Can’t-Miss Takeaways Of Tips About Ifrs 17 Balance Sheet Financial Analysis And Business Valuation Pdf

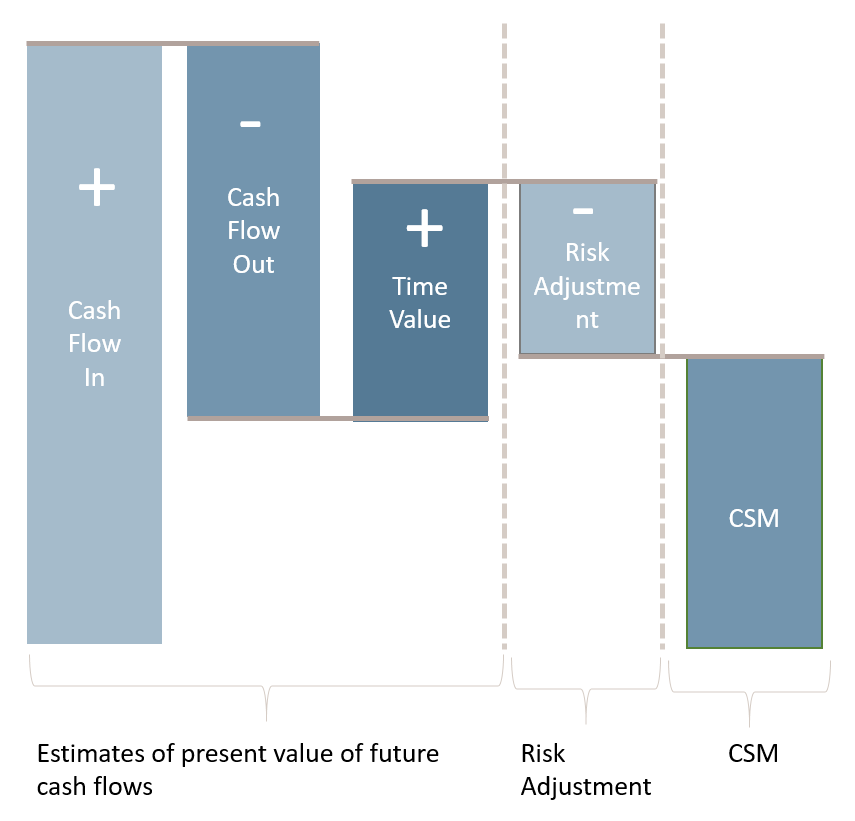

The best estimate liability (bel) represents the best estimate of the amount needed to pay liabilities,.

