Ideal Tips About Prepaid Insurance Income Statement Free Cash Flow Calculation From

![[Solved] Question The unadjusted trial balance and statement](https://www.investopedia.com/thmb/WRTLhamdgnKVN92bz5cxygwuD4E=/6244x1627/filters:no_upscale():max_bytes(150000):strip_icc()/dotdash_Final_How_Are_Prepaid_Expenses_Recorded_on_the_Income_Statement_Oct_2020-06-7efbf5b828c64e319cca3507cd3210bf.jpg)

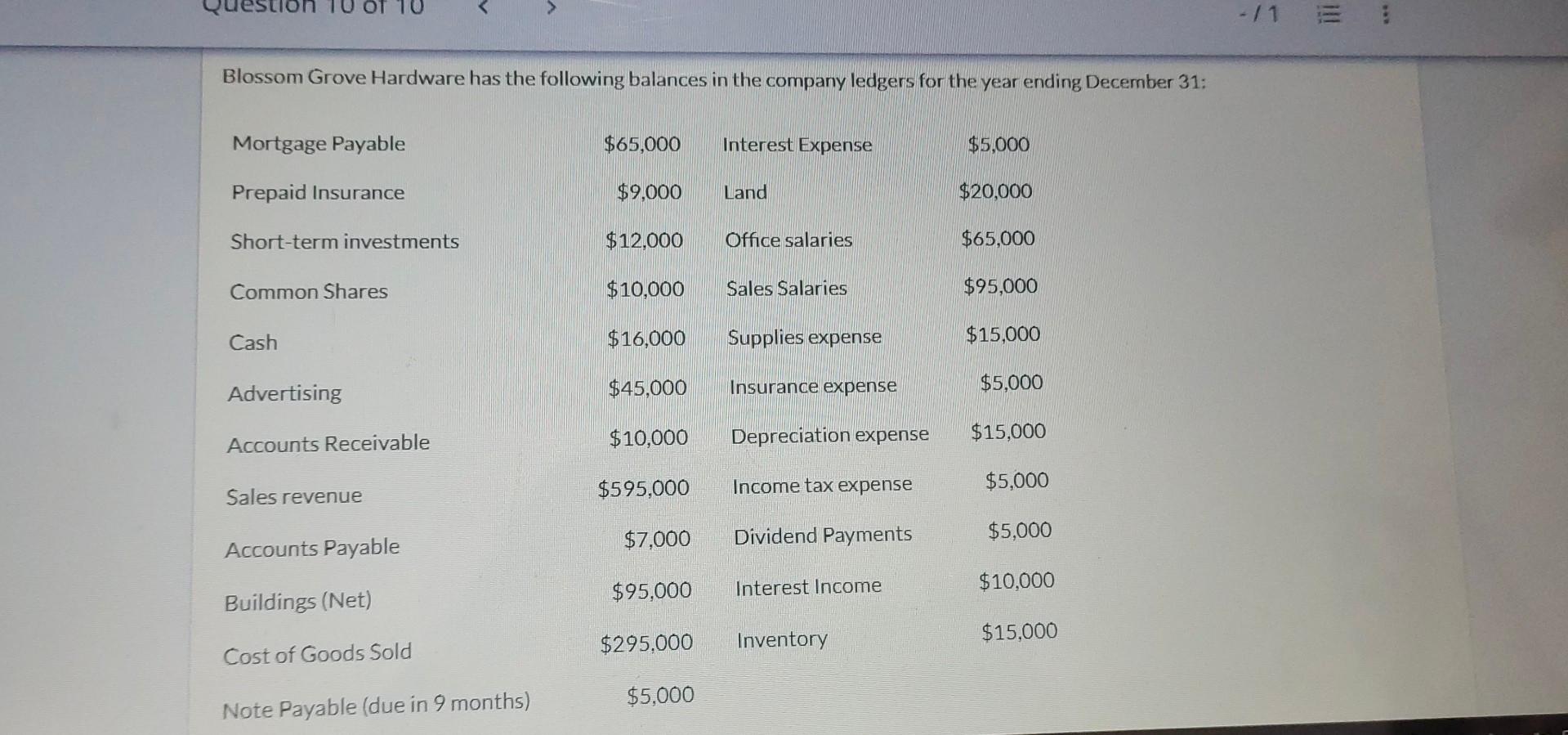

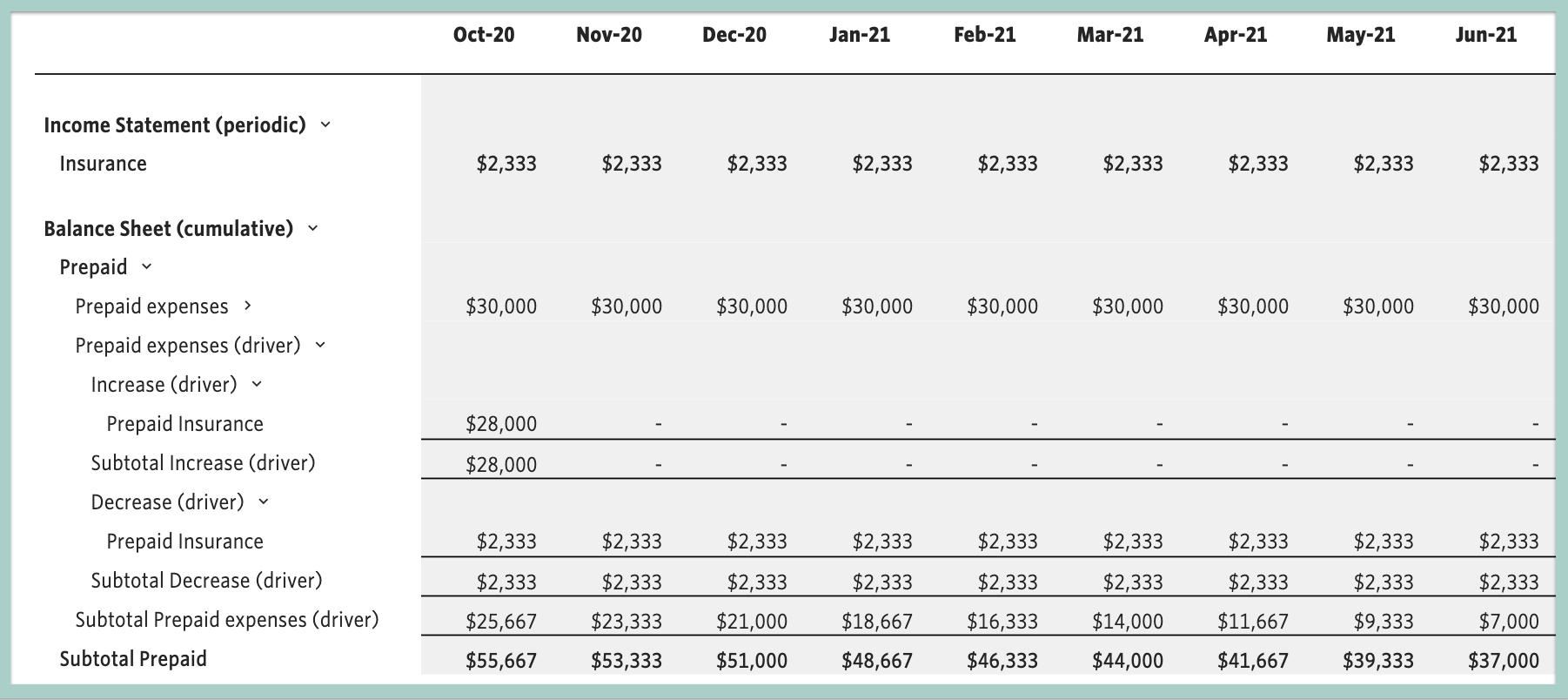

Effect of prepaid expenses on financial statements.

