Great Info About Adjusting Entry For Accrued Revenue Form 413

Example on december 31, 2021,.

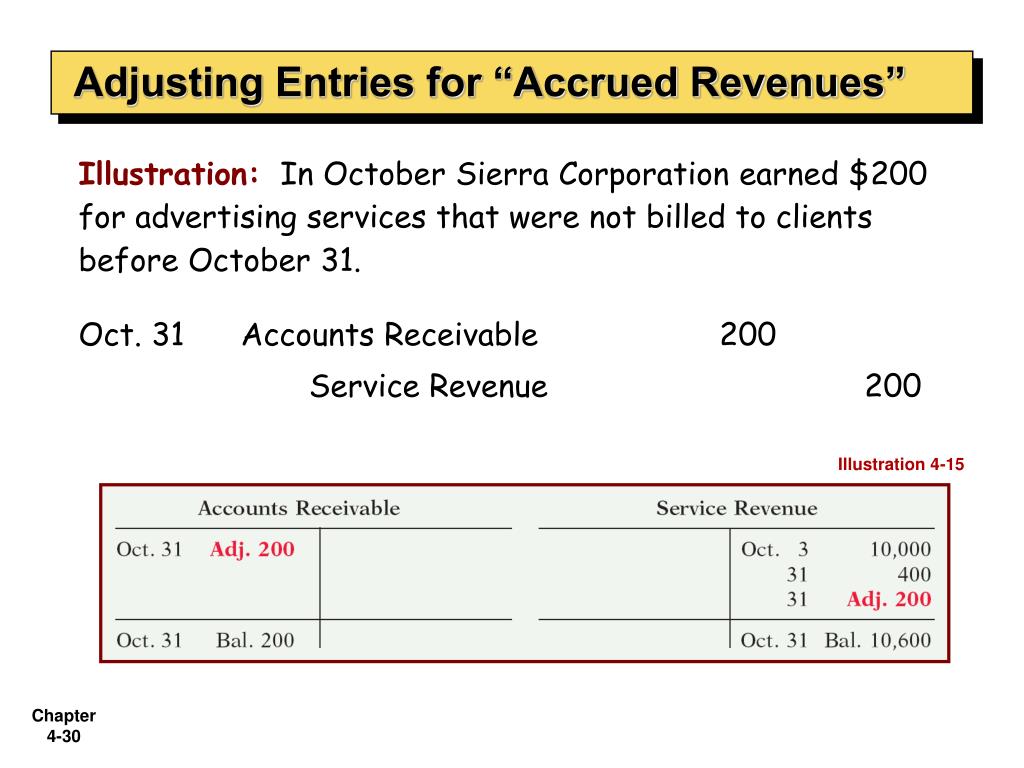

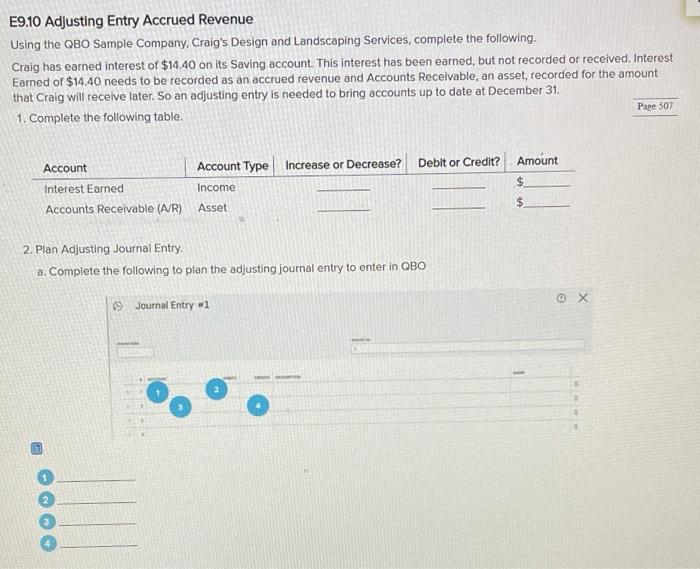

Adjusting entry for accrued revenue. What is the journal entry when the company receives the payment in november 2020?. Statement of cash flows 5m. Uncollected revenue is revenue that is earned during a period but.

