Matchless Info About Net Loss In Balance Sheet Format Financial Statement Analysis Coursera

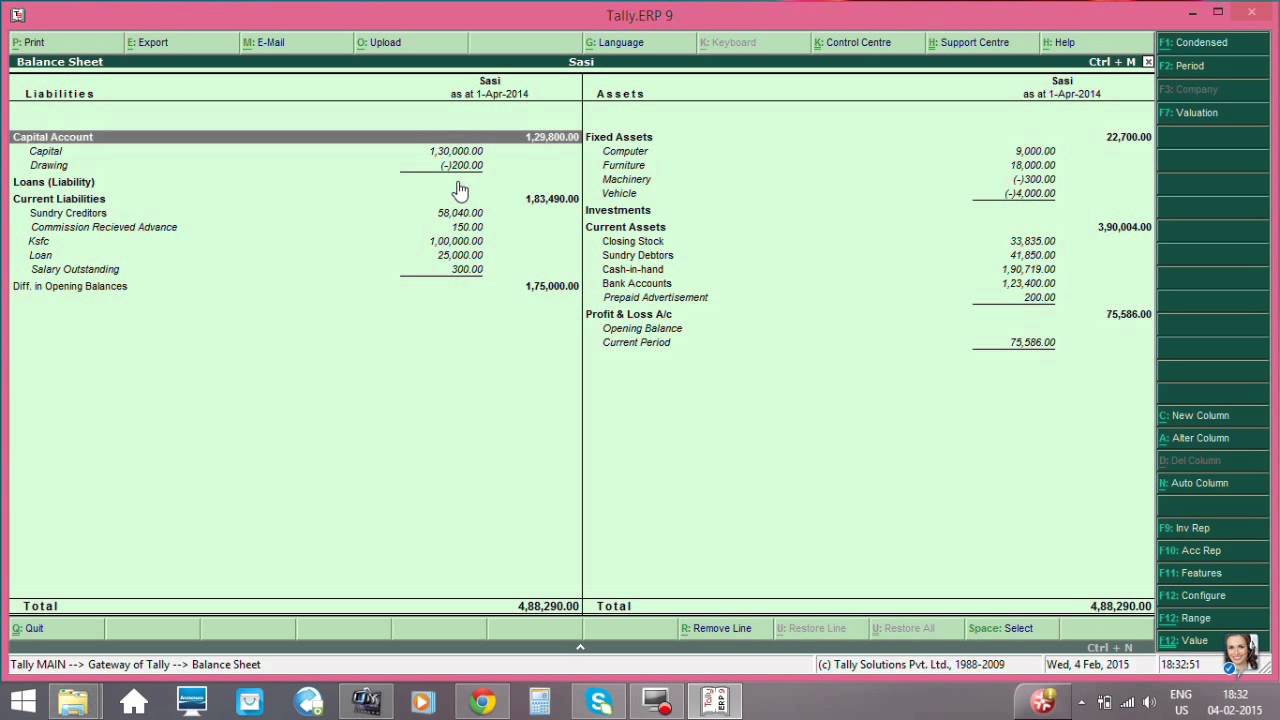

The balance sheet is a statement that shows the financial position of.

Net loss in balance sheet format. The balance sheet explained. Assets represent things of value that a company owns and has in its possession, or. The net result is either net profit or net loss as the balance in the income summary account.

A company's balance sheet is comprised of assets, liabilities, and equity. Chris andreou updated february 7, 2024 contents balance sheet vs profit & loss explained what is a balance sheet? The balance sheet, one of the core financial statements, provides a snapshot of a company’s assets, liabilities and shareholders’.

What is the balance sheet? Why is a balance sheet important? It helps evaluate a business’s capital structure.

The statement uses the final number from the financial statement previously completed. The balance sheet is one of the three financial statements businesses use to measure their financial performance. Net cash € 10.7 billion.

