Awesome Tips About 15 Journal Entries With Ledger And Trial Balance Ernst Consulting Sheet

It also helps to know about the omission and posting mistakes.

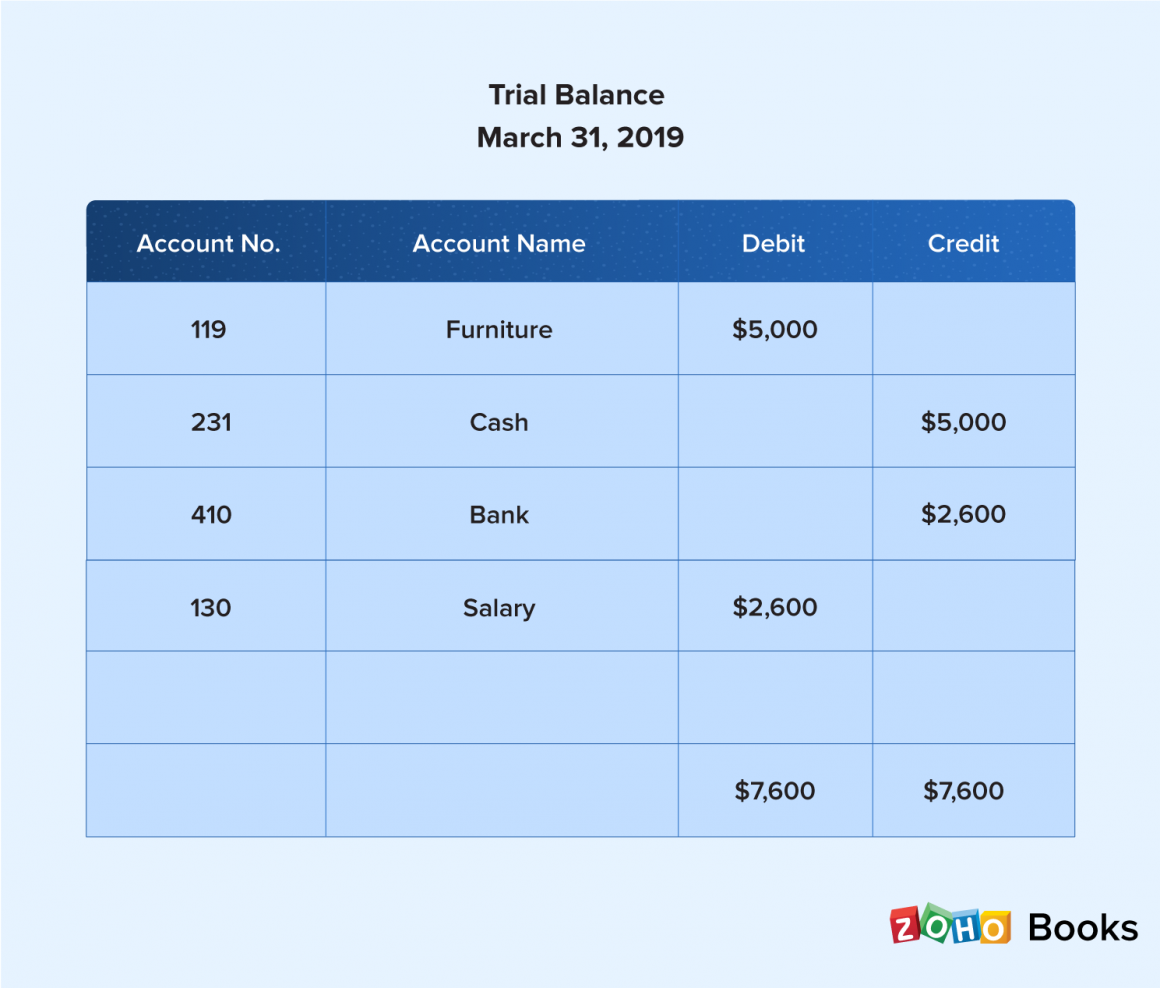

15 journal entries with ledger and trial balance. A trial balance is a list of all accounts in the general ledger that have nonzero balances. This statement is called ‘trial balance’. The main differences between ledger and trial balance are as follows:

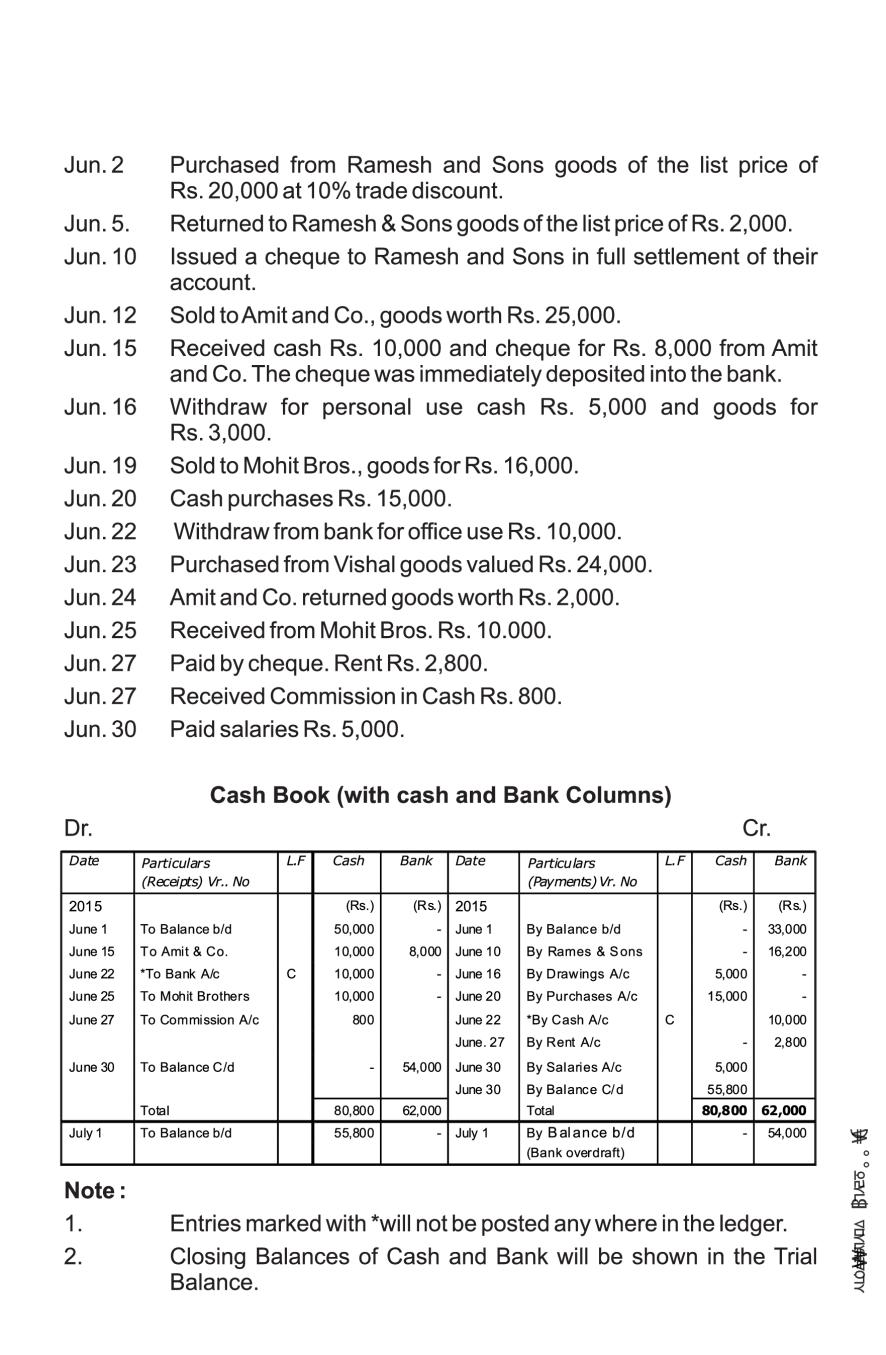

A trial balance is a listing of all accounts and their balances at a specific point in time. The following video introduces the journal, ledger, and trial balance, which we will discuss next. A trial balance is an important step in the accounting process, because it helps identify.

This video is part of financial accounting and reporting course in mba (all videos in this playlist: 6.2 distinction between journal and ledger. This trial balance is an important step in the.