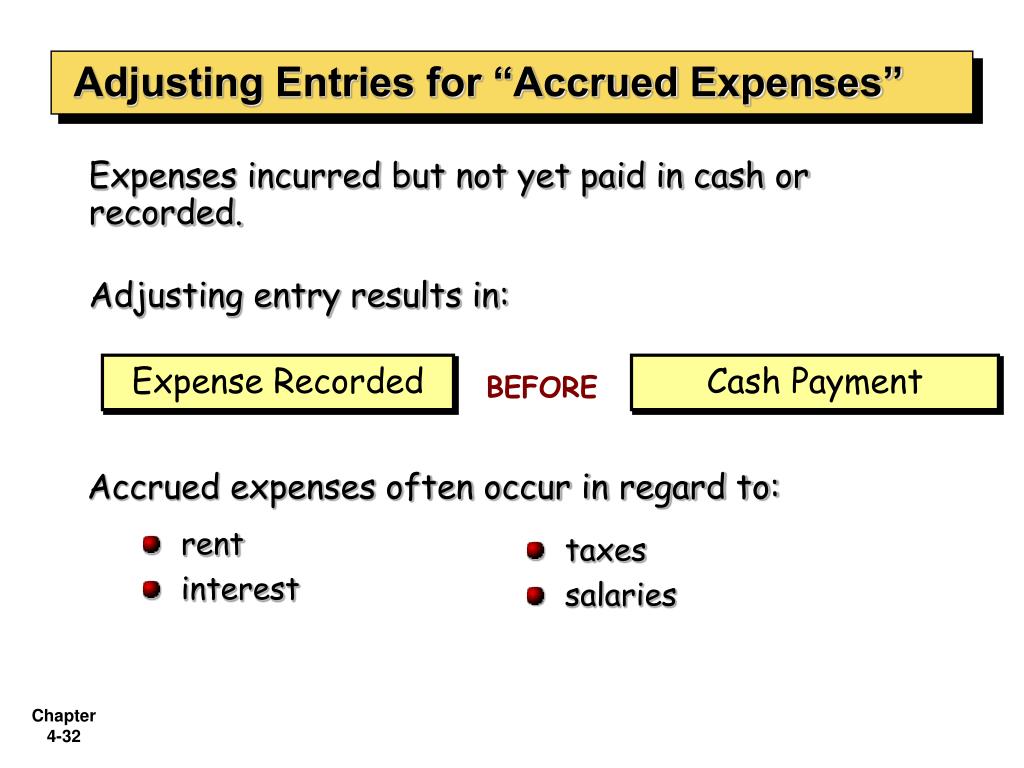

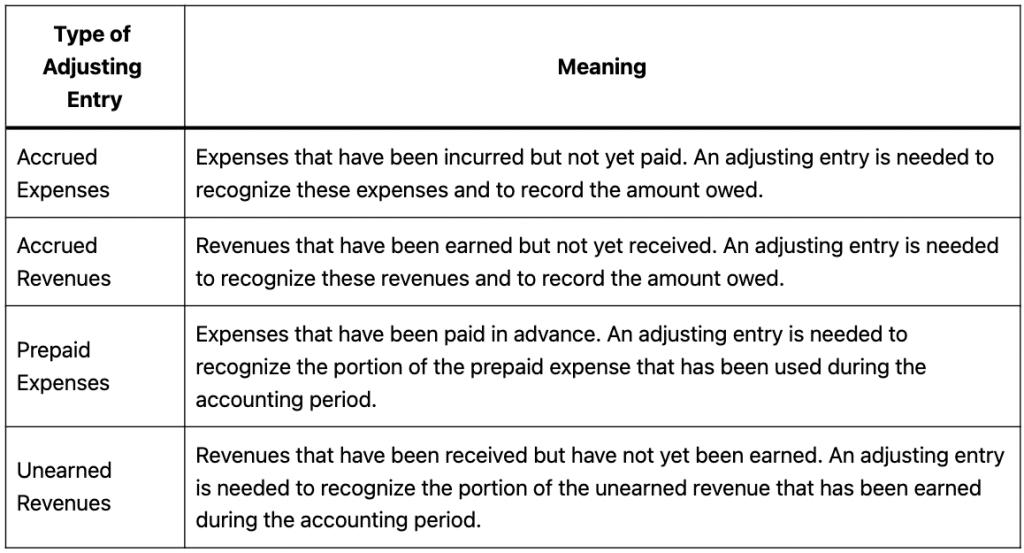

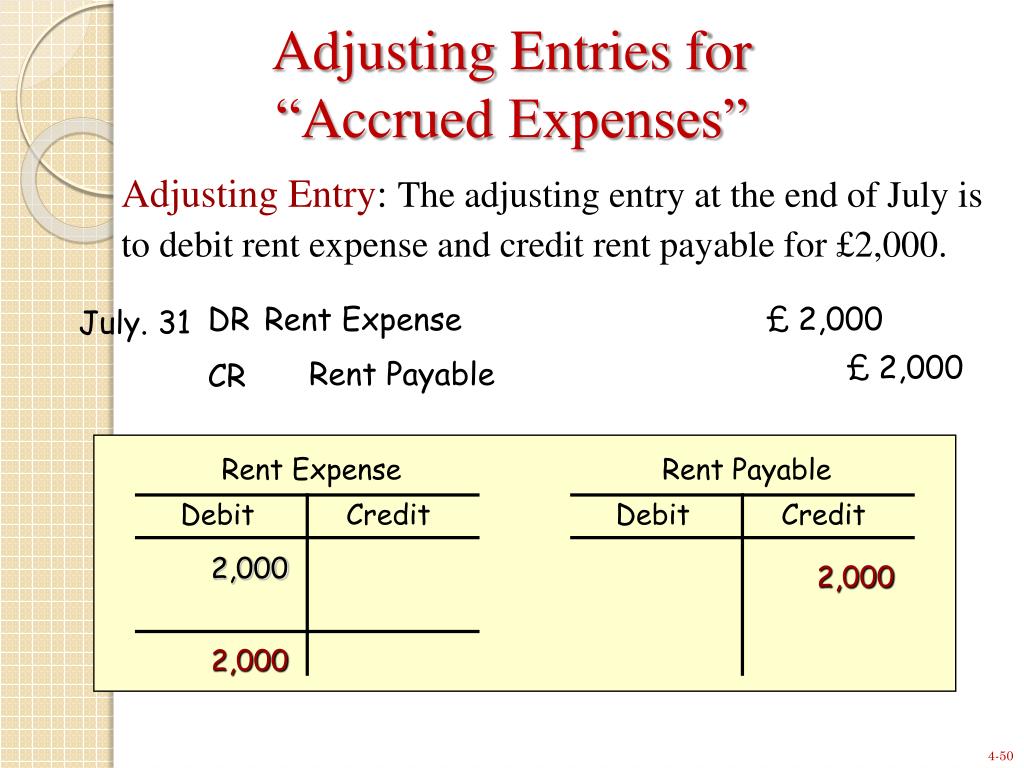

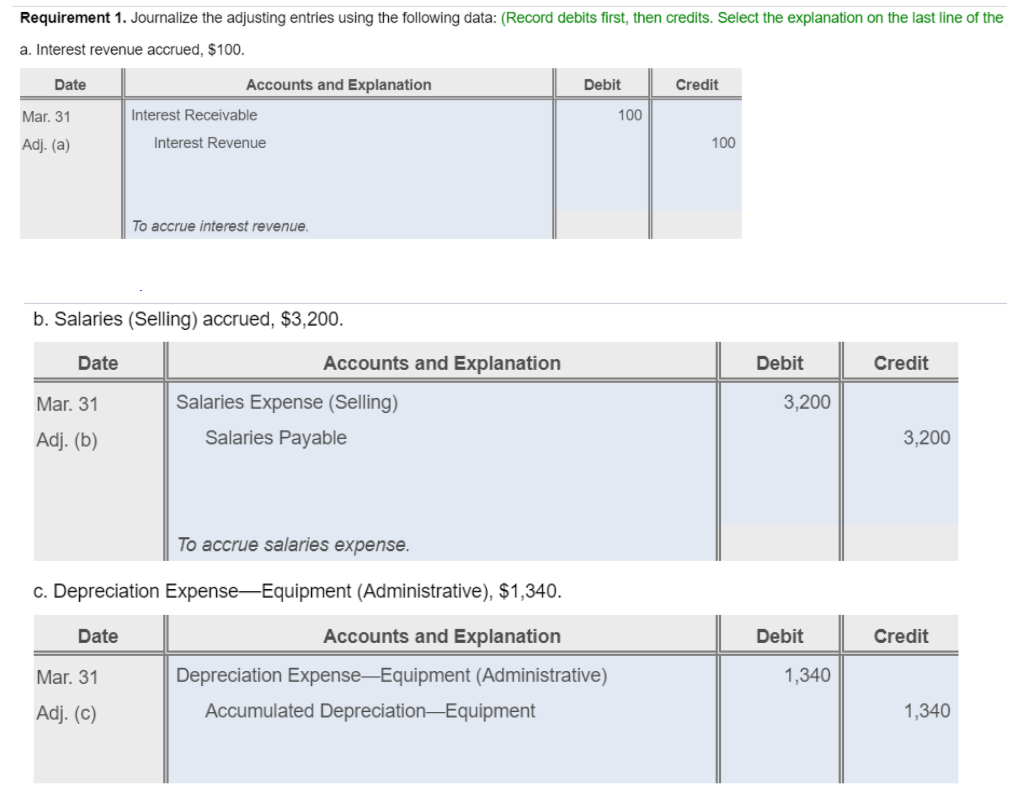

