Brilliant Strategies Of Tips About Difference Between Cash Budget And Income Statement Prepaid Tax Current Asset

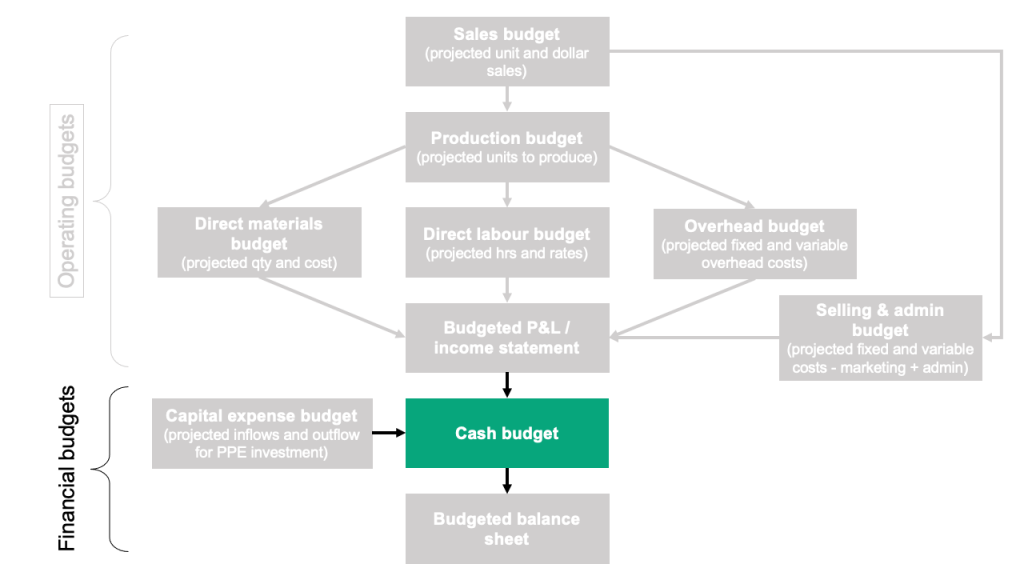