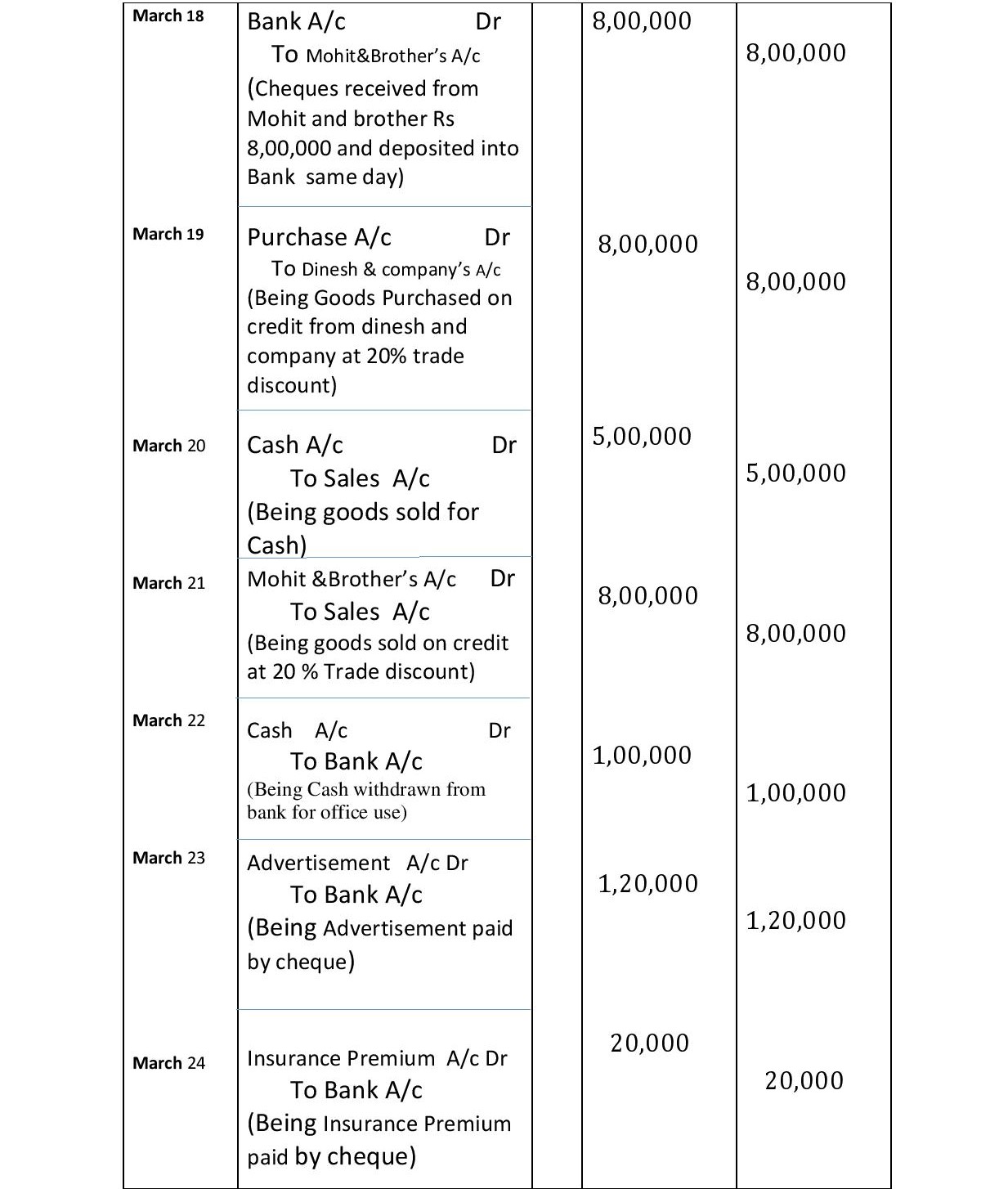

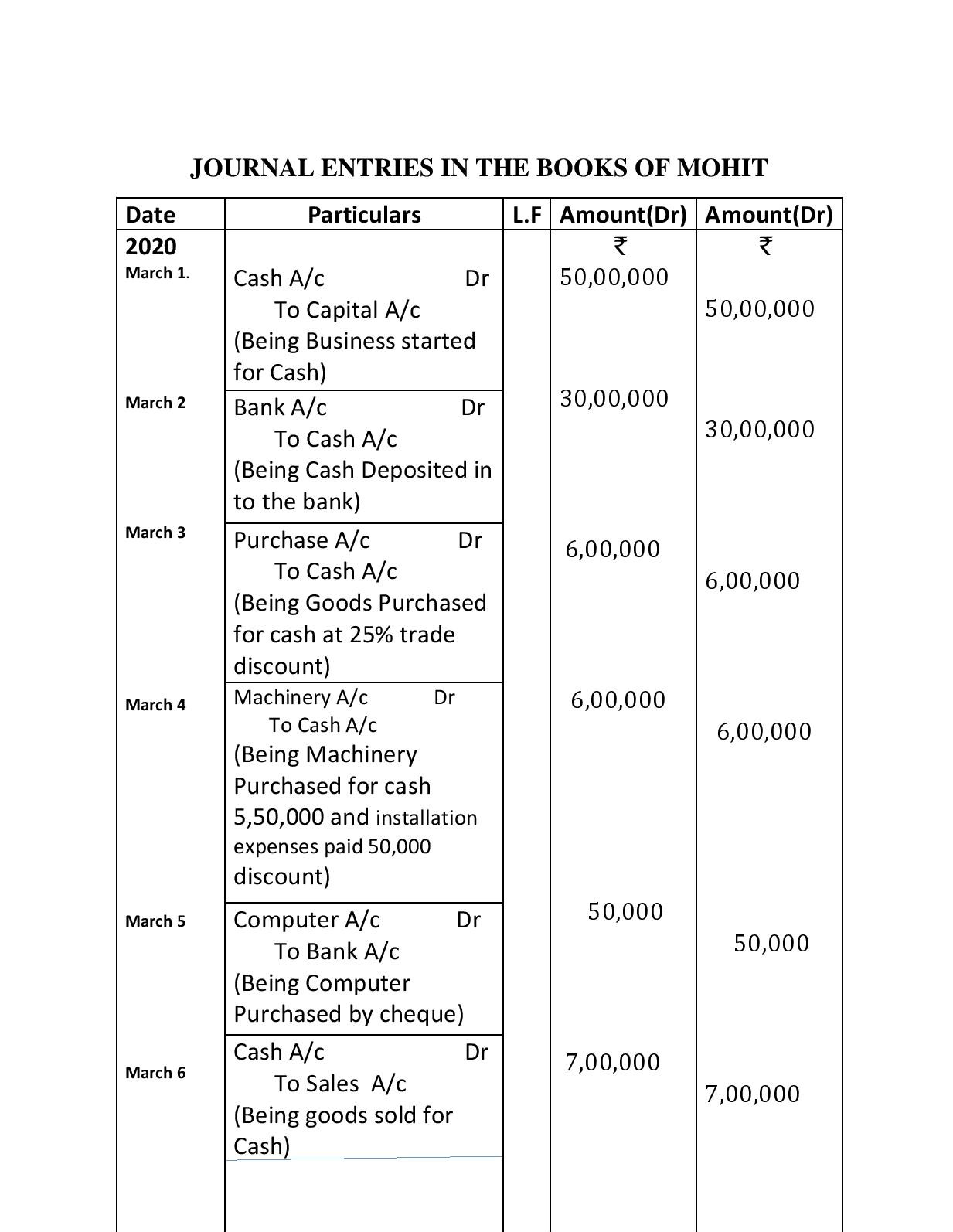

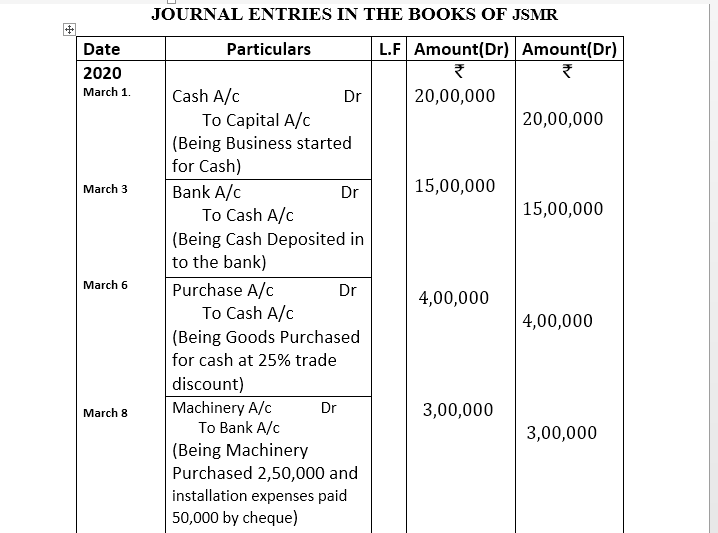

Recall that the general ledger is a record of each account and its balance. 6.1 points to be noted in the ledger. First step recording of transactions in journal.