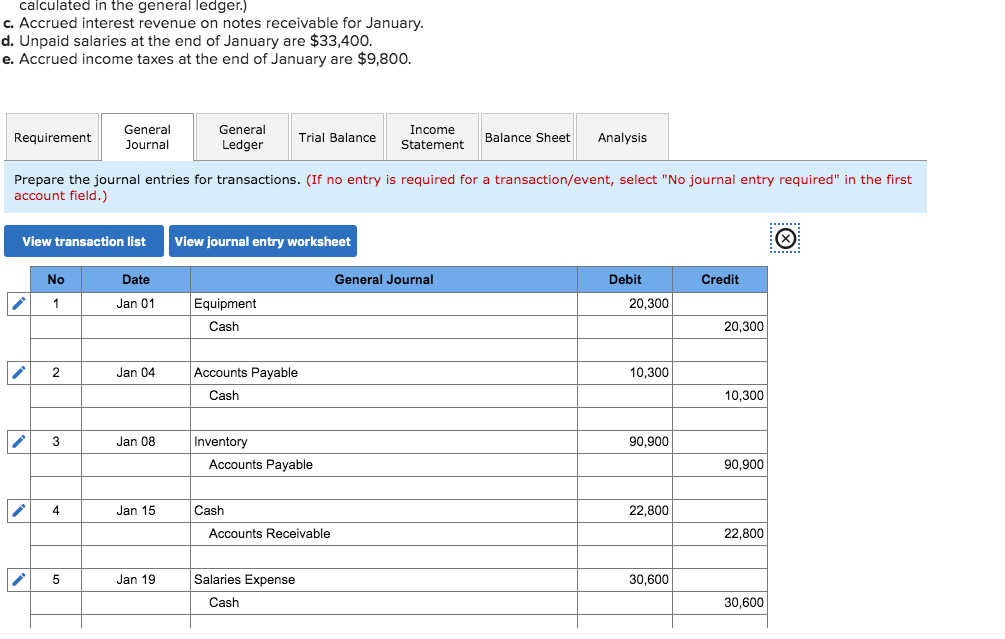

Adjusting entries are step 5 in the accounting cycle and an important part of accrual accounting. An adjusting entry is an entry made to assign the right amount of revenue and expenses to each accounting period. The company is bringing the salaries that have been.