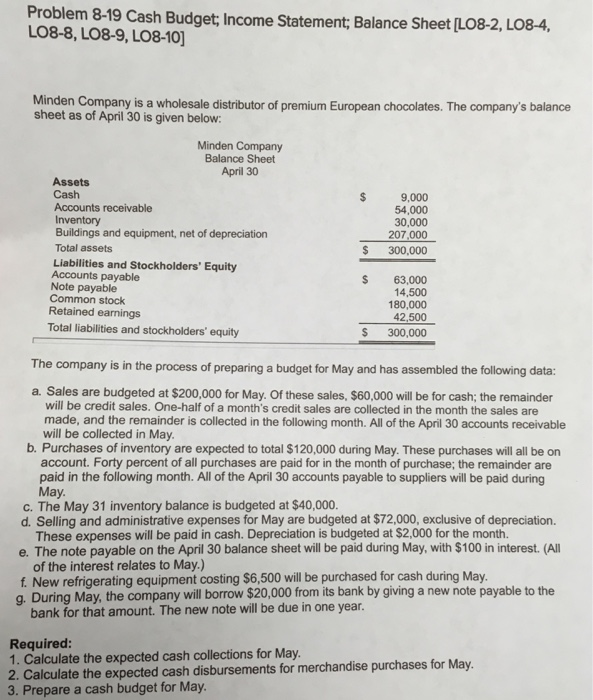

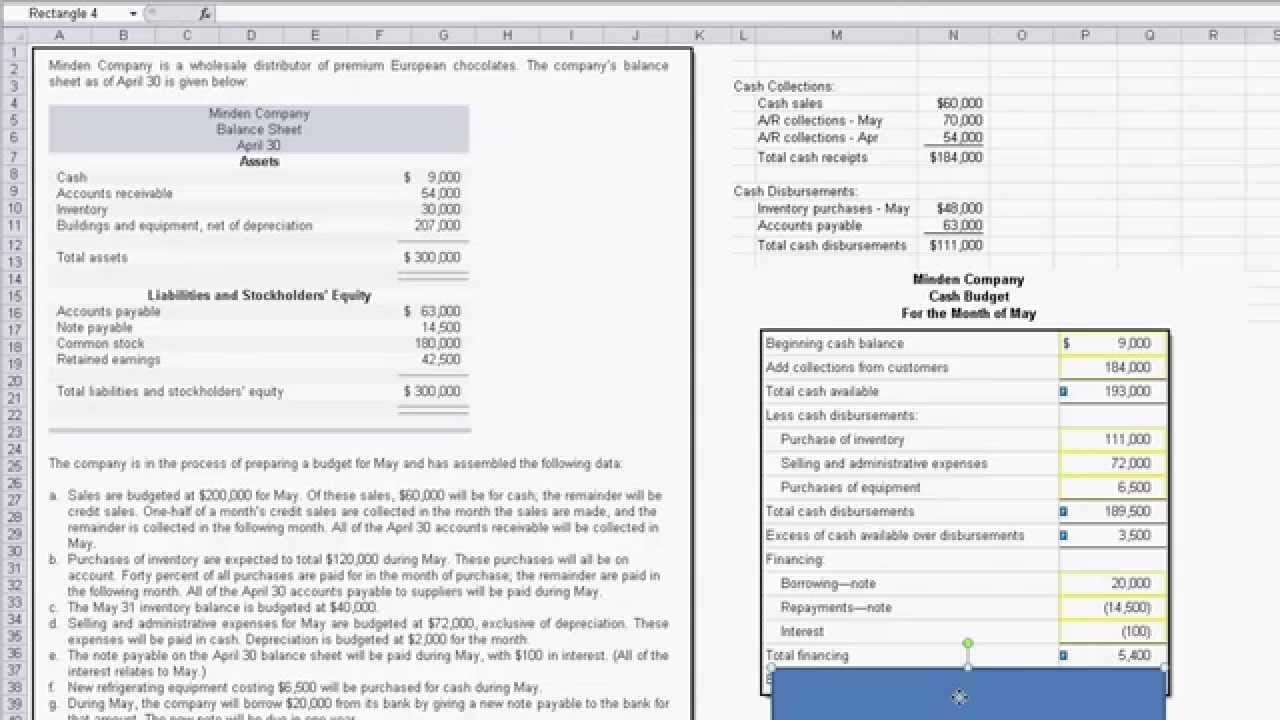

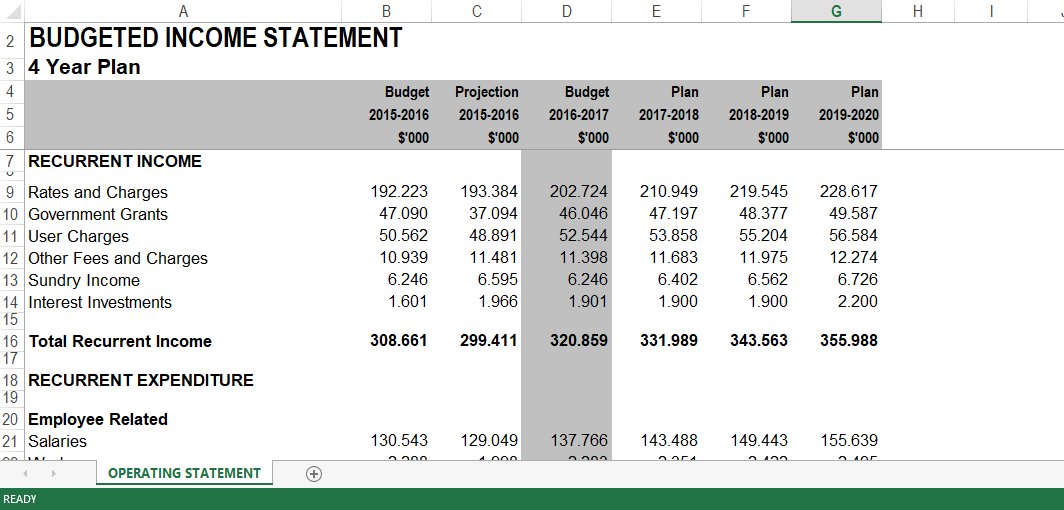

Cash budgets/projected income statement.

