Build A Tips About Subsequent Event Note Disclosure Example Yearly Profit And Loss Template Excel

Use of judgements and estimates 22 performance for the year 24 5.

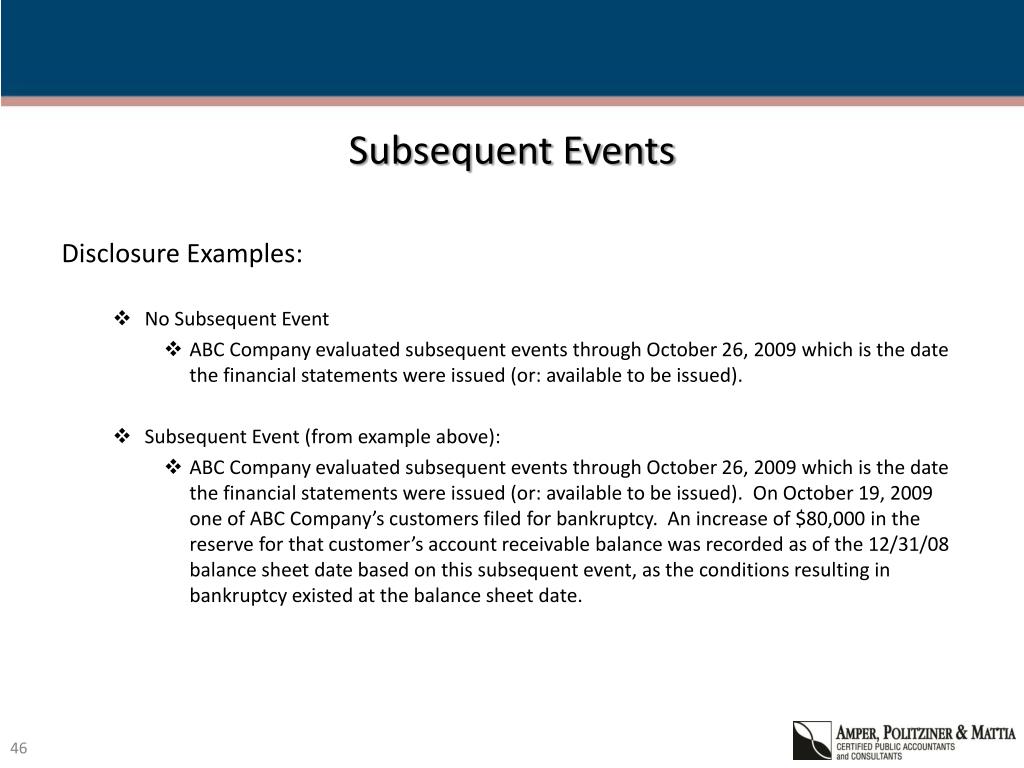

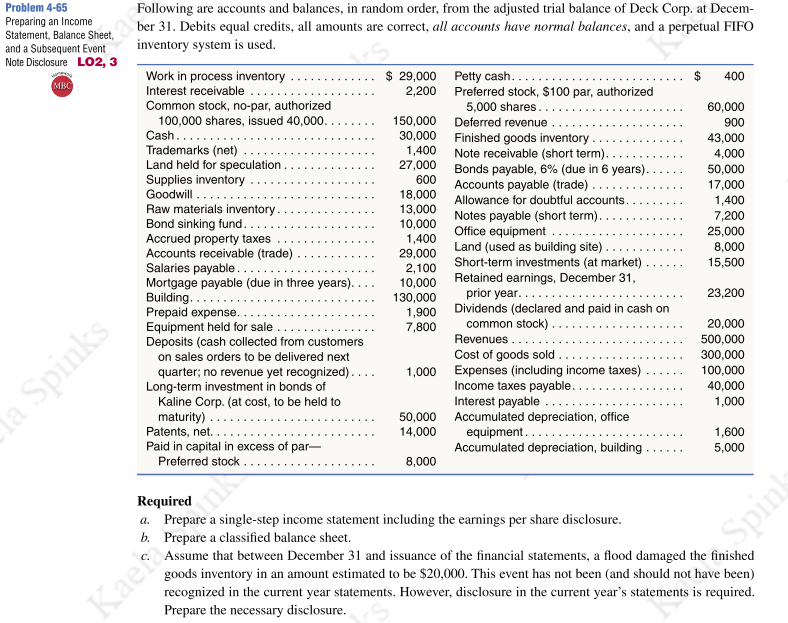

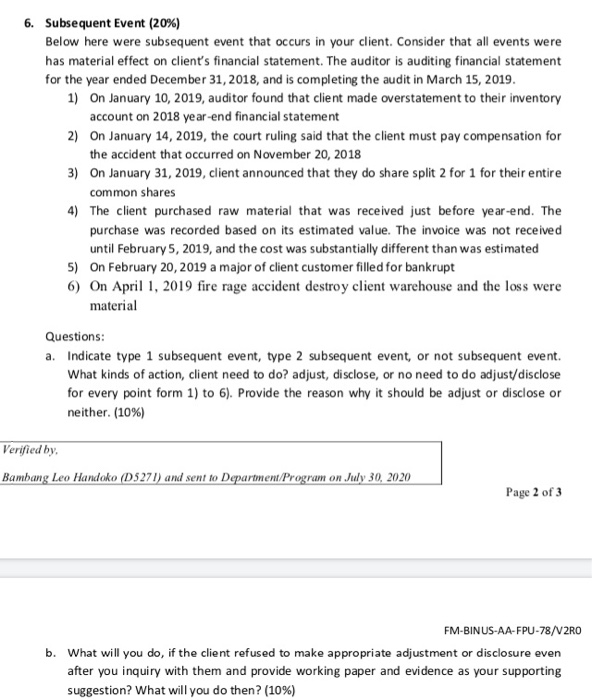