Accrued revenue made easy | adjusting entries accounting stuff 682k subscribers join subscribe subscribed 4.1k 172k views 4 years ago complete guide to. The company has an accrued expense. When the payment is made, it is.

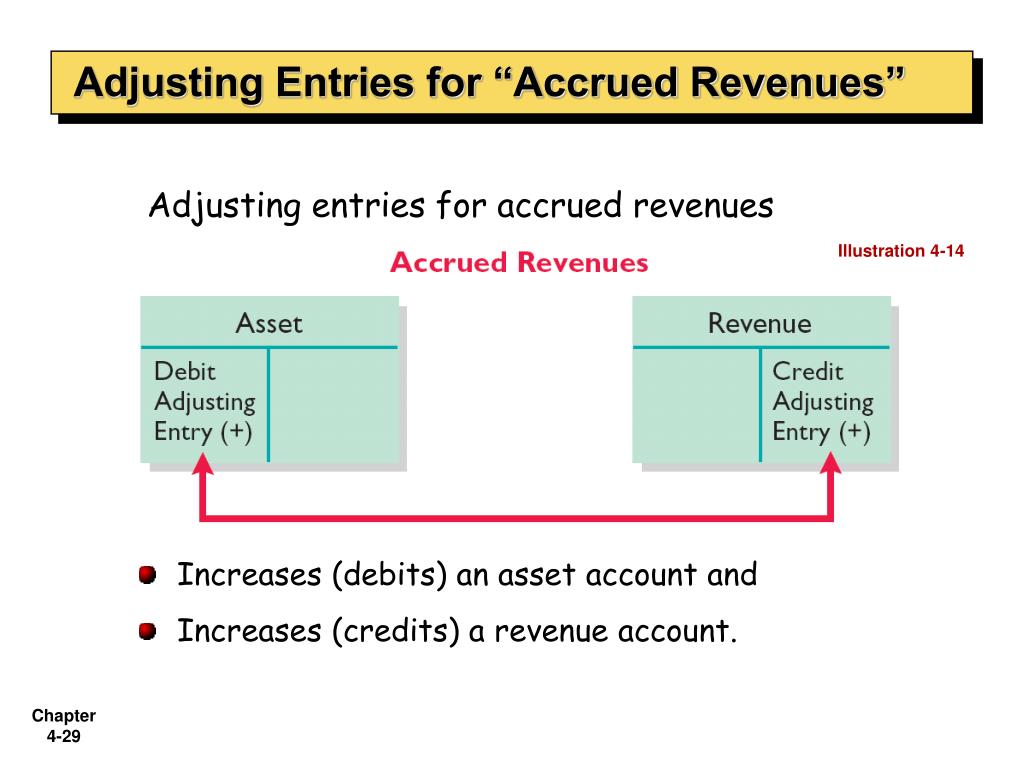

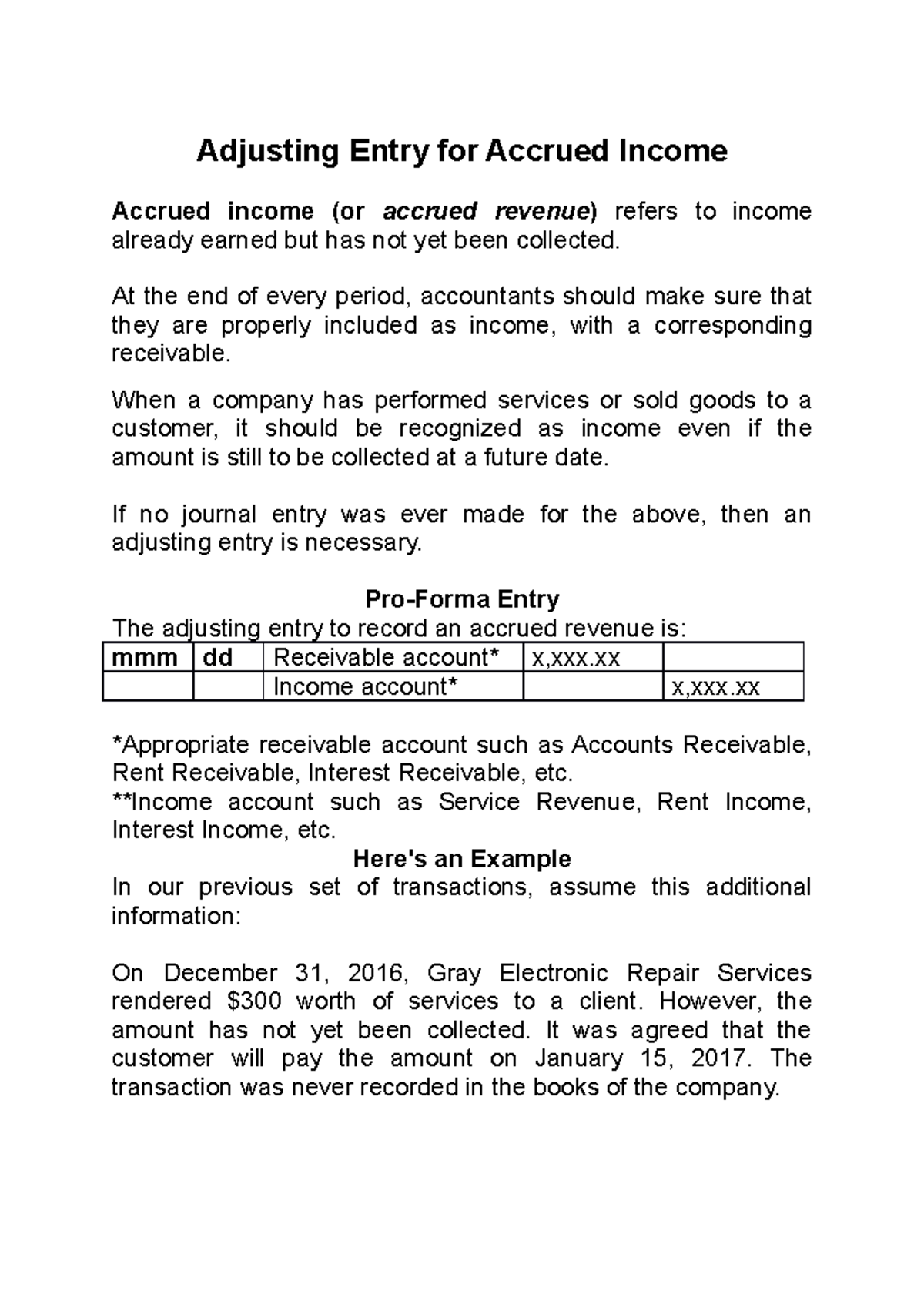

The adjusting entry to record an accrued revenue is: Adjusting entries for accruing uncollected revenue: Companies record accrued revenue as an adjusting entry in the financial statements.

Deferred revenue and accrued revenue: Adjusting entry on january 31: Adjusting entries allow you to adjust income and expense totals.

Accrued revenue deferred revenue now let’s look at deferred revenue. The adjusting entry records the change in amount that occurred during the period. Deferred revenue is when the revenue is spread over time.

It updates previously recorded journal entries so that the. An adjusting entry, often referred to as a balance day adjustment, forms part of financial reporting under accrual accounting systems. What is the journal entry for the accrued revenue in the october 31 adjusting entry?

**income account such as service revenue, rent income, interest income, etc. But in this case, your. Milestones refer to specific points in your project schedule.

Analysis and income statement presentation 5m. The adjusting entry for accrued revenue updates the accounts receivable and fees earned balances so they are accurate at the end of the month. The entry of accrued revenue entry happens for all the revenue at once.

One important accounting principle to remember is that just. It is credited and shown on the credit side of the income statement, and. Milestones on large orders, you can book revenue when you reach project milestones.