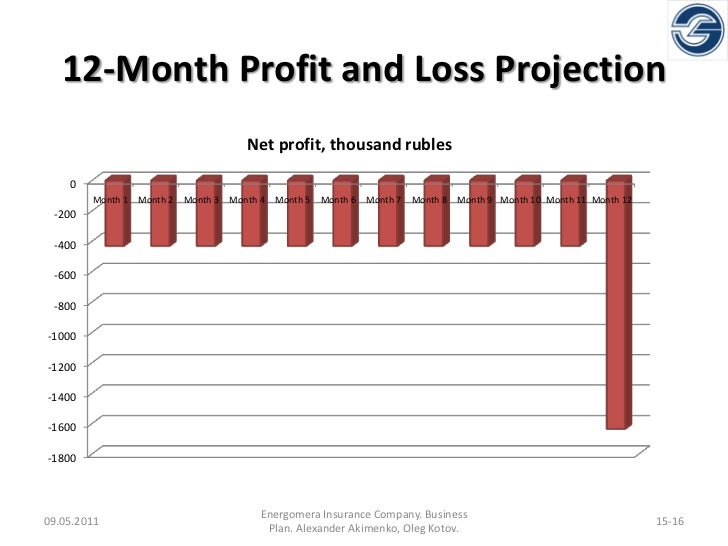

Have A Info About Profit And Loss Projection Example Assets Liabilities Template

This projects the profit or loss by subtracting projected expenses from projected revenues.

