Ace Tips About Examples Of Expenses On Income Statement Management Responsibility

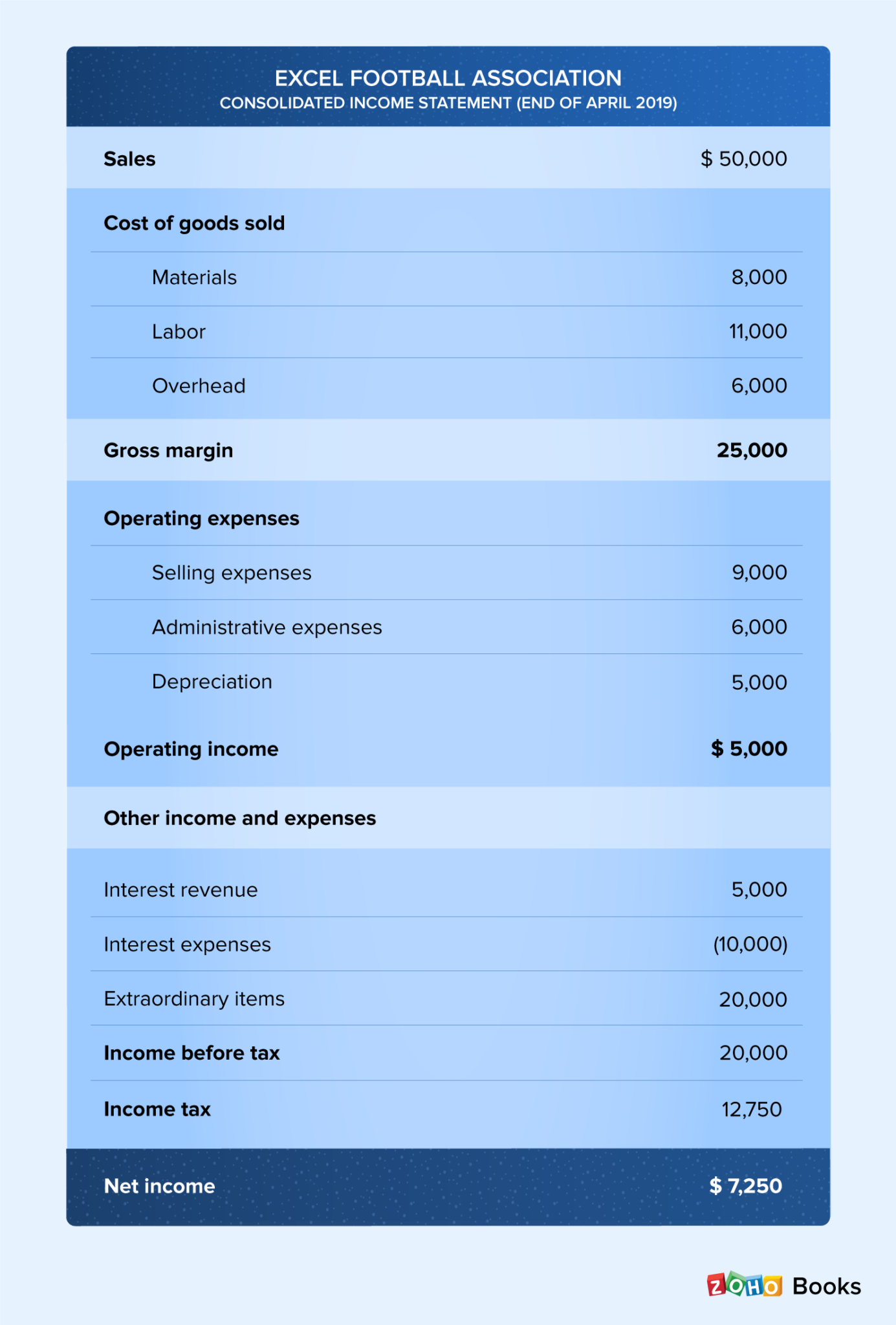

Gross profit minus operating expenses

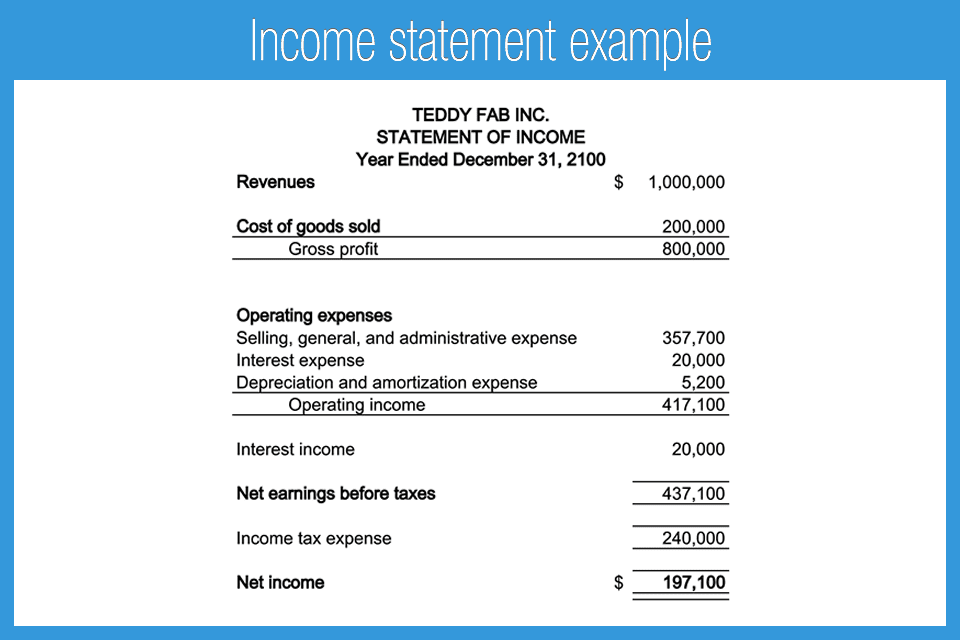

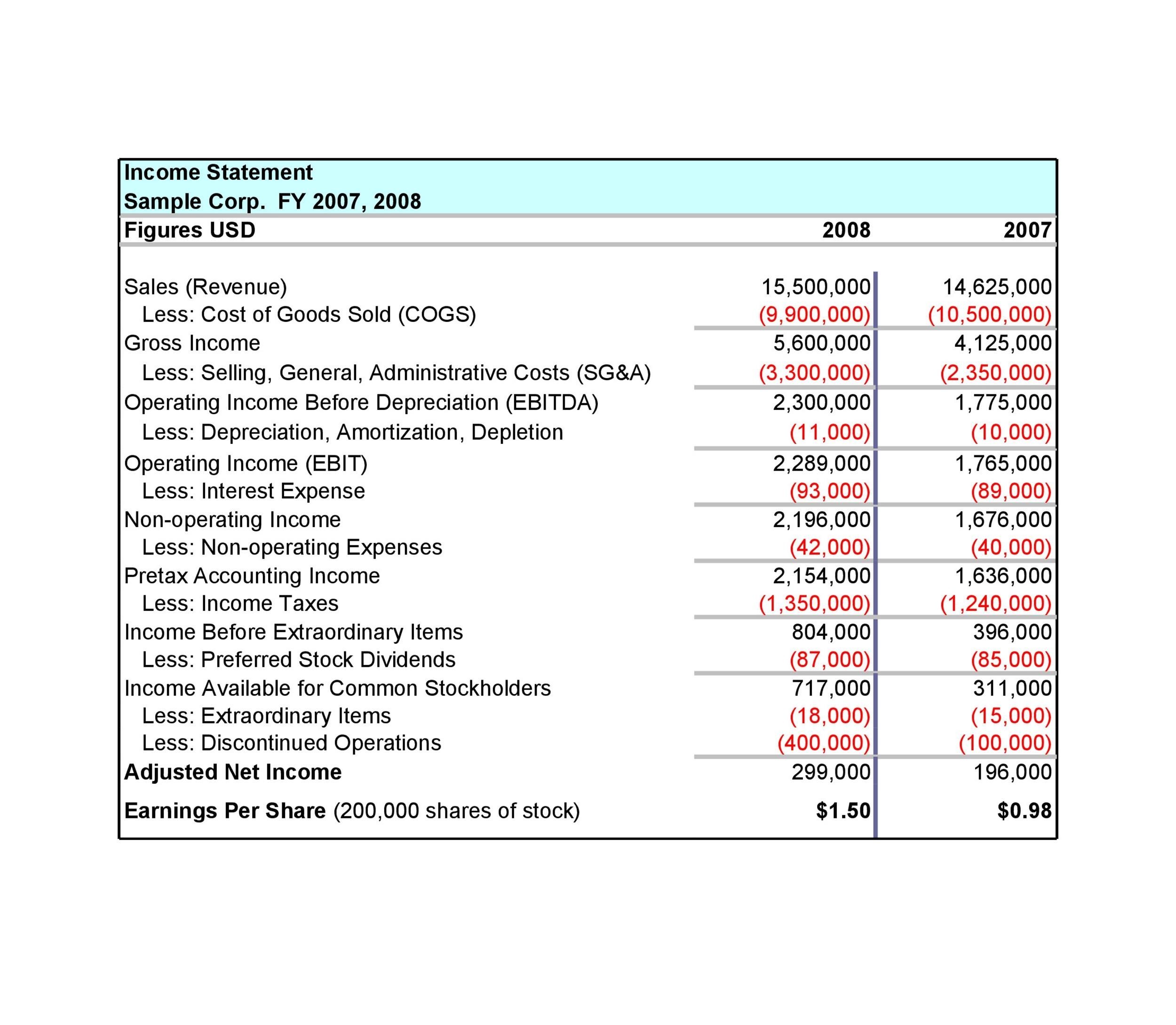

Examples of expenses on income statement. Cost of goods sold (cogs) selling, general and administrative expenses (sg&a). Income statement for year ended dec. Expenditures denote the amount of money that a business uses to purchase a fixed asset or for increasing fixed asset value.