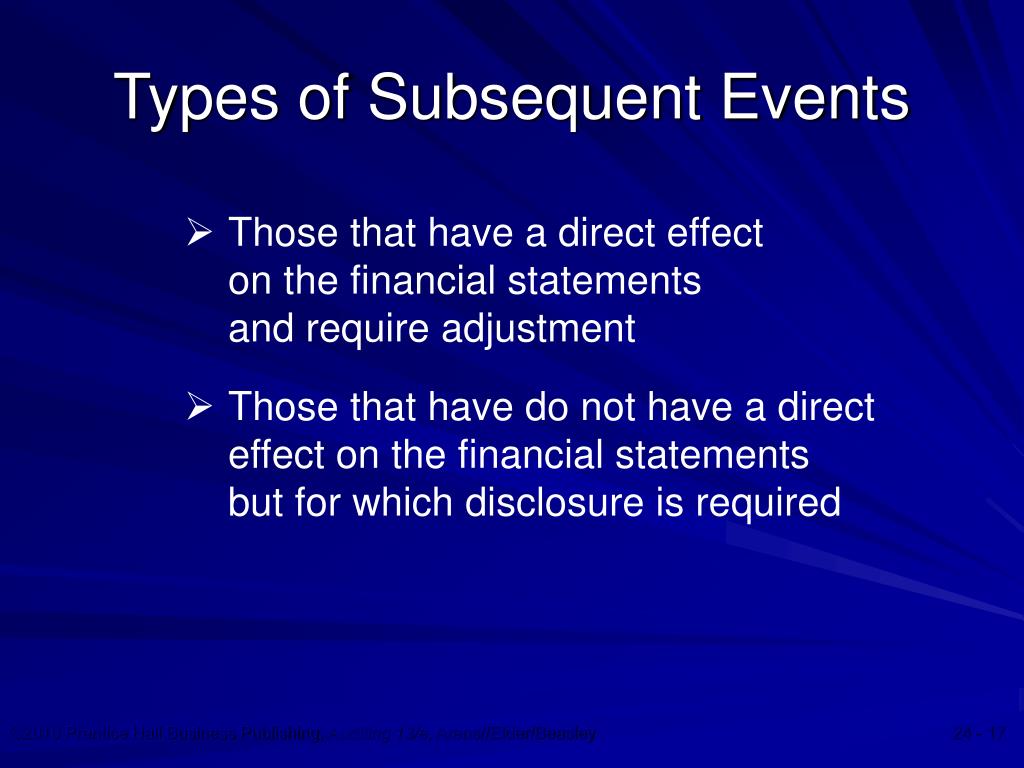

Subsequent event note disclosure example. Functional and presentation currency 22 4. Subsequent events disclosures fill in the gaps between balance sheet entries and a company's public release of financial statements. A labor strike that could potentially threaten the.

