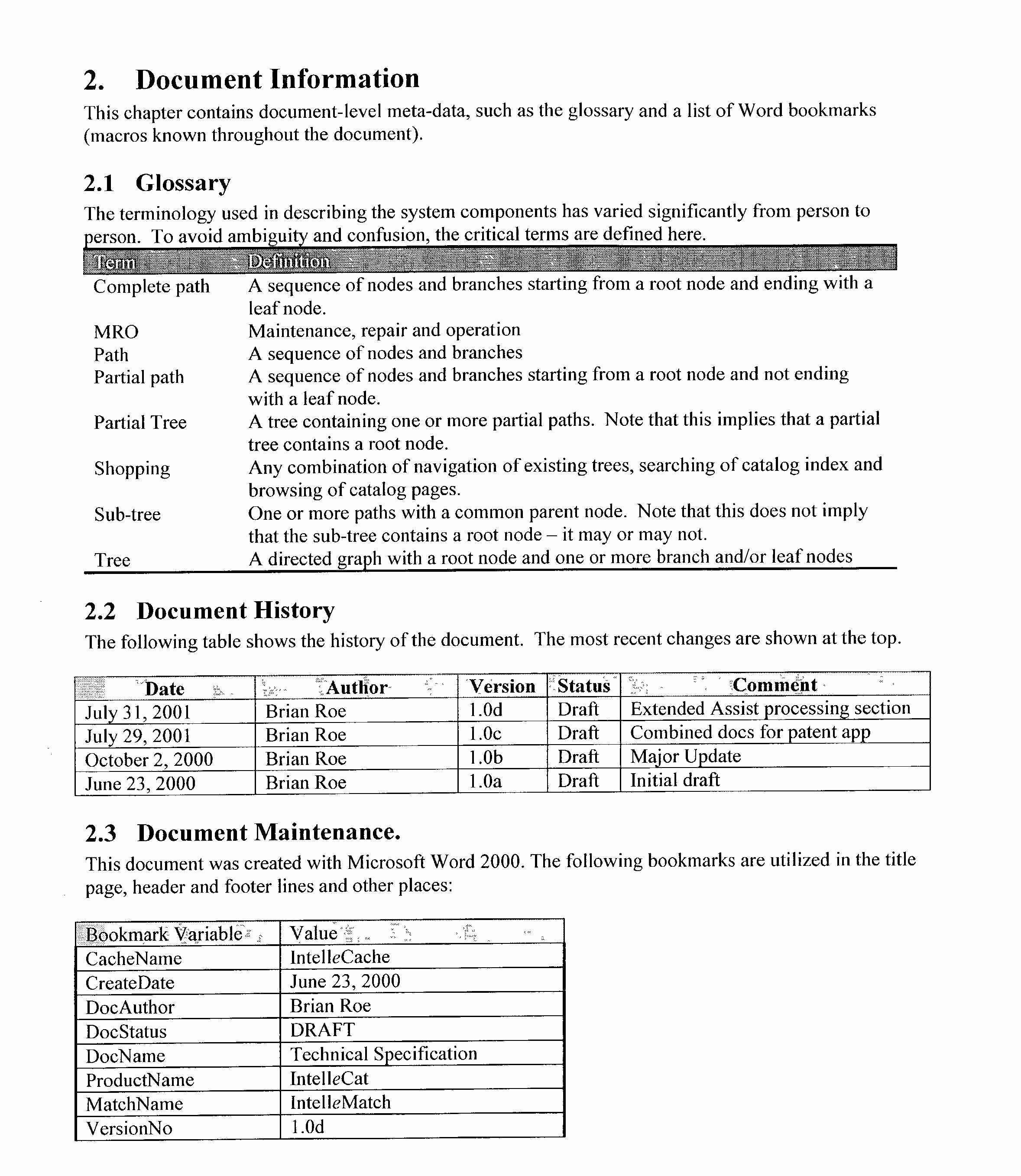

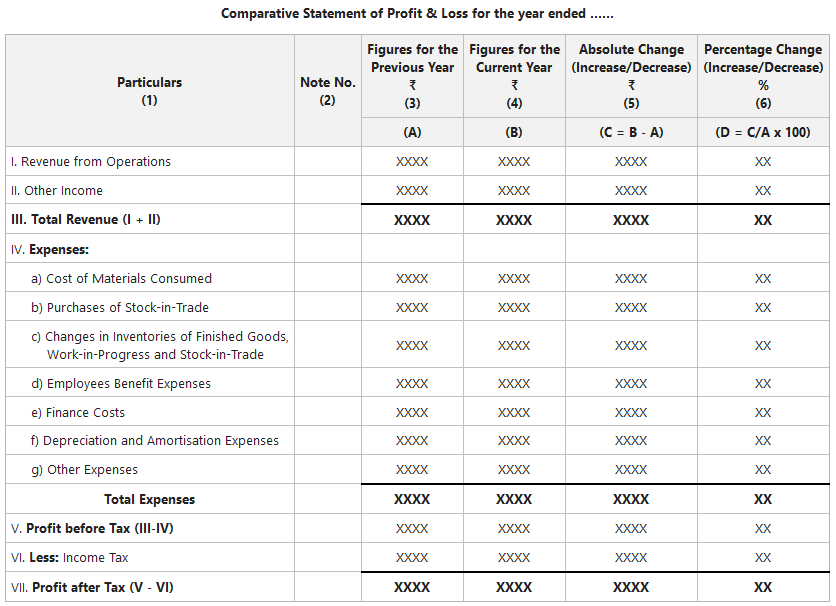

The following list shows the connections between the profit & loss statement and the balance sheet accounts. The oil and gas company's earnings statement showed that adjusted net income totalled 513 million euros ($556 million) in. An income statement, also known as a profit and loss (p&l) statement, summarizes the cumulative impact of revenue, gain, expense, and loss transactions for a given period.

A profit and loss statement is a straightforward way to summarise expenses and income during a period of time. Since your income statement breaks down your business’s costs and gains, it offers key insights into growing your revenue and. The profit and loss report is an important financial statement used by business owners and accountants.

