Unique Info About Marketable Securities On Balance Sheet Proforma In Accounts

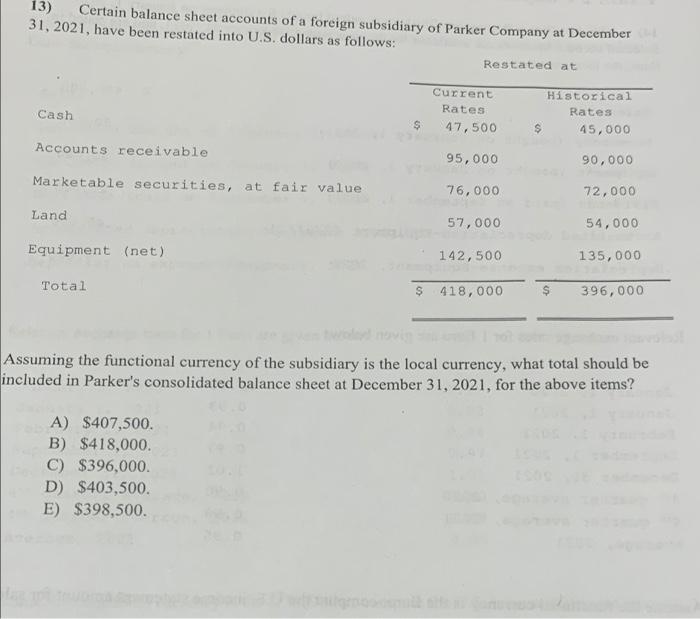

Gaap, some marketable securities must be adjusted at each balance sheet date so that the value shown on the balance sheet is the market value.

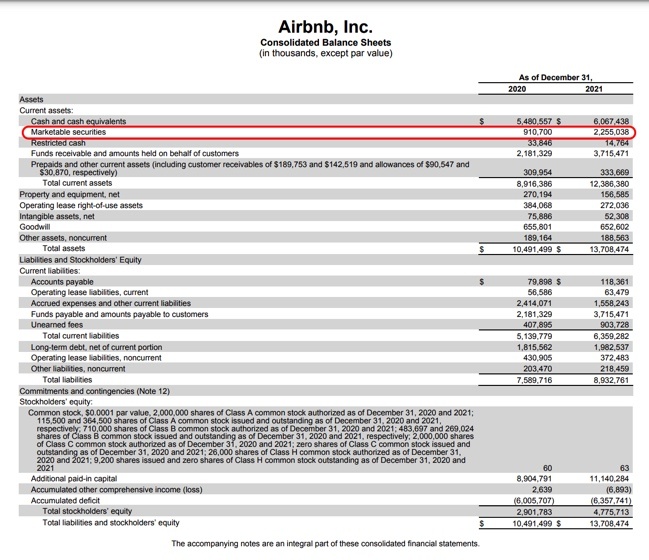

Marketable securities on balance sheet. As such, management extended its projected cash. They are presented on a balance sheet in the current assets section just above cash and cash equivalents (or below) depending on whether the assets are presented in ascending (or descending) order of liquidity. These securities can include stocks, bonds, and other types of investment instruments that can be converted into cash within a short period of time.

Let us understand how marketable securities are shown in the balance sheet of a company. In this article, we will break down the definition of marketable securities so you know all there is to know about it! Marketable securities are classified as debt and equity assets under the current assets head on a company balance sheet.