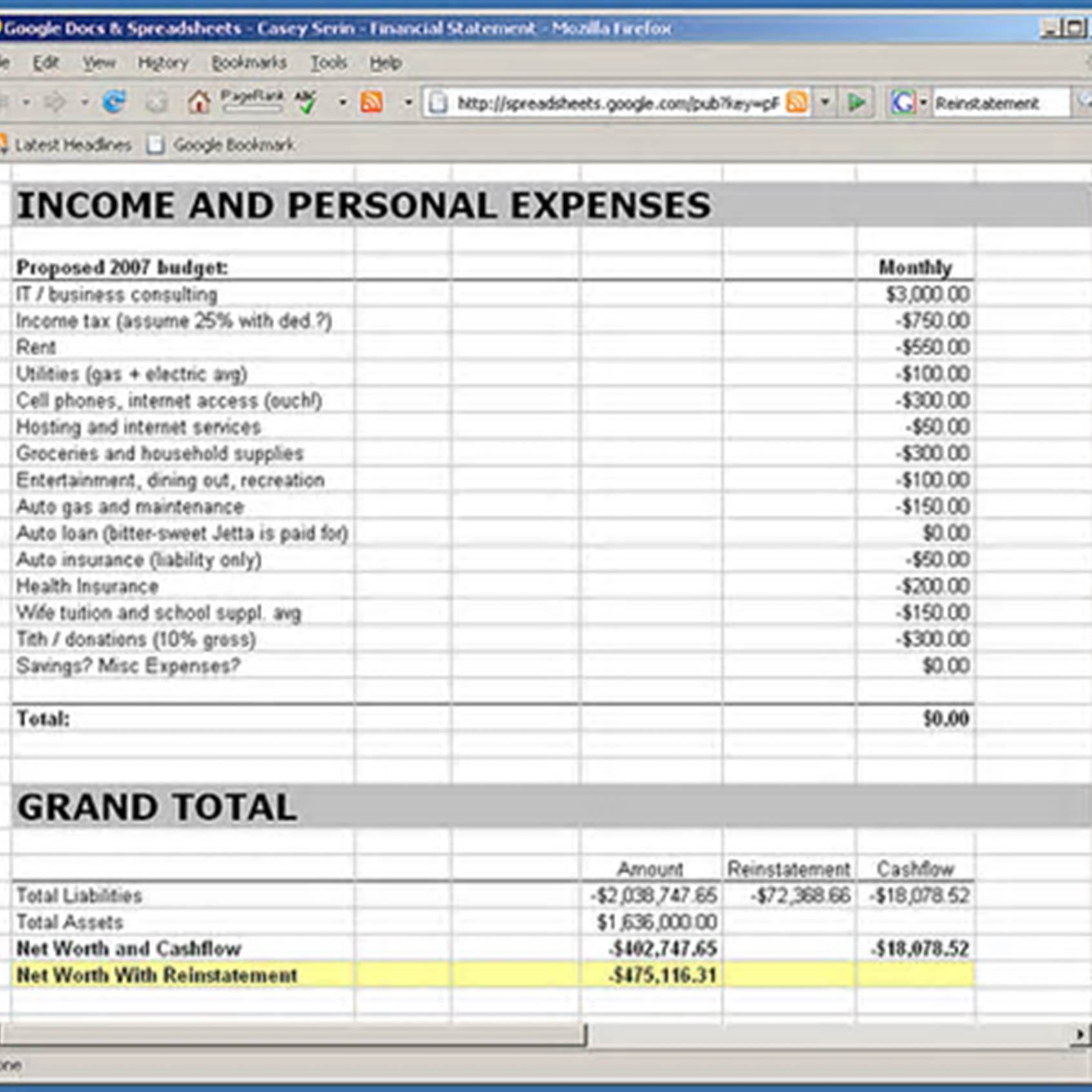

Here’s an example of an income statement from a fictional company for the year that ended on september 28, 2019. One way to gain insight into your company’s finances is by analyzing the income statement. For example, freelancers, travel, website costs and marketing.

This information helps you make timely decisions to make sure that your business is on a good financial footing. Expenses are the costs and expenses incurred to earn the company's revenues during the period of the income statement. Then they are deducted from the total income to get net income before tax.