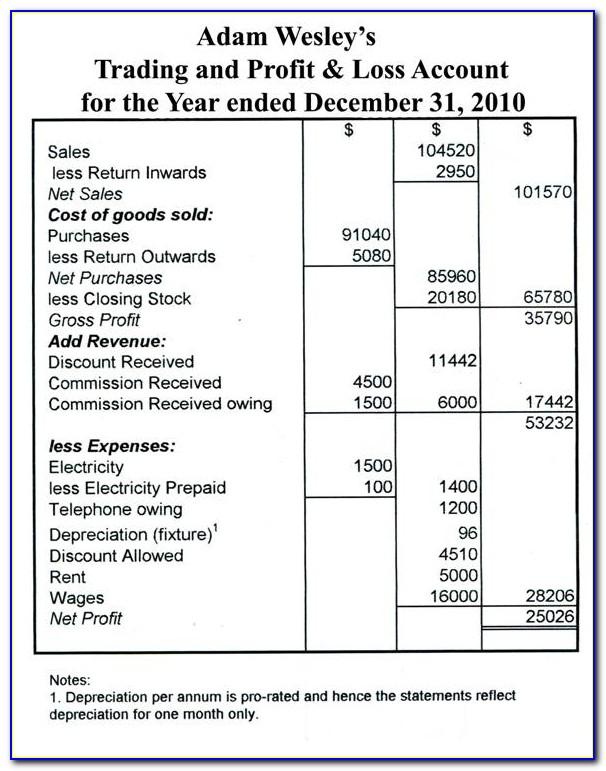

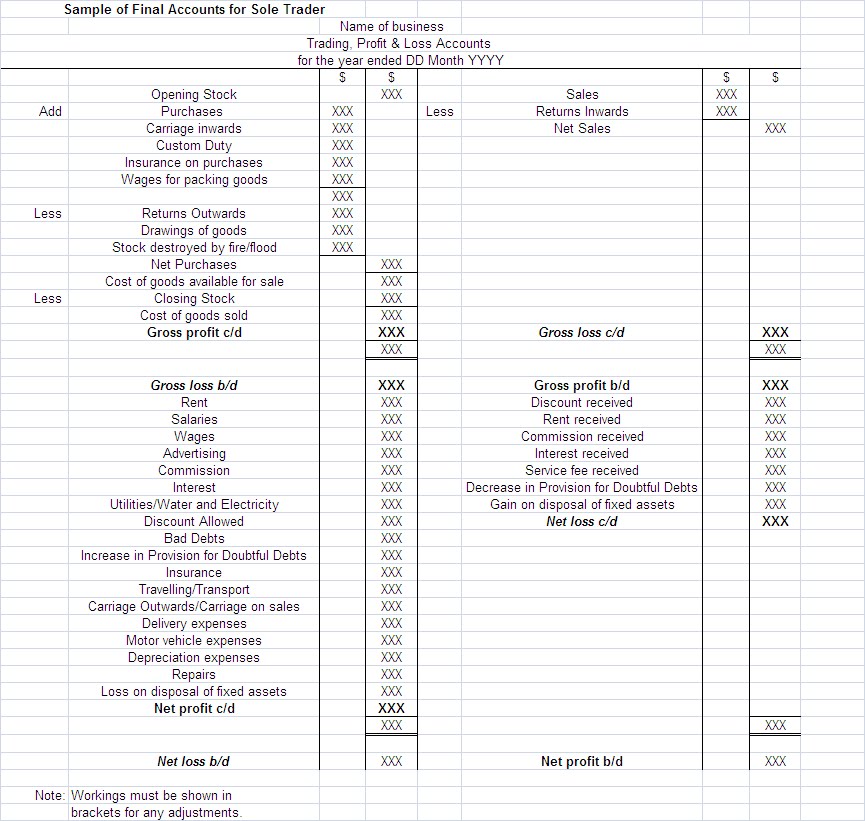

A profit and loss (p&l) statement summarizes the revenues, costs and expenses incurred during a specific period of time. (1) the income statement, (2) the balance sheet, and (3) the cash flow statement. Net loss or net income is a key indicator used to evaluate the company operating results in a specific period.

Importance of net income/net loss. Free cash flow before m&a and customer financing € 4.4 billion; Each of the financial statements provides important financial.

A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and. Balance sheet as on 31st march _____ balance sheet as on 31st march _____ note no. A company’s balance sheet is a financial record of its liabilities, assets and shareholder’s equity at a specific date.

A p&l statement provides information. Remember that the retained earnings account reflects all income the firm has. In this case, the statement of owner’s equity uses the net income (or net loss) amount.

Investors look at the size of the net loss and trends from previous periods to assess the company’s performance. The liabilities side of the balance sheet details all the liabilities of the company.

![Balance Sheet vs. Profit and Loss Account [2024]](https://res.cloudinary.com/goforma/image/upload/v1585669485/small business accounting/profit-and-loss-example_simgmu.jpg)

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)