Unbelievable Tips About Understanding The Income Statement Operating Expenses Appear On

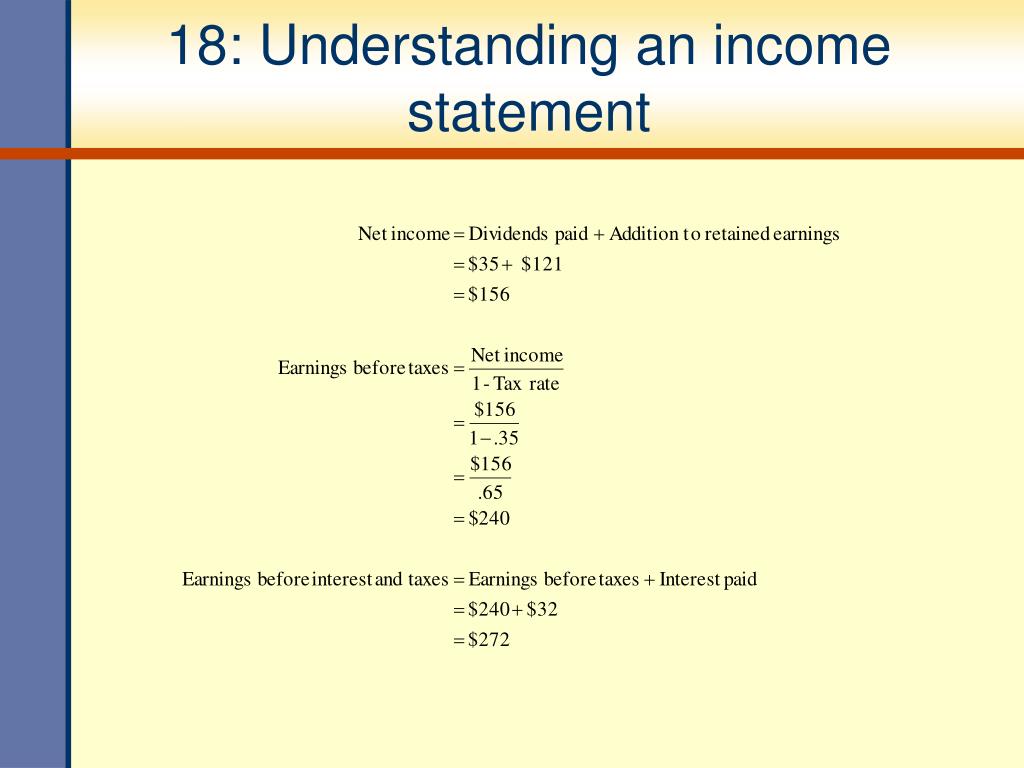

Earnings before income taxes (ebit) is the amount of profit a company generates before accounting for income tax expenses.