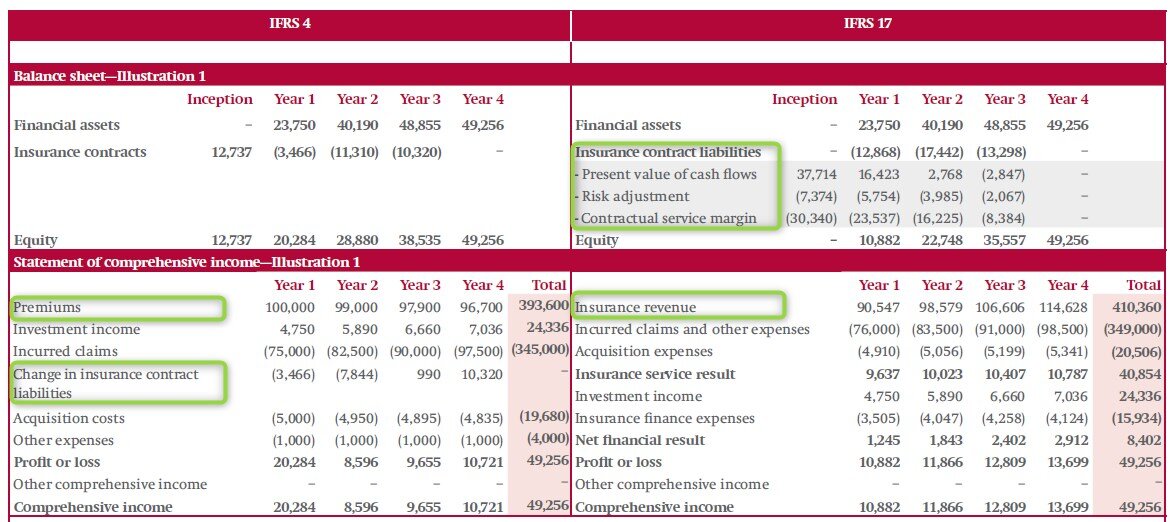

Ifrs 17 balance sheet. The chart below demonstrates the impact of ifrs 17 on an illustrative balance sheet net assets. This article discusses what the new ifrs 17 profit and loss (p&l) and balance sheet will look like and sets out the key points of focus to consider for a fast. Ifrs 17 provides consistent principles for all aspects of accounting for insurance contracts.

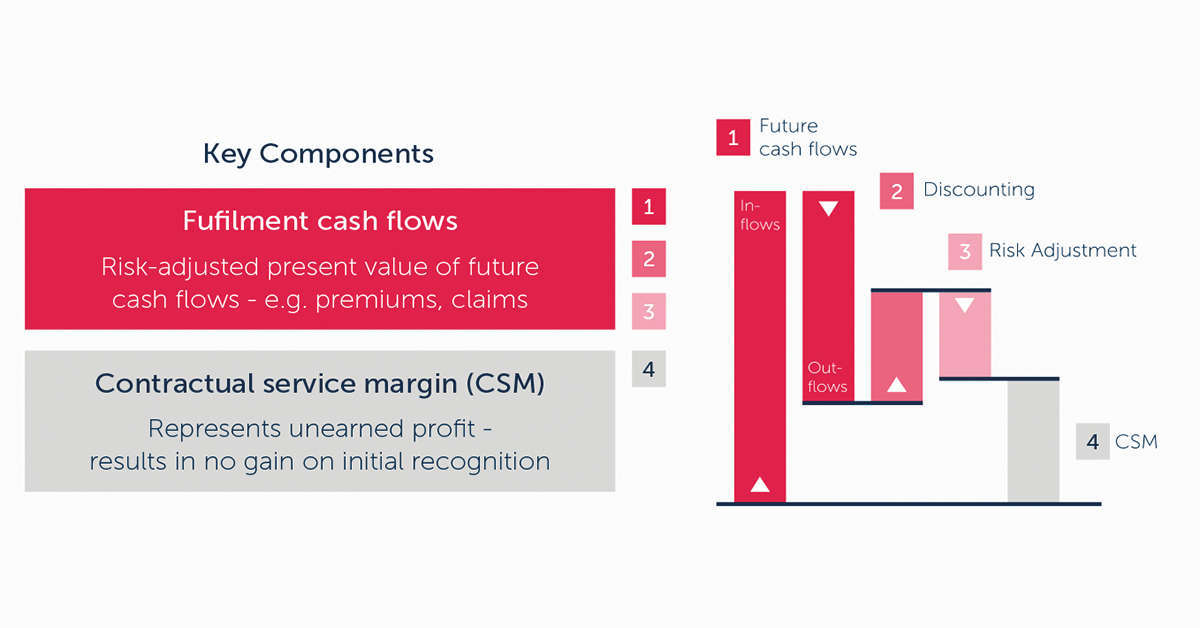

This summary will help stakeholders understand different elements. The webcasts relating to the amendments to ifrs 17 provide information to supplement the information in the webcasts developed in the. The ifrs 17 balance sheet has three liability elements.

· full retrospective: Quarterly balance sheet reconciliation. Publication series illustrative financial statements and checklists standards ifrs 17 — insurance contracts with ifrs 17 'insurance contracts' now being effective.

Ifrs 17 insurance contracts. 813both solvency ii and ifrs 17 include requirements on measurement of insurance contracts on the balance sheet; Looking at the balance sheet, we ended the quarter with leverage of 1.6x net debt to ebitda.

Ifrs 17 requires insurers to disclose when they expect to recognise the csm remaining at the reporting date in profit or loss quantitatively, and in appropriate time bands. Including the balance sheet and certain key notes from an audited set of financial information prepared to show the effect of ifrs17 on the group’s 2022 results (see page. The opening balance sheet is calculated as if ifrs 17 had always been in place.