Smart management of these costs helps maintain financial health. Below is an example of an income and expenditure. Expenses are recognized when incurred regardless of when paid.

This means that the income and expenses presented in the income statement have already been. The income statement shows a company’s expense, income, gains, and losses, which can be put into a mathematical equation to arrive at the net profit or loss for that time period. The gao audit report on the u.s.

Some of the common expenses recorded in the income statement include equipment depreciation, employee wages, and supplier payments. It is common for an expense to be reported on the income statement in an accounting period different from when the company paid out the money. Income is recognized when earned regardless of when collected.

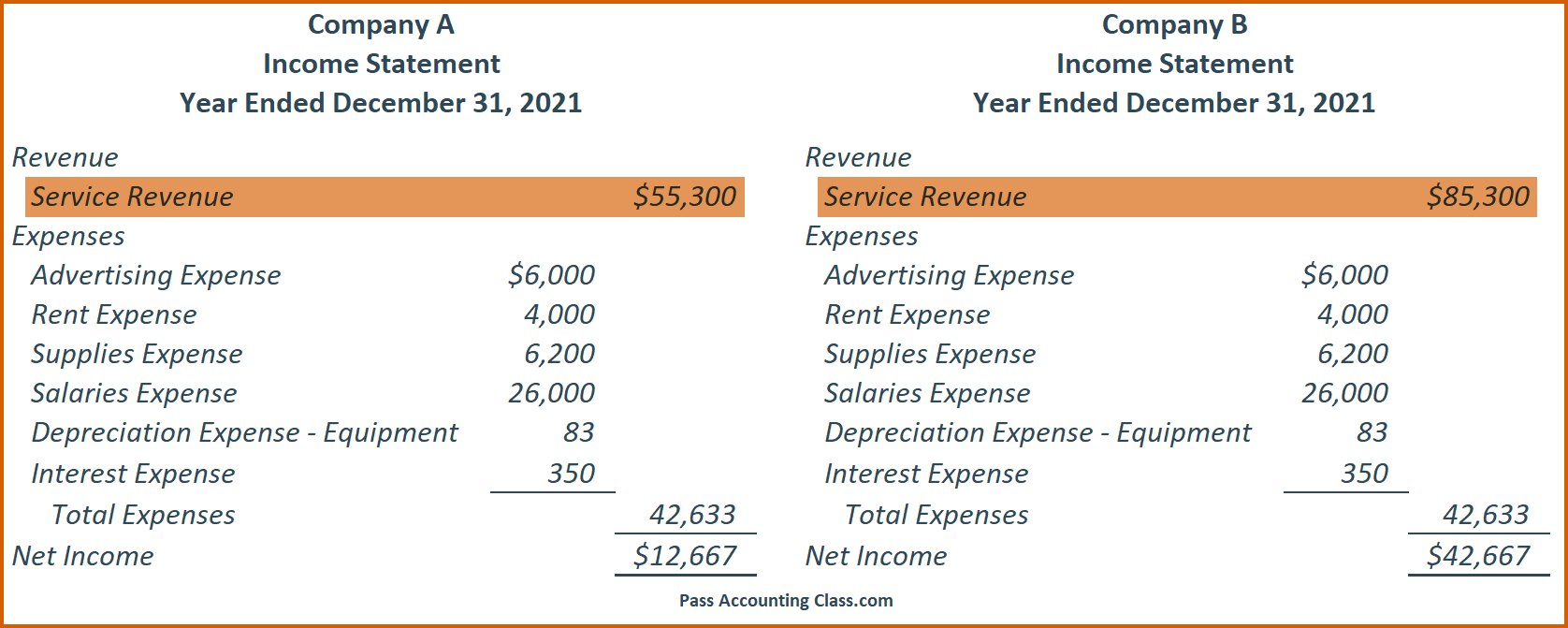

The statement’s format will vary from business to business because they have different income and expenses. While a balance sheet provides the snapshot of a company’s financials as of a particular date, the income statement reports income through a specific period, usually a quarter or a year, and. Partnership income tax returns will need.

It shows whether a company has made a profit or loss during that period. In this post, i will explain the most common types of expenses that are encountered by businesses, how to differentiate between them, and what you need to know to classify them correctly in the financial statements. For example, if you itemize, your agi is $100,000 and your.

Government’s consolidated financial statements can be found beginn218 ing on page of the full. Go to the alternative version. Accounting fees advertising and marketing insurance legal fees license fees office supplies maintenance and repairs rent salaries and wages (other than direct labor for production employees) property.

Here are a few examples of how atl and btl expenses arise on company income statements and calculations. Businesses need to watch their revenue expenditure s closely because they affect cash flow and profits. Here are a few examples of expenses:

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)