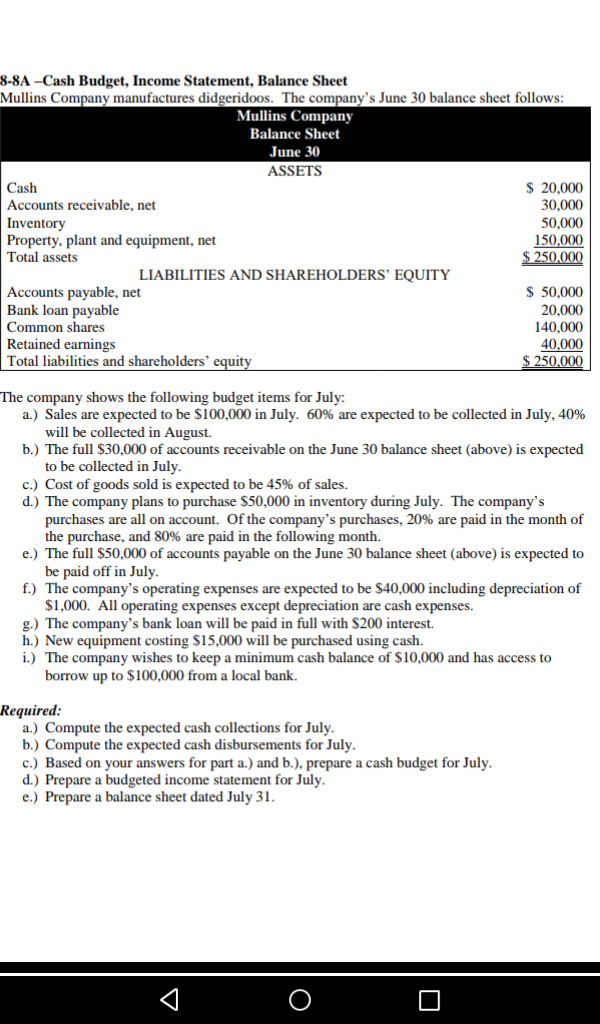

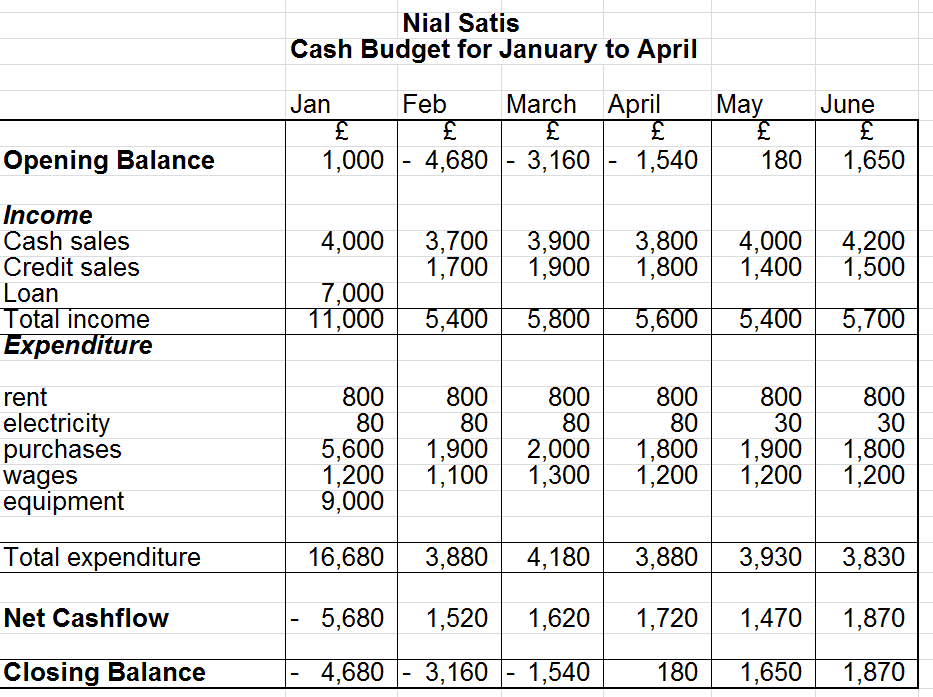

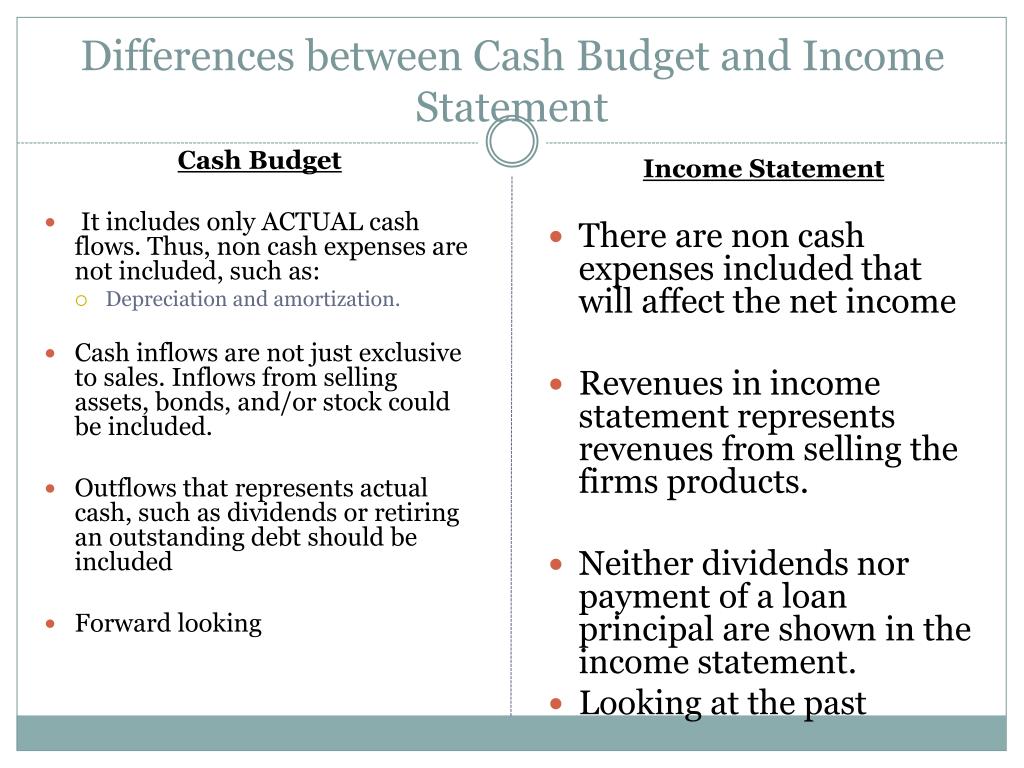

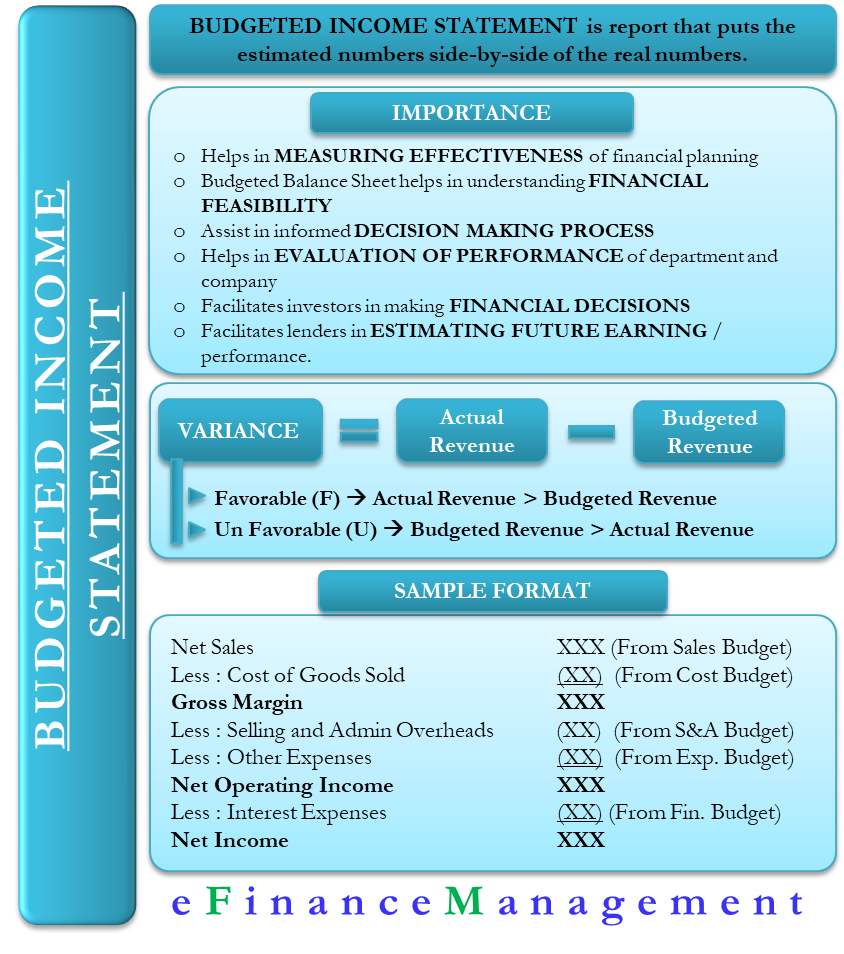

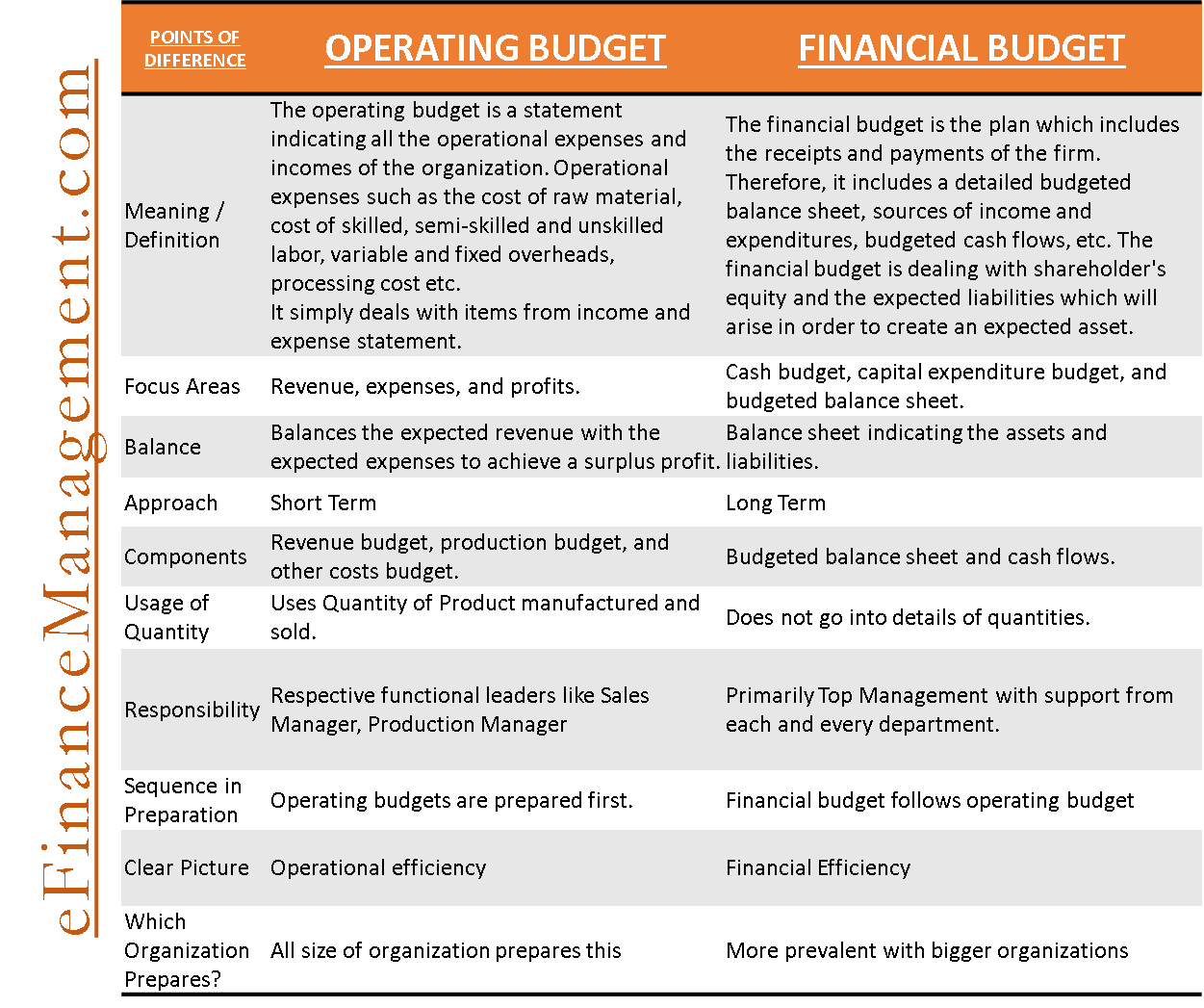

Difference between cash budget and income statement. Income statements enumerate revenue and expenses. Key differences between cash budget and projected income statement advantages and limitations of cash budgeting how to create an effective cash. The cash flow statement tells you the amount of cash inflows and outflows of a business during a financial year.

In this lesson we consider the following: An income statement differs from a budget on various fronts, and understanding these distinctions can help you make sense of concepts such as profitability, liquidity. 8 rows the cash budget focuses on the inflows and outflows of cash, allowing businesses to anticipate.

