Peerless Tips About Equation For Ending Retained Earnings Ytd P&l Template

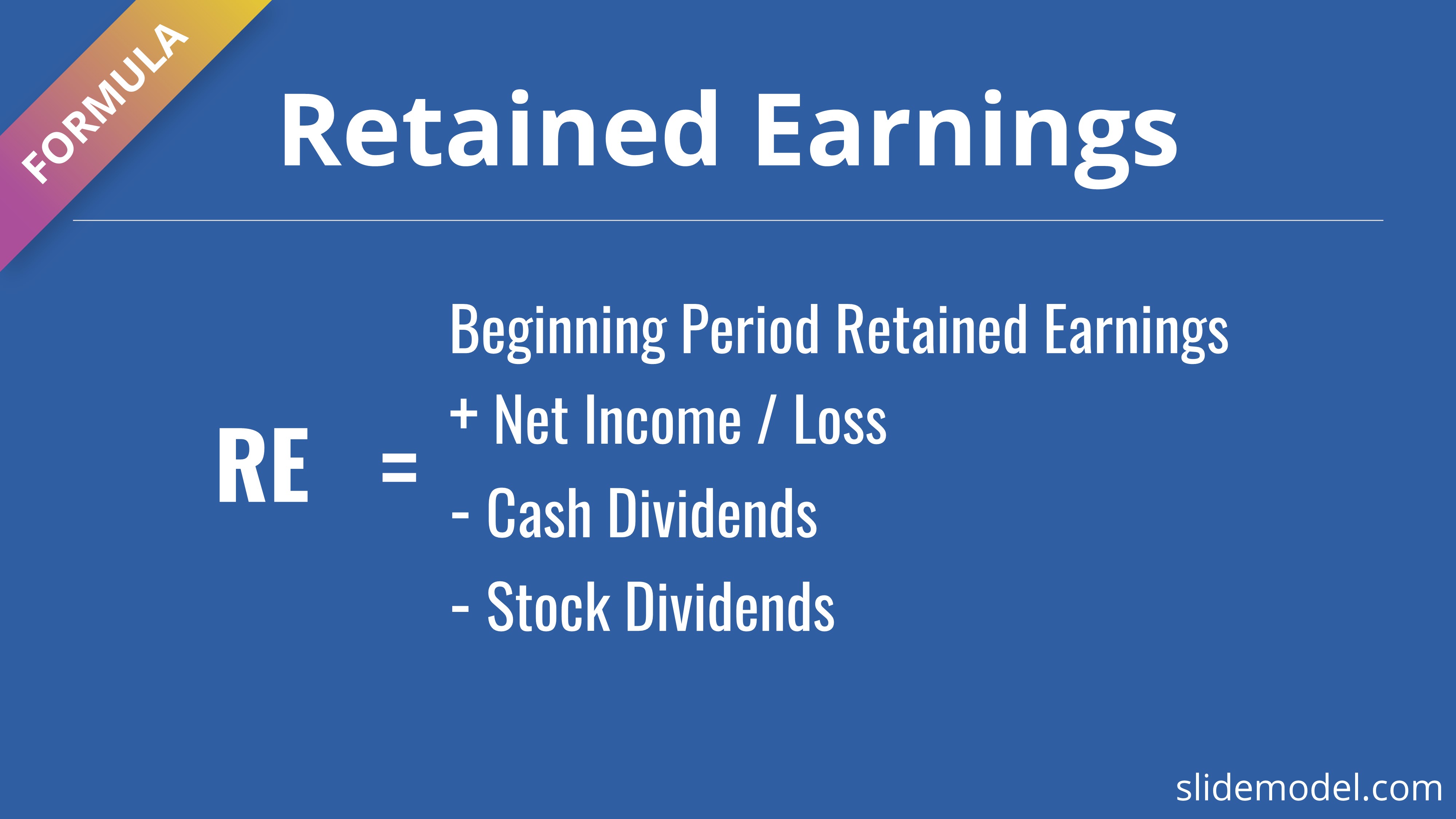

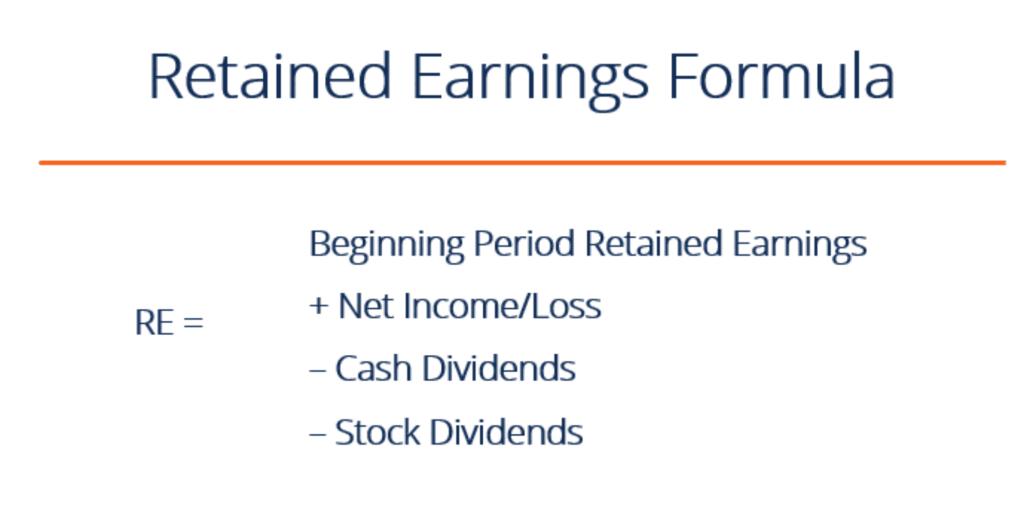

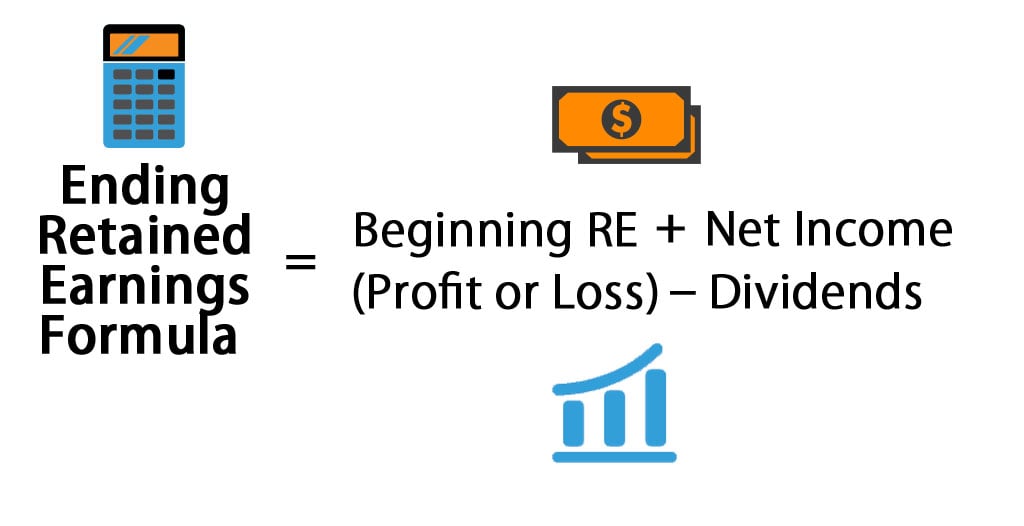

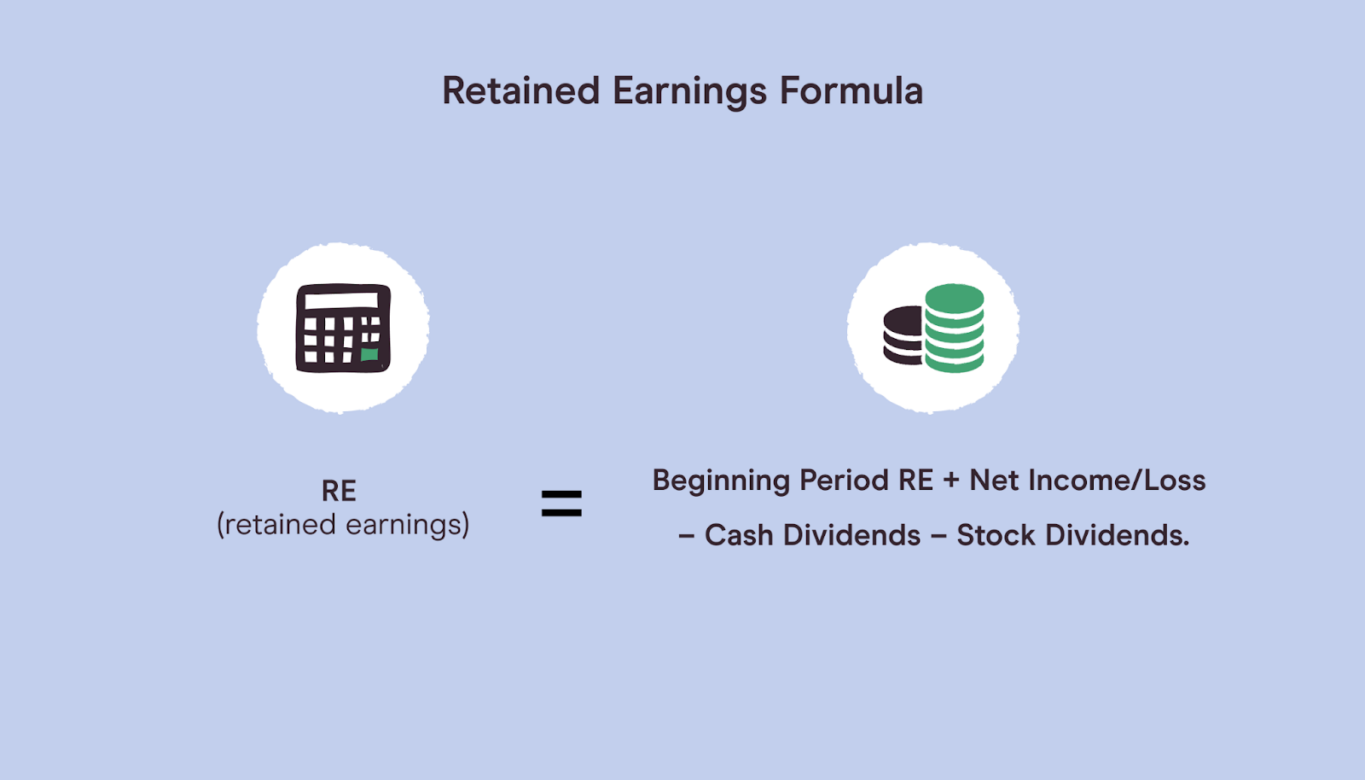

The formula for the company's retained earnings at the end of the accounting period would be as follows:

Equation for ending retained earnings. To calculate re, we’ll apply the formula: To calculate retained earnings subtract a company’s liabilities from its assets to get your stockholder equity, then find the common stock line item in your balance. Retained earnings formula and calculation.

To obtain the net income or earnings, it is recommended. To calculate ending retained earnings, we can use the below formula: By applying the formula (beginning retained.

This article explains how to find your company's retained earnings. To calculate retained earnings, start with the company's net income figure for the period in question. Determine the net income or earnings.

In order to prepare a retained earnings statement, you or your bookkeeper should use the retained earnings formula: The formula for calculating retained earnings (re) is as follows: There are 4 steps in applying the retained earnings equation:

Ending retained earnings formula retained earnings vs. Start with the beginning balance of your retained earnings. = ending retained earnings.

How do i calculate retained earnings? The re formula is as follows: Both revenue and retained earnings are essential in evaluating a company’s financial health,.

Formula, examples and more. Do you have a firm grasp on the retained earnings formula? Retained earnings are calculated by subtracting distributions to shareholders from net income.

Add your net income for the most recent reporting period. Beginning retained earning + net. Beginning retained earnings + net income.

What makes up retained earnings. Subtract any dividends paid out of that net income. Here’s the basic formula for calculating retained earnings:

Quarterly gaap earnings per diluted share of $2.89;

:max_bytes(150000):strip_icc()/statement-of-retained-earnings-final-8500839aff40433dba054ce0af9f9f42.png)