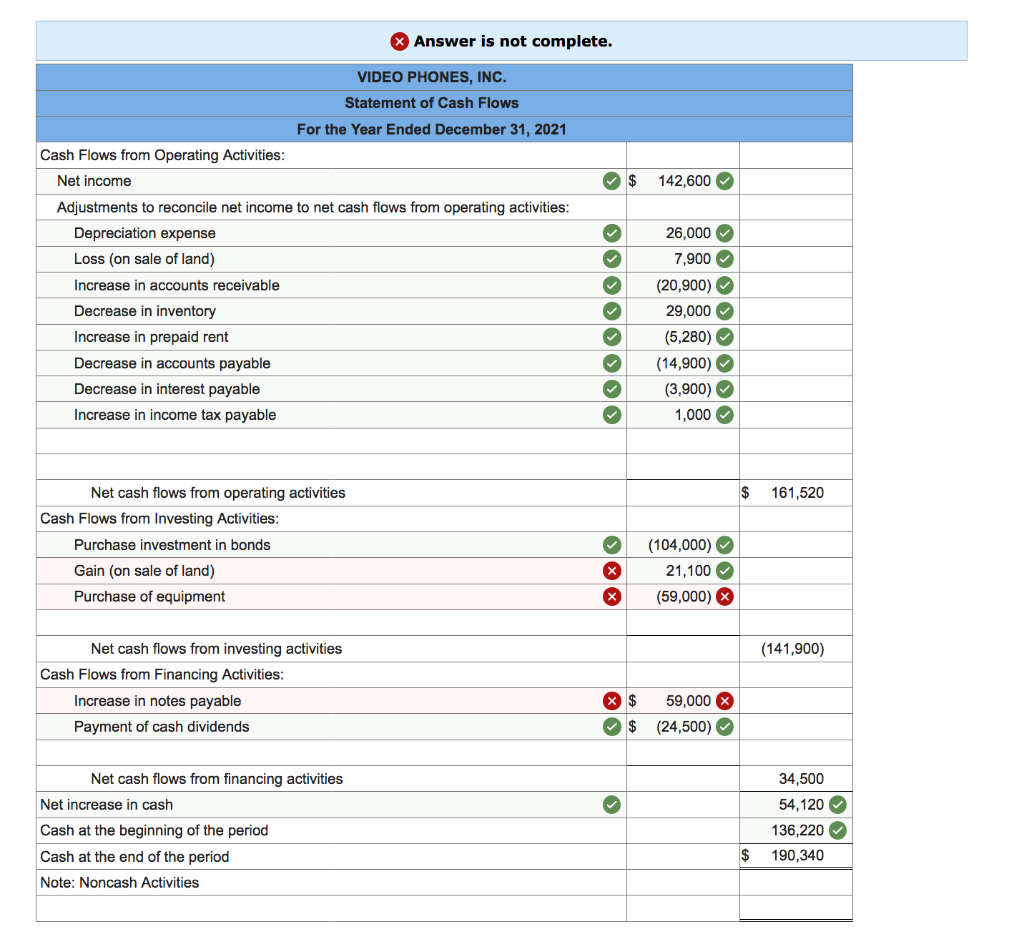

Lessons I Learned From Tips About Prepaid Expenses On Income Statement Balance Sheet Ratio Formula