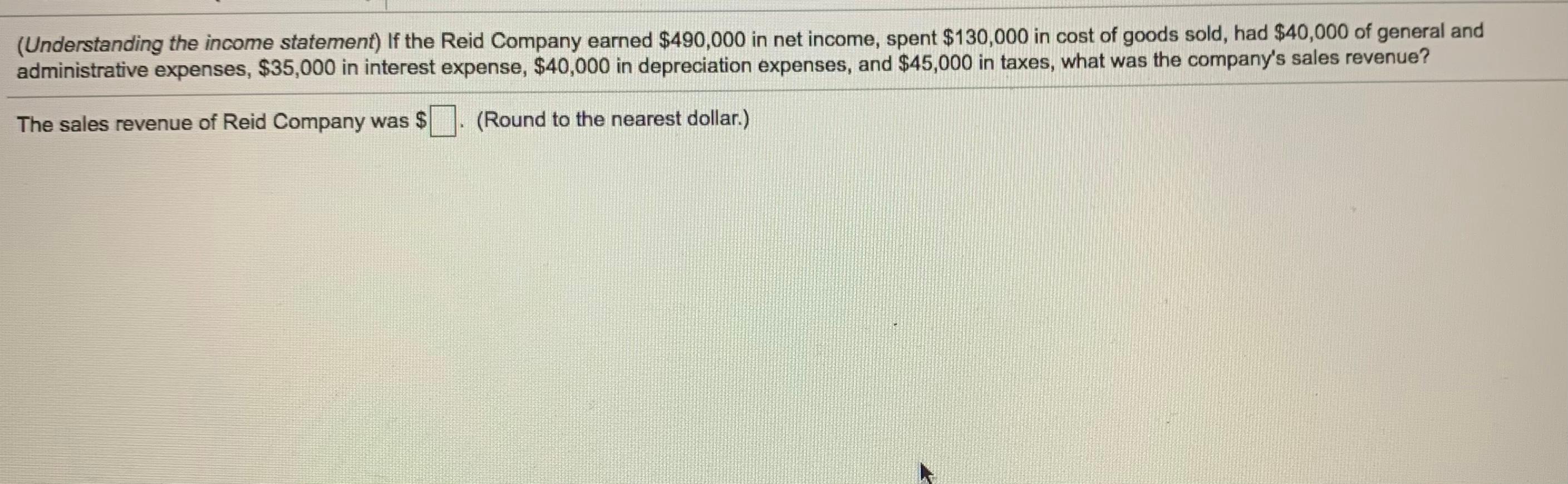

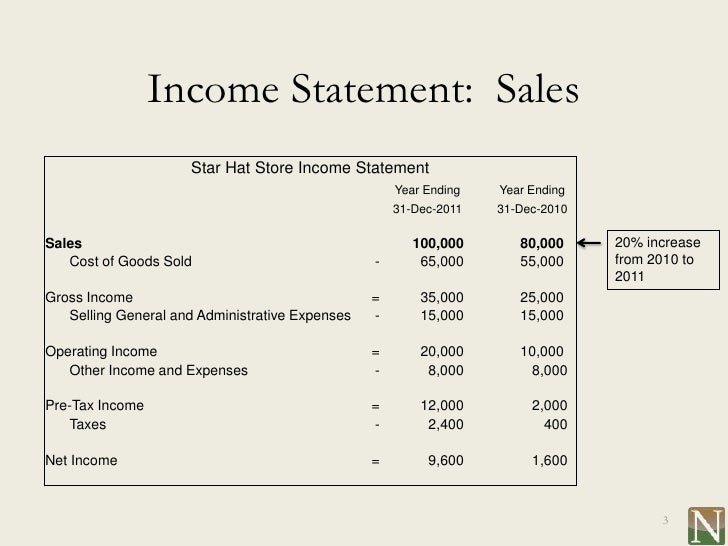

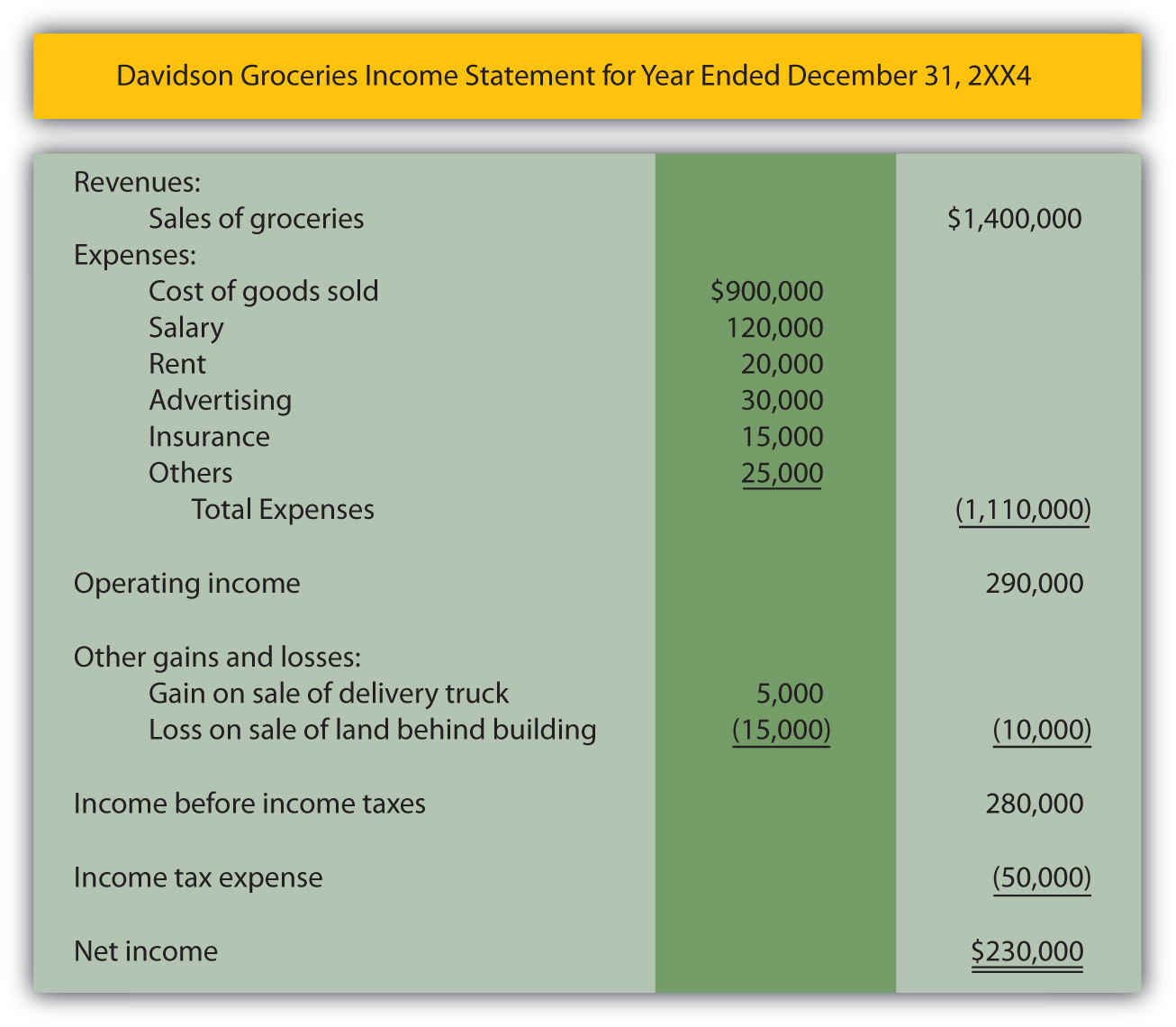

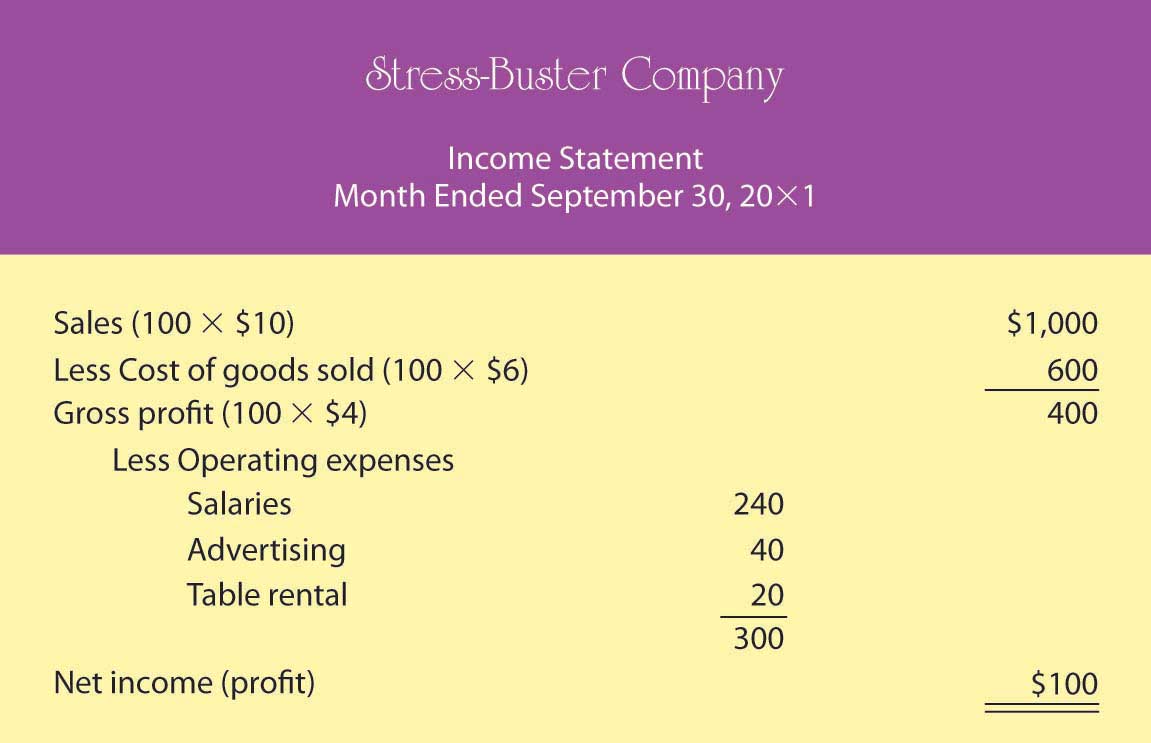