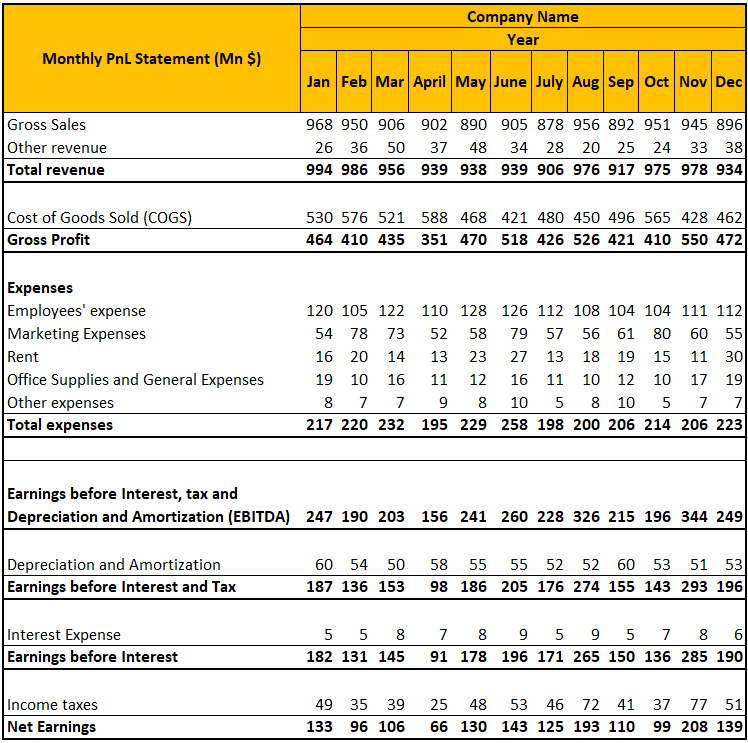

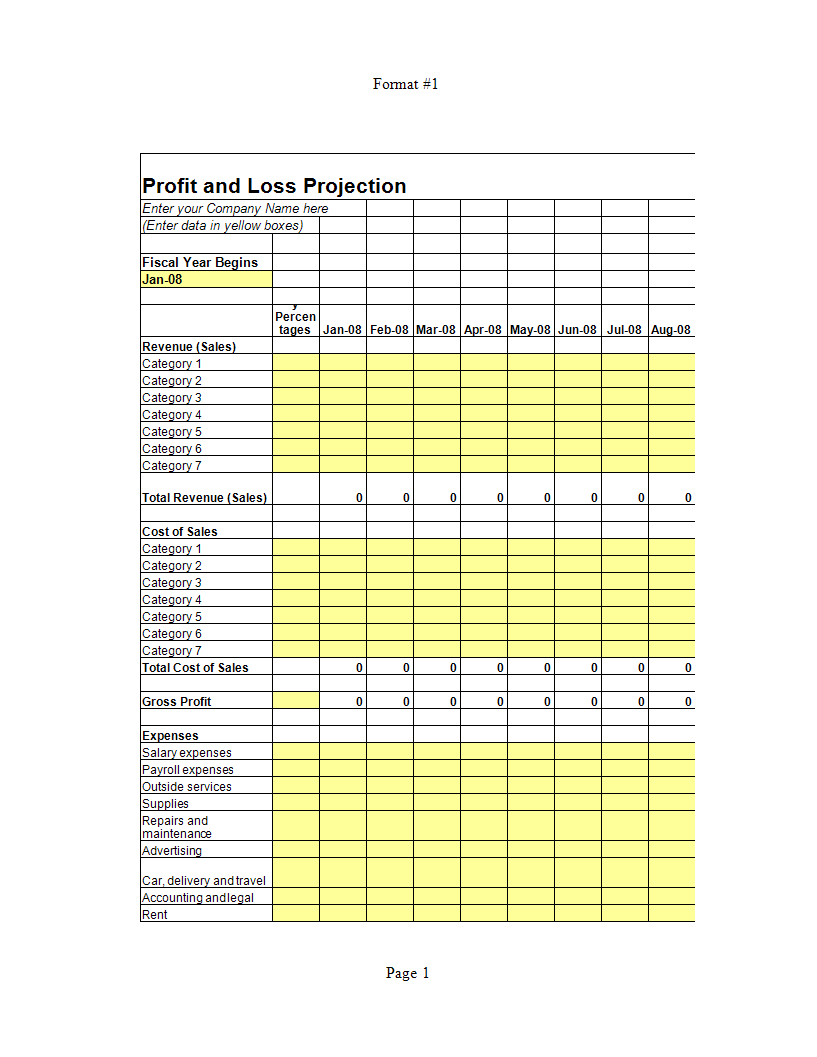

Profit and loss projection example. Revenue levers, revenue drivers, activity assumptions, and pricing. An income statement, also called a profit and loss statement (or p&l), is a fundamental tool for understanding. It’s time for the “loss” part of “profit and loss.” calculate the cost of goods sold for each month in your projection.

Now she knows she will get to keep, on average, about. You should change “category 1, category. Adjustment to retained earnings is the amount of profit actually.

It begins with an entry for revenue, known as the top line, and subtracts the costs of doing. Profit and loss projection: By analysing historical data, market trends,.

A profit and loss forecast is the projection of a company's anticipated financial performance over a specific period. Collect critical inputs four crucial inputs are used to calculate revenue for a new business: Emme divides her monthly gross profit of $5,500 by her $10,000 of sales, to get a profit margin of 55%.

This document follows a general form as seen in the example below. A p&l statement shows a company's revenues and expenses related to running the business, such as rent, cost of goods sold, freight, and payroll. It uses the same list of categories.

With this profit and loss projection statement template for microsoft excel, you can keep your finger on the pulse of your. Then, deduct it from your sales. Profit and loss statement examples.

Owner draw/ dividends is how much the owners plan to take out for themselves. Use this template to create an itemized list of business expenses. The following profit and loss statement examples are some of the most common ones reported by listed companies.

Real example with an explanation. Profit and loss forecast: It’s often used as cl.

A profit and loss projection is a basic financial statement of a particular company that reports on its revenues and expenses in a given period, which can be either weeks,. Ever heard the tired claim that there’s “no money in architecture”? Example expenses include staff wages, office rent, utilities, insurance costs, supplies, and taxes.