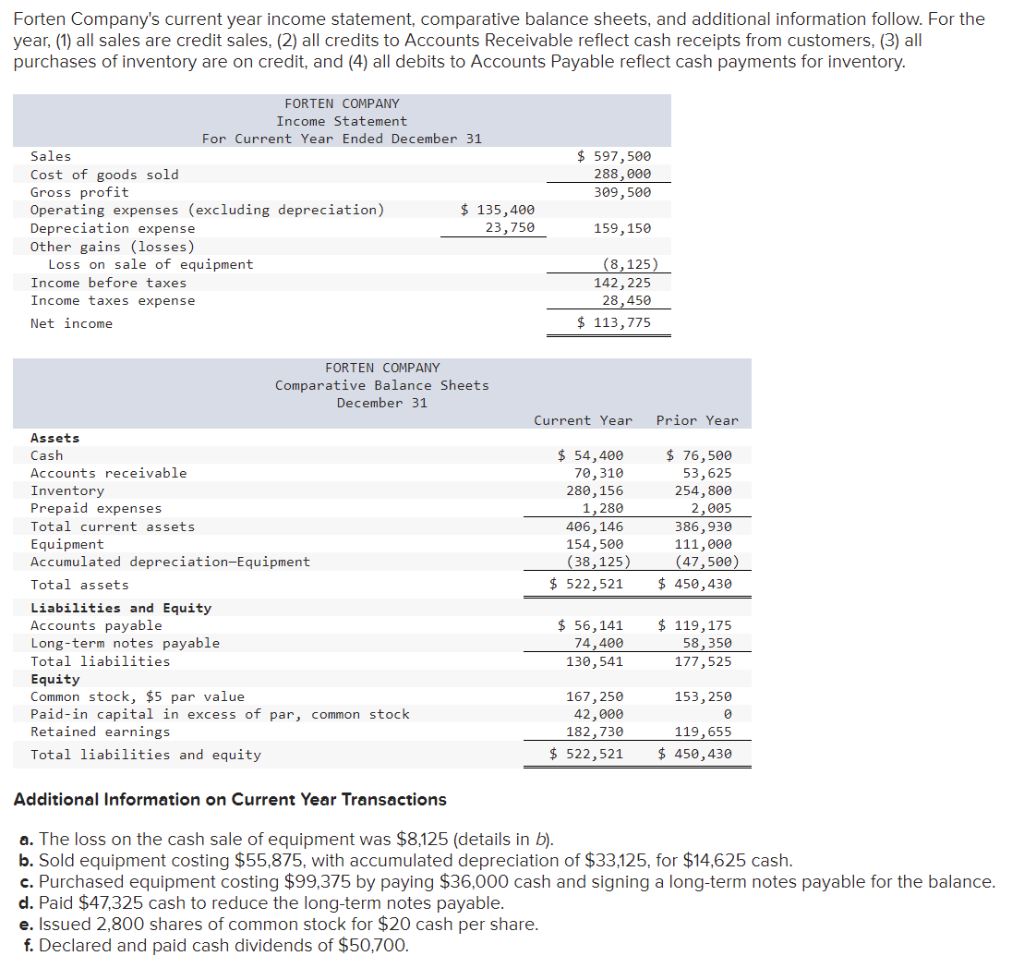

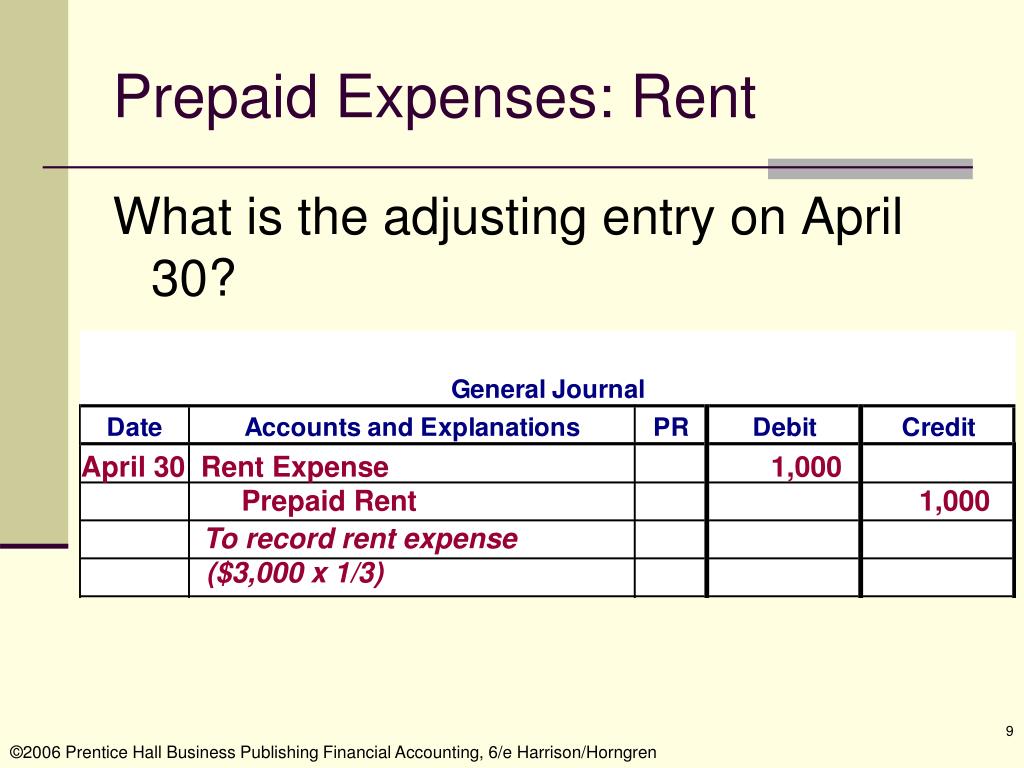

On the income statement, rent expense is recorded, which increases expenses, and in turn, decreases net income.