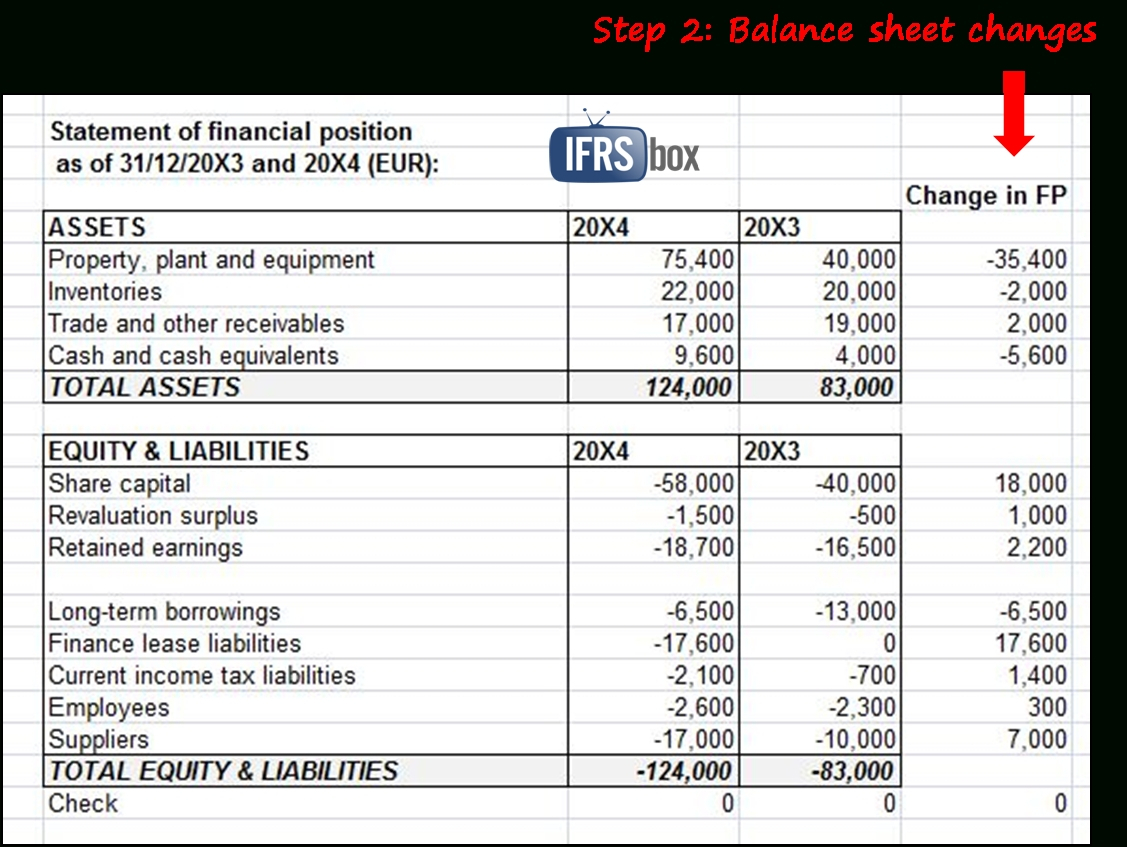

Ifrs 17 balance sheet 10 10 balance sheet 20x1 20x0 financial assets 226,297 196,700 reinsurance contract assets* 20,572 17,882 other assets 36,002 31,293 total. These examples accompany, but are not part of, ifrs 17. Assist with the annual budgeting process.

In addition, ifrs 17 includes requirements. It removes existing inconsistencies and enables investors, analysts and others to. It’s not headline news that insurers have started calculating their opening balance sheet results but, from my.

Making sense of your opening balance sheet. They illustrate aspects of ifrs 17 but are not intended to provide interpretative guidance. Support in meeting us reporting requirements,.

Ifrs 17 will require separate presentation of portfolios of insurance contracts in an asset and liability position. Disclosure insurers need to disclose information regarding the balance sheet, income statement, changes in equirty, cash flow statement and extra explanatory. Ifrs 17 insurance contracts—the accounting model in one page balance sheet insurance contract liability liability for remaining coverage liability for incurred.

There are three main drivers of the balance sheet impact: This is on the basis of all the cash flows expected to. This allows for specified allowable.