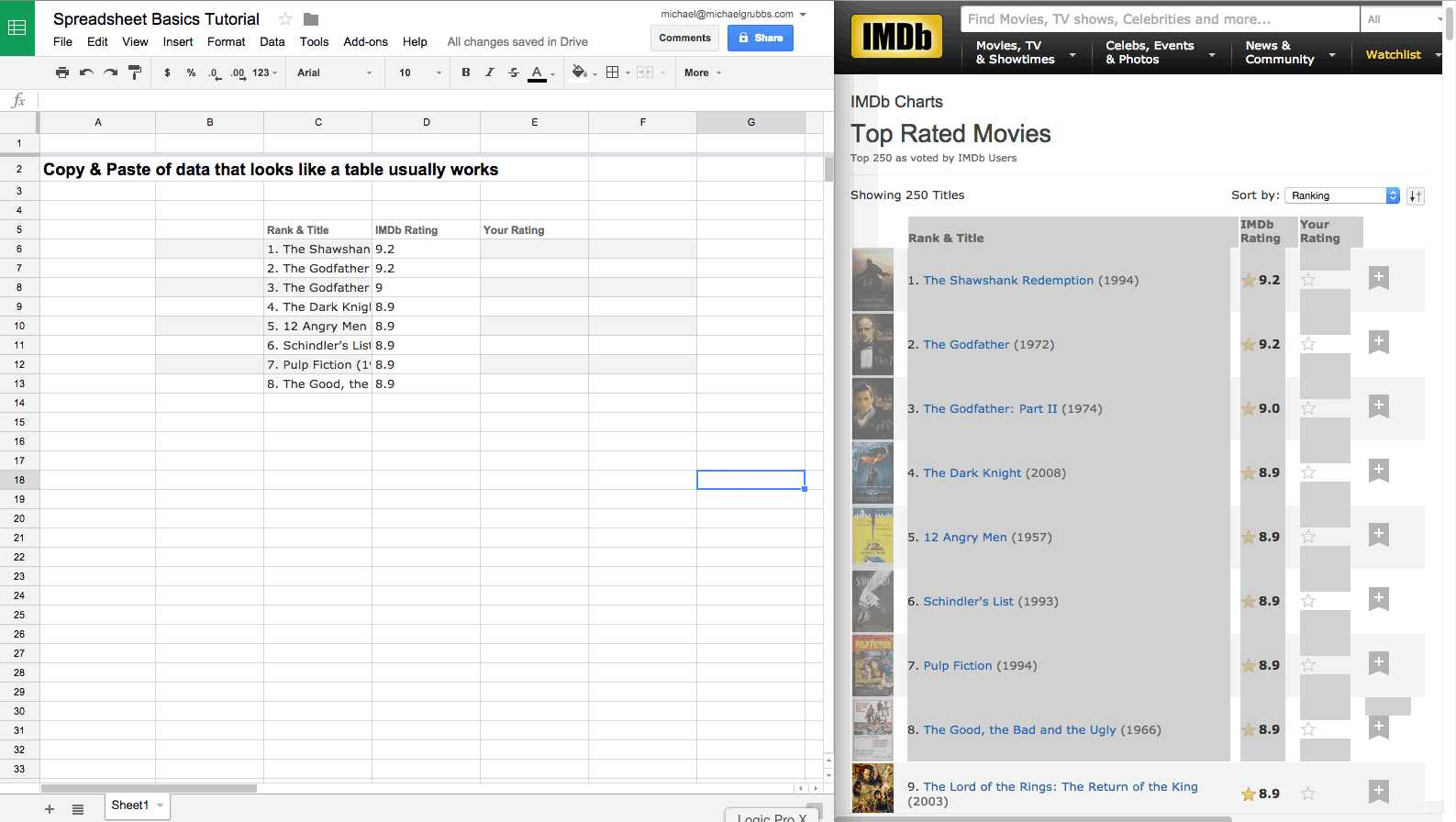

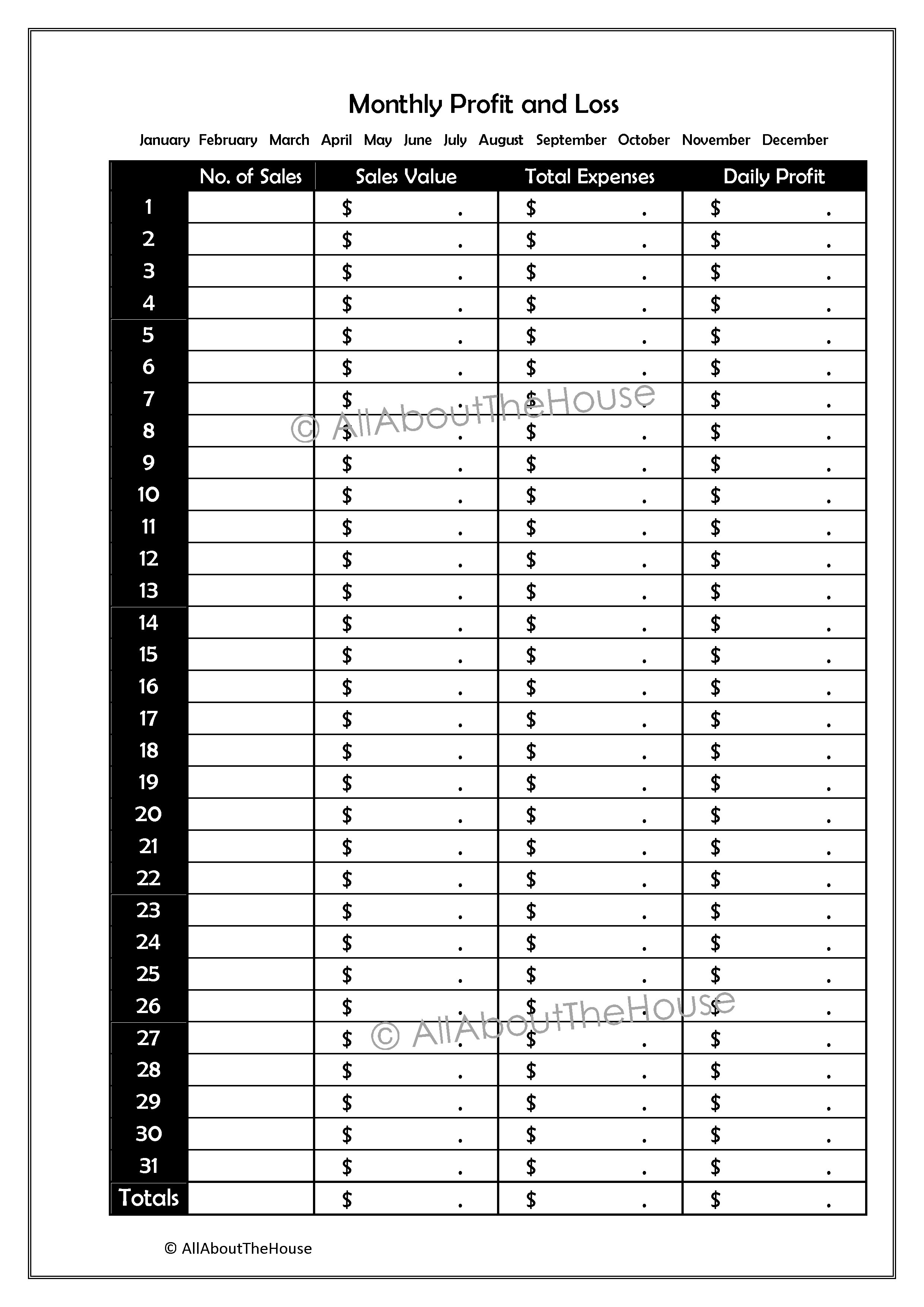

Revenue details the income from sales and activity for the reporting period. Analysing profit and loss statements across various periods can offer detailed insight into a business' costs. These reports are prepared as frequently as managers need them, usually monthly or quarterly — perhaps even weekly in some businesses.

How to read a p&l report. You can start that process by looking at your business’s profit and loss statement (aka income statement). Create the report either annually, quarterly, monthly or even weekly.

Calculate revenue the first step in creating a profit and loss statement is to calculate all the revenue your business has received. Business management business management profit and loss statements explained (+ templates and examples) jury duty leave laws by state: It captures how money flows in and out of your business.

It shows your revenue, minus expenses and losses. These profit and loss statements help owners understand the financial health of a business. It really is that simple.

The oil and gas company's earnings statement showed that adjusted net income totalled 513 million euros ($556 million) in. It shows all the company’s income and expenses incurred over a given period. A profit and loss statement (p&l) is an effective tool for managing your business.