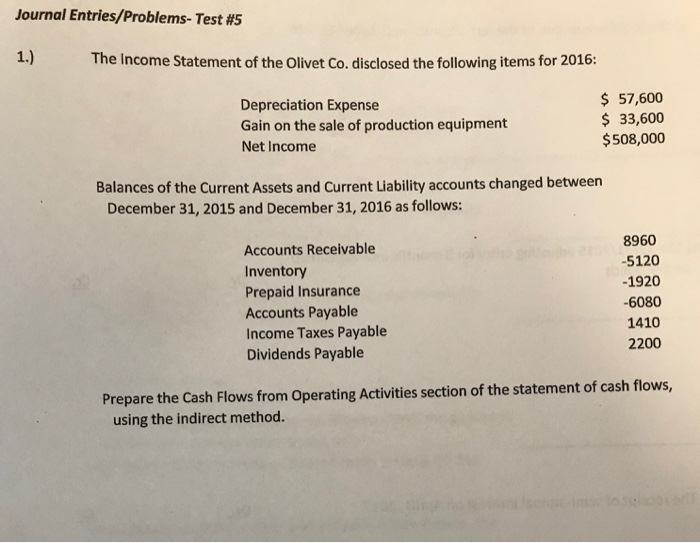

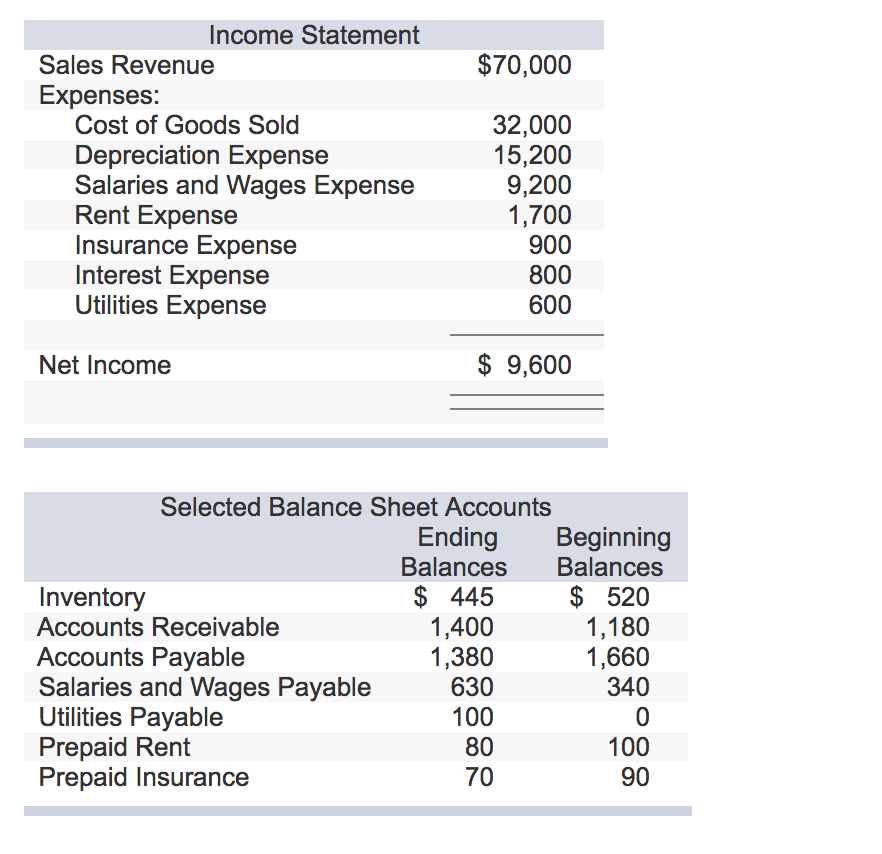

Prepaid insurance income statement. The initial journal entry for a prepaid expense does not affect a company’s financial statements. Income statement by crediting prepaid insurance and debiting insurance expenses. It is reflected on the balance sheet, statement of cash flows, and income statement.

Prepaid insurance plays a crucial role in financial statements. Thus, prepaid expenses aren’t recognized on the income statement when paid, because they have. This records the prepayment as an asset on the company's.

Since the amount paid for insurance will either come from a bank or cash, which is also a balance sheet item, prepaid insurance does affect the income statement. The current month's insurance expense of $1,000 ($6,000/6 months) is reported on each month's income statement. At the payment date of prepaid insurance, the net effect is zero on the balance sheet;

And there is nothing to record in the income statement. As the coverage period expires, the prepaid insurance account is reduced, and the consumed portion is recorded as an insurance expense in the income. Prepaid expenses refer to payments made in advance for products or services expected to be.

Prepaid expenses aren’t included in the income statement per. In other words, these are advanced payments by a. That is, expenses should be recorded when incurred.

As noted above, prepaid expenses are payments made for goods and services that a company intends to pay for in advance but will incur sometime in the future. Last updated december 6, 2023 learn online now what are prepaid expenses? The unexpired amount of the prepaid insurance is.

The prepaid insurance income statement is typically used to gauge the company’s financial performance and to ensure the accuracy of their financial reporting. With the $5,300 increase in prepaid expenses and other information in the example, we can prepare a schedule of cash flows from operating activities under the. At the end of any accounting period, the amount of the insurance premiums that remain prepaid should be reported in the current asset account, prepaid insurance.

Therefore, in accordance to this principle, prepaid insurance would be treated as a current asset in the year when the advance payment is made. This is recorded on the business’s income statement. Working capital and liquidity ;

For example, refer to the. As the amount expires, the current asset is reduced and the amount of the reduction is reported as an expense on the income statement. Examples of prepaid expenses include insurance, rent, leases, interest, and taxes.

Prepayments) represent payments made for expenses which have not yet been incurred or used. Date particulars debit amount ($) credit amount ($) 1st january 2023:.

:max_bytes(150000):strip_icc()/dotdash_Final_How_Are_Prepaid_Expenses_Recorded_on_the_Income_Statement_Oct_2020-01-5994210f98a84b468a9a113c94643d50.jpg)