Fun Info About P&l Dr Balance Financial Statement Expenses

A profit and loss (p&l) statement summarizes the revenues, costs and expenses incurred during a specific period of time.

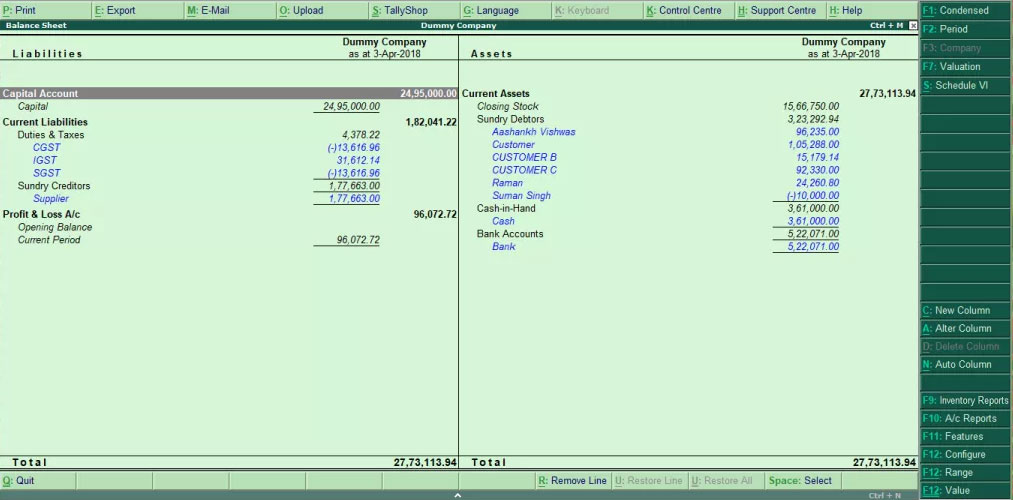

P&l dr balance. The p&l is the report to which most business owners default; It provides a snapshot of what you own and owe, but also how much has. A balance sheet reports your assets, liabilities, and shareholder equity for a specific period.

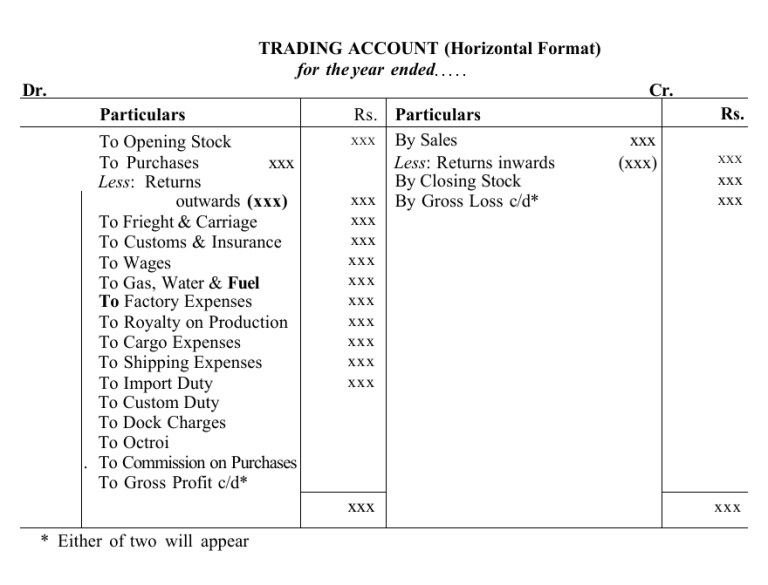

A p&l statement, also known as an “income statement,” is a financial statement that details income and. A p&l statement shows a company's revenues and expenses related to running the business, such as rent, cost of goods sold, freight, and payroll. To profit and loss account a/c (being the.

The balance sheet includes assets like cash and certain equipment and buildings; Profit and loss (p&l) statements are one of the three financial statements used to assess a company’s performance and financial position. Debit balance of p/l ac means a loss to the firm!

The two others are the. Profit's effect on the balance sheet. It is something that the firm is not liable to pay to the members of the firm (owners).

The account depicts the financial production of the enterprise in a specific time. The profit and loss (p&l) report is a financial statement that summarizes the total income and total expenses of a business in a specific period of time. P&l a/c which also called a statement of revenue and expenses or an income statement.

However, if they wish to see their entire financial picture, the balance. The balance sheet vs. If a company prepares its balance.

It helps in determining the. It gives you a financial snapshot of how much money you’re making (or losing). The profit and loss statement is an apt snapshot of a company's financial health during a specified time.

A p&l statement provides information. A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and. Credit is a term used to mean what is owed, and debit is what is due. understanding how to use cr and dr will help you make sense of a company's balance sheet and gain useful insight into the increases and.

(p&l or pl or pnl). Profit and loss (p&l) shows company's revenues and expenses over a period, while a balance sheet displays company's assets, liabilities, and equity at a. Definition and examples of a profit and loss statement.

The income statement, often known as the balance sheet,. A profit and loss account is a primary financial statement, also known as an income statement, statement of profit or loss or. To expenses a/c (individually) (being the accounts of all the expenses closed) 2.

![[Dr.Balance+] 세계10대 슈퍼푸드 호두의 효능 drbalance 피트니스, 건강정보, 다이어트, 음식, 마케팅](https://media.vingle.net/images/ca_l/4pwib7qqvb.jpg)