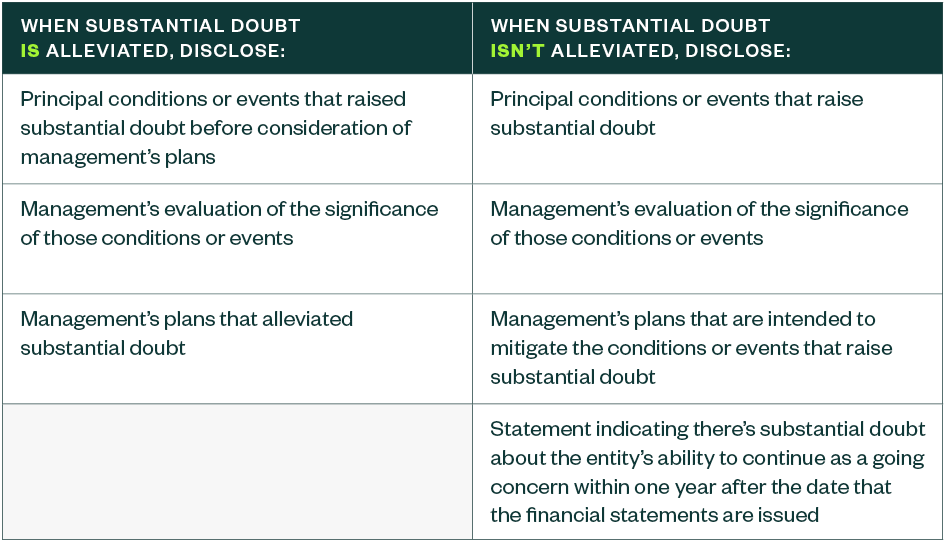

(b) management is aware of material uncertainties related to events or conditions that may cast significant doubt upon the entity’s ability to continue as a going concern. Gain a better understanding of both. Nonrecognized subsequent events (see fsp 28.6) are considered for disclosure based on their nature to keep the financial statements from being misleading.