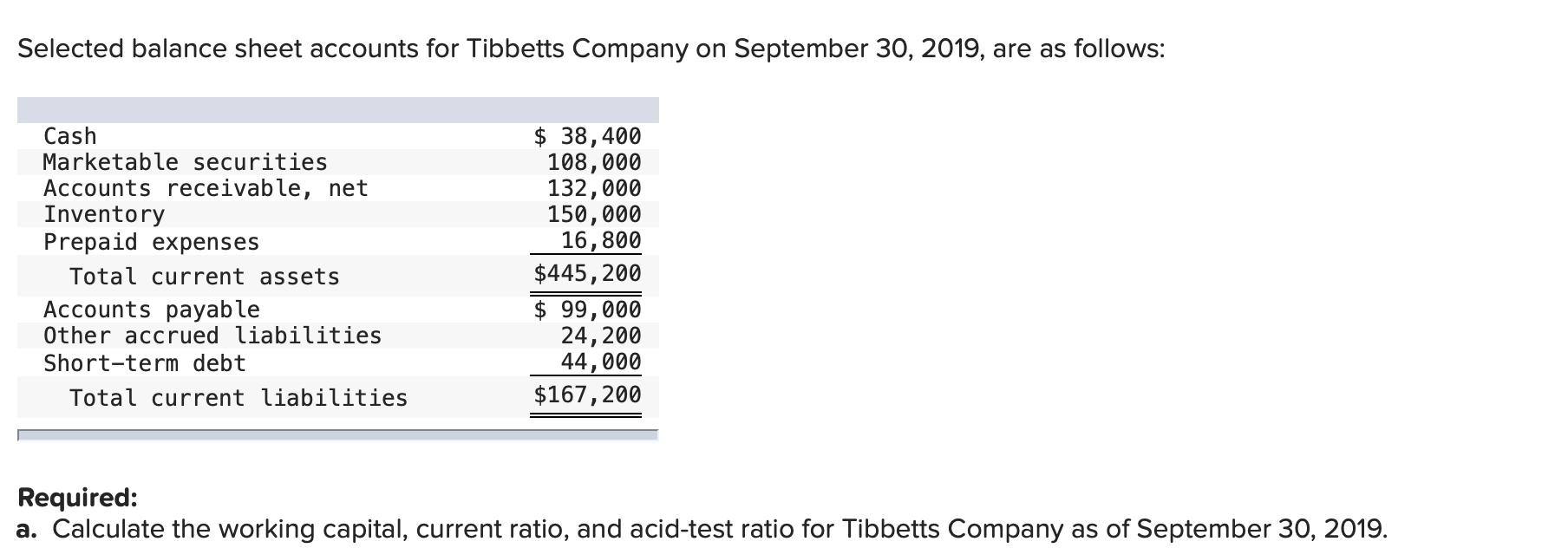

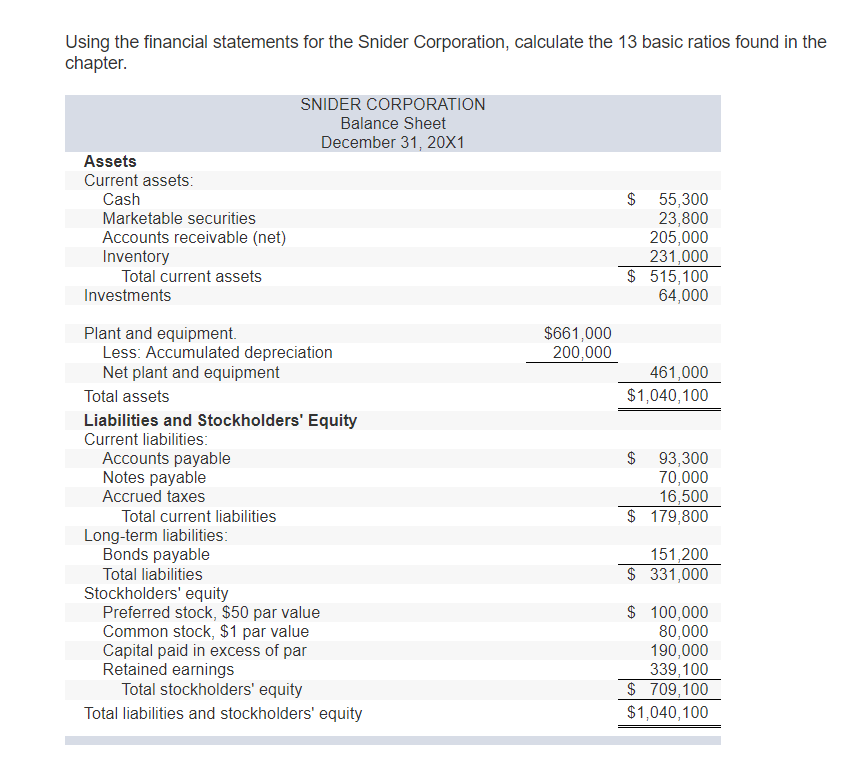

Marketable securities are a great way for businesses to be able to have a large amount of cash at hand as liquid assets. How marketable securities are used in liquidity ratios. This would be in the current assets section.

Marketable securities tend to be reported under the cash and cash equivalents accounts on the balance sheet of a company. Record quarterly data center revenue of $18.4 billion, up 27% from q3, up 409% from year ago. Are marketable securities current assets?

Some common examples of marketable securities include stocks, bonds, money market instruments, and etfs. As long as marketable securities are expected to be converted into cash within one year, they are listed in the current assets section of the investor’s balance sheet at their current market value. It can be better demonstrated with a marketable security example.

Money market instruments, futures, options, and hedge fund investments can also be. Typically, investments are securities held for more than a year. Etfs , preferred shares) and debt investments (e.g.