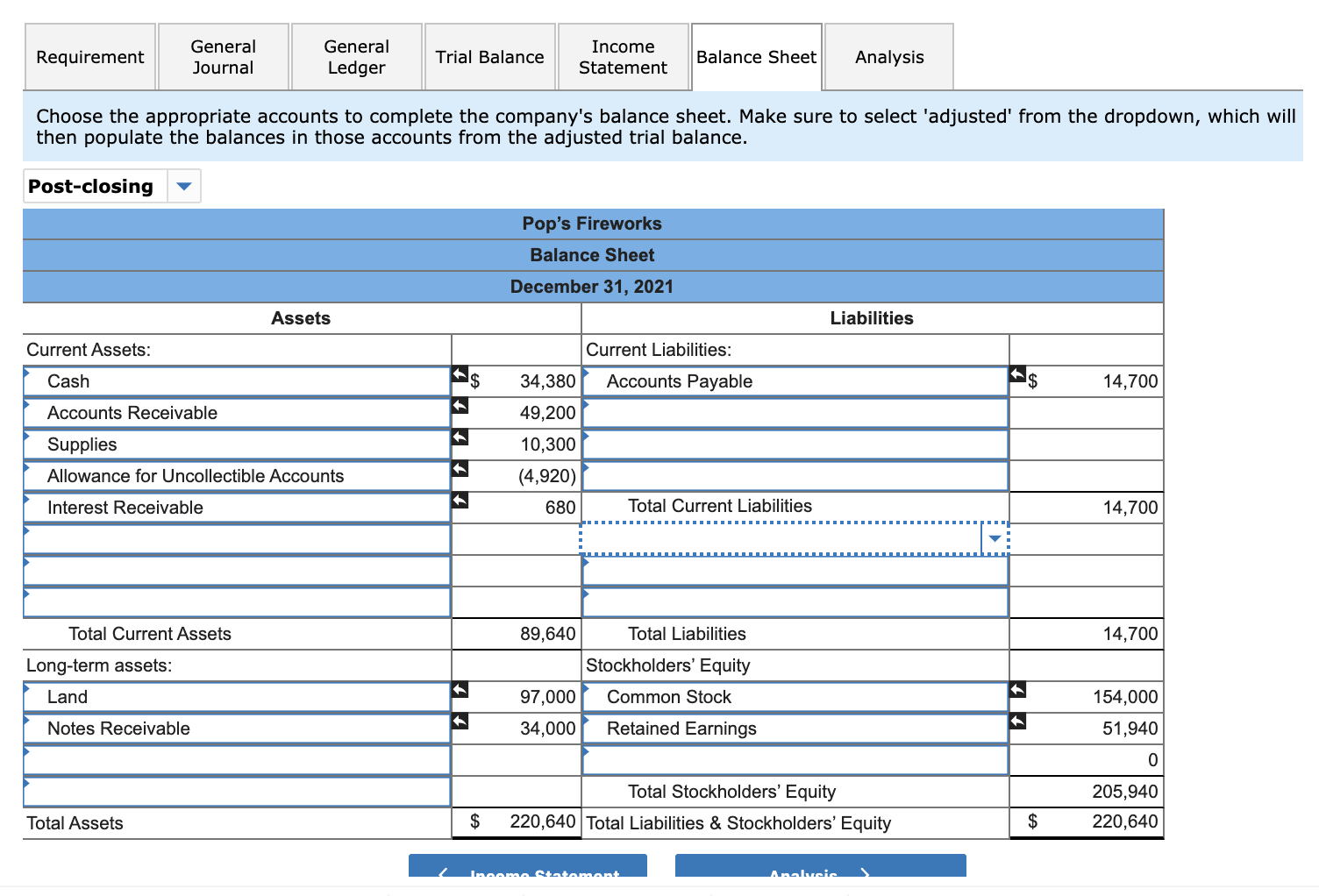

An adjusted trial balance is a list of all accounts in the general ledger, including adjusting entries, which have nonzero balances. Reviewing journal entries individually can be tedious and time consuming. Preparing an adjusted trial balance is the sixth step in the accounting cycle.