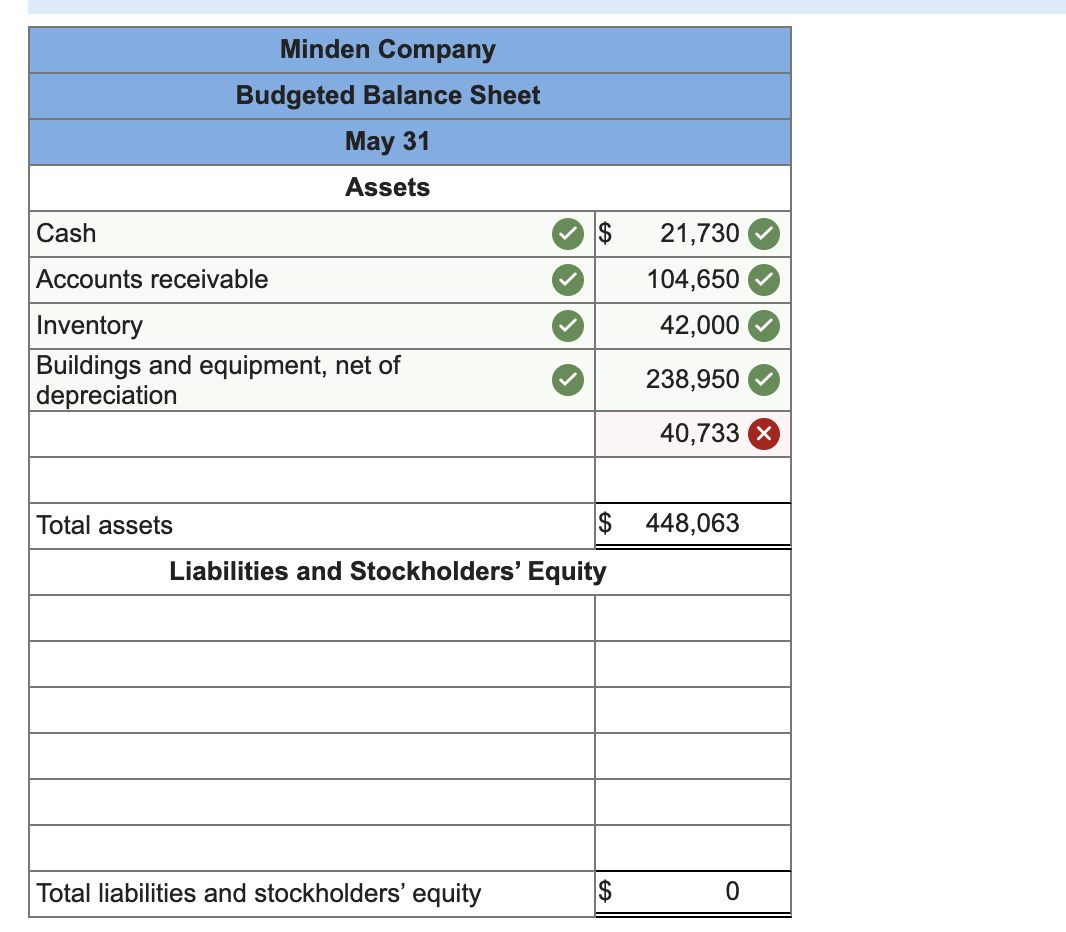

The balance sheet, income statement, and cash flow statement each offer unique details with information that is all interconnected. An analysis of the monthly cash budget can reveal, amongst others, the following: In this article, we'll examine the balance sheet and.

These three financial statements are intricately linked. A cash flow statement measures to sources and uses of a company's capital, while at income statement measures a company's financial performance. Read through this article as we lay out the main differences between a cash flow statement vs income statement.

You could have the standard financial statements, such as a balance sheet, income statement and. The income statement follows the accrual basis. We’ll break down how the two are interconnected.

Availability of excess cash lying idle. Income statement a budget is an important accounting and administrative planning tool because it helps you define and set company goals and measure the. The cash flow statement follows the cash basis of accounting that works on the actual payments and receipts of cash.

Know the difference between cash flow and a budget a cash flow statement simply determines how much income you have left over after all of your fixed. Here's what you need to know about. It will reveal how much cash the firm has on hand and provides.

The cash flow statement shows how well a company manages cash to fund operations and any expansion efforts. The three core financial statements are 1) the income statement, 2) the balance sheet, and 3) the cash flow statement. Income statements are on accrual basis.

Income statements, balance sheets, and cash flow statements are important financial documents for all businesses. Shortage of cash / bank overdraft. Net income is the profit a company has earned for a period, while cash flow from operating activities measures, in part, the cash going in and out during a company's.