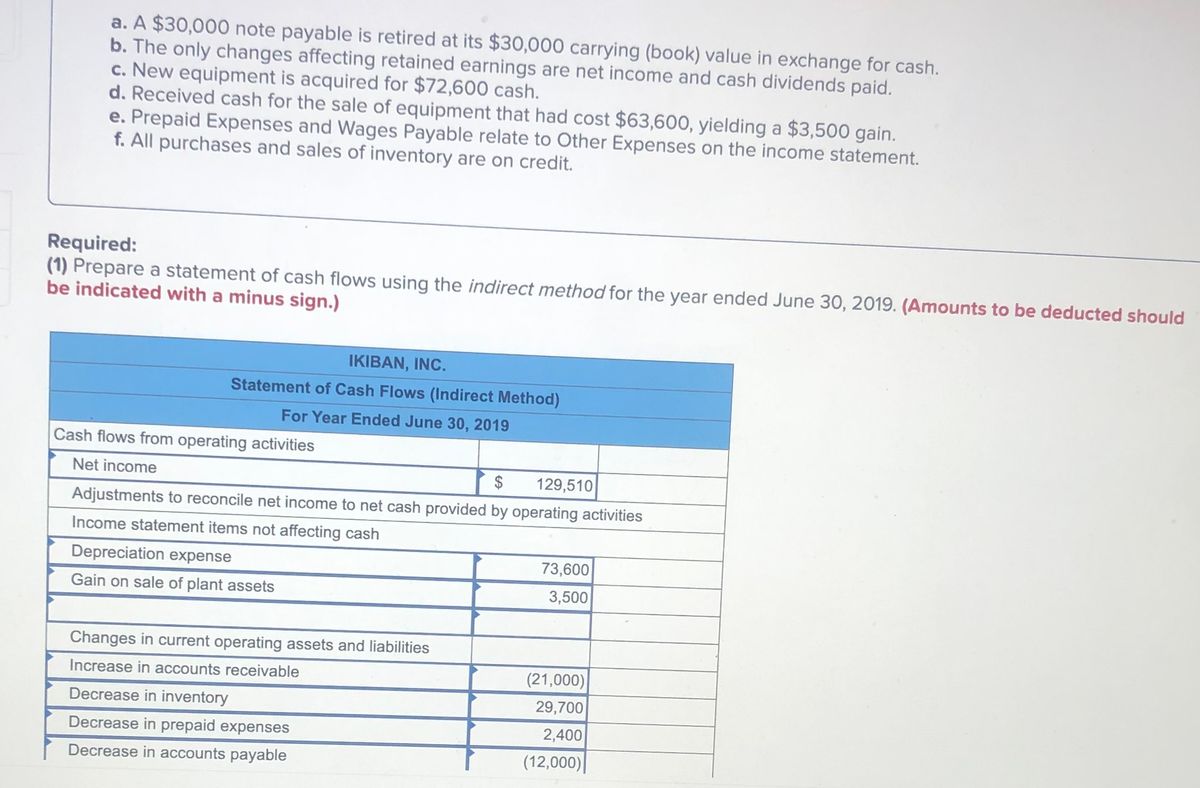

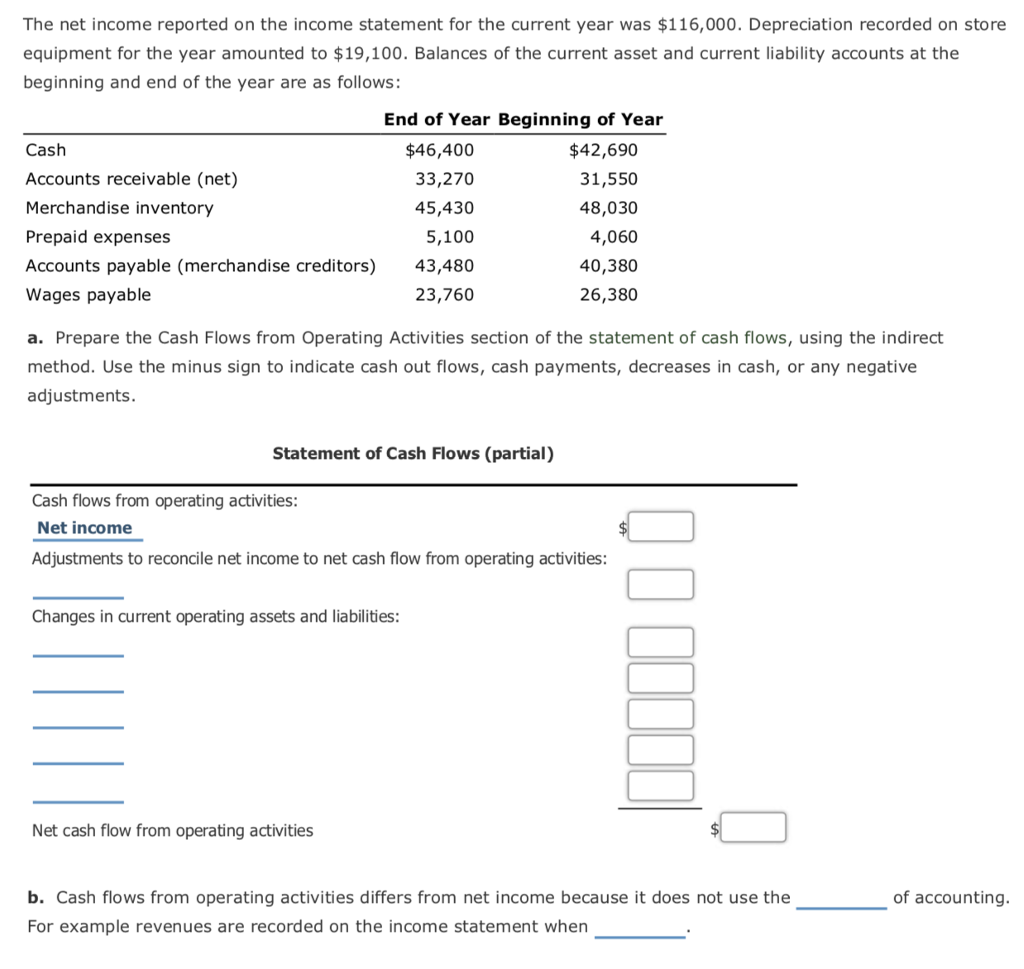

Prepaid expenses on income statement. In accounting, prepaid expense is a current asset that occurs as a result of advance payment that we have made for goods or services that we will receive in the near future. Medical expenses are deductible only to the extent the total exceeds 7.5% of your adjusted gross income (agi). Under the accrual method, no expense is recorded until it is incurred.