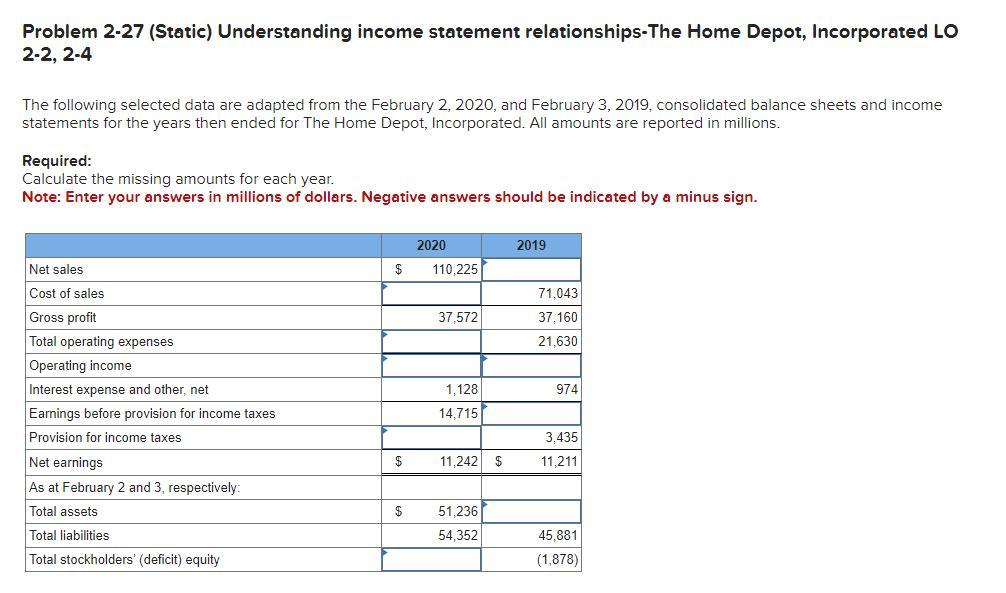

Understanding the income statement. It’s based on the equation: The income statement is one of the three major financial statements that show a company’s expense, income, gains, and losses, which enables us to calculate the net profit or loss for that time. Revenue realized through primary activities is often referred to as operating revenue.