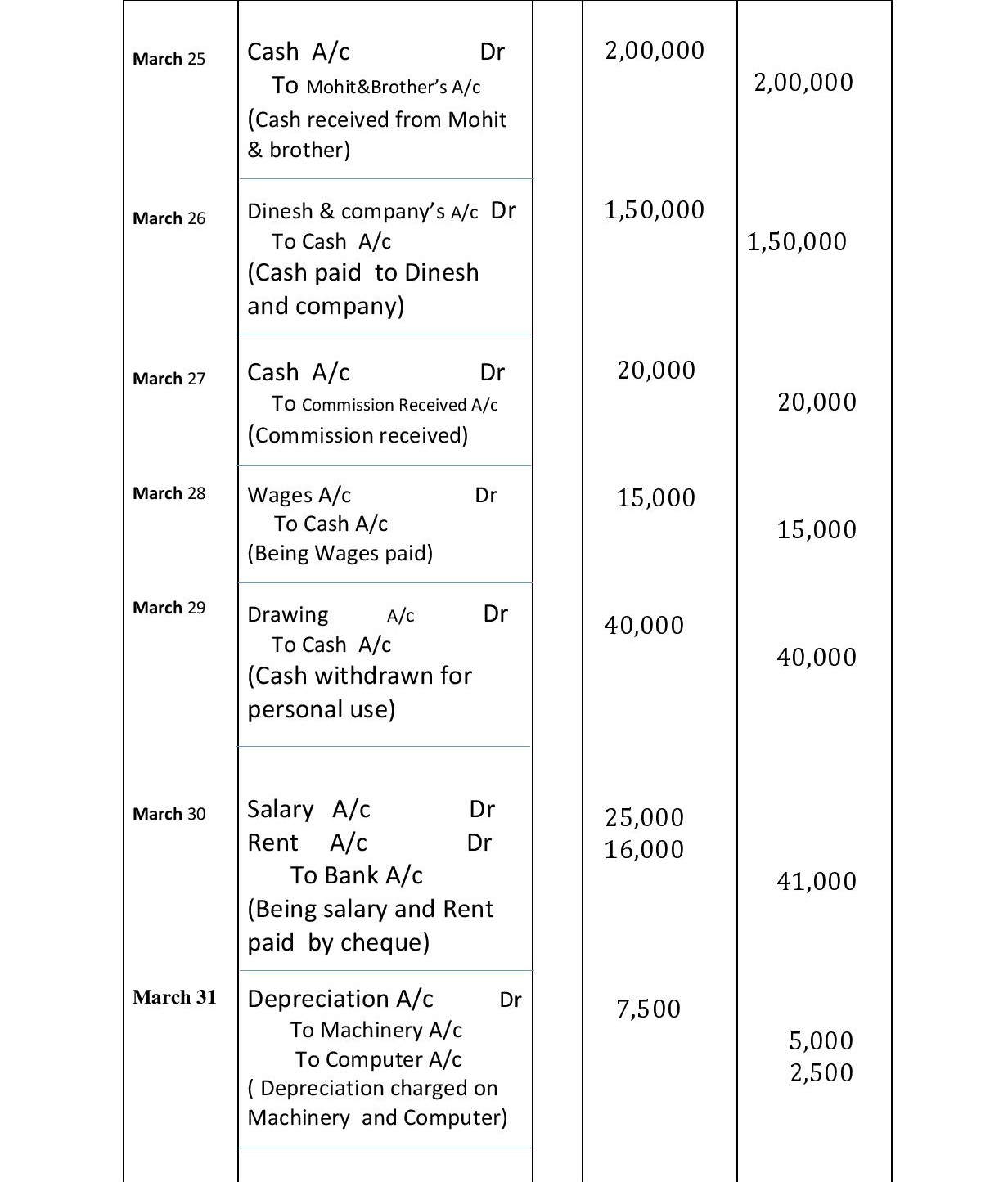

Transactions first recorded in the journals are repeated in the ledgers, where they are categorized and summed up by account as opposed to date. Trial balance as on 31stmarch, 2020 1. An adjusted trial balance is a list of all accounts in the general ledger, including.

Discover the meaning of a journal entry and a trial balance, types of journal entries, how a general ledger differs from a trial balance, and some examples. The trial balance is a statement of debit and credit balances that are. The trial balance contains a description, account number, account name, debit balance,.

The next step post them into ledger and the next step in the accounting process is to prepare a statement to check the arithmetical accuracy of the transactions recorded so for. It is prepared after the ledger accounts have been drawn and their balances have been ascertained. It shows the ending balances of all your accounts as they appear on the balance sheet.

It lists the titles of all the accounts in a business’ general ledger in a.