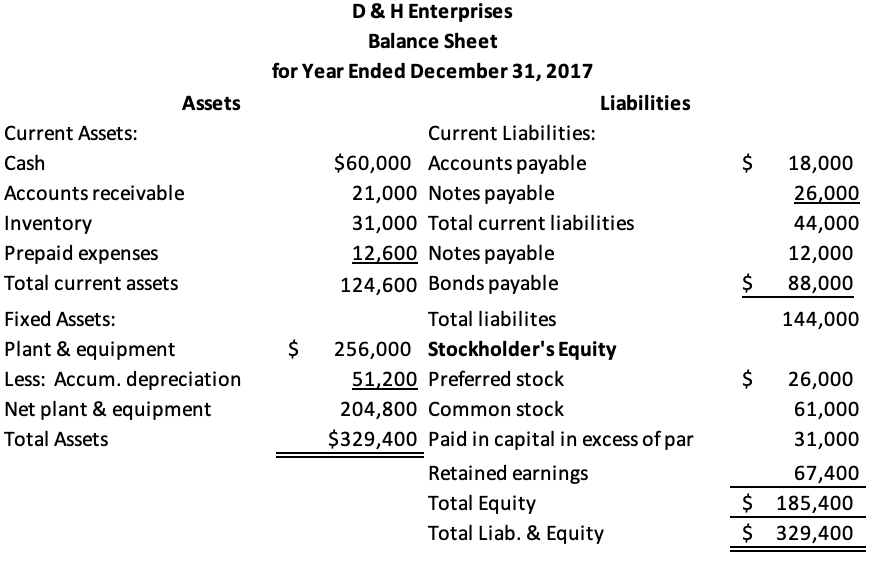

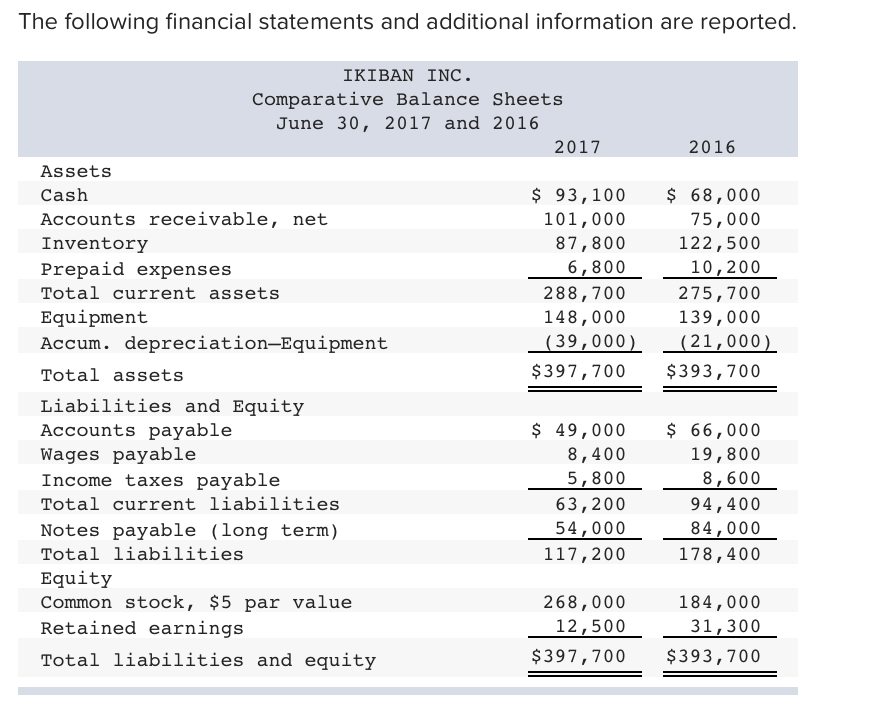

Impact on financial statements: They also impact the accuracy of. Prepaid expenses refer to payments made in advance for goods or services that a company will receive or use in the future.

This is so that the business can. Their primary purpose is to allocate. For example, if you itemize,.

Initially, prepaid expenses increase the assets of a company on the balance sheet. Instead, prepaid expenses are initially recorded on the balance sheet, and then, as the. But there is a floor.