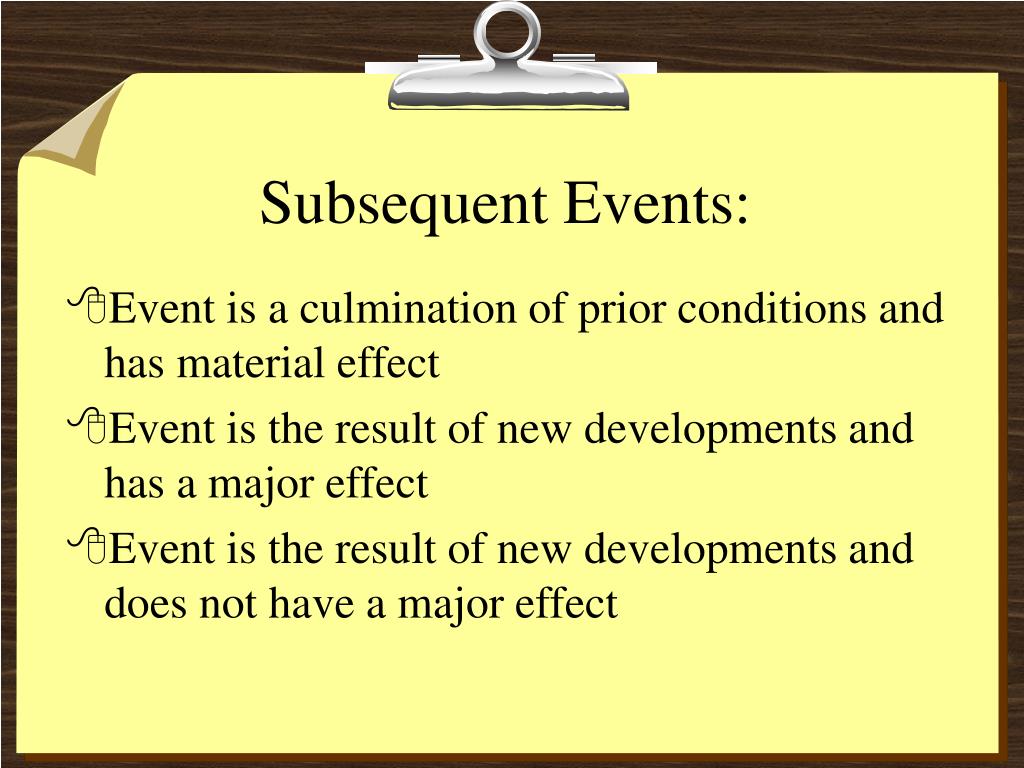

Generally, there are two criteria that are both required for a subsequent event to need disclosure. Basis of accounting 22 3. An event after the reporting period that provides further evidence of conditions that existed at the end of the reporting period, including an event that.

The event should have a determinable significant effect on the balance. This article will consider the financial reporting aspects concerning subsequent events using a case study type scenario, and will then discuss the auditing requirements that. The following events and transactions occurred subsequent to december 31, 20xx:.

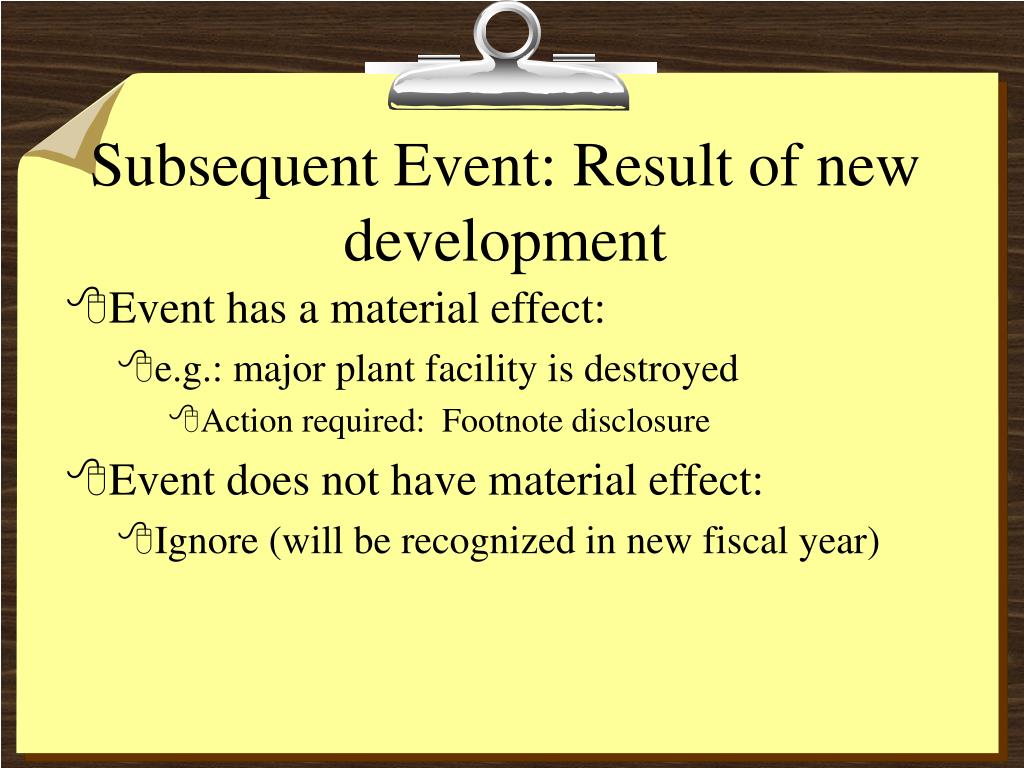

The scope of asc 855, subsequent events, is broad and encompasses all subsequent events that are not addressed in other parts of us gaap.for example, us gaap. This is not an adjusted event and it has no impact on the financial statements, but management must disclose it in a note on retained earning. However, a subsequent event footnote disclosure should be made so that investors know the event occurred.

Disclosing subsequent events on financial statements is. They are provided to aid the sector in the preparation of the financial statements. Of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenues and expenses during the.

_HTML/Images/F8_INT_Ch11_170.gif)