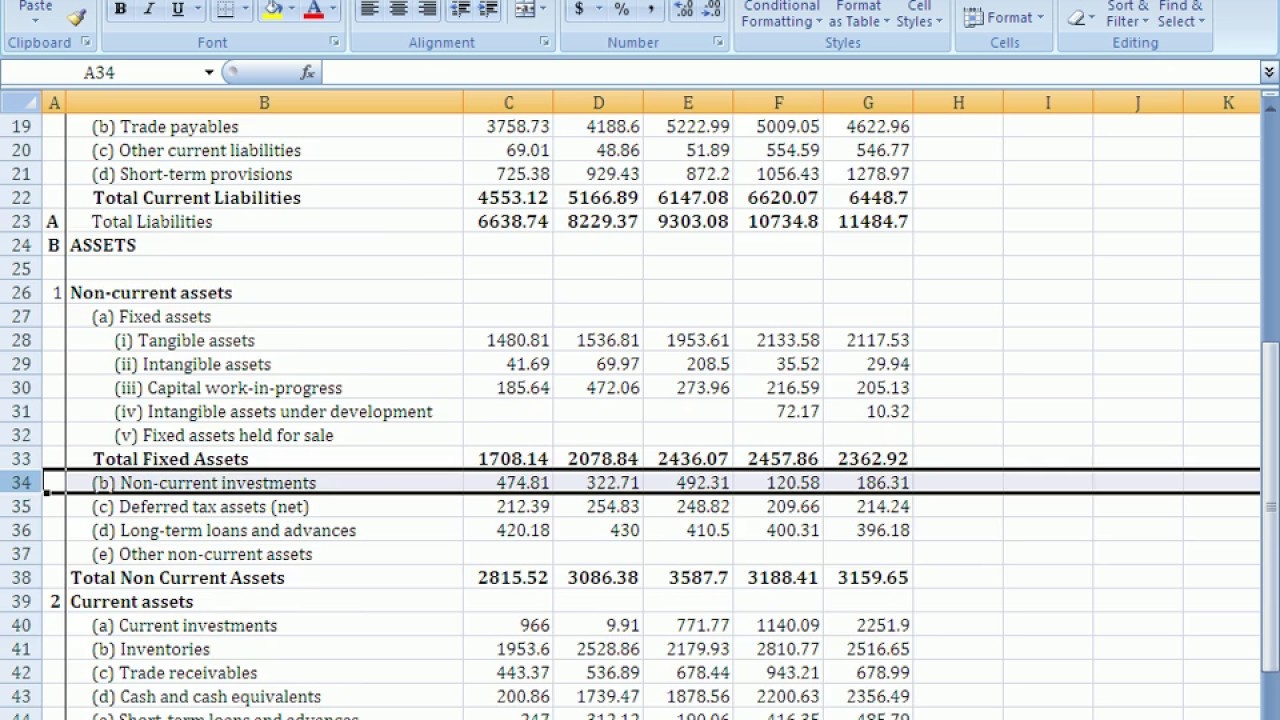

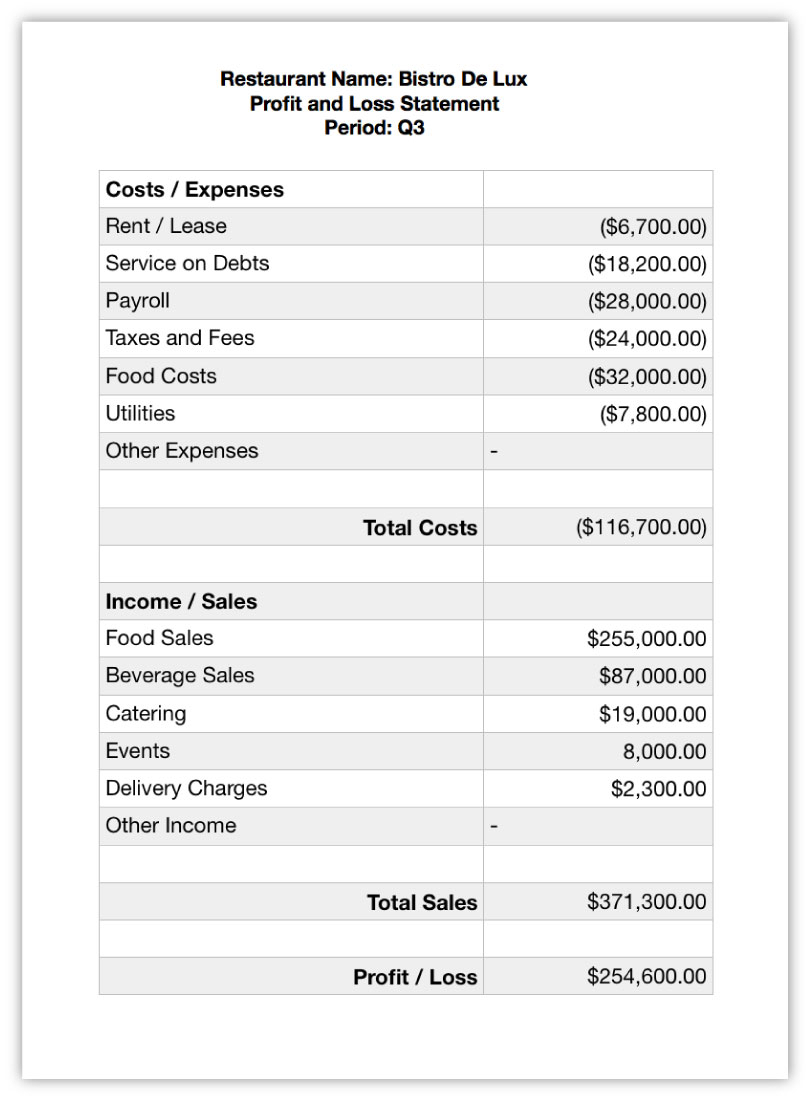

Income statements depict a company’s financial performance over a reporting period. The three main types of financial statements are the balance sheet, the income statement, and the cash flow statement. The document is often shared as part of quarterly and annual reports, and shows financial trends, business activities (revenue and expenses), and comparisons.

The income statement is an integral part of the company performance reports that. In this guide we’ll use annual reports as examples, but you can prepare income statements quarterly or monthly as well. Income statement example sales revenue.

The income statement income statement read more starts with the company’s revenue from selling products to its customers. How to read and use it understanding the income statement.

Understanding an income statement. Also referred to as a profit and loss statement. Let’s break down these components and learn what they signify.

Income statements, also known as profit and loss (p&l) statements, are crucial financial documents that you might encounter on a daily basis.to ensure we have a comprehensive understanding, let's review the essential components of an income statement, as well as the different types, relevant financial metrics, and other related. The official definition says an income statement is: The components of an income statement include:

Often shortened to “ cogs ,” this is how much it cost to produce all of the goods or services you. Also known as profit and loss (p&l) statements, income statements summarize all income and expenses over a given period, including the cumulative impact of revenue, gain, expense, and loss transactions. The income statement measures the company's financial performance over a set timeframe.

A financial document generated monthly and/or annually that reports the earnings of a company by stating all relevant revenues (or gross income) and expenses in order to calculate net income. It's based on a fundamental accounting equation: Cost of goods sold (cogs):

An overview of income statements. An income statement is a financial report detailing a company’s income and expenses over a reporting period. This is the direct cost associated with producing or delivering the goods or services that generated.

It reflects the company’s financial performance by subtracting the total costs and expenses, including tax and interest, from the total revenue. This is the amount of money a company earns from its operations during a specific period. Every income statement begins with your company’s revenues.