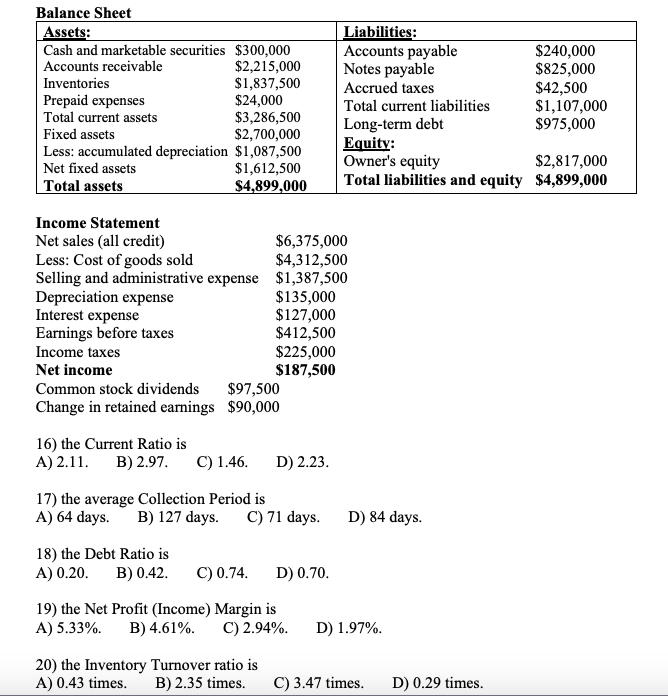

Record quarterly revenue of $22.1 billion, up 22% from q3, up 265% from year ago. A debt instrument should be listed on the company's balance sheet as a long. Marketable securities are the liquid assets that are readily convertible into cash reported under the current head assets in the company’s balance sheet, and the top example of which includes commercial paper, treasury bills, commercial paper, and the other different money market instruments.

In the balance sheet the market value of short‐term available‐for‐sale securities is classified as short‐term investments, also known as marketable securities, and the unrealized gain (loss) account balance of $15,000 is considered a stockholders' equity account and is part of comprehensive income. Examples of marketable securities in balance sheet.

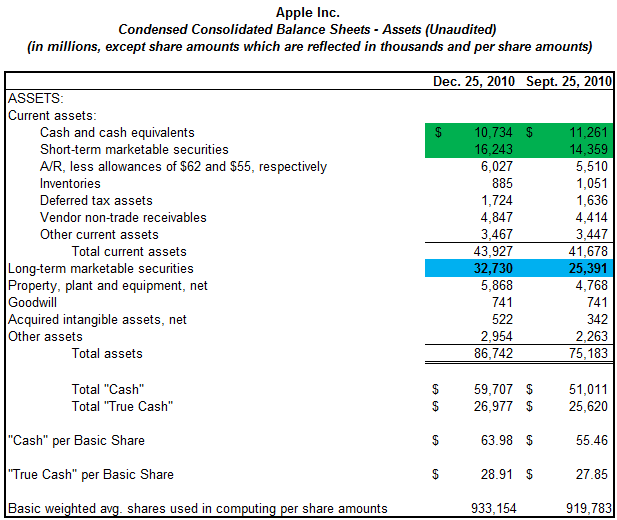

It has $142.5 million in cash and an additional $928.3 million in marketable securities. Condensed consolidated balance sheets (in millions) (unaudited) january 28, january 29, 2024 2023: We do not believe the term marketable securities is required on the face of the balance sheet.

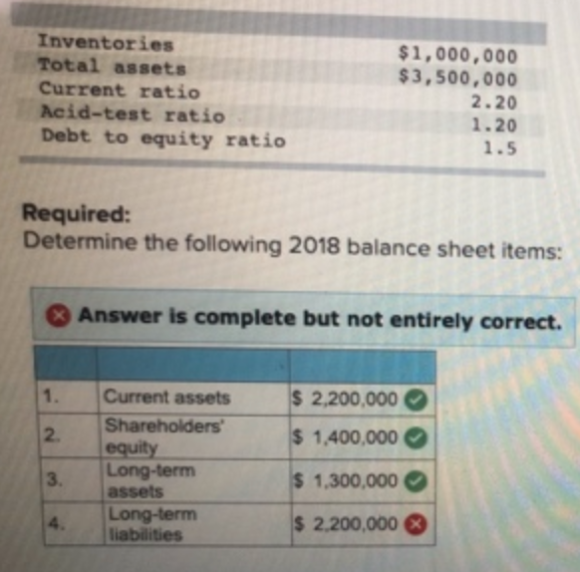

Let’s say an organisation known as abc chemicals has invested its cash reserve in bonds, shares and etfs for the years 2021 and 2022. Nvidia announces financial results for fourth quarter and fiscal 2024. Marketable securities are used when calculating a.

:max_bytes(150000):strip_icc()/MarkettableSecurities-b632c277add041a899b2b4a25c653b25.jpg)

/GettyImages-824185000-03c0d898d7e449ac8fef137d17f73dd1.jpg)