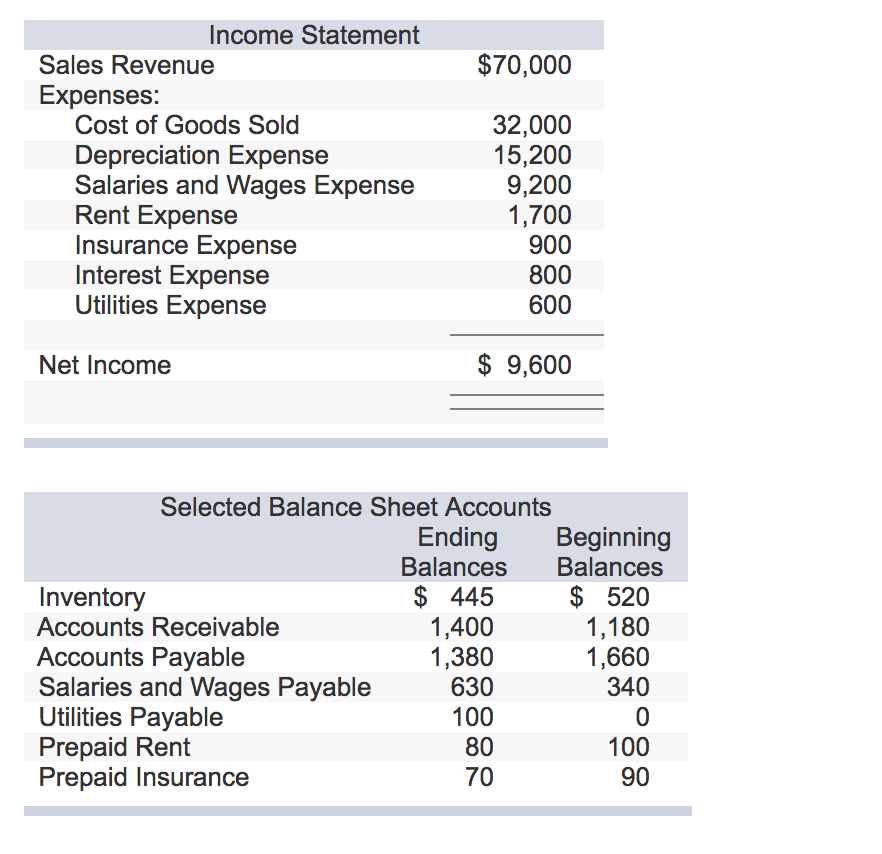

Prepaid expenses aren’t included in the income statement per. Prepaid expenses are first recorded in the prepaid asset account on the balance sheet as a current asset (unless the prepaid expense will not be incurred. As noted above, prepaid expenses are payments made for goods and services that a company intends to pay for in advance but will incur sometime in the future.

Under the accrual method, no expense is recorded until it is incurred. Balance sheet and opening entry stakeholders and their information requirement depreciation, bad debts and provision for bad and doubtful debts need for adjustment,. On the balance sheet, current assets decrease as prepaid.

For example, refer to the. Add up all your gains then deduct your losses. Prepaid expenses are important in accounting because they represent a prepaid asset that will be used in future periods.

Effect of prepaid expenses on financial statements. Simultaneously, as the company’s recorded balance. When do prepaid expenses hit the income statement?

The $2,000 you expensed for january’s rent appears on your income statement as rent expense, while your prepaid rent asset account is reduced by $2,000. In layman’s terms, prepaid expense. Prepaid expenses represent prepayment of an expense and hence it is debited and the cash account is credited.

Prepaid expenses are incurred for assets that will be received at a later time. When do prepaid expenses hit the income statement? Examples of prepaid expenses include insurance, rent, leases, interest, and taxes.

:max_bytes(150000):strip_icc()/dotdash_Final_How_Are_Prepaid_Expenses_Recorded_on_the_Income_Statement_Oct_2020-06-7efbf5b828c64e319cca3507cd3210bf.jpg)

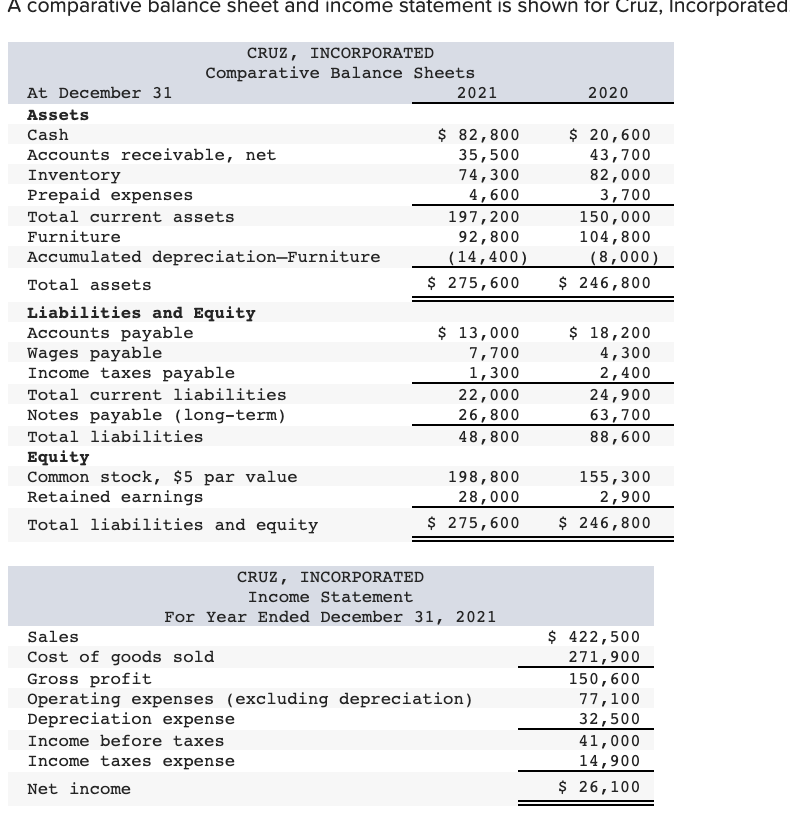

![[Solved] The following financial statements and ad SolutionInn](https://s3.amazonaws.com/si.experts.images/questions/2021/02/60225803e72ed_1612863490510.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_How_Are_Prepaid_Expenses_Recorded_on_the_Income_Statement_Oct_2020-03-8b430eba78534c66be0eb416